Appreciate our quality journalism? Please subscribe here

EXCLUSIVE

An alleged mastermind of PwC’s tax leaks scheme was just weeks ago providing training seminars and legal advice to the highest levels of Australia’s tax authorities – and was personally praised by the Taxation Ombudsman.

Former PwC Australia tax partner Michael Bersten — one of the four former partners PwC yesterday named as alleged masterminds in the scandal — just weeks ago ran a three-day “national online training” course for the Australian Taxation Office (ATO).

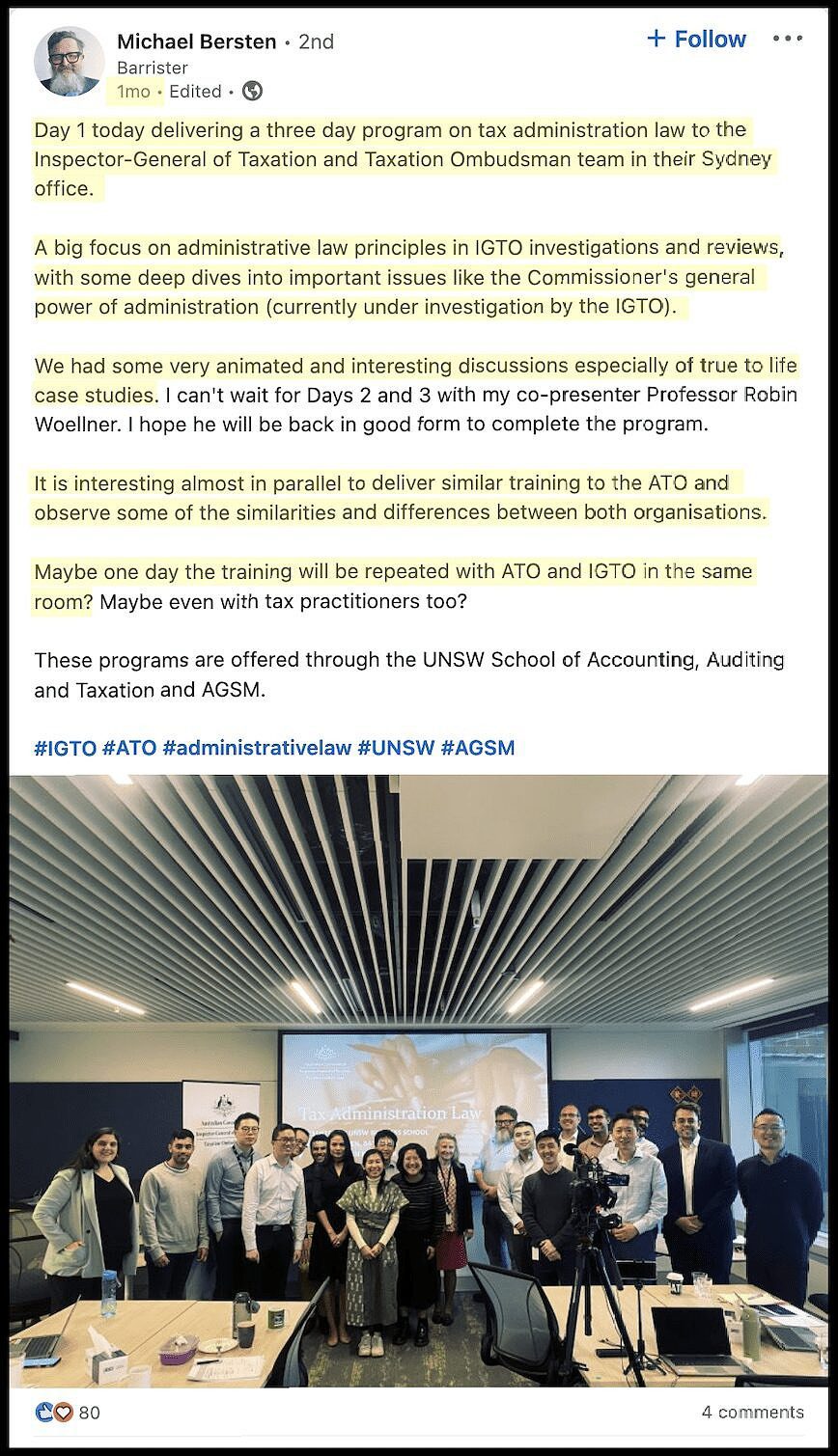

“Day 1 of our national online training for the ATO on tax administration law (over 3 days),” Bersten posted to LinkedIn.

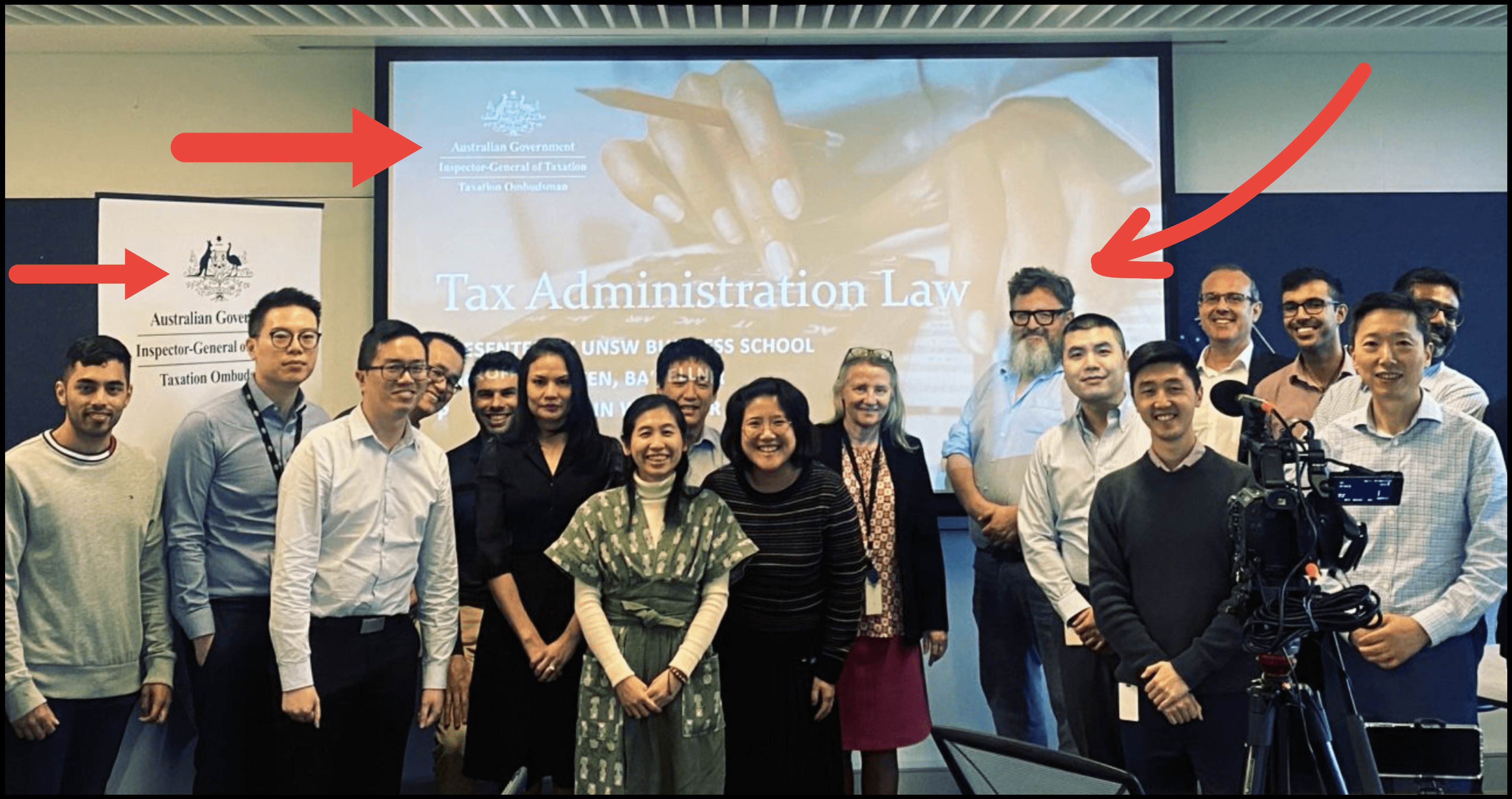

The next week Bersten gave — for the first time — a seminar to the office of the Inspector-General of Taxation and Taxation Ombudsman (IGTO), which oversees both the ATO and the Tax Practitioners Board.

“Day 1 today delivering a three day program on tax administration law to the Inspector-General of Taxation and Taxation Ombudsman team in their Sydney office,” Bersten posted to LinkedIn about a month ago.

That program covered “important issues” going to the heart of Australia’s tax law and power structures, including a “a big focus” on laws around “IGTO investigations” and the powers of the Taxation Commissioner, which were “currently under investigation by the IGTO”.

“A big focus on administrative law principles in IGTO investigations and reviews, with some deep dives into important issues like the Commissioner’s general power of administration (currently under investigation by the IGTO),” writes Bersten, a barrister.

“We had some very animated and interesting discussions especially of true to life case studies”.

“We had some very animated and interesting discussions especially of true to life case studies” – Micheal Bersten

Enjoying this article? CLICK HERE to support our important work

Michael Bersten delivers a three-day seminar in the Sydney offices of the Inspector-General of Taxation and Taxation Ombudsman. Source: LinkedIn

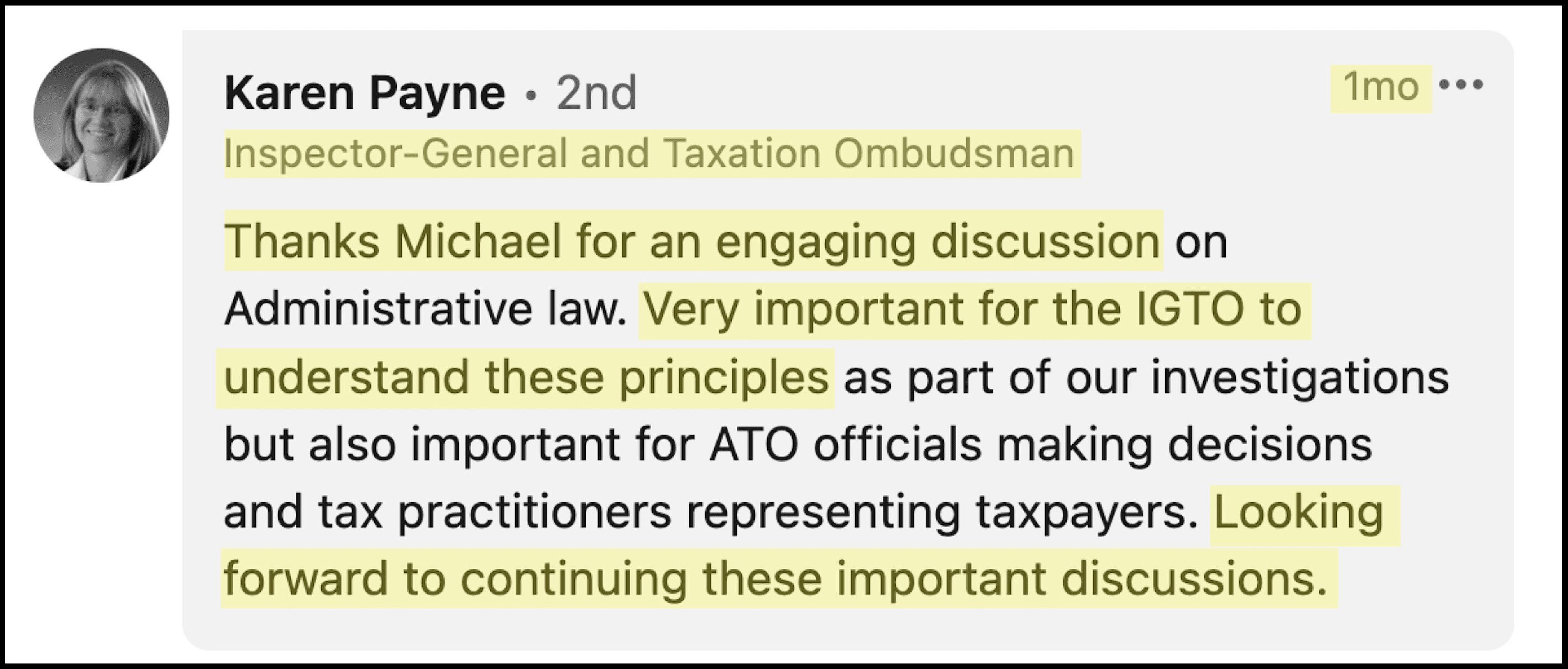

Karen Payne, who is both Australia’s Inspector-General of Taxation and Taxation Ombudsman, responded: “Thanks Michael…very important for the IGTO to understand these principles as part of our investigations”.

“Also important for ATO officials making decisions and tax practitioners representing taxpayers.

“Looking forward to continuing these important discussions,” writes Payne.

“Thanks Michael…very important for the IGTO to understand these principles as part of our investigations” – Taxation Ombudsman Karen Payne

Bersten’s posts, and Payne’s responses, are stamped as posted to LinkedIn “1 month” ago. (LinkedIn posts do not carry specific dates beyond a handful of days).

Bersten and Payne have been approached for comment.

The revelations come as the Senate inquiry into consulting services holds public hearings in Canberra Wednesday.

“Very important for the IGTO to understand these principals,” says Tax Ombudsman Karen Payne. Source: LinkedIn

PwC has been embroiled in scandal since the Tax Practitioners Board in January revealed that former PwC tax partner Peter Collins had leaked confidential Federal Government plans to combat multinational tax evasion.

Collins, who left PwC late last year amid the TPB investigation, was banned from practicing for two years.

Treasury had engaged Collins starting in 2014 to assist in drafting new laws, but despite confidentiality agreements Collins shared the secret information widely within PwC, which then sold it to multinationals seeking to avoid Australian tax.

Internally, PwC called its illegal scheme “Project North America”.

The scandal erupted on May 2 when the Tax Practitioners Board (TPB) handed a Senate inquiry a 144-page cache of PwC emails discussing the illegal scheme (although it had redacted all names other than Peter Collins).

Yesterday, following weeks of demands, PwC Australia acting CEO Kristin Stubbins handed the Senate inquiry the names of 63 PwC partners and staff who received emails about the scheme.

It also gave it the names of 9 partners that PwC last week said had been “stood down” over the scandal.

Those 72 names have not yet been released.

Bersten posts to Linkedin. Source: LinkedIn

An internal email to PwC staff yesterday afternoon named four former partners allegedly involved in the scheme, including Colin Peters (named by the TPB in January).

“The four former partners include; Michael Bersten, Peter Collins, Neil Fuller, and Paul McNab,” Stubbins wrote.

“[Former PwC Australia CEO] Tom Seymour no longer has any role in our firm, and we will take appropriate action for these individuals when our investigation is complete.

(PwC has confirmed the email, which was first reported by The Australian Financial Review).

Bersten’s bio states he was a tax partner at PwC from 2004 until July 2018 and is currently deputy chairman of the Law Council of Australia’s Tax Committee.

“I was a senior Partner within the PwC Australia Tax Controversy & Dispute Resolution Group for 14 years having founded the practice,” it states.

“I acted in many of the major tax controversies in Australia, predominantly in the publicly listed and global business sectors and also with high wealth individuals”.

WE NEED YOUR HELP! Please CLICK HERE to support our important work

Bersten’s recent post about his three-day ATO “national online training”. Source: LinkedIn

Former PwC tax partner McNab worked at PwC from 1997 to 2020, before becoming a tax partner at global law firm DLA Piper.

“PwC has today released my name as one of four former partners they say were involved in confidentiality breaches. It is noteworthy that the firm has taken this action to name former partners only,” McNab said yesterday in a statement posted to LinkedIn.

“It is noteworthy that the firm has taken this action to name former partners only” — Paul McNab

“At all times I worked with my clients to comply with Australian law, and not avoid it”.

Last night it was announced McNab had departed DLA Piper.

“Paul decided to do the honourable thing in the midst of this media storm and act in the interest of the firm,” a spokesman for McNab reportedly said.

Former PwC tax partner Paul McNab. Departed DLA Piper last night. Source: International Tax Review

Former PwC tax partner Neil Fuller is alleged to have gone to the US in 2015 armed with secret government information Collins had obtained from Treasury.

Fuller allegedly used the confidential material to pitch to the head offices of dozens of US tech giants with Australian operations.

Fuller’s LinkedIn bio, which appears to have been deleted, stated he retired from PwC in July 2019, after 31 years at the firm.

Searches show in Fuller’s last few years at PwC he was based outside Australia, including in Canada.

He listed as a speaker at January 2018 medical conference in the Canadian ski resort Whistler.

On the bill “Neil Fuller, PwC Global Tax, Canada” is listed as giving an “Experts’ Forum” address titled: “Issues in international taxation including a look at the Fonseca Panama Papers”.

Former PwC tax partner Neil Fuller. Source: PwC

The Inspector-General of Taxation and Taxation Ombudsman (ITGO) is an “independent statutory office” that “strives to improve the administration of tax laws for the benefit of community”.

Its website states it provides “independent advice and assurance” through “investigation, review and reporting” that “Australian taxation administration laws are operating effectively and consistently with community expectations”.

“The IGTO provides independent advice to government, engaging with Parliamentary committees and relevant Ministers (especially the Treasurer, Assistant Treasurer and Minister for Superannuation and Financial Services) as appropriate”.

It was created in May 2015 by the Federal Coalition, which merged the Office of the Inspector-General of Taxation (which it had created in 2003) with the Taxation Ombudsman (which until then had been the responsibility of the Commonwealth Ombudsman).

“From 1 May 2015, the IGT also became the Taxation Ombudsman (IGTO) to help address their complaints about the administrative actions of the ATO or the TPB,” IGTO’s website states.

Karen Payne, Inspector-General & Taxation Ombudsman. Source: Australian Government

In April 2019, weeks before that year’s federal election, then Federal Treasurer Josh Frydenberg appointed Payne as Inspector-General of Taxation & Taxation Ombudsman, for a five-year term.

“Previously, Ms Payne was a partner with Minter Ellison specialising in corporate and international tax, with extensive experience managing complex tax related matters,” Frydenberg said.

In his LinkedIn posts, Bersten says his recent “national online training” for the ATO was “the second time we have provided the ATO program” after “our first run in 2022”.

“Next week we start a similar program for the Inspector-General of Taxation and Taxation Ombudsman,” he writes.

The ATO has been criticised for failing to take appropriate action in the PwC scandal, despite being aware Collin’s illegal activities since 2015.

When asked about Bersten’s “national online training”, the ATO refused to comment.

“The ATO has no further comment on the PwC matter,” it said in a statement to The Klaxon tonight.

“The ATO has no further comment on the PwC matter” – ATO

Last financial year ATO boss Chris Jordan, the Taxation Commissioner, received a $833,421 salary from taxpayers.

Bersten’s posts continue:

“It is interesting almost in parallel to deliver similar training to the ATO and observe some of the similarities and differences between both organisations,” he writes.

“Maybe one day the training will be repeated with the ATO and IGTO in the same room?”

BEFORE YOU GO – WE HAVE A SMALL FAVOUR TO ASK! Less than 2% of our readers currently contribute. Please help us stay afloat and telling these stories. Please SUBSCRIBE or CLICK HERE to make a one-off donation. Thank you!

Anthony Klan

Editor, The Klaxon

Do you know more? anthonyklan@protonmail.com

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.