A Federal tax agency’s “missing” annual report covers the period it was taking formal “advice” on tax laws from eight PwC partners – including Peter Collins. The person responsible is now Australia’s Taxation Ombudsman. Anthony Klan reports.

EXCLUSIVE

INVESTIGATIVE FEATURE

The person responsible for the Board of Taxation’s “missing” 2017-18 annual report is now Australia’s Taxation Ombudsman — and she’s refusing to say where it is, or even if it exists.

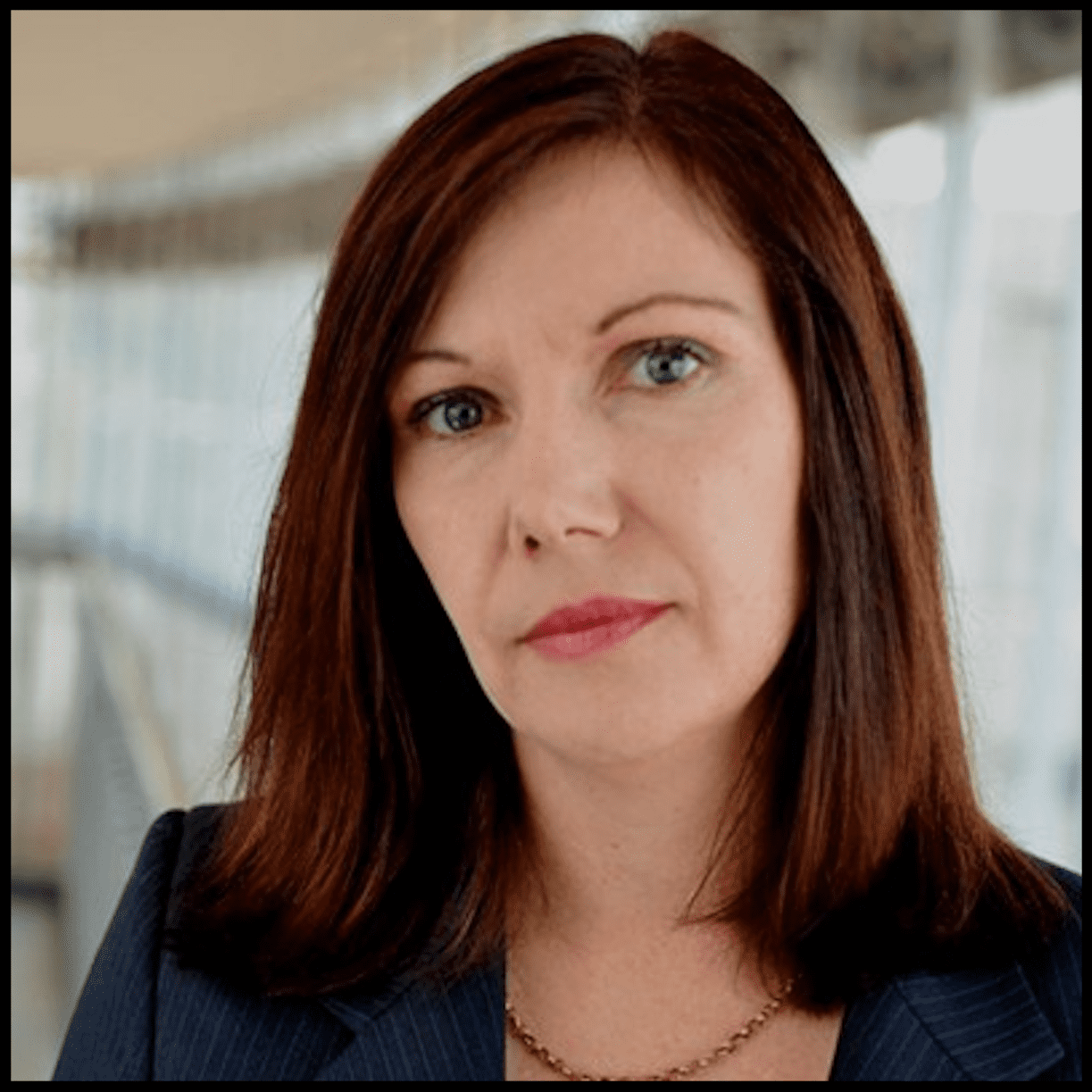

Karen Payne, who is currently both Australia’s Taxation Ombudsman and the nation’s Inspector-General of Taxation, was CEO and director of the Federal Government’s Board of Taxation until 2019.

The Board of Taxation’s “missing” annual report, for the year to June 30, 2018, covers the period the Board of Taxation’s official “Advisory Panel” included around eight PwC partners — including the disgraced accountant at the heart of the PwC tax scandal, Peter Collins.

The Federal Treasurer at the time was Scott Morrison.

Please support us by SUBSCRIBING HERE

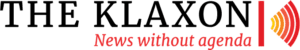

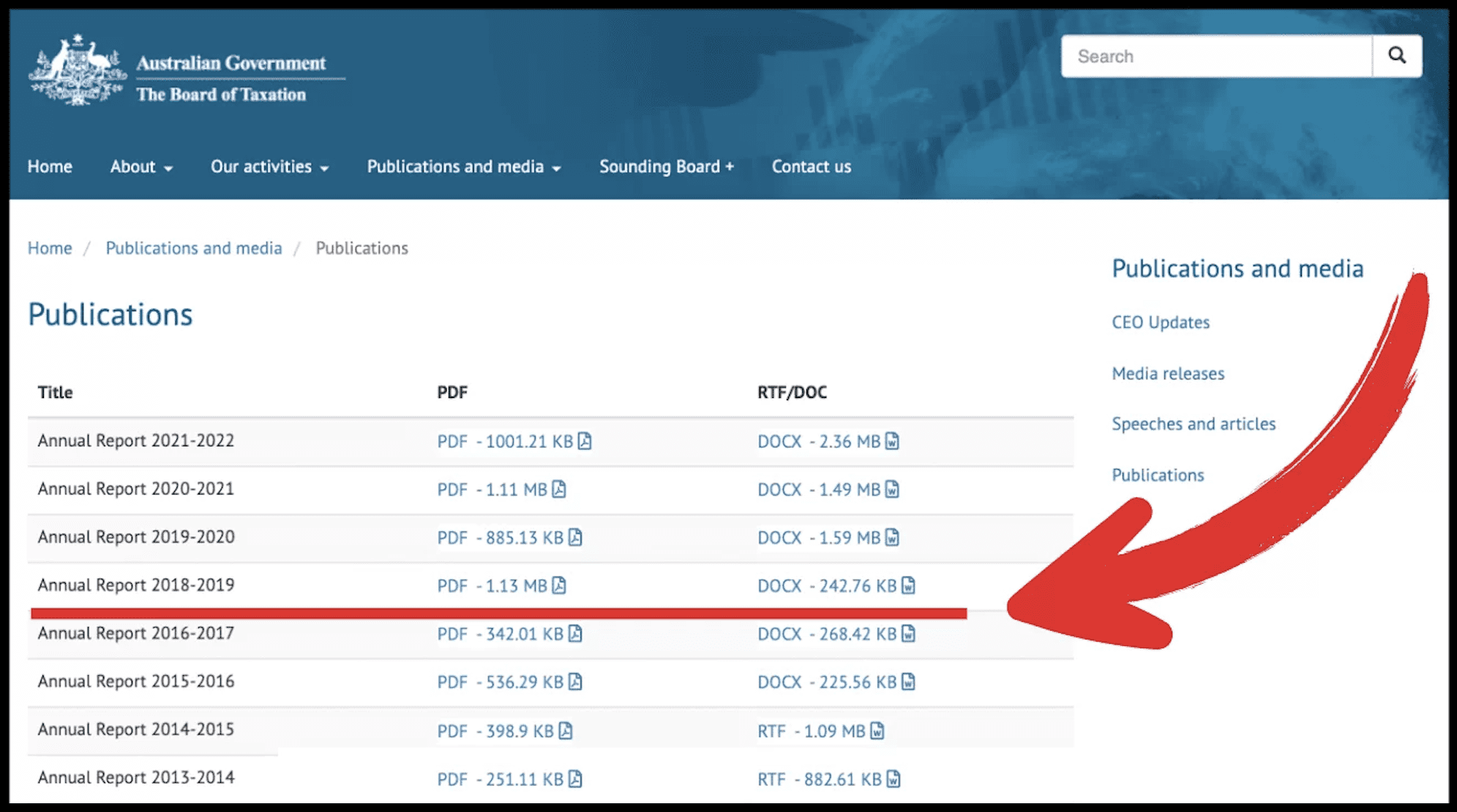

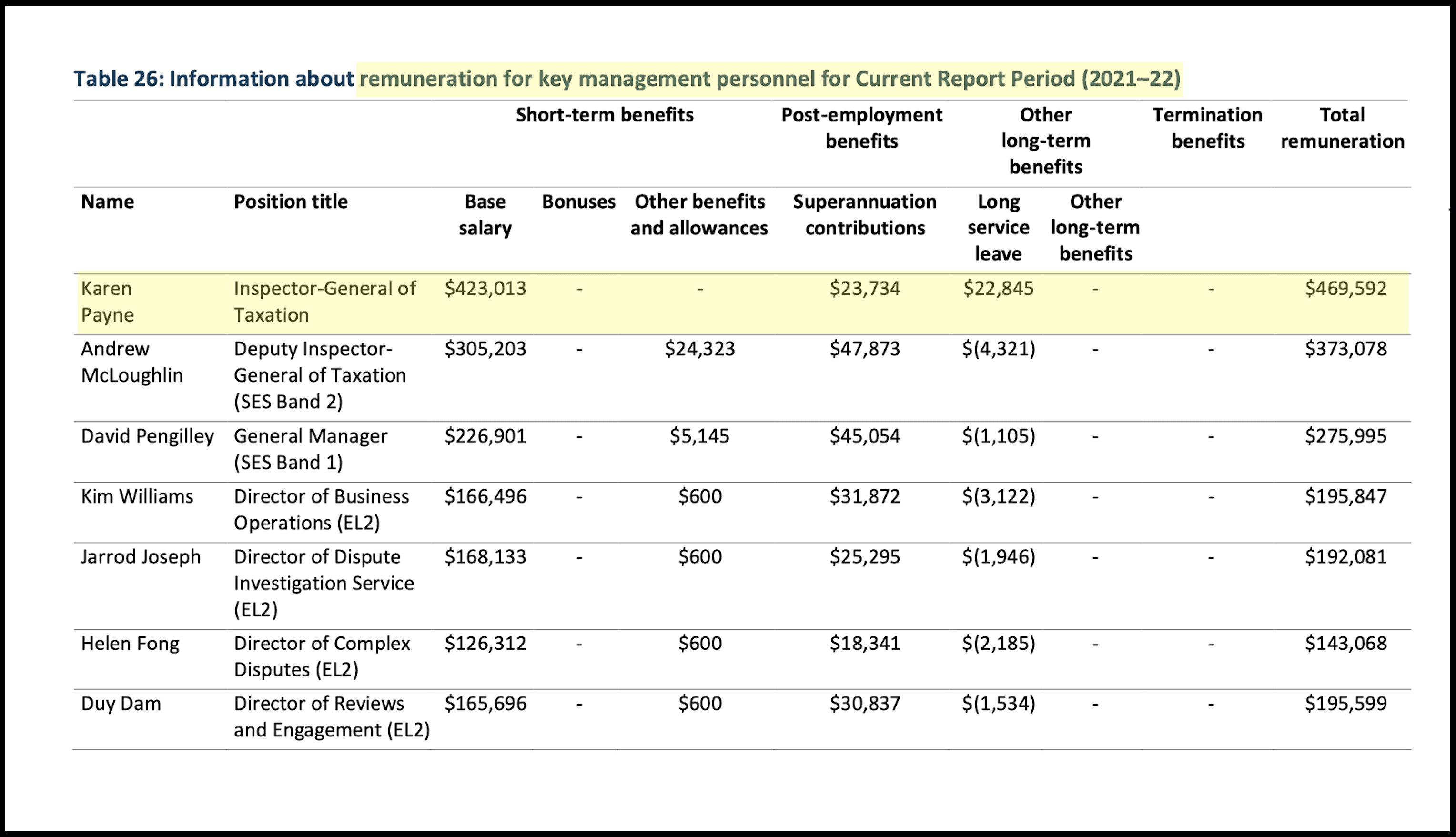

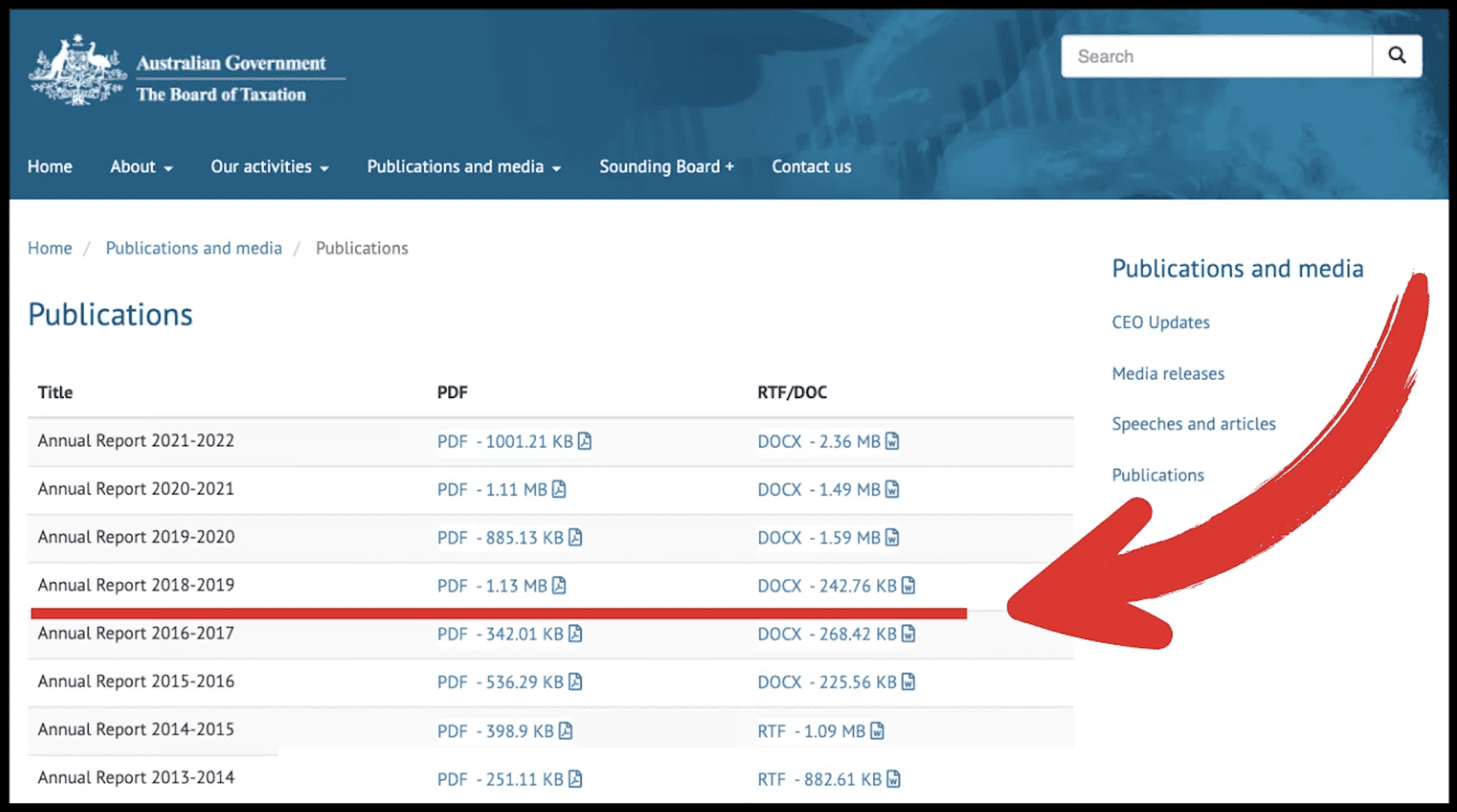

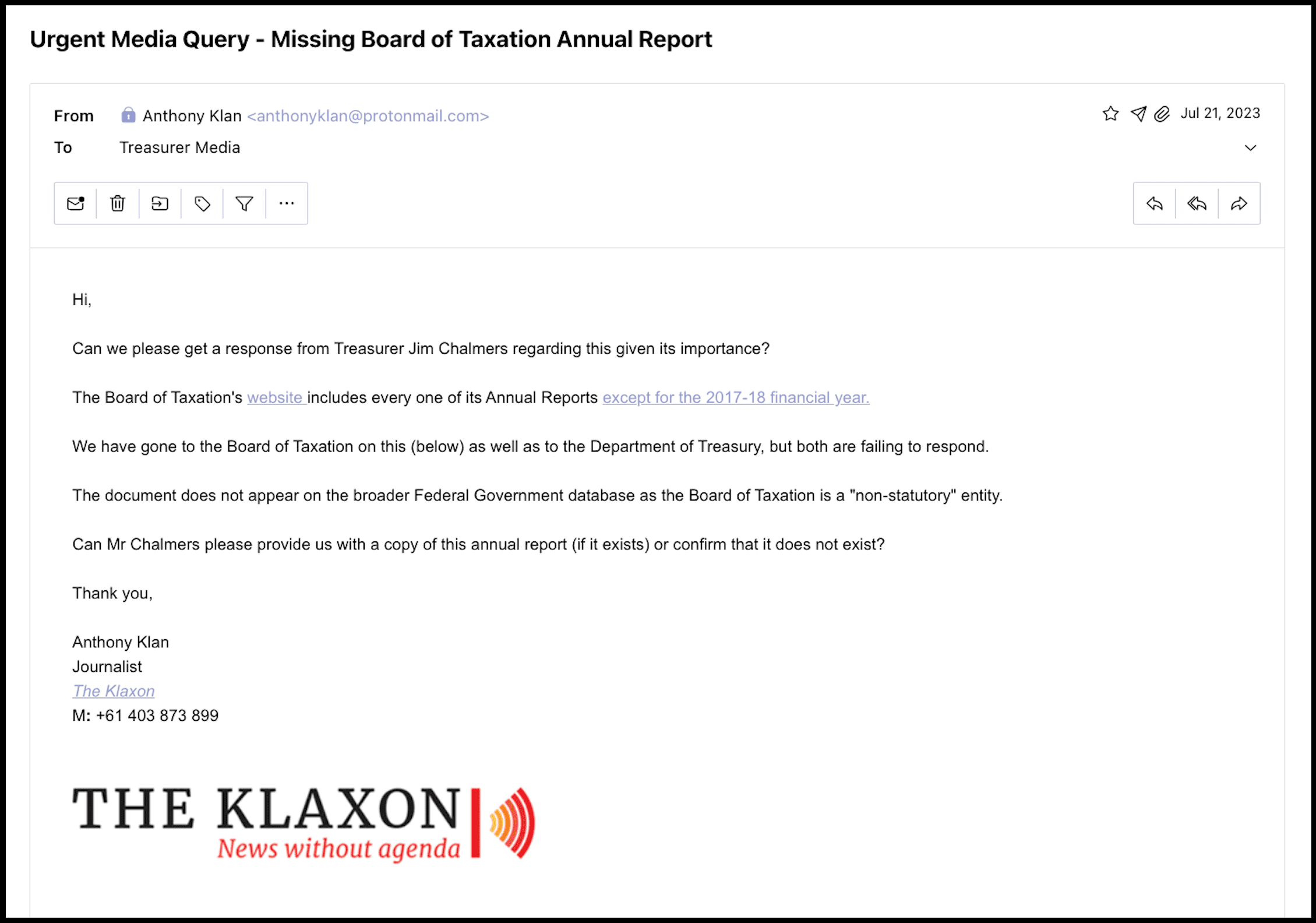

MISSING: The 2017-18 Board of Taxation Annual Report. Source: Board of Taxation

Payne, a former tax accountant of “Big Four” firm EY and former tax partner at commercial law firm Minter Ellison, was herself on the Board of Taxation “Advisory Panel”, from 2010 until 2015.

In May 2015 Payne became a Board of Taxation director, and in March 2016 (the same month she departed Minter Ellison), she was also appointed Board of Taxation CEO.

Payne left the Board of Taxation in May 2019, when she became Australia’s Taxation Ombudsman and Inspector-General of Taxation (IGTO).

Australian’s four main tax agencies are the Australian Taxation Office (ATO); the Board of Taxation (BoT); the Tax Practitioners Board (TPB); and the office of the Inspector-General of Taxation and Taxation Ombudsman (ITGO).

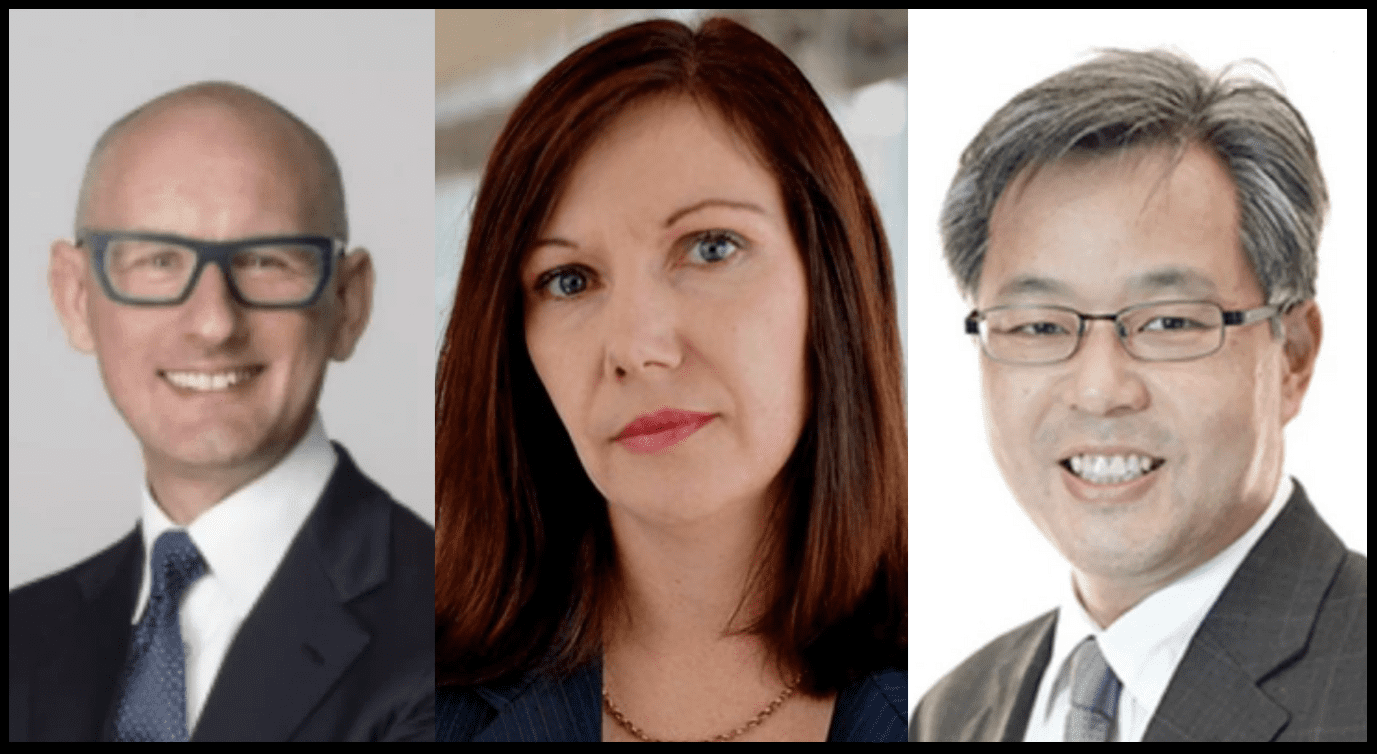

Australia’s four main tax agencies. Source: Australian Government.

Payne has failed to directly answer questions from The Klaxon, including whether the 2017-18 Board of Taxation annual report exists, if she signed off on it — and if it does exist, where it is.

However, after earlier declining to do so, on Friday afternoon Payne provided us with a vague written response.

Payne does not say whether the Board of Taxation’s 2017-18 annual report exists, but she appears to suggest it was never prepared.

Payne said she was “no longer a member of the Board of Taxation” and “do not have access to Board of Taxation records”.

“I provide some brief background on the Board of Taxation which I trust is useful and of assistance,” Payne writes, including six dot points.

“The Board of Taxation is neither a seperate legal entity nor statutory body and accordingly there is no statutory or formal requirement to produce an annual report.

“However, in the interests of transparency, I understand it is customary to do so,” Payne writes.

“There is no statutory or formal requirement to produce an annual report” – Taxation Ombudsman

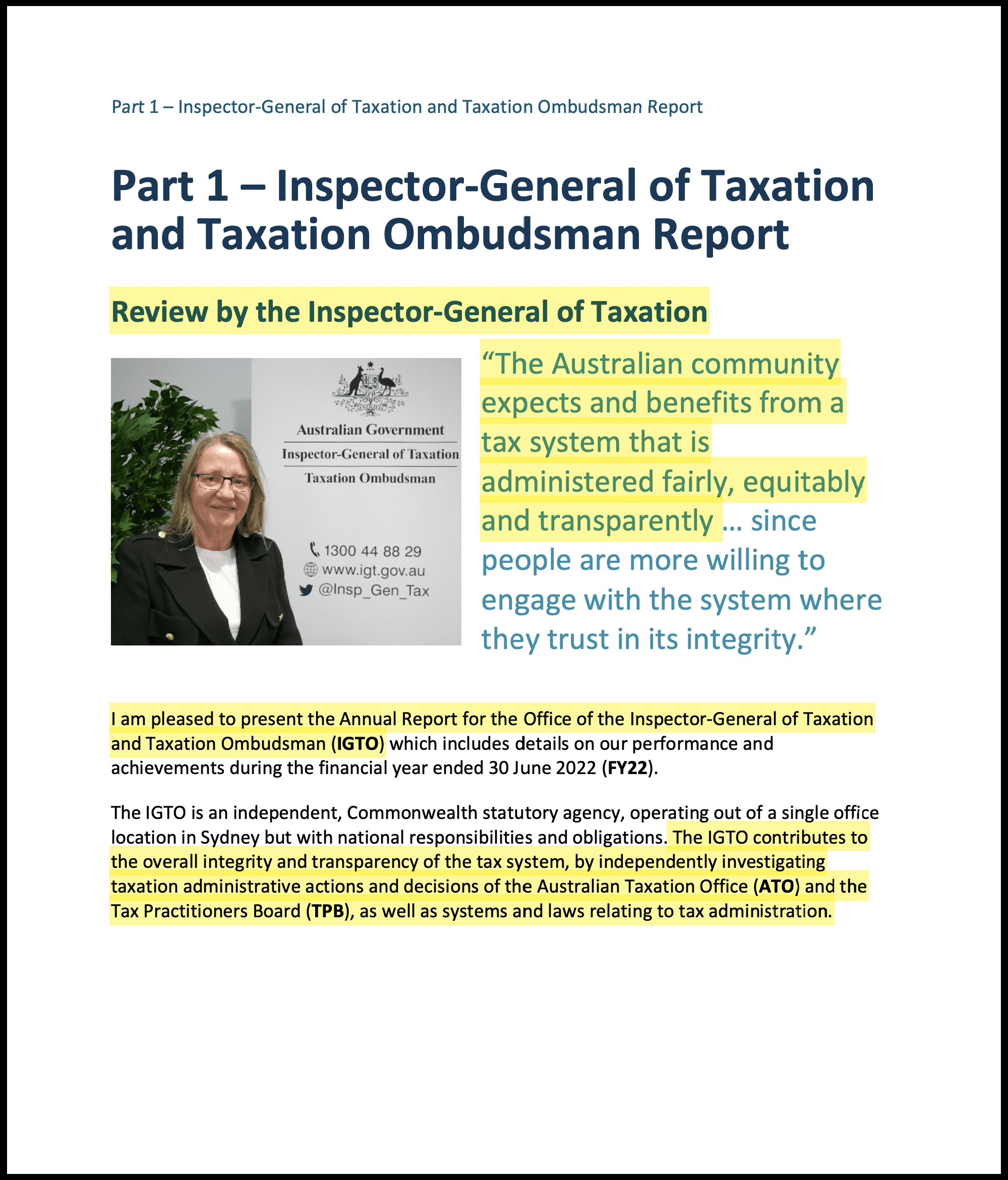

As Australia’s Taxation Ombudsman and Inspector-General of Taxation, Payne received total remuneration of $469,592 in the 2021-22 financial year.

Please support us by SUBSCRIBING HERE

Payne was paid $469,592 last financial year as Tax Ombudsman. Source: IGTO 2021-22 Annual Report

Associate Professor of the Univerisity of Woolongong Dr Andrew Schmulow, one of the nation’s top corporate governance experts, said Payne’s response was “dissapointing”.

The Taxation Ombudsman is “in a position of the greatest gravitas” and “her independence must be as inviolable as the perception thereof”, Schmulow tod The Klaxon.

“As such it is disappointing that the current Ombudsman has refused to clarify the position in respect of her former activities on the Board of Taxation.

“The result is that the only credible solution is a Royal Commission,” Schmulow said.

“The only credible solution is a Royal Commission” – Dr Andrew Schmulow

Between 2013 and 2018 Collins and other unnamed PwC partners gleaned confidential tax policy information from the Department of Treasury, and the Board of Taxation, while providing government “advice” on new tax laws to stop multinationals avoiding Australian tax.

That information was illegally shared widely within PwC, and by PwC with clients and prospective clients globally.

Some of that stolen information was sold by PwC for millions of dollars to multinationals seeking to avoid Australian tax.

The scandal has drawn the spotlight on the penetration of the Australian Government by the so-called “Big Four” global accountancy and “consultancy” firms, PwC, KPMG, EY and Deloitte. (Continues after timeline).

TIMELINE

2010 — Karen Payne joins BoT “Advisory Panel” (On panel 2010-15)

Karen Payne

2013-2018 — Peter Collins & unnamed PwC partners engaged by Treasury & BoT for “advice” on new laws

2013-2018 — Secret data gleaned from Treasury & BoT and shared widely within PwC & with clients

2013, June 30 — Three PwC partners on BoT “Advisory Panel”: Hayden Scott, Judy Sullivan & Ken Woo

From left: Hayden Scott, Judy Sullivan & Ken Woo

2014, June 30 — Five PwC partners on BoT “Advisory Panel”: Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan & Ken Woo

From left: Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan & Ken Woo

2015, May — Karen Payne becomes a BoT director

2015, June 30 — Five PwC partners on BoT “Advisory Panel”: Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan & Ken Woo (same as year before, above)

2015, Sep — Scott Morrison becomes Federal Treasurer (and in charge of BoT)

2016, Feb — Peter Collins starts on BoT “Advisory Panel” somewhere between Nov 22 2015 and Feb 28 2016 (remains on Advisory Panel until at least Jan 2020).

Peter Collins

2016, Mar 31 — Karen Payne becomes “inaugural” BoT CEO.

2016, June 30 — Seven PwC partners on BoT “Advisory Panel”: Peter Collins, Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan & Ken Woo

2017, June 30 — (Last BoT Annual Report for two years). Eight PwC partners on BoT “Advisory Panel”: Peter Collins, Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan, Chris Vanderkley & Ken Woo.

Clockwise from top left: Peter Collins, Steve Ford, Nick Houseman, Anthony Klein, Ken Woo, Chris Vanderkley, Judy Sullivan & Hayden Scott

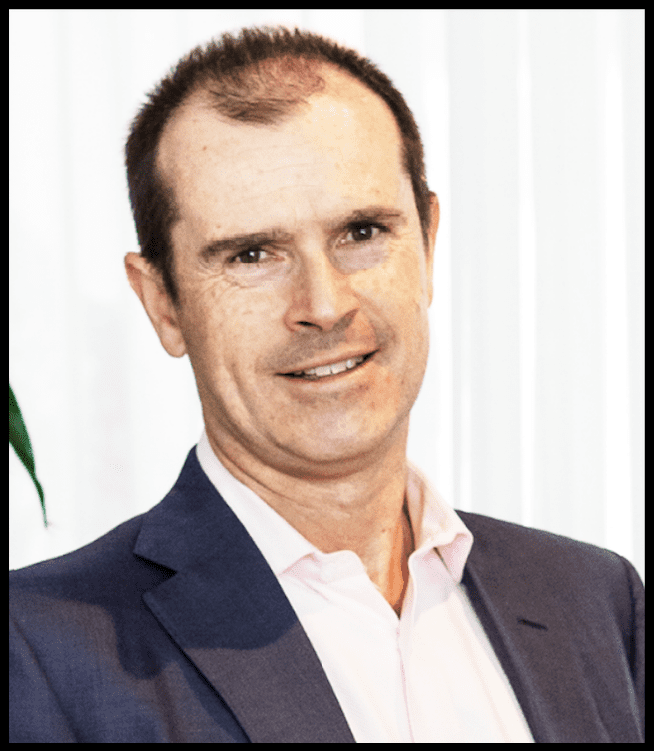

2018, Jan — Rosheen Garnon (ex KPMG partner) appointed BoT director for three-year term. (Became chair in March 2020.)

Rosheen Garnon

2018 — BoT Annual Report for FY 2017-18 “missing”

2018, Aug — Josh Frydenberg replaces Scott Morrison as Federal Treasurer

2019, May —Karen Payne appointed Taxation Ombudsman and Inspector-General of Taxation (IGTO), departs BoT

2019, June 30 — (First BoT Annual Report in two years). Eight PwC partners on BoT “Advisory Panel”: Peter Collins, Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan, Chris Vanderkley & Ken Woo (all the same as June 30, 2017)

2020, Jan 31— Peter Collins departs “Advisory Panel” sometime between Jan 31 2020 and Mar 8 2020

2020, Mar 26 — PwC Special Counsel Chris Vanderkley appointed BoT director for three-year term

Chris Vanderkley

2020, June 30 — Six PwC partners on BoT “Advisory Panel”: Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan & Ken Woo (Peter Collins & Chris Vanderkley no longer on Advisory Panel)

2020, July — Judy Sullivan departs PwC (LinkedIn) where she had been partner since 2013

2020, October — Judy Sullivan becomes director of Tax Practitioners Board (TPB)

2021, March/April – Judy Sullivan departs as member of Advisory Panel between Mar 13 2021andApril 11, 2021

2021, June 30 — Four PwC partners on BoT “Advisory Panel”: Steve Ford, Nick Houseman, Hayden Scott & Ken Woo. (Judy Sullivan no longer on Advisory Panel. Anthony Klein remains but no longer at PwC)

Judy Sullivan

2021, July/August — Christina Sahyoun (current PwC partner & employee) quietly starts as BoT CEO

Christina Sahyoun

2021, Oct 21 — Klein appointed BoT director for three-year term

2022, June 30 — Four PwC partners on BoT “Advisory Panel”: Steve Ford, Nick Houseman, Hayden Scott & Ken Woo. (Anthony Klein no longer on Advisory Panel)

2023, Jan 22 — PwC scandal breaks

2023, Jan 31 —BoT CEO Christina Sahyoun (a PwC partner) quietly exits

2023, March 26 — Rosheen Garnon appointed BoT chair for a further three years by Treasurer Jim Chalmers

2023, June 23 — The Klaxon sends Anthony Klein & BoT detailed questions re PwC

2023, June 23 —Anthony Klein “resigns” as BoT director

Anthony Klein

2023, June 29 — BoT “Advisory Panel” of 47 members quietly axed

2023, July 21 — Treasurer Jim Chalmers refuses to comment re “missing” BoT 2017-18 Annual Report

2023, July 23 — The Klaxon reveals BoT CEO until Jan 31 was PwC partner & employee Christina Sahyoun

2023, July 28 — Taxation Commissioner (ATO boss) Chris Jordan says he will not seek another term

2023, July 31 —The Klaxon reveals Australia’s Taxation Ombudsman Karen Payne responsible for “missing” BoT annual report

“Working Groups”

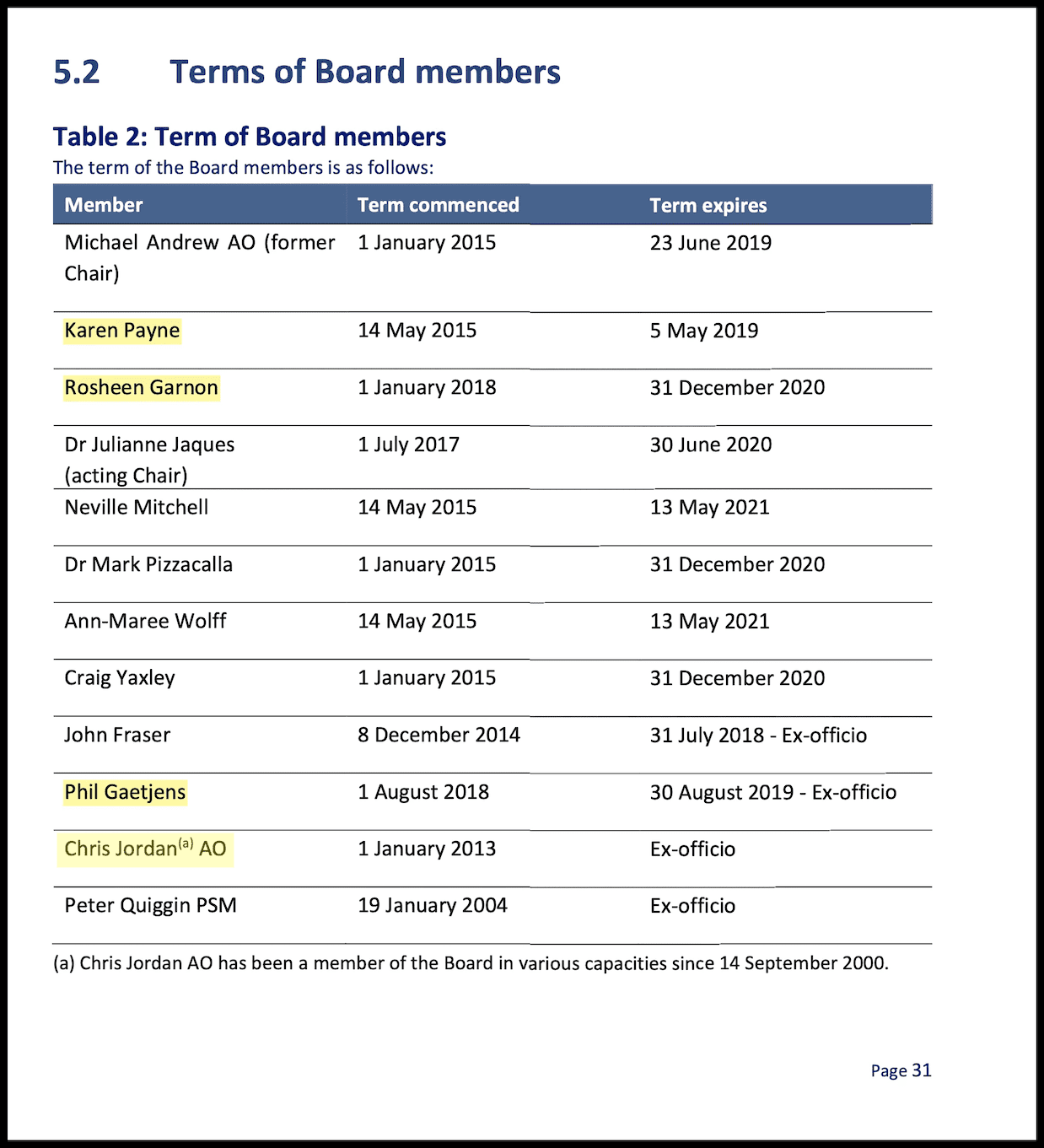

The Board of Taxation was created in 2000. Every annual report since then appears on its website, except for 2017-18.

Those annual reports provide a host of key information, including how much government funding the Board of Taxation received in the year, who its directors were, what they were paid, and what its expenses were in the year.

They also include details of the Board of Taxation’s “Board Working Groups” each year, including the stated purpose of each working group — and who its members were.

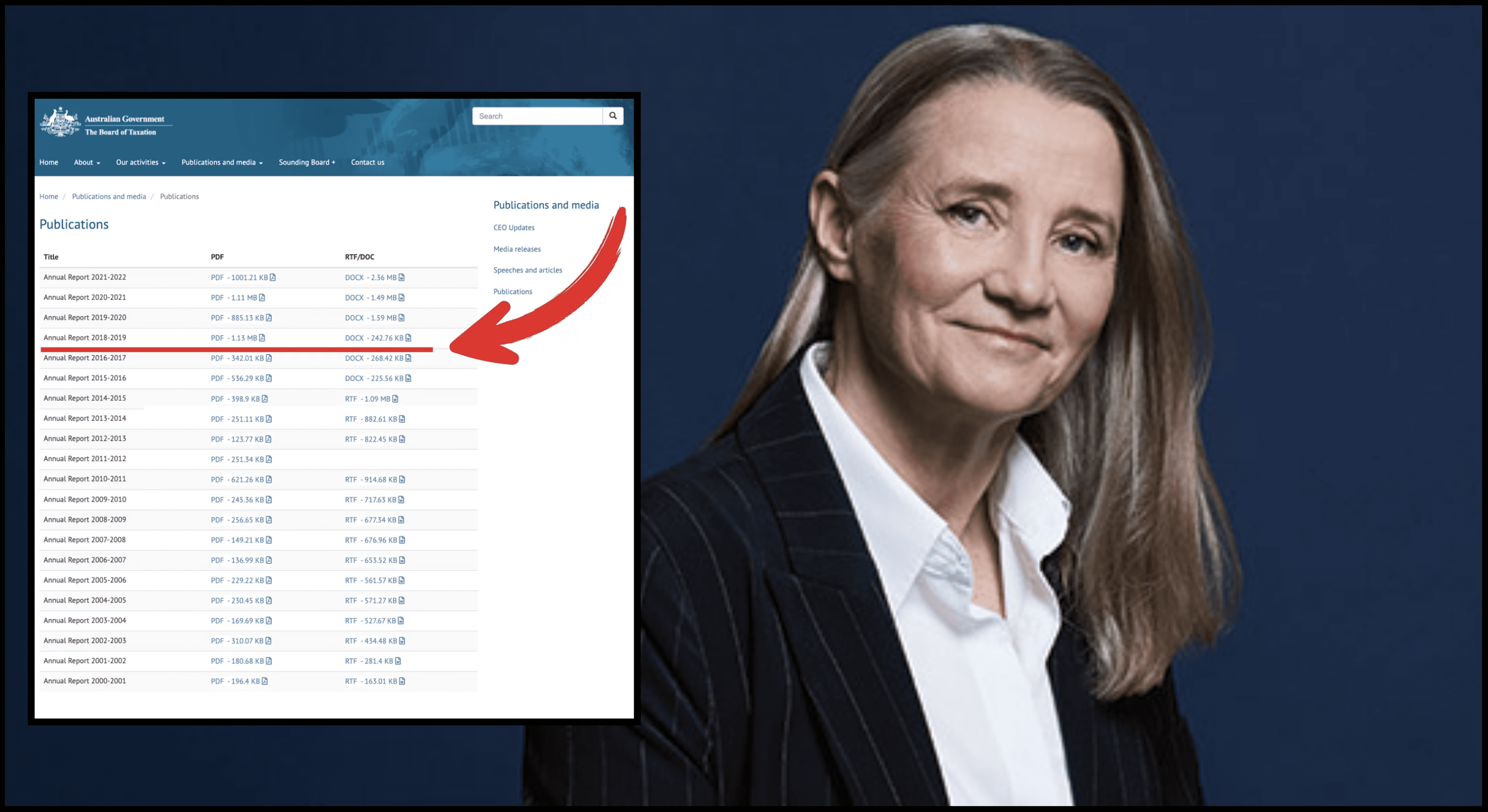

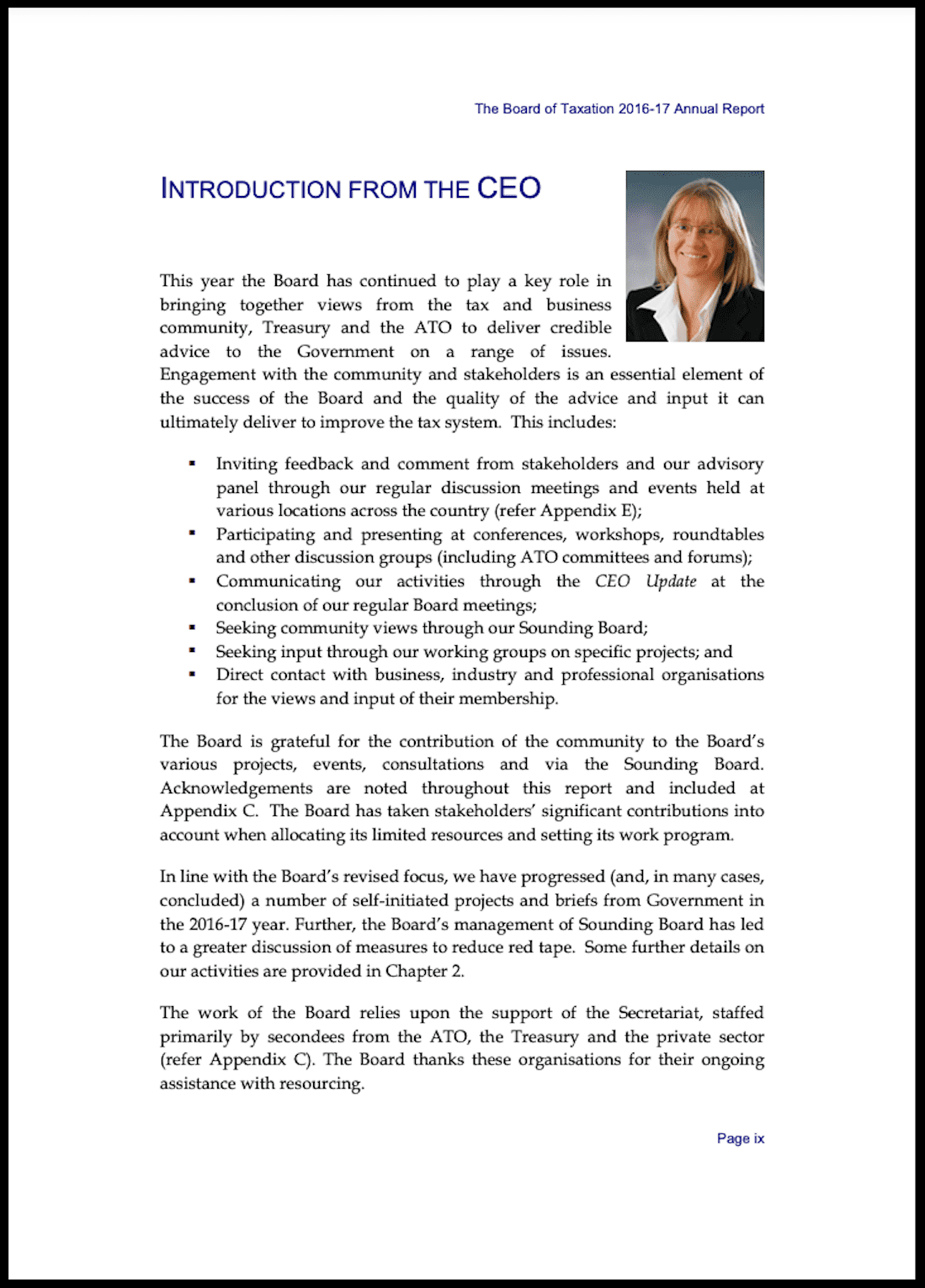

For example, the 48-page, 2016-17 Annual Report shows there were 12 “Board Working Groups” that financial year. Among them were working groups on the “Application of Hybrid Mismatch Rules to Regulatory Capital”, “Advice on Mandatory Disclosure Rules” and “Targeted Trust Simplification”.

Please support us by SUBSCRIBING HERE

The 39-page, 2018-19 Annual Report shows there were 12 Board Working Groups that year.

The Board Working Groups are comprised of Board of Taxation directors, Advisory Panel members, and others.

The available annual reports show that at the end of 2016-17 (June 30, 2017), and the end of 2018-19 (June 30, 2019), there were eight PwC partners on the Board of Taxation’s Advisory Panel, including Collins.

Both Payne (as CEO and director) and current Board of Taxation director Rosheen Garnon were in charge during 2017-18.

Please support us by SUBSCRIBING HERE

Board of Taxation directors at June 30, 2019. BoT 2018-19 Annual Report. Source: Board of Taxation

Garnon, a former long-time KPMG partner, was appointed a Board of Taxation director on January 1, 2018.

A director at all times since, Garnon was in March 2020 additionally appointed Board of Taxation CEO for three years.

In March this year she was reappointed as chair for another three years by Treasurer Jim Chalmers.

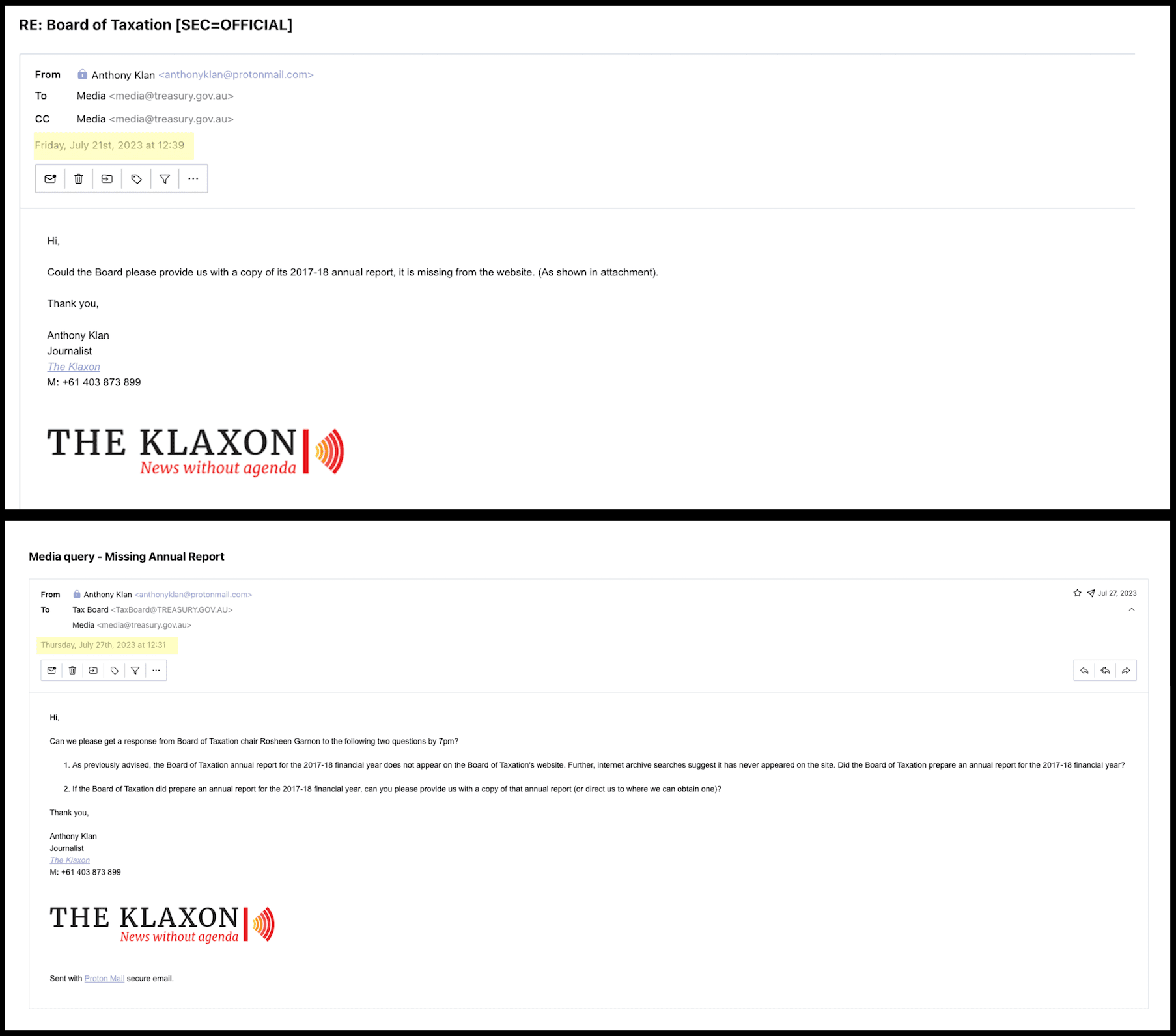

Garnon and the Board of Taxation have refused to respond when formally asked by The Klaxon about the missing 2017-18 annual report, including on July 21 and July 27.

As chair, a part-time role, Garnon receives a taxpayer salary of $122,460 a year plus expenses.

Garnon, the Board of Taxation website says, “has over 30 years experience” in tax, including as “National Managing Partner for KPMG Australia’s Taxation Division” from 2009 to 2015.

Australia’s Taxation Commissioner (ATO boss) Chris Jordan has been a director of the Tax Practitioners Board since it was founded in 2000. He was a KPMG partner until December 2012, when he became Taxation Commissioner.

Unanswered questions put to Garnon and Australia’s Board of Taxation.

On Thursday last week, The Klaxon put questions to Taxation Ombudsman Payne about the missing 2017-18 annual report, given she was Board of Taxation CEO and director at the time.

“We advise that Ms Payne is no longer a member of the Board of Taxation or its Cheif Executive Officer,” said a written response from spokeswoman Duy Dam.

“We understand that a similar enquiry has been put to the Board. We consider it appropriate for any response to be provided by the Board of Taxation”.

We responded, that same day, that we had repeatedly put questions to the Board of Taxation and Garnon but received no response.

We said we were seeking response directly from Payne in her capacity as Taxation Ombudsman and asked for confirmation our questions had been put to her.

Please support us by SUBSCRIBING HERE

The Klaxon’s four questions to Taxation Ombudsman Karen Payne.

On Friday afternoon Payne provided us with her written response.

We had asked whether the Board of Taxation had prepared a 2017-18 annual report; if so, if it had been posted to the Board of Taxation website while Payne was CEO; if Payne could provide us a copy of the annual report (or direct us to one) if it exists; and if the annual report had been prepared, whether Payne as Board of Taxation CEO had signed off on it.

“Please note that I am no longer a member of the Board of Taxation and do not have access to Board of Taxation records. The current Chair and/or Secretariat of the Board of Taxation would be best placed to assist you,” Payne writes.

Payne provided “some brief background” comprised of six dot points. The first three are general information about the Board of Taxation, including that it is staffed by a “small [full time] secretariat that forms part of the Revenue Group within Treasury”.

The other three are:

- The Board of Taxation is neither a separate legal entity nor statutory body and accordingly there is no statutory or other formal requirement to produce an annual report. However, in the interests of transparency, I understand it is customary to do so.

- In accordance with the Board’s Charter – the Chair of the Board will report to the Treasurer, at least annually, on the operation of the Board during the year.

- I also draw your attention to regular CEO Updates included on the Board’s website – which include July, August, September, October, December 2018 and March 2019.

“I also draw your attention to regular CEO Updates included on the Board’s website” – Taxation Ombudsman

Taxation Ombudsman Payne’s response Friday.

Leaving aside that the “CEO Updates” Payne cites refer to the 2018-19 financial year – and not 2017-18, the year of the missing annual report – Payne’s response appears to suggest she never created the 2017-18 annual report.

Rather, it appears Payne is suggesting, there is no requirement (although advisable) to create an annual report.

Payne also appears to be suggesting (although pointing to the wrong financial year) the “CEO Updates” she prepared satisfied the requirement of reporting “to the Treasurer, at least annually, on the operation of the Board during the year”.

A review of all the CEO Updates (the CEO is supposed to publish one after each board meeting) published in 2017-18 (and in 2018-19) shows they provide some information – but only a fraction of what is typically provided in Board of Taxation annual reports.

There is no list of directors and no financial information, such as what directors were paid, or the Board of Taxation’s funding or expenses.

Crucially, none of the CEO Updates state what the Board of Taxation’s “Board Working Groups” were in 2017-18 — or who sat on them.

Payne’s responses appear to contrast with statements she has made as Taxation Ombudsman.

“The Australian community expects and benefits from a tax system that is administered fairly, equitably and transparently…since people are more willing to engage with the system where they trust in its integrity,” Payne writes in the IGTO’s 2021-22 Annual Report.

Please support us by SUBSCRIBING HERE

Taxation Ombudsman 2021-22 Annual Report. Source: IGTO

That there appears to be no 2017-18 annual report for the Australian Government’s Board of Taxation is remarkable, multiple governance experts have told The Klaxon.

At the time, the Board of Taxation was receiving federal funding of almost $2 million a year and had “employee expenses” of around $1.5m a year.

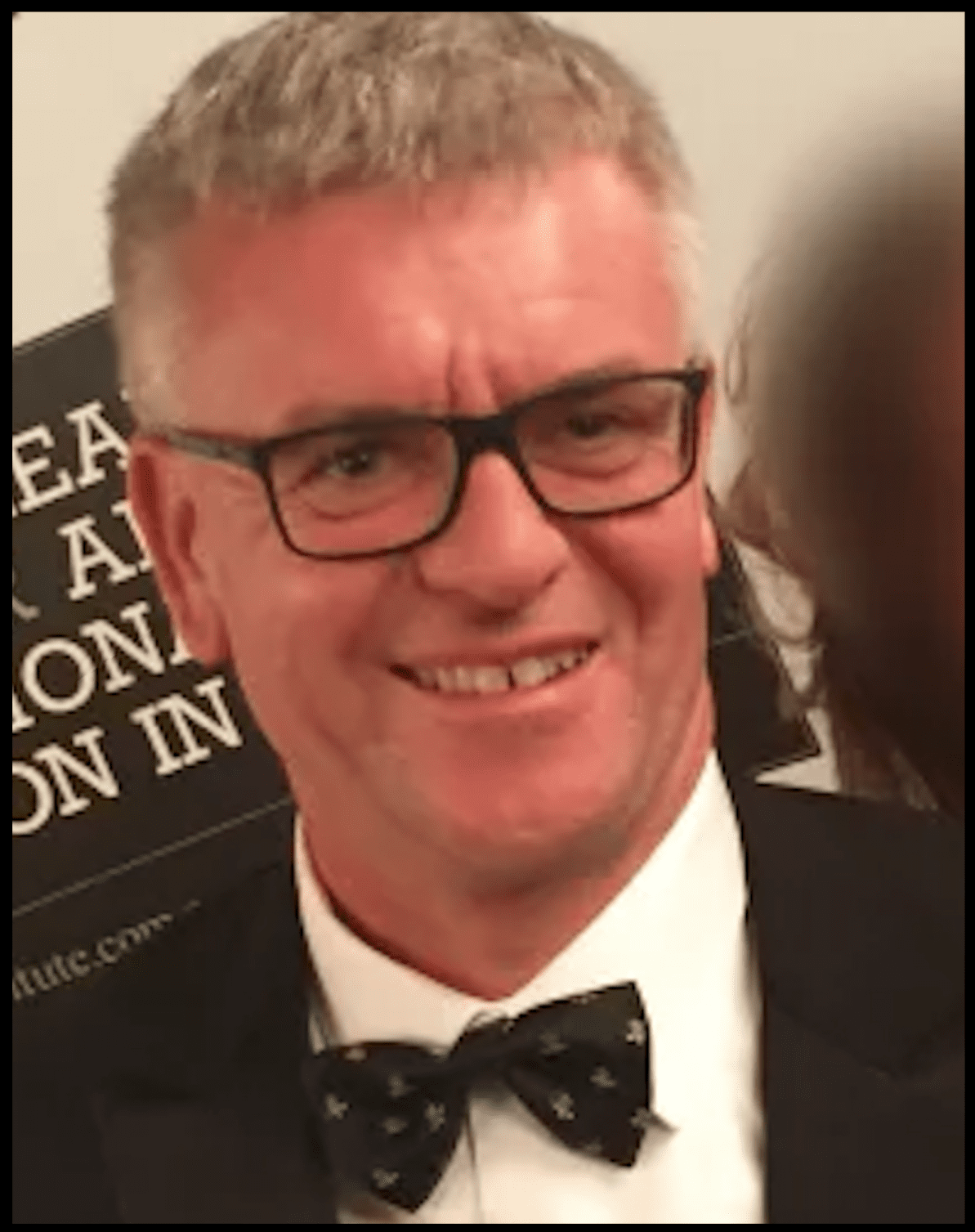

Payne’s CEO statement in the 2016-17 Bot Annual Report. Source: Board of Taxation

Treasurer Chalmers refused to respond when asked about the Board of Taxation’s missing annual report.

Chalmers has been Treasurer since the ALP was elected in May last year, replacing the Coalition’s Josh Frydenberg, who had been Treasurer since August 2018.

Scott Morrison was Treasurer from September 2015 until August 2018, when he became Prime Minister.

Please support us by SUBSCRIBING HERE

Questions The Klaxon put to Chalmers on July 21.

As revealed last week, the CEO of Board of Taxation until January 31 this year — days after the PwC scandal broke — was Christina Sahyoun, a current PwC partner and employee. (Sahyoun has been an employee of PwC at all times since 2007).

Sahyoun has repeatedly refused to respond when asked if her term as CEO had a pre-determined end date, and if so when that was.

Sahyoun’s start date as CEO appears to be July 1, 2021, according to the Board of Taxation’s 2021-22 Annual Report (although her LinkedIn profile states she started in “August” 2021).

The Board of Taxation and Sahyoun have repeatedly refused to say what Sahyoun was paid as CEO, although it appears to be well over $500,000 a year.

How The Klaxon broke the story last week. Source: The Klaxon

The eight PwC partners on the Board of Taxation’s Advisory Panel at June 30 2017 and at June 30 2019 were: PwC tax partners Steve Ford, Nick Houseman, Anthony Klein, Hayden Scott, Judy Sullivan, Ken Woo and Chris Vanderkley.

Multiple snapshots of the Board of Taxation’s Advisory Panel webpage, taken by web archive WayBack Machine at various times across 2017-18, consistently show all eight listed, strongly suggesting all were Advisory Panel members throughout the period.

The PwC tax leaks scandal emerged in January when the Tax Practitioners Board, the Federal Government agency responsible for the nation’s 80,000-odd tax practitioners, posted to its website details of investigations it had conducted into the affair.

It posted two reports on January 22, one on Collins (who was banned for two years) and one on PwC (which was found to have breached the law but received no penalty other than being required to conduct some extra staff “training”).

The TPB reports name only Collins but refer to other unnamed “PwC partners”.

The TPB said Collins had been engaged by both Treasury (where he signed “confidentially” contracts in 2013, 2015 and 2018) and the Board of Taxation.

The TPB has not said whether that engagement of Collins by the Board of Taxation was via his position on the “Advisory Panel”, or though some other Board of Taxation mechanism.

More Klaxon PwC Tax Scandal Exclusives:

25 July — PwC’s Peter Collins on Tax Board “Advisory Panel”

23 July — Tax Board run by PwC Partner

18 July — Gov’t “Advisory Panel” of PwC tax partners axed

17 July — First public official ousted in global PwC tax scandal

13 July — Gov’t tax boss at heart of PwC tax scammers nest

27 June — PwC tax scam CEO quits as charity chair

26 June — Tax Ombudsman schooled by PwC emails partner

7 June — “Vanished” Tax boss was exec at pre-PwC

24 May — You don’t Sayers? PwC Mini-Me in $6m Gov’t bonanza

PwC has been heavily criticised over a “cover-up”, and of failing to “come clean” over the scandal, by the Senate inquiry into Consultancies.

On May 2, the TPB provided the Senate inquiry with a heavily redacted, 144-page cache of internal PwC emails from 2013-2018.

The emails show many PwC partners and staff discussing secret federal government information, although the only name not blacked out is Collins’.

PwC has refused to make unredacted versions of the emails public (despite ongoing requests by the Senate inquiry). Instead, it has provided the inquiry with a list of 63-odd current and former PwC partners and staff it says received confidential information.

The Board of Taxation’s Advisory Panel was quietly dissolved, after more than two decades, on June 29.

There were four — current — PwC Australia tax partners on the Advisory Panel immediately before it was dissolved: PwC Australia Global Tax Controversy and Dispute Resolution Co-Leader Hayden Scott; PwC Australia Transfer Pricing and International Tax Partner Nick Houseman; PwC Australia Tax Partner Steve Ford; and PwC Australia Tax Partner Ken Woo.

All four refused to respond when asked by The Klaxon if they were on PwC’s “list” of 63-odd people.

Please support us by SUBSCRIBING HERE

PwC Partners & BoT “Advisory Panel” members in 2016,17,18. Clockwise from top left: Peter Collins, Steve Ford, Nick Houseman, Anthony Klein, Ken Woo, Chris Vanderkley, Judy Sullivan and Hayden Scott. Source: Supplied. Graphic: The Klaxon

Long-time Advisory Panel member Anthony Klein, a PwC partner for 17 years until July 2021, was appointed a Board of Taxation to a three-year term in October 2021.

On June 23 The Klaxon put detailed questions to him, and the Board of Taxation, about his PwC past.

That same day, it later emerged, Klein “resigned” from the Board of Taxation. (It also later emerged the Advisory Panel had been quietly axed on June 29).

Klein has subsequently said he is on the PwC “list” but has said he engaged in no wrongdoing.

Judy Sullivan was a PwC partner from 2013 to July 2020, her LinkedIn bio states.

In October 2020 she was appointed a director of the Tax Practitioners Board, a position she still holds.

Via the TPB, The Klaxon yesterday asked Sullivan, regarding the Collins matter, whether, while at PwC she had received any confidential information and whether she was on the PwC “list”.

TPB spokeswoman Julie Shaw said the “TPB has been advised by Ms Sullivan” that she was “not involved in the unauthorised disclosures of confidential information by Peter Collins” and she was not aware, at the time she was at PwC, “of unauthorised disclosures, including the contents, by Mr Collins”.

That carefully worded response did not answer our questions.