Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE

The Australian Government official who oversaw the PwC tax leaks investigations failed to recuse himself or declare a conflict of interest despite having worked almost a decade at PwC’s precursor Coopers & Lybrand.

The revelations raise serious questions over the integrity of the Tax Practitioners Board’s entire multi-year investigations into PwC, and its tax partner Peter Collins, after the firm was caught widely sharing — and selling for millions of dollars — stolen Federal Government tax policy data.

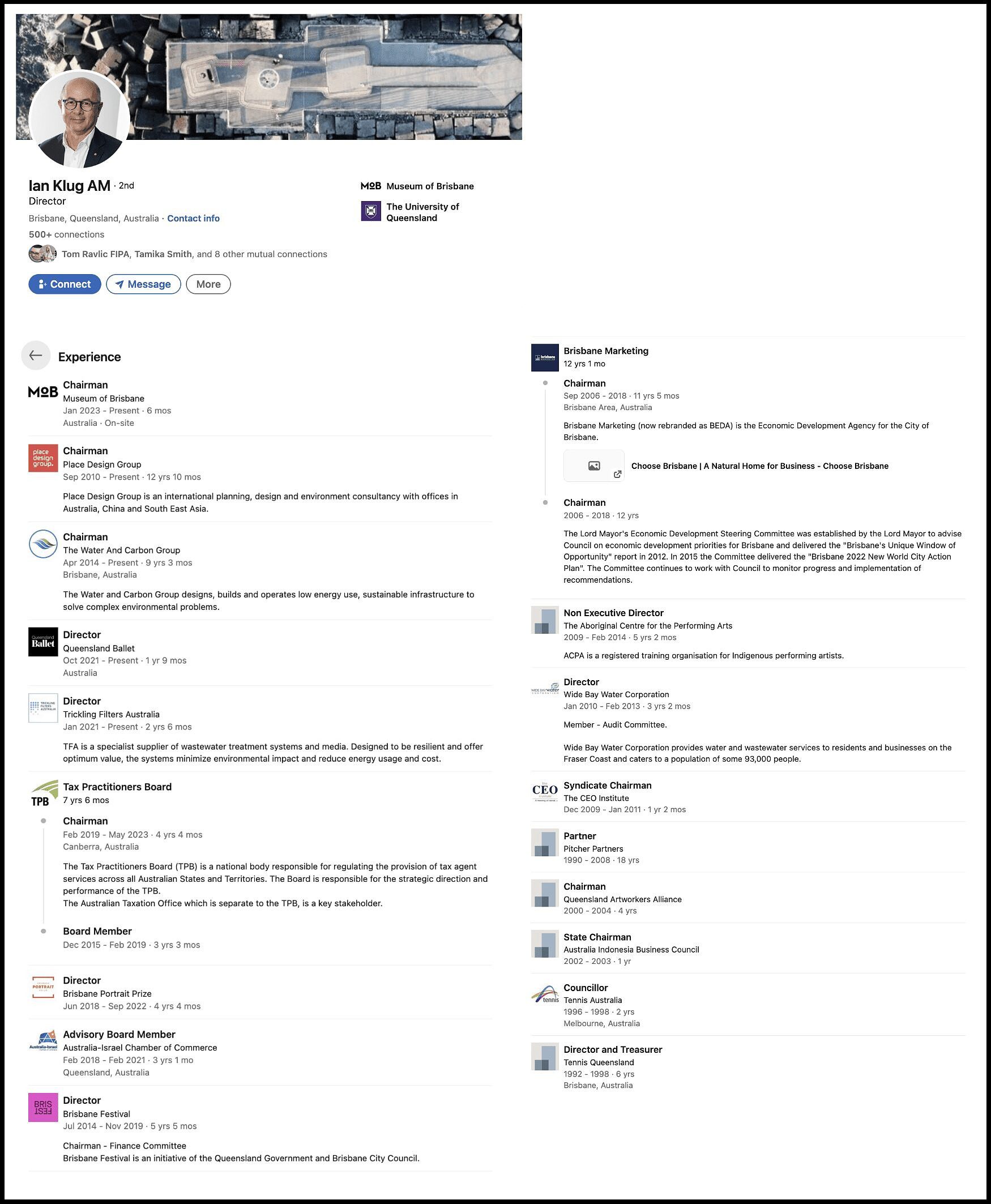

Ian Klug was chair of the Federal Government Tax Practitioners Board until he suddenly departed in May, his exit announced just days before he was due to appear before long-scheduled, high-profile Senate Estimates hearings.

The TPB has been heavily criticised for perceived leniency: Collins was given a two-year ban from practicing, of a possible five, and PwC received no penalty, other than having its staff do some extra “training”.

The scandal emerged publicly in January after the Tax Practitioners Board, responsible for policing the nation’s 80,000-odd tax practitioners, published information on its Collins and “PwC” investigations.

As revealed by The Klaxon on June 7, Klug spent almost a decade working at Coopers & Lybrand (now PwC) but that past did not appear in his bio in any of the Tax Practitioners Board’s annual reports; did not appear in his bio on its website; and did not appear on his extensive LinkedIn resume.

That was despite Klug, appointed TPB chair based on his tax experience, having worked for just two accounting firms in his career — Coopers & Lybrand (PwC) and what is now Pitcher Partners.

Klug also did not disclose it to the Senate Economics Committee, after ALP Senator Deborah O’Neill asked about PwC links in February.

Klug and the TPB repeatedly refused to comment when asked by The Klaxon about Klug’s past and whether he had worked at Coopers & Lybrand.

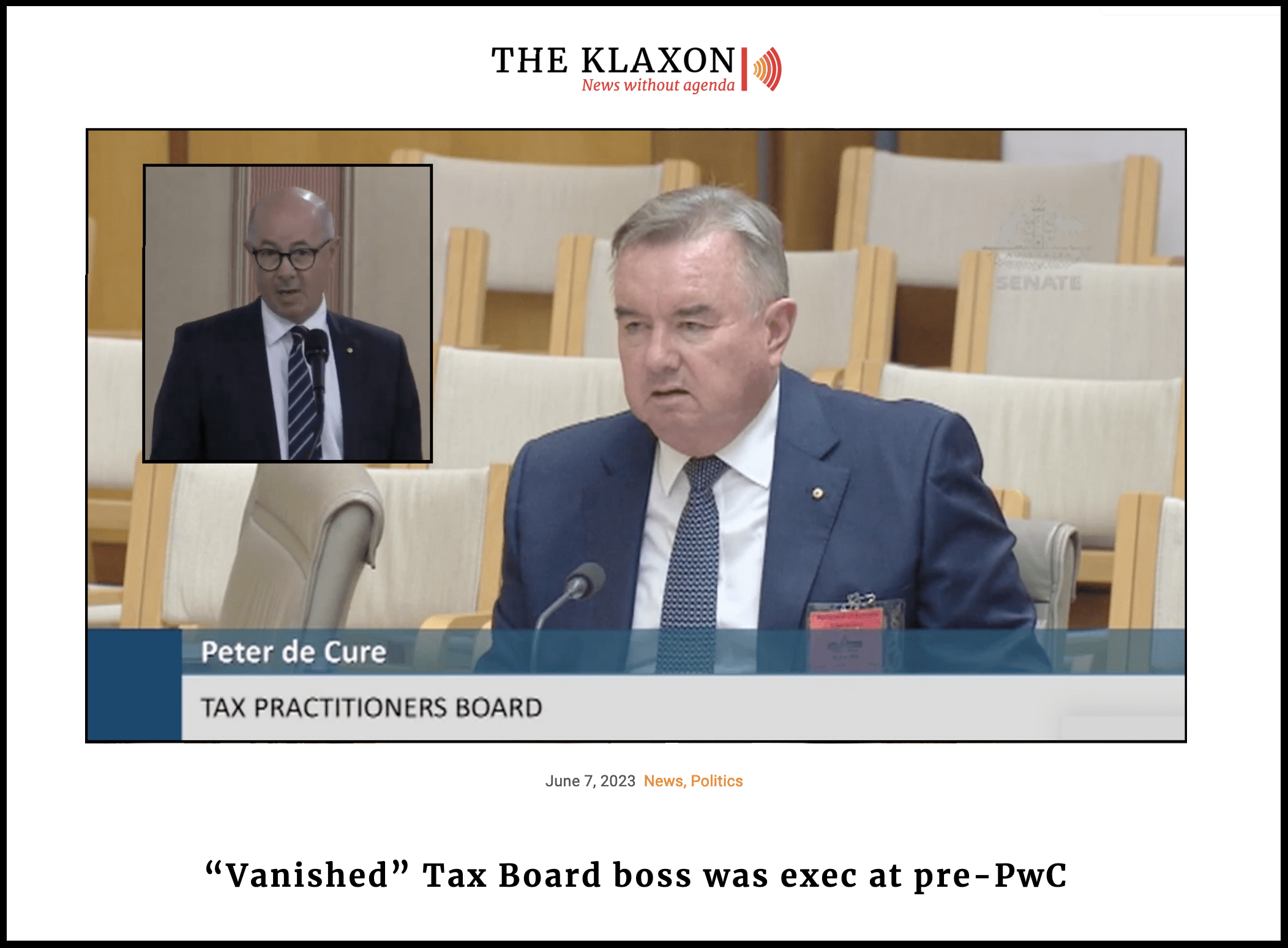

On June 7, the same day as The Klaxon’s expose, the TPB appeared before the Senate inquiry into consultancies and was asked about the revelations.

Please SUBSCRIBE HERE and support our quality journalism

How The Klaxon broke the story on June 7. Source: The Klaxon

Its CEO Michael O’Neill and new chair Peter de Cure (a former KPMG tax partner who had been a board member of the TPB since 2017) both said they didn’t know whether Klug had declared a conflict or recused himself in relation to the PwC matters.

Now, over two months later — and regarding one of the biggest corporate scandals in Australian history — the TPB has admitted its chair for the entire Collins and PwC probes did not declare his PwC conflict and did not recuse himself in relation to the Collins and PwC matters.

As revealed yesterday, the TPB has also admitted it doesn’t know “which” or “precisely how many” PwC tax partners were involved in the affair, despite completing its Collins and “PwC” investigations nine months ago.

It’s also despite those investigations taking far longer than the TPB’s usual six-month time limit.

The Australian Taxation Office (ATO) alerted the TPB to the matter in “late 2019”; the TPB started an “investigation” into Collins in January 2021 (and into “PwC” in March 2021); completed them both on November 16 last year, and on January 19 “updated the public register” with its “reasons for decision” in the investigations, causing it to become public.

The scandal has drawn the spotlight on the vast connections between Australia’s four main tax agencies and the “Big Four” global accountancies — PwC, KPMG, Deloitte and EY.

Senator Pocock demands answers over June 7 Klaxon expose. Source: The Klaxon

At its June 7 appearance the TPB came under fire from Greens Senator Barbara Pocock.

O’Neill and de Cure, when asked about Klug’s past, repeatedly deflected to two TPB board members who were former PwC partners who they said had declared their conflicts, including informing the Federal Treasurer, and had recused themselves from the parts of board meetings where the PwC affair was handled.

The TPB has said Peter Hogan (a former partner of Coopers & Lybrand) and Judy Sullivan (a former PwC partner), had “importantly” made “appropriate declarations of interest” about “their previous associations with PwC”, including informing the Federal Treasurer.

They had “left the room whenever this matter came up”, had been “completely isolated” and “totally excluded”, and there was “no ability for them to influence these decisions”.

“My questions are not about them. I understand that’s what they did, entirely appropriately,” Pocock said.

O’Neill and de Cure also pointed to the “Board Conduct Committees” of the TPB board that had conducted the Collins and PwC investigations.

“That’s not my question. My question is: did he (Klug) disclose, as would be appropriate, his previous employment of almost a decade with PwC and its precursor body?” Pocock said.

“I’m riled up about that, I think it’s a very legitimate line of inquiry”.

De Cure responded: “I’m not in a position to answer that. I don’t know whether he did or didn’t”.

O’Neill responded: “On Mr Klug’s disclosure to us, I’d have to check what he said. I’m not sure what the detail is”.

(That’s despite O’Neill having been CEO since 2018, de Cure having been a board member since 2017, and the men stating other detailed information about Klug, including that he had mentioned, in some form, his past at Coopers & Lybrand and that Klug “told us he was not” still receiving any money from Coopers & Lybrand/PwC).

Timeline:

Feb 15 — TPB (Klug and O’Neill) front Senate Estimates. Klug fails to disclose his PwC ties

May 2 – TPB responds to questions taken “on notice”. No mention of Klug’s PwC ties

May 26 — Assistant Treasurer announces Klug has departed as TPB chair, replaced by de Cure

May 31 — TPB (de Cure and O’Neill) front Senate Estimates

June 7 — The Klaxon reveals Klug’s past at Coopers & Lybrand

June 7 — TPB (de Cure and O’Neill) front Senate inquiry into consultancies. Klug questions taken “on notice”

Aug 7 — TPB responds to the June 7 questions

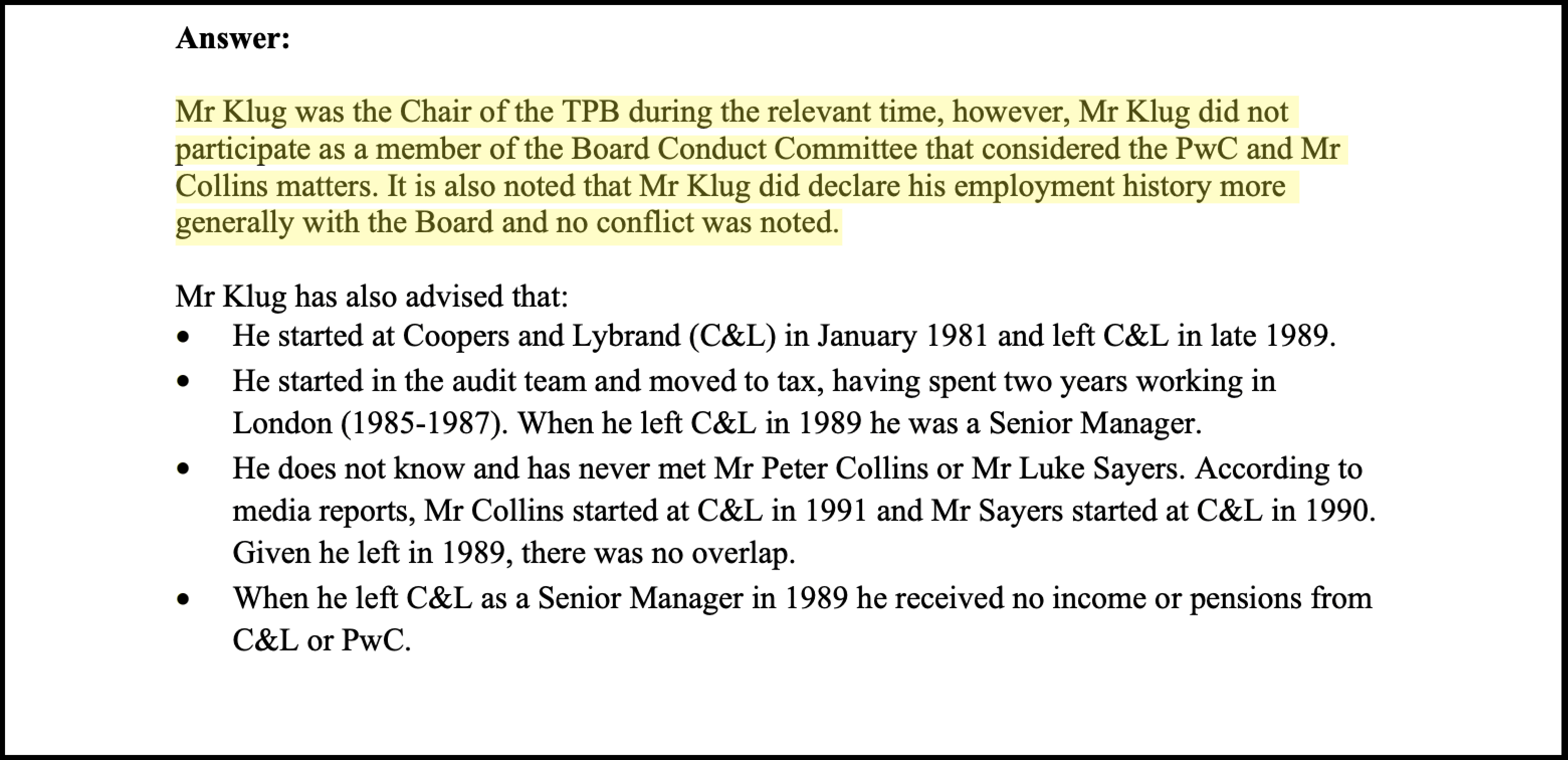

Two months later — and following an “extension” granted by the Senate inquiry — the TPB has provided a two-sentence response.

It has also provided some information provided by Klug.

The TPB’s response, submitted on August 7 and published by the Senate inquiry this week, repeats the same statements which angered Pocock on June 7, but shows Klug did not declare a conflict or recuse himself from board meetings in relation to the PwC affair.

It says:

“Mr Klug was the Chair of the TPB during the relevant time, however, Mr Klug did not participate as a member of the Board Conduct Committee that considered the PwC and Mr Collins matters. It is also noted that Mr Klug did declare his employment history more generally with the Board and no conflict was noted”.

(That Klug had not been a member of the Board of Conduct Committees – and that his past at Coopers & Lybrand was known by at least some TPB board members – was already known, not contested, and not asked by Pocock).

Regarding “no conflict was noted”, it does not state whether that means Klug did not note a conflict, or whether the board did not note a conflict (or both). Regardless of who it relates to, no explanation is given as to why “no conflict was noted”.

Klug was appointed a director of the Tax Practitioners Board in December 2015, his bio states.

Ian Klug. Source: LinkedIn

In February 2019 he was appointed chair, for a three-year term, by then Treasurer Josh Frydenberg.

In February 2021 it was announced Klug’s term as chair had been extended.

His sudden departure as chair, after 4.25 years in the role, was announced by Assistant Treasurer Stephen Jones on Friday May 26, three business days before a scheduled Senate Estimates hearing on May 31.

On June 7 Pocock noted Klug had not disclosed the “very important” PwC connection — “an association that’s of interest to anyone that’s pursuing this matter” — when questioned at Senate Estimates.

“I note that Mr Klug did not disclose this association when he appeared at (Senate) Estimates in February of this year, where he was questioned on the PwC matter,” she said.

“Everything this committee and estimates (has) scratched in relation to PwC (has revealed) a dense network of tentacles, so excuse me if I’m interested in the association”.

Please SUBSCRIBE HERE and support our quality journalism

WATCH: “Riled up” Senator Pocock grills the Tax Practitioners Board over Ian Klug’s PwC ties. Source: Australian Senate

As TPB chair, a part-time role, Klug received a taxpayer-funded salary of $144,000 a year.

He is currently chair of the Museum of Brisbane, engineering company Place Design Group and infrastructure company The Water and Carbon Group.

He is also a director of Queensland Ballet and Trickling Filters Australia, a wastewater treatment company.

PriceWaterhouseCoopers (which was later changed to “PwC”) was created in 1998 when Coopers & Lybrand merged with fellow accountancy Price Waterhouse.

The Klaxon reported on June 7 it appeared Klug and Collins may have worked at the same firm within months of each other, with Collins’ LinkedIn bio stating he started at “PwC” in January 1990.

Ian Klug’s LinkedIn bio – no mention of Coopers & Lybrand. Klug is refusing to comment. Source: LinkedIn

Luke Sayers, who was PwC Australia CEO from 2012 to 2020 and so for the entire tax leaks affair, started at “PwC” in June 1991, his LinkedIn profile states.

The TPB does not state why it took two months to respond to Pocock’s simple questions.

The response, citing Klug, says he started at Coopers & Lybrand in January 1981 and left in “late 1989”.

“He (Klug) does not know and has never met Mr Peter Collins or Mr Luke Sayers. According to media reports, Mr Collins started at C&L in 1991 and Mr Sayers started at C&L in 1990. Given he left in 1989, there was no overlap,” it states.

The TPB response. Source: Senate inquiry into consultancies

Searches show there are multiple current PwC partners who worked at Coopers & Lybrand at the same time as Klug.

PwC partners – including many former partners – are personally impacted by the scandal, as PwC attracts fewer contracts, especially from the Federal Government.

(In 2020 PwC disclosed that it paid eligible former partners an average of $140,000 a year under its retirement plan – with the size of those payments determined by the firm’s profits.)

The Klaxon revealed Klug had discussed his past at Coopers & Lybrand in an obscure 2017 podcast.

“I was fortunate enough to get a job with what was then Coopers and Lybrand, which became…PwC,” Klug says.

“I spent nine years…with Coopers and Lybrand,” he says.

“I had really only worked in two different firms, the former Coopers and Lybrand and at Douglas Heck & Burrell, which then morphed into Pitcher Partners”.