Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE

The disgraced accountant at the heart of the PwC tax scandal, Peter Collins, was a member of the Board of Taxation’s “high-level Advisory Panel”, which was quietly scrapped late last month after more than two decades.

It can also be revealed the Board of Taxation’s annual report for the 2017-18 financial year — which includes Collins’ time on the influential Advisory Panel — is “missing” from public records.

Australian Treasurer Jim Chalmers, responsible for the Board of Taxation, is refusing to respond.

It can be revealed Collins was a member of the Advisory Panel — which was scrapped on June 29 after investigations by The Klaxon — from at least February 2016 until at least January 31, 2020.

That information is from WayBack Machine, an internet archive that has captured the Board of Taxation “Advisory Panel” webpage multiple times back to 2015.

The Board of Taxation quietly deleted from its website details of the Advisory Panel, including its 47-members, when on June 29 it quietly axed the panel after 21 years.

Investigations by The Klaxon revealed the “high-level Advisory Panel” was stacked with fossil fuel “tax specialists” and “Big Four” tax partners, including four current PwC tax partners.

The Big Four global accountancy and “consultancy” firms are PwC, EY, Deloitte and KPMG.

Chalmers has made no statement regarding the scrapping of the Advisory Panel, which the Board of Taxation website had stated: “assists the Board in carrying out its activities, including by contributing to the Board’s real time policy advice to the Treasurer”.

The role of the Advisory Panel included “advising on the quality and effectiveness of tax legislation” and “recommending improvements to support the general integrity and functioning of the tax system”.

As revealed by The Klaxon Sunday, the CEO of the Board of Taxation from August 2021 until January 31 this year — just days after the PwC scandal broke — was Christina Sahyoun.

Please support us and SUBSCRIBE HERE

How The Klaxon broke the story yesterday. Source: The Klaxon

Sahyoun, a PwC tax partner, has been an employee of PwC at all times since 2007.

Sahyoun, new PwC Australia CEO Kevin Burrowes, and the Board of Taxation, are all refusing to say whether Sahyoun is one of the 63-plus people on PwC’s “list” of those to have received stolen Federal Government tax information.

The PwC scandal emerged publicly on January 22 after the Tax Practitioners Board, an Australian Government agency that oversees the nation’s 80,000-odd tax practitioners, on January 20 posted details regarding investigations it had completed in November into Collins and PwC.

Collins and other unnamed PwC partners gleaned confidential data while providing the Federal Government “advice” over new tax laws to stop multinationals avoiding Australian tax, which PwC sold for millions of dollars to multinationals seeking to avoid Australian tax.

The information was gleaned from the Department of Treasury and the Board of Taxation.

The Tax Practitioners Board said Collins signed “confidentiality” agreements in 2013, 2015 and 2018 but has not named the other PwC partners to have also signed the agreements.

It said the Board of Taxation information gleaned was subject to “confidentiality”, but has not said who, other that Collins, was provided that Board of Taxation information.

Australian’s four main tax agencies are the Australian Taxation Office (ATO); the Board of Taxation (BoT); the Tax Practitioners Board (TPB); and the office of the Inspector-General of Taxation and Taxation Ombudsman (ITGO).

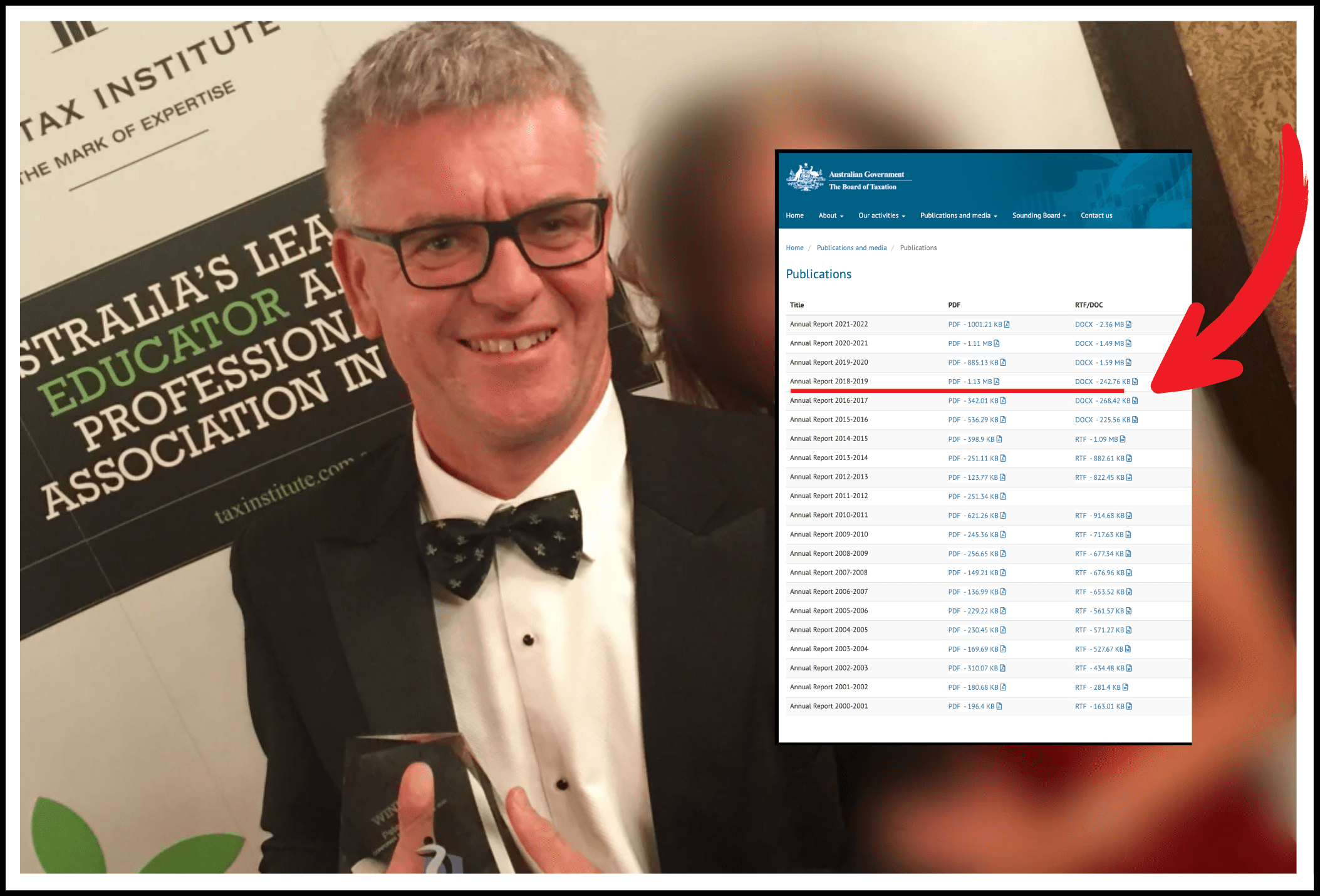

Peter Collins appears in the Board of Taxation’s 2016-17 annual report as one of eight PwC members on the Advisory Panel as at June 30 2017.

Collins was a member of the Advisory Panel for all of the 2017-18 financial year.

The Board of Taxation website includes all 21 annual reports since it was created — except for the 2017-18 financial year.

Please support us and SUBSCRIBE HERE

MISSING: The 2017-18 Board of Taxation Annual Report. Source: Board of Taxation

The Board of Taxation; its chair Rosheen Garnon, a former KPMG tax partner; the Department of Treasury, overseen by Treasury Secretary Steven Kennedy (a Board of Taxation director); and Treasurer Chalmers have all refused to respond since Friday when asked if the 2017-18 financial report exists — and if so where it is.

The Board of Taxation, overseen by the Department of Treasury, is a “non-statutory advisory body” and its annual reports are not audited by the Commonwealth Ombudsman’s Australian National Audit Office (ANAO).

Searches show none of the Board of Taxation’s annual reports appear in the Australian Government Transparency Portal, the “central repository and data store of publicly available corporate information for all Commonwealth entities”.

“None of the Board of Taxation’s annual reports appear in the Australian Government Transparency Portal”

The Board of Taxation is to consists of three “ex-officio” members, being the “Secretary to the Department of the Treasury; the Commissioner of Taxation (the ATO boss); and the “First Parliamentary Counsel”.

Other directors are to be “appointed by the Treasurer” for “a term of up to three years”.

Chalmers has been Treasurer since the ALP was elected in May last year, replacing the Coalition’s Josh Frydenberg, Treasurer since August 2018.

Scott Morrison was Treasurer from September 2015 until August 2018, when he became Prime Minister.

More Klaxon PwC Tax Scandal Exclusives:

23 July — Tax Board run by PwC Partner

18 July — Gov’t “Advisory Panel” of PwC tax partners axed

17 July — First public official ousted in global PwC tax scandal

13 July — Gov’t tax boss at heart of PwC tax scammers nest

27 June — PwC tax scam CEO quits as charity chair

26 June — Tax Ombudsman schooled by PwC emails partner

7 June — “Vanished” Tax boss was exec at pre-PwC

24 May — You don’t Sayers? PwC Mini-Me in $6m Gov’t bonanza

The 2016-17 annual report shows the eight PwC members of the Advisory Panel at June 30 2017 were: PwC tax partners Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan, Ken Woo and PwC Special Counsel Chris Vanderkley.

As revealed Sunday, Vanderkley was a Board of Taxation director, along with Klein, until his three-year term expired in March, two months after PwC tax partner Sahyoun departed as Board of Taxation CEO.

Sahyoun has repeatedly refused to respond when asked if her term as CEO had a pre-determined end date, and if so when that was.

“The Board of Taxation has made no mention of Sahyoun’s departure”

PwC spokesman Patrick Lane said Sahyoun’s “term as CEO of the Board of Taxation was always to January this year” and “her position and length of tenure was a matter of public record”.

Lane has provided no evidence to back the claim, despite repeated requests, and The Klaxon has been unable to find any public records stating Sahyoun had a pre-determined end date of January 31.

The Board of Taxation has made no mention of Sahyoun’s departure.

Sahyoun, PwC and the Board of Taxation are refusing to say how much Sahyoun was paid as CEO, but Board of Taxation annual report for 2020-21 suggests the taxpayer-funded role was over $500,000 a year.

The chair of the Board of Taxation at June 30, 2017 was Karen Payne, a former EY accountant and tax partner with corporate law firm Minter Ellison “specialising in corporate and international tax for mergers and acquisitions”.

In May 2019 Payne was appointed Australia’s Inspector-General of Taxation and Taxation Ombudsman (IGTO).

The June 29 scrapping of the “Advisory Panel” came days after Anthony Klein, a PwC tax partner for 17 years until July 2021, “resigned” as Board of Taxation director.

Klein last week said he “resigned” on June 23, which is the same day The Klaxon put questions to him and the Board of Taxation about his past at PwC.

The Board of Taxation made no statement about Klein’s departure, halfway through his $67,000 a year taxpayer-funded term, rather it quietly scrubbed his name from its website.

He is the first government official to depart over the global PwC tax scandal.

Please support us and SUBSCRIBE HERE

Klein last week said he is one of the 63 people PwC has said received at least one email containing confidential federal government information.

He denies any wrongdoing.

The 2016-2017 Board of Taxation annual report lists 12 “membership of board working groups” including “Tax and the sharing economy” of which Klein is listed as a member.

PwC’s Hayden Scott is listed as a member of the “Post implementation review of the contingent consideration rules”.

Payne is one of four members of the “Application of Hybrid Mismatch Rules to Regulatory Capital” working group.

“Payne chaired the Board’s working group that advised on the implementation of the OECD hybrid mismatch rules – both generally and specifically in relation to regulatory capital and has chaired the working group advising on the OECD BEPS Action 12 Mandatory Disclosure Rules,” the accounts state.

A “Chartered Accountant and Chartered Tax Advisor”, Payne “has over 20 years’ experience as a taxation advisor at top tier legal and accounting firms.

Prior to her appointment as CEO to the Board, she was a Partner at Minter Ellison “focusing on international and corporate taxes for the financial services industry, and mining, energy and utilities sectors”, the accounts state.

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.