Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE

The Australian Government Board of Taxation has for more than six years been holding board meetings inside the offices of PwC, including as recently as last August – when it held its board meeting at PwC’s complex at Melbourne’s Southbank.

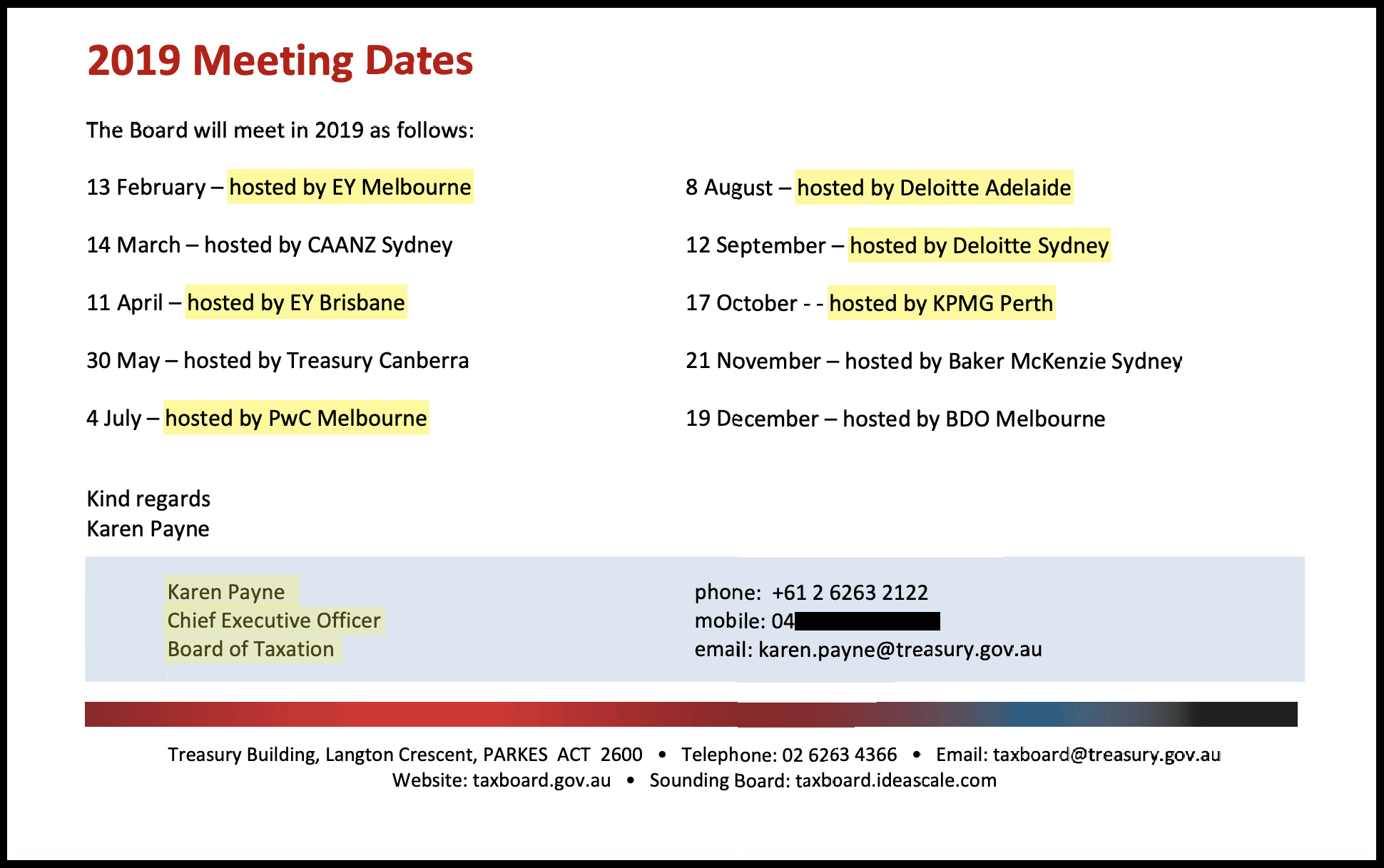

Investigations reveal the embattled Board of Taxation has been holding board meetings in the offices of all the “Big Four” accounting firms – as well as in the offices of corporate law firms, and other entities associated with aggressive tax minimisation – since at least 2017.

Board of Taxation board meetings were being held at PwC offices in at least two years of the period disgraced accountant Peter Collins and other unnamed PwC partners were gleaning secret government tax policy data – which PwC was illegally sharing around the world.

That information was gleaned from Treasury and the Board of Taxation between 2013 and 2018.

Locations of Board of Taxation’s 2019 board meetings. Source: Board of Taxation

One Board of Taxation board meeting, held in PwC’s Sydney offices in February 2017, was arranged by then PwC partner Peter Calleja – who was directly involved in, and has been ousted over, the PwC tax leaks scandal.

Another, held at PwC’s Melbourne office on August 5 last year, was while disgraced accountant Peter Collins remained employed as a PwC partner — out of that same office.

Calleja was ousted on May 10 — one of the first to be shown the door — just days after the Senate inquiry into consultancies published a heavily-redacted 144-page cache of internal emails from 2013-18, showing scores of PwC partners and staffers sharing confidential government data.

(He was also one of the partners PwC announced on July 3 as having been “exited” over the scandal “for professional or governance breaches”.)

Ousted PwC partner Peter Calleja. Source: LinkedIn

In a February 2017 “CEO Update”, the Board of Taxation’s then CEO Karen Payne thanks Calleja for the “invitation” to hold its board meeting at PwC’s Sydney offices.

“PwC in Sydney hosted the Board meeting and a discussion over lunch with stakeholders and the Board’s advisory panel,” Payne writes.

“The Board would…like to thank PwC for hosting the Board at its Sydney premises and for the many PwC partners who attended and engaged in the stakeholder discussions.

“Many thanks to Pete Calleja at PwC for the invitation and his assistant Tracey Williams for organising our arrangements – the Board is very grateful,” Payne writes.

“Many thanks to Pete Calleja at PwC for the invitation…the Board is very grateful” — Karen Payne.

Payne writes it was a “great forum” for PwC partners and their clients to hear “informally” what was on the Board of Taxation’s agenda.

“Thank you to everyone [PwC partners and their clients, stakeholders and the Board’s advisory panel] for kick starting the year with a high level of engagement, energy and enthusiasm,” Payne writes.

“Many ideas were shared and this was a great forum to hear [informally] what’s on our agenda and yours in the year ahead!”

Payne is now holds the powerful “dual roles” position as Australia’s Taxation Ombudsman and Inspector-General of Taxation (IGTO).

“Payne is now Australia’s Taxation Ombudsman and Inspector-General of Taxation”

She was appointed to the prestigious role in 2019 by then Federal Treasurer Josh Frydenberg.

Payne was previously a long-time tax specialist with EY and tax partner with corporate law firm Minter Ellison.

Australia’s Taxation Ombudsman Karen Payne. Source: LinkedIn

The PwC tax scandal has drawn serious concerns over close ties between Australia’s tax agencies and the industries they are supposed to be regulating.

The function of the Board of Taxation, “supported by a secretariat provided by the Treasury”, is to “provide advice to the Treasurer”, including “on the effectiveness of tax legislation” and “improvements to the general integrity and functioning of the taxation system”.

Its charter states its mission is to “contribute a business and broader community perspective” to improving the “design of taxation laws and their operation”.

Yet investigations show rather than a “business” perspective, the board has been stacked with the entities who aggressively minimise the Australian tax they pay – including some multinational mining giants – and, even more heavily, by those who facilitate that aggressive tax minimisation — such as the “Big Four” and other major “consultancies”, and commercial law firms.

The “community” aspect is effectively non-existent.

Its directors are appointed by the Treasurer.

From 2002 the board had an “Advisory Panel”, until June 29 when it was scrapped following inquiries from The Klaxon.

“Membership of the Advisory Panel will change from time to time and will be reviewed periodically by the Board,” the Board of Taxation site stated.

Please support us and SUBSCRIBE HERE

How The Klaxon broke the story. Source: The Klaxon

Immediately before it was “dissolved” the “Advisory Panel” had 47 members.

They included four — current — PwC Australia tax partners: PwC Australia Global Tax Controversy and Dispute Resolution Co-Leader Hayden Scott; PwC Australia Transfer Pricing and International Tax Partner Nick Houseman; PwC Australia Tax Partner Steve Ford; and PwC Australia Tax Partner Ken Woo.

Also on the Advisory Panel were three EY (Ernst & Young) partners and four KPMG tax executives from KPMG.

Tax executives from the Big Four consultancies comprised 14 of the 47 — or 30 per cent — of Advisory Panel members.

There were also nine tax partners from other tax “consultancies”, including two BDO tax partners, a partner of Grant Thornton and the deputy chair of Australian Standfirst Board — a “global investing specialist” which focuses on “Ultra High Net Worth (UHNW) wealth”.

Together, consultancies comprised 23 places, or 49 per cent, of the Advisory Panel.

More Klaxon PwC Tax Scandal Exclusives:

25 July — PwC’s Peter Collins on Tax Board “Advisory Panel”

23 July — Tax Board run by PwC Partner

18 July — Gov’t “Advisory Panel” of PwC tax partners axed

17 July — First public official ousted in global PwC tax scandal

13 July — Gov’t tax boss at heart of PwC tax scammers nest

27 June — PwC tax scam CEO quits as charity chair

26 June — Tax Ombudsman schooled by PwC emails partner

7 June — “Vanished” Tax boss was exec at pre-PwC

24 May — You don’t Sayers? PwC Mini-Me in $6m Gov’t bonanza

There were also six tax corporate lawyers, including two partners from King & Wood Mallesons and a partner of Madgwicks Lawyers

Australia’s fossil fuels sector was also very well represented.

“Advisory Panel” members included: Chevron Taxation Manager Michael Fenner; BHP Billiton Global Head of Tax Premila Roe; Shell Australia Vice President Tax for Asia Pacific, Coralie Trotter; South32 Head of Tax; and two Rio Tinto executives.

In 2016, 2017 and 2018 — and so at the time of the February 2017 Board of Taxation board meeting held at PwC’s offices — there were eight PwC partners on the “Advisory Panel”, including Peter Collins.

The others were Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan, Chris Vanderkley & Ken Woo.

PwC partners on Board of Taxation “Advisory Panel” 2017-19. Clockwise from top left: Peter Collins, Steve Ford, Nick Houseman, Anthony Klein, Ken Woo, Chris Vanderkley, Judy Sullivan & Hayden Scott

PwC Melbourne

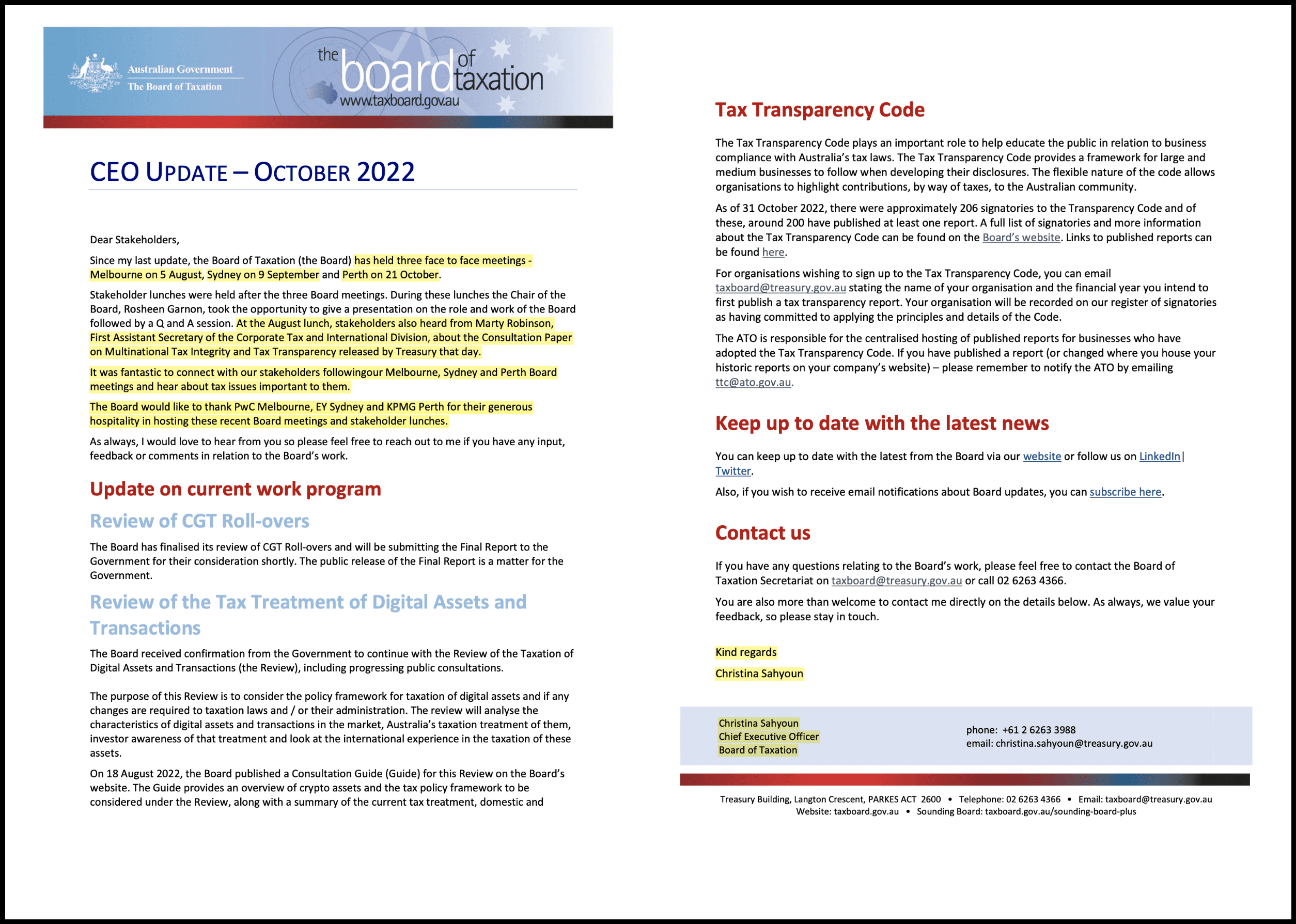

In late October last year, the Board of Taxation reported having held five board meetings “face-to-face” (post Covid-19) in the year.

Four of those were held inside Big Four firms.

The fifth was held in was held in the Brisbane offices of “consultancy” giant BDO.

The Board of Taxation’s July board meeting was held in Deloitte’s Adelaide offices; its August 5 board meeting in the Melbourne offices of PwC; its September 9 meeting in the Sydney offices of EY; and its October 21 board meeting was held in the Perth offices of KPMG.

Please support us and SUBSCRIBE HERE

Part of Sahyoun’s October “CEO Update”. Source: Board of Taxation

In the October “CEO Update”, then Board of Taxation CEO Christina Sahyoun, thanks PwC, EY, and KPMG for hosting its three most recent board meetings.

“The Board would like to thank PwC Melbourne, EY Sydney and KPMG Perth for their generous hospitality in hosting these recent Board meetings and stakeholder lunches,” writes Sahyoun.

Sahyoun quietly departed as Board of Taxation CEO on January 31, days after the PwC tax scandal broke in the media on January 22.

As revealed by The Klaxon, at the same time as being Board of Taxation CEO, Sahyoun was a PwC employee and tax partner.

She was on “secondment” from PwC for the 17 months she was Board of Taxation CEO.

How The Klaxon broke the story. Source: The Klaxon

It can now be revealed Sahyoun was also part of PwC’s “global tax team”.

“By way of introduction my name is Christina Sahyoun and I am on secondment to the Board from PwC where I am a Partner in the corporate and global tax team,” Sahyoun writes in a September 21 Board of Taxation “CEO Update”.

Sahyoun and PwC have repeatedly refused to say if Sahyoun is one of those 63-odd people PwC has said received confidential information in the Collins matter.

Among those at the Board of Taxation’s board meeting on August 5 last year — at PwC’s Melbourne offices — was then Board of Taxation director Chris Vanderkley, who was simultaneously a PwC tax partner and senior employee.

Also present was Board of Taxation director Anthony Klein.

Klein had been a PwC tax partner in the Melbourne office for 17 years, until July 2021. Frydenberg appointed him a Board of Taxation director three months later.

He “resigned” from that role on June 23 following questions from The Klaxon over his PwC ties.

As previoulsy revealed, at PwC, in the Melbourne office, Klein had worked in direct collaboration with Collins, at least as recently as October 2018.

Refusing to comment: Board of Taxation chair Rosheen Garnon.

In August Collins was still employed by PwC, and out of the Melbourne office. Collins didn’t depart PwC until around October last year.

Whether Collins was present on August 5 is unclear.

Many of his co-workers were — and not just the ones who were also working as Federal Government Board of Taxation officials.

Sahyoun writes that on the August 5 at PwC Melbourne, attendees — including PwC partners and staff — “heard from (Treasury official) Marty Robinson” who discussed the “Consultation Paper on Multinational Tax Integrity and Tax Transparency” that had been “released by Treasury that day”.

As revealed last week, the 2017-18 Board of Taxation annual report is “missing” and appears to have never been prepared.

Board of Taxation chair Rosheen Garnon, a former long-time KPMG partner, has repeatedly refused to respond when asked about the missing annual report.

Australian’s four main tax agencies are the Australian Taxation Office (ATO); the Board of Taxation (BoT); the Tax Practitioners Board (TPB); and the office of the Inspector-General of Taxation and Taxation Ombudsman (ITGO).

The bosses of three — the ATO (Commissioner Chris Jordan) BoT (Garnon) and TPB (chair Peter de Cure) — are all former KPMG tax partners.

Experts are calling for a Royal Commission.

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.