Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE INVESTIGATION

The CEO of the Australian Government’s powerful Board of Taxation quietly exited the role on January 31 — just days after the eruption of the PwC tax scandal now sending reverberations worldwide.

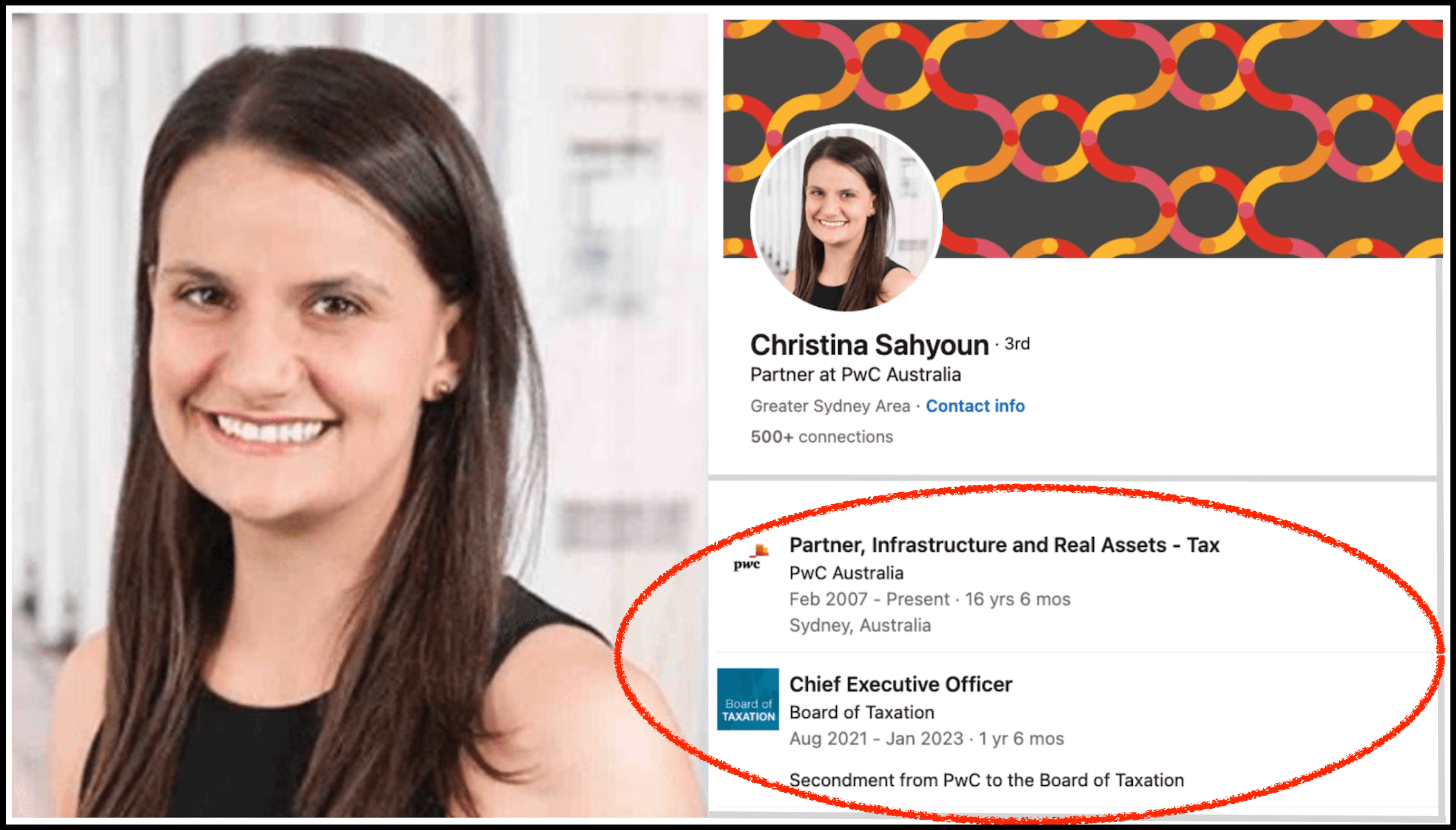

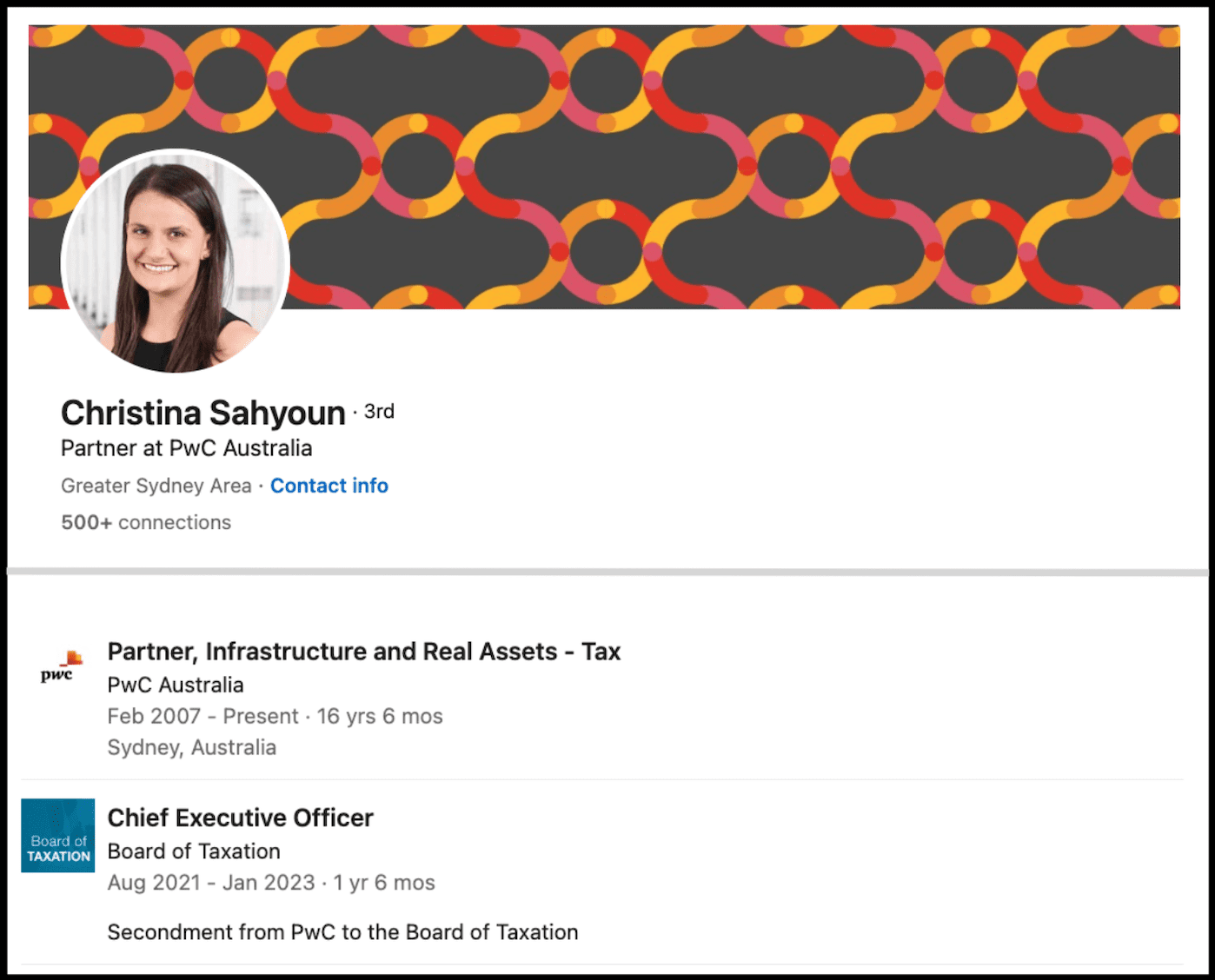

That CEO was Christina Sahyoun.

Sahyoun, for entire term as Board of Taxation CEO, was simultaneously a current senior employee and tax partner of PwC Australia.

On “secondment” to the Board of Taxation — where she was paid an undisclosed taxpayer annual salary in the hundreds of thousands of dollars — Sahyoun has been an employee of PwC at all times since 2007.

“Sahyoun, PwC CEO Kevin Burrowes, and the Board of Taxation, are all refusing to say whether Sahyoun is one of the 63-plus people on PwC’s list”

Sahyoun herself, PwC Australia’s new CEO Kevin Burrowes, and the Board of Taxation, are all refusing to say whether Sahyoun is one of the 63-plus people on PwC’s “list” of current and former partners and staff to have received stolen Federal Government tax policy data.

It can be revealed:

— Tax Board has made zero mention of exit

— Tax Board had no replacement CEO

— Sahyoun’s “CEO Update” weeks earlier makes zero mention of exit

— Sahyoun’s salary a secret, likely $500,000-plus

— Another PwC partner was also a Tax Board director

— He is PwC’s boss of “tax transparency” and “tax governance”

Please support us and SUBSCRIBE HERE

PwC employee and partner Sahyoun simultaneously Board of Taxation CEO. Source: LinkedIn

On January 22 it was revealed that between 2013 and 2018 PwC took secret government tax data and sold it for millions of dollars to multinationals seeking to avoid Australian tax.

“For her entire term, the CEO of Australia’s Tax Board was a senior PwC employee”

The PwC partners who obtained the data, including disgraced accountant Peter Collins, since banned for two years, had been engaged by the Department of Treasury and Board of Taxation to provide “advice” on drafting new laws to prevent multinationals avoiding Australian tax.

Partners, including Collins, signed “confidentiality” clauses, but the data became stolen when it was given to others not authorised to receive it.

The Board of Taxation’s website states it provides “independent advice to the Government”, including “real-time advice on tax policy issues”, as part of “improving the design and operation of taxation laws”.

This week The Klaxon repeatedly asked Sahyoun whether she was one of the 63-plus on the PwC “list”, yet she consistently refused to say.

PwC Australia CEO Kevin Burrowes, who started last Monday, also repeatedly refused to say.

“PwC Australia’s new CEO Kevin Burrowes also refused to comment”

That’s despite former PwC tax partner Anthony Klein — who “resigned” from his role as a Board of Taxation director last month, the same day he received questions from The Klaxon over his PwC past — last week confirming he is one of those on the list.

PwC head of media relations Patrick Lane said the “vast majority” of those on its “list” had “not been found” to have “disseminated” confidential government information.

He said: “PwC is not releasing the names of individuals on the 63 list”.

“PwC is not releasing the names of individuals on the 63 list” – PwC’s Patrick Lane

PwC has gradually released the names of some of those involved in the tax leaks affair over several months, but only under intense public pressure.

On June 2, after months of requests, it provided the Senate inquiry into consultancies with the names of 63-plus partners and staff who received stolen government information.

Almost all of names were blacked out from the document, and although PwC also provided the inquiry with a non-redacted version, it is refusing the inquiry’s requests to make that non-redacted version public.

The Senate inquiry has said it is reluctant to make the unredacted list public – and so is pushing PwC to do so — for fear it might weaken potential criminal or other action against those named on it.

The Australian Government has four main tax agencies: the Australian Taxation Office (ATO); the Board of Taxation (BoT); the Tax Practitioners Board (TPB) and the office of the Inspector-General of Taxation and Taxation Ombudsman (ITGO).

PwC tax partner Sahyoun’s LinkedIn profile states she was Board of Taxation CEO until “January”.

It says she started at PwC in 2007.

“PwC Australia Partner, Infrastructure and Real Assets — Tax; Feb 2007—Present”, it states.

As the nation reels from the PwC tax scandal, which is making worldwide headlines, the spotlight has fallen on Australia’s tax agencies and their connections to the tax industry they are supposed to police.

Of particular focus are the “Big Four” global accountancy and “consultancy” firms, PwC, KPMG, EY and Deloitte, who each make hundreds of millions of dollars a year in “consultancy” contracts from the Federal Government.

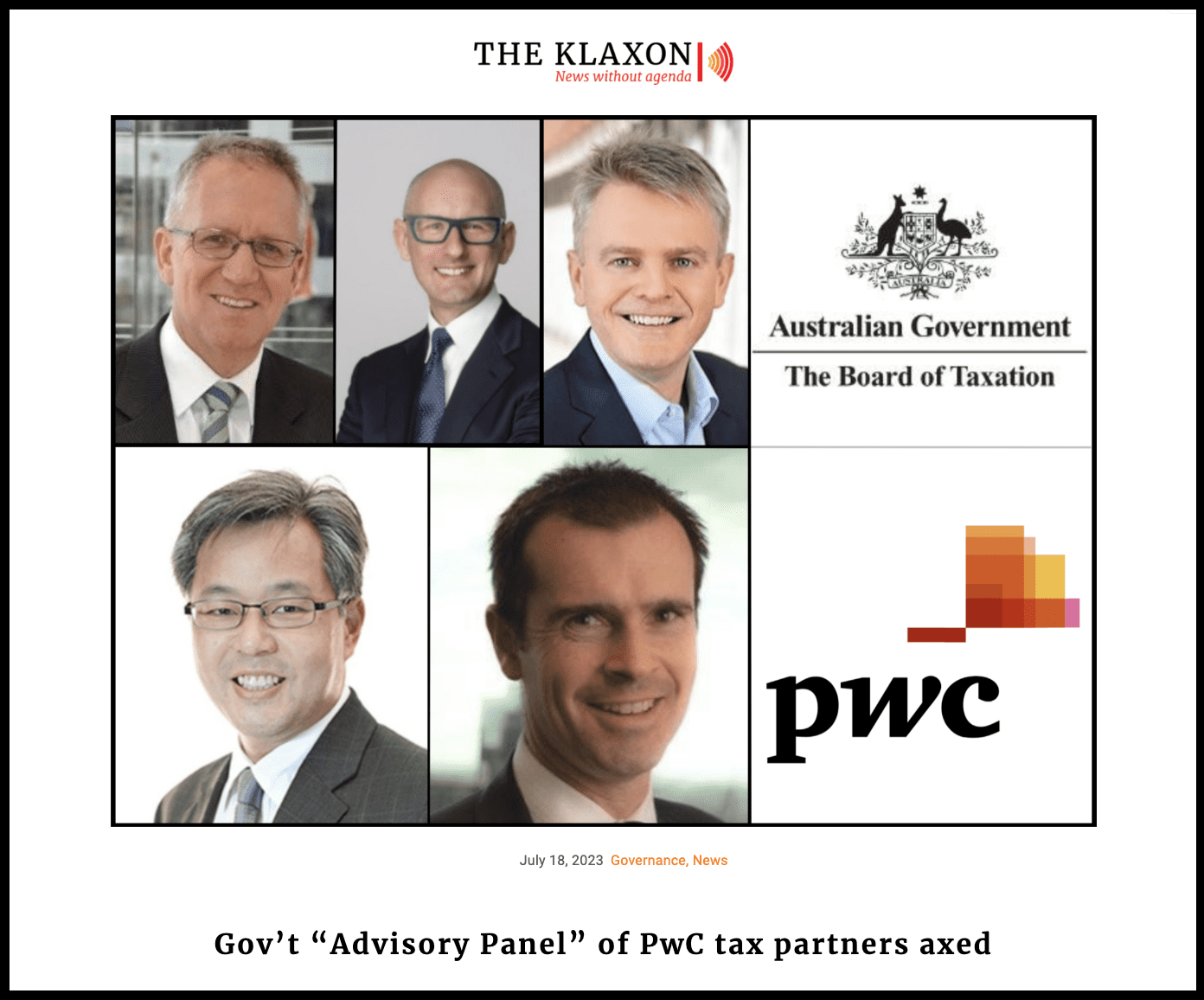

On Tuesday The Klaxon exclusively revealed the Board of Taxation’s “Advisory Panel”, which was comprised of 47 members, has been quietly axed after more than two decades.

As revealed, that “Advisory Panel” was stacked with fossil fuel “tax specialists” and tax partners of the “Big Four” — including four current PwC tax partners.

The Board of Taxation website said the “high-level” Advisory Panel provided “real time policy advice to the (Federal) Treasurer”; was responsible for “advising on the quality and effectiveness of tax legislation”; and for “recommending improvements” to “support the general integrity and functioning of the tax system”.

Please support us and SUBSCRIBE HERE

How The Klaxon broke the story last week. Source: The Klaxon

Klein, who was tax partner with PwC for 17 years until July 2021, was appointed to a three-year term as Board of Taxation director in October 2021.

He had been a member of the “Advisory Panel” since at least January 2015.

Klein’s name was quietly scrubbed from the Board of Taxation website, as was the entire “Advisory Panel”.

Klein last week said he “resigned” from the Board of Taxation on June 23 — the same day The Klaxon put questions to him and the Board of Taxation — and investigations show the “Advisory Panel” was scrapped on June 29.

He is the first government official to depart over the global PwC tax scandal.

Comments Anthony Klein emailed to The Sydney Morning Herald following The Klaxon’s revelations. Source: SMH

At the Board of Taxation, Klein sat alongside fellow directors Treasury Secretary Stephen Kennedy and Australian Taxation Office boss Chris Jordan (who is a former KPMG partner).

Sahyoun’s appointment — and secretive departure — as Board of Taxation CEO raises many questions, most of which she and the Tax Board are refusing to answer.

“Sahyoun’s appointment as Tax Board CEO raises many questions, most of which she and the Tax Board are refusing to answer”

The Board of Taxation has made no mention of Sahyoun’s departure, including anywhere on its website.

It has also made no mention of any new CEO having been appointed.

The Board of Taxation on Thursday told The Klaxon the CEO role was “currently being filed by a Treasury employee” in an “acting capacity”, but it refused to say who that was.

“Once the Board’s forward work program has been agreed with the Government, an external search will be conducted for the role,” it said.

The Board of Taxation said Sahyoun had been CEO from August 30 2021 to January 31 this year.

That’s 17 months.

The PwC tax scandal emerged publicly on January 22, after the Tax Practioners Board on January 20 posted to its website two statements detailing investigations into Collins and “PwC” in the matter.

(The Tax Practioners Board issued a media release on January 22).

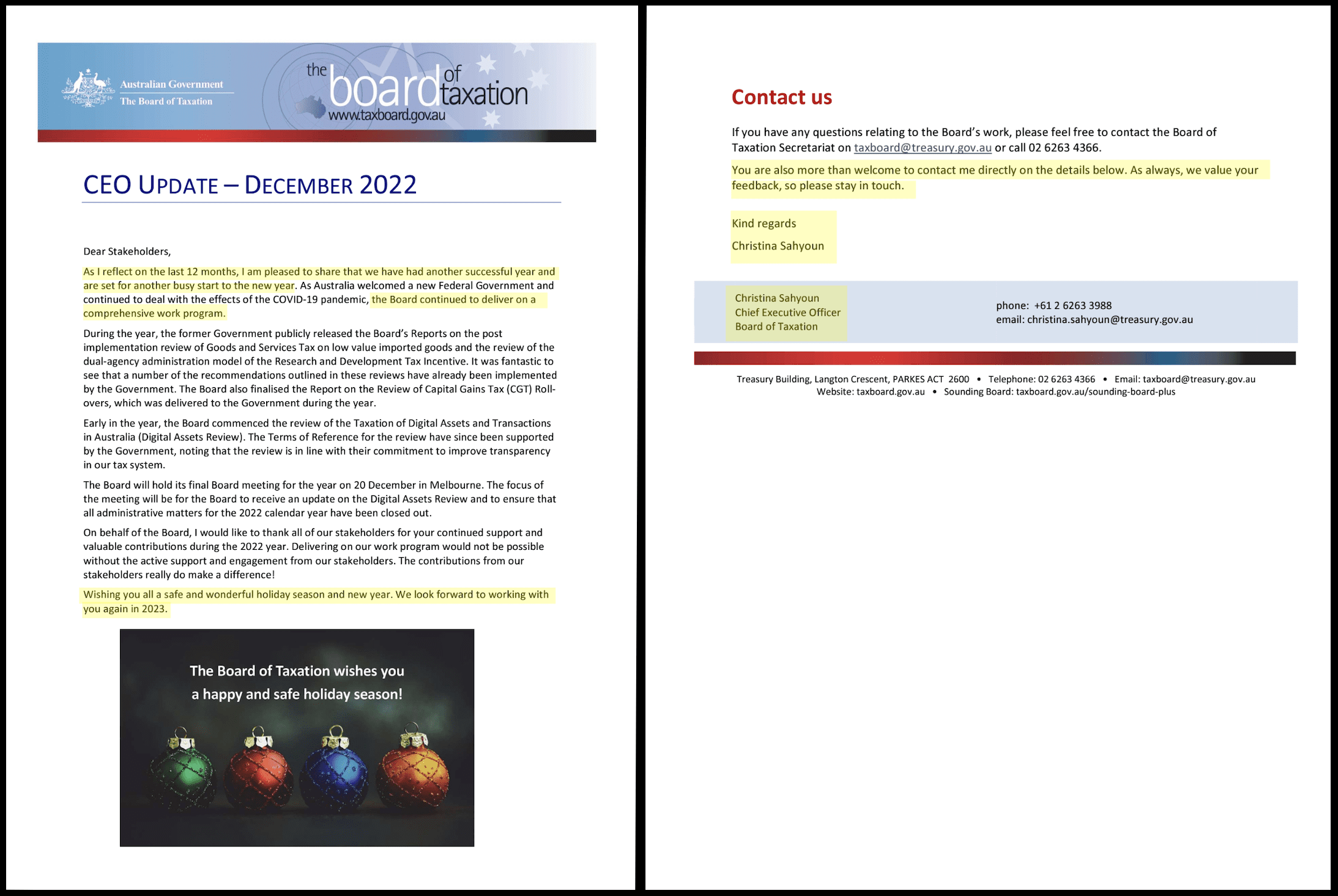

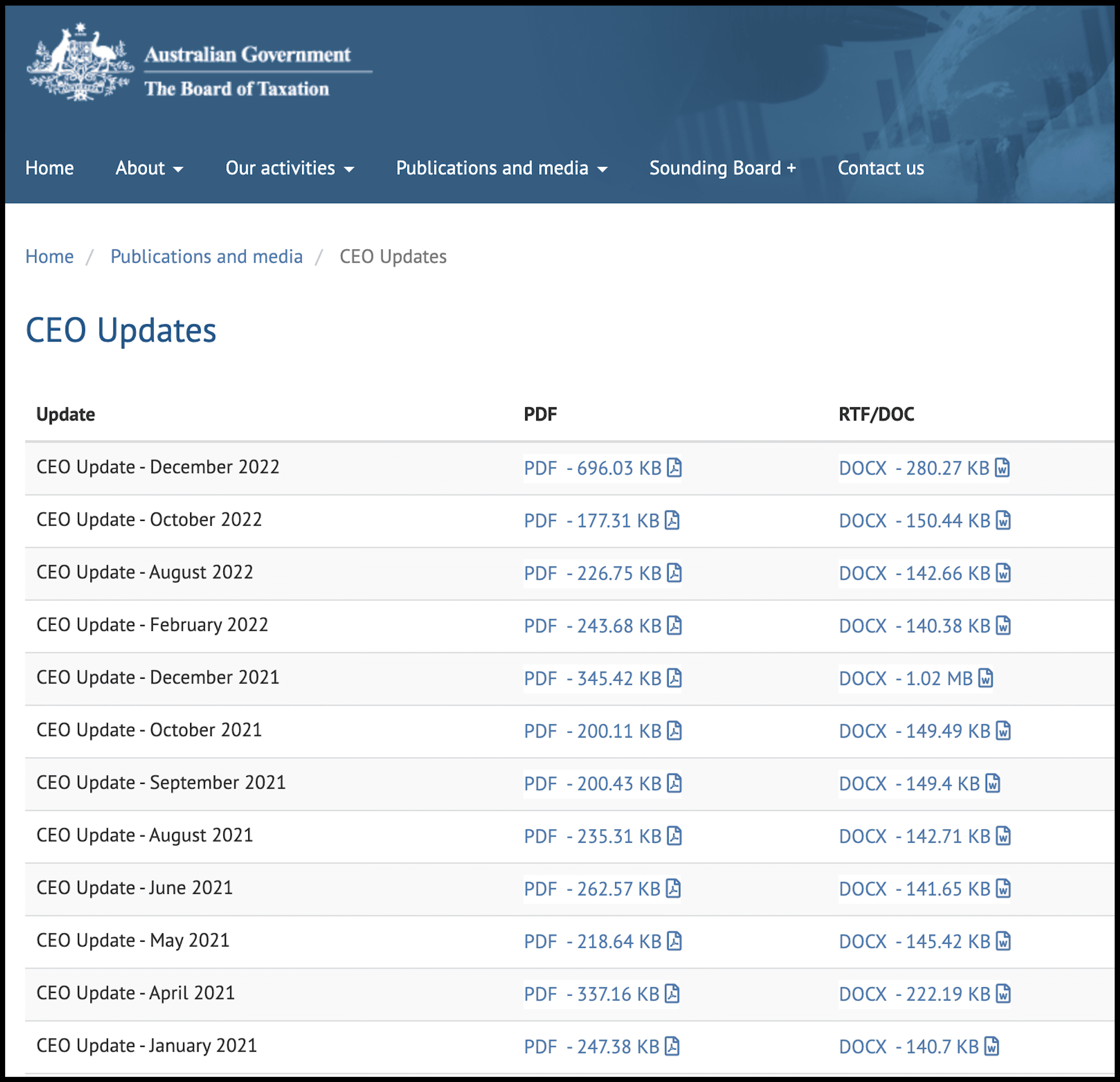

The Board of Taxation website carries a section titled “CEO Updates”.

Please support us and SUBSCRIBE HERE

Christina Sahyoun’s CEO Update from December. Source: Board of Taxation

The most recent update is from December, by Sahyoun, and makes no mention of her departing.

“As I reflect on the last 12 months, I am pleased to share that we have had another successful year and are set for another busy start to the new year,” Sahyoun writes.

“Wishing you all a safe and wonderful holiday season and new year. We look forward to working with you again in 2023.

“You are also more than welcome to contact me directly on the details below. As always, we value your feedback, so please stay in touch,” Sahyoun writes in the December update.

Board of Taxation “CEO Updates” are posted multiple times a year, usually after board meetings, and there were eight posted in 2022.

Not one has been posted since Sahyoun’s “update” in December – seven months ago.

CEO Updates – last one December 2022. Source: Board of Taxation

Sahyoun and the Board of Taxation are refusing to say what Sahyoun’s taxpayer-funded salary was as CEO.

The Board of Taxation’s 2021-22 annual report, its most recent, states it had two “secondments” from the “private sector” during the financial year.

They were Sahyoun, as CEO, and Chris McFallan from KPMG as “Senior Advisor”.

Between them, the two “seconded employees” were paid $777,273 in the financial year.

Neither worked the full financial year.

Sahyoun started on August 30 (and so worked ten months), while McFallan’s LinkedIn bio states he started in “September 2021” (and so worked a maximum of ten months).

At that rate, the equivalent pay for a full year would be $932,729.

Sahyoun held the substantially more senior role, suggesting she was paid $500,000 a year or more as Board of Taxation CEO.

McFallan’s LinkedIn bio states he is a tax specialist who worked at PwC until March 2019, before starting at KPMG.

It can be revealed McFallan also exited his role at the Board of Taxation in January.

“Former PwC tax specialist Chris McFallan also exited his role at the Board of Taxation in January”

He was a “senior consultant” and “manager” in tax at KPMG until “January 2023” — the same time he left the Board of Taxation – his LinkedIn bio states.

Since January McFallan has been a “senior manager” in tax at Deloitte.

When asked whether Sahyoun had been appointed for a “set term” — ie whether a pre-determined end date had been stipulated in her initial employment contract — the Board of Taxation dodged the question.

It said: “The term of Ms Christina Sahyoun as the CEO of the Board of Taxation commenced on 30 August and concluded on 31 January 2023. Ms Sahyoun returned to PwC after completing her full term with the board”.

This carefully worded response does not answer the question: it states when Sahyoun started, when she finished, and that she departed after her “full-term”.

If no predetermined end date had been stated in her initial employment contract, it would still be accurate that Sahyoun had departed after her “full-term” — as her “term” would “end” whenever she departed.

Further, if a predetermined end date had been stated in her initial employment contract, and that date was later changed, the Board of Taxation’s statement that she departed after her “full-term” could still be technically accurate.

PwC spokesman Lane said Sahyoun’s “term as CEO of the Board of Taxation was always to January this year”.

“Her position and length of tenure was a matter of public record, and any inferences to the contrary are wrong,” Lane said.

Lane failed to produce any evidence to substantiate those claims, and The Klaxon has been unable to find any “public record” stipulating Sahyoun’s pre-determined departure date as Board of Taxation CEO.

We pushed the Board of Taxation for more information, noting it had not answered our question as to whether “Ms Sahyoun was appointed for a set-term and if so, when that set-term was established”.

We noted this was particularly important given Sahyoun had “made no mention of her departing in her CEO letter” and that the “Board of Taxation has made no disclosure anywhere” regarding her departure.

The Klaxon seeks responses to the unanswered questions.

The Board of Taxation responded Friday: “The board has nothing further to add”.

Federal Treasurer Jim Chalmers is responsible for the Board of Taxation.

“Federal Treasurer Jim Chalmers is responsible for the Board of Taxation”

The Board of Taxation consists of a board, and also draws a handful of staff — a “secretariat” — from the Department of Treasury.

The Board of Taxation’s chair, Rosheen Garnon, is a former long-time tax partner at KPMG, where she was “National Managing Partner for KPMG Australia’s Taxation Division” from 2009-2015.

Garnon has at all times refused to respond to The Klaxon’s request for comment.

The response Friday.

The Klaxon has requested comment from Garnon herself, or, in the absence of that, that responses provided be attributed to an actual person “for transparency and accountability”.

The Board of Taxation, and its Treasury Secretariat, have at all times refused, instead providing nameless emails with a statement that their response is to be attributed to an unnamed “spokesperson for the Board of Taxation”.

For her part-time role as chair, Garnon, receives a taxpayer salary of $122,460 a year plus expenses.

Other directors are paid $61,230 a year plus expenses.

Under its “Charter”, the Board of Taxation is to be made up of three “ex-officio” members, being the Treasury Secretary; the Commissioner of Taxation (the ATO boss); and the First Parliamentary Council, who is currently Meredith Leigh.

Other board members, of which there are now eight after Klein’s exit last month, are to be “appointed by the (Federal) Treasurer”.

Board of Taxation chair Rosheen Garnon.

They are: chair Garnon, who “has over 30 years of experience” in tax “having been a senior partner with KPMG” where she became tax partner in 2000; Julianne Jaques, a “Chartered Accountant and a Chartered Tax Adviser” who “previously worked as a solicitor with Freehills (now Herbert Smith Freehills) and an accountant with Coopers & Lybrand (now PricewaterhouseCoopers)”; Andrea Laing, a tax accountant and former “Head of Tax for Shell Australia”, where she “spent more than two decades”; Tanya Titman, accountant and partner with major “consultancy” BDO where she has had “over 20 years’ experience in the accounting industry”; and Ian Kellock, a tax partner at global commercial law firm Ashurst, who has “25 years’ experience as a taxation professional”.

Until March, when his three-year term ended, another Board of Taxation director was PwC executive Chris Vanderkley.

Vanderkley is boss of “tax transparency” and “tax governance” at PwC Australia, where he has been since 2016 — including during his entire term as Board of Taxation director.

“Mr Vanderkley is currently Special Counsel at PwC leading their tax transparency and tax governance practice,” his bio at the Board of Taxation states.

“PwC Australia’s boss of tax transparency and tax governance Chris Vanderkley was Board of Taxation director until March”

Board of Taxation director until March, PwC’s Chris Vanderkley

In June the Senate inquiry into consultancies published an “interim report” specifically on PwC, titled: “PwC Australia: A calculated breach of trust”.

“Taken together, the committee concludes that PwC engaged in a deliberate strategy over many years to cover up the breach of confidentiality and the plan by PwC personnel to monetise it,” the report said.

“Given the extent of the breach and subsequent cover-up now revealed on the public record, when is PwC going to come clean and begin to do the right thing?”

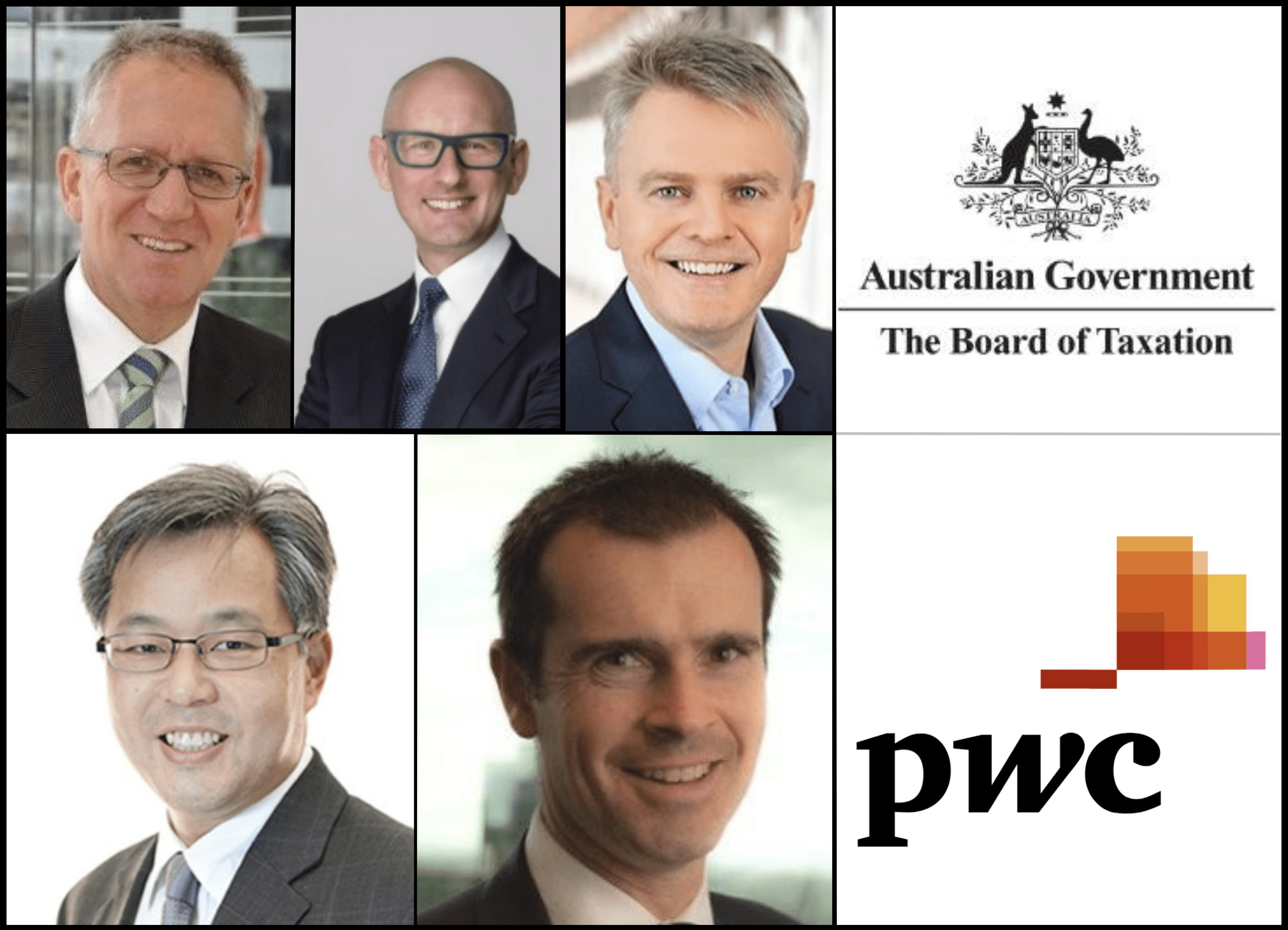

Before it was quietly axed on June 29, the Board of Taxation’s “Advisory Panel” included four current PwC tax partners.

Clockwise from bottom left: PwC Australia tax partners Ken Woo; Steve Ford; Hayden Scott; Nick Houseman; and former PwC tax partner Anthony Klein. Source: Supplied. Graphic: The Klaxon

They are PwC Australia Global Tax Controversy and Dispute Resolution Co-Leader Hayden Scott; PwC Australia Transfer Pricing and International Tax Partner Nick Houseman; PwC Australia Tax Partner Steve Ford; and PwC Australia Tax Partner Ken Woo.

All four refused to respond to detailed questions from The Klaxon.

The Board of Taxation held its most recent board meeting Friday.

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.