Appreciate our quality journalism? Please subscribe here

The embattled Tax Practioners Board will be forced to reveal whether its former chair — who was in charge for the entire PwC tax leaks investigation — recused himself from the probe, including from board meetings.

As revealed by The Klaxon Wednesday, Ian Klug spent nine years at Coopers & Lybrand — now PwC — but failed to disclose the connection to Senate hearings, despite being specifically asked about ties between Tax Practitioners Board (TPB) executives and PwC.

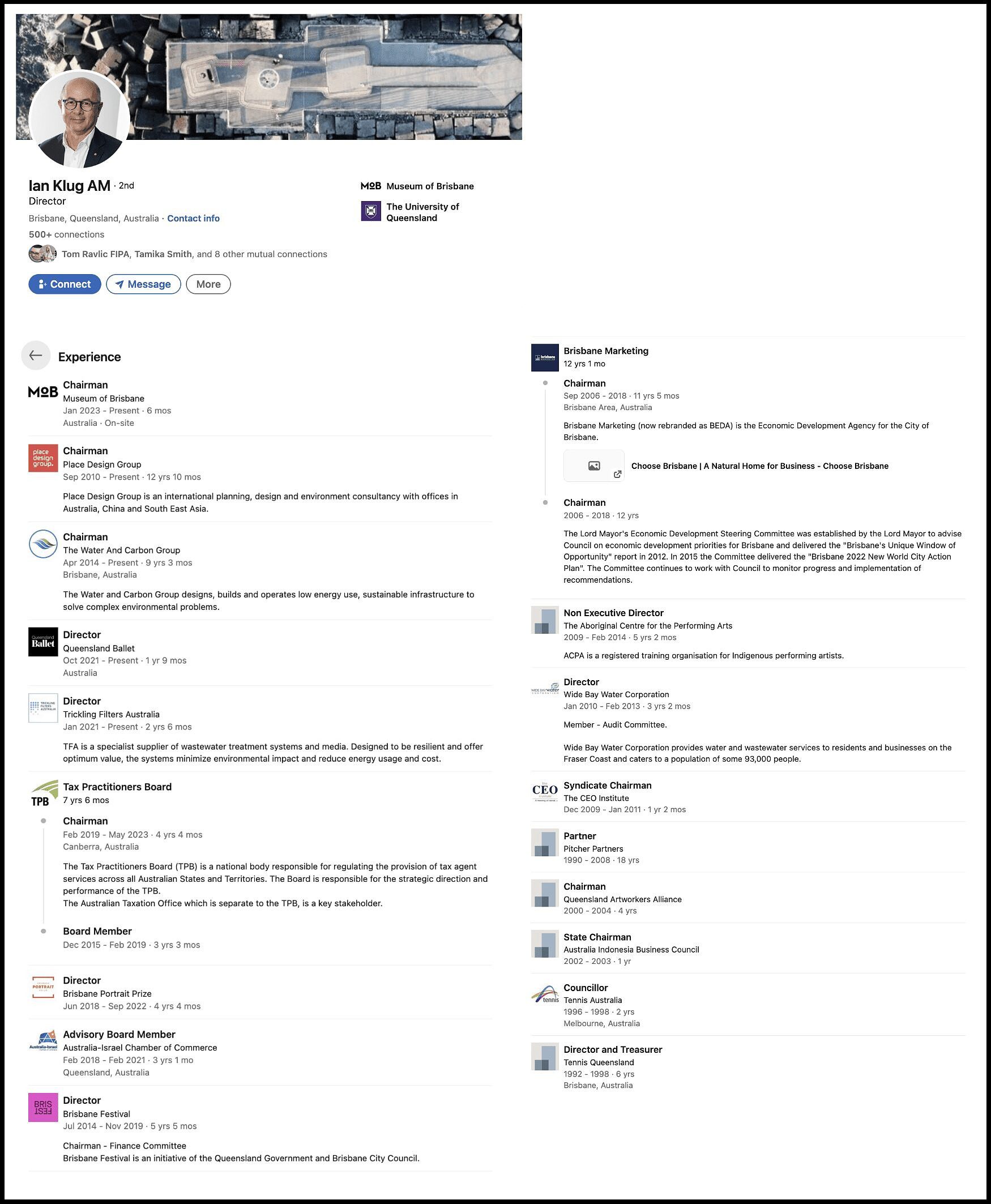

Klug’s time at Coopers & Lybrand does not appear in his bio in the Tax Practitioners Board (TPB) annual reports; it did not appear in his bio on the TPB’s website; and it does not appear on his extensive LinkedIn resume, The Klaxon revealed.

He suddenly left the TPB last month — after 4.25 years as chair — with his departure announced just days before he was due to front Senate Estimates to give evidence over the TPB’s multi-year investigation into the PwC tax leaks scandal.

Responding to The Klaxon’s revelations, a “riled-up” Greens Senator Barbara Pocock on Wednesday ordered the TPB to reveal whether Klug had disclosed his past at Coopers & Lybrand or recused himself in relation to the TPB’s handling of the affair.

WATCH: “Riled up” Senator Pocock grills the Tax Practitioners Board over Ian Klug’s PwC ties. Source: Australian Senate

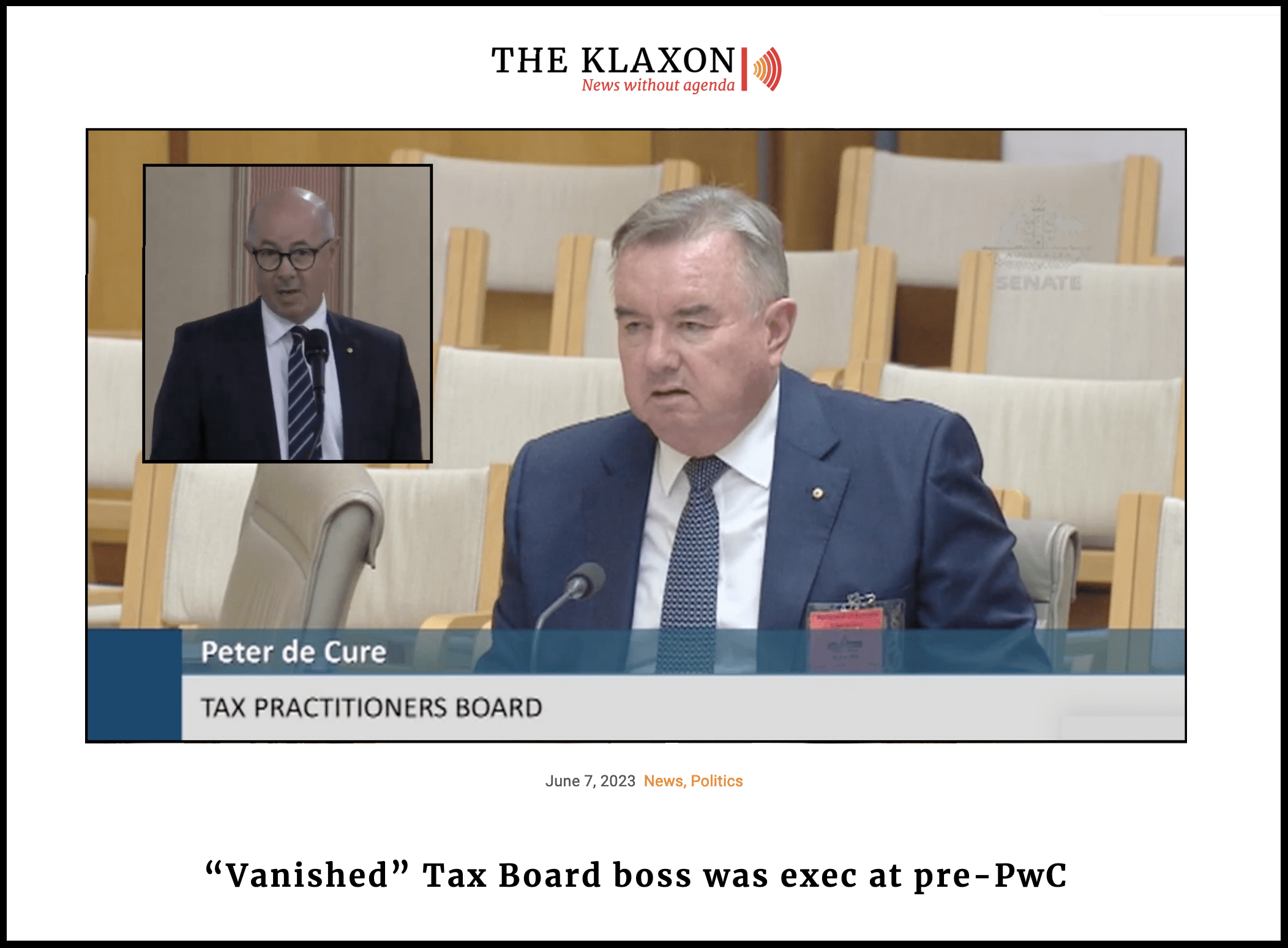

That came as Peter de Cure — who replaced Klug as chair on May 26 but has been a TPB director since 2017 — and TPB CEO Michael O’Neill, who has been in the role since 2018, both said they didn’t know whether Klug had disclosed his PwC ties or recused himself.

The issue was “very important” and “an association that’s of interest to anyone that’s pursuing this matter”, said Pocock, at the Senate inquiry into consultancies.

“I note that Mr Klug did not disclose this association when he appeared at (Senate) Estimates in February of this year, where he was questioned on the PwC matter,” she said.

“Everything this committee and estimates (has) scratched in relation to PwC (has revealed) a dense network of tentacles” – Senator Pocock

Pocock became angered when de Cure and O’Neill appeared to deflect questions about Klug, including by pointing to two TPB directors — Judy Sullivan and Peter Hogan — who had disclosed their PwC ties and recused themselves. (Sullivan and Hogan are former partners of PwC).

“I understand that’s what they did, and my questions are not about them,” Pocock said.

“Everything this committee and estimates (has) scratched in relation to PwC (has revealed) a dense network of tentacles, so excuse me if I’m interested in the association.

“I’m riled up about that, I think it’s a very legitimate line of inquiry,” Pocock said.

The TPB has 21 days to respond.

“I’m riled up about that, I think it’s a very legitimate line of inquiry” – Senator Pocock

TPB chair Peter de Cure (left) and CEO Michael O’Neill say they don’t know whether Klug declared his PwC ties or recused himself from board meetings. Source: Australian Senate

The TPB has faced widespread criticism over perceived leniency in its actions in the PwC scandal.

In January — in a statement directly quoting Klug — the TPB announced it had conducted a multi-year investigation into former PwC tax partner Peter Collins.

Treasury engaged Collins starting in 2014 to assist in drafting new laws to tackle multinational tax avoidance.

Despite multiple confidentiality agreements, Collins shared the secret information widely within PwC, which sold it to multinationals seeking to avoid Australian tax.

Collins was barred for two years, of a maximum of five.

PwC faced no penalties. Rather, the January statement said PwC had been told it needed “to have processes and training in place to ensure conflicts of interest are adequately managed”.

Klug has repeatedly refused to respond to detailed questions from the Klaxon for more than a week.

The TPB — de Cure and O’Neill —also formally refused to comment when asked about Klug’s past.

Enjoying this article? CLICK HERE to support our important work

“The TPB are not making any further public comments on the PwC matter,” TPB communications manager Julie Shaw said last week.

Yet de Cure and O’Neill were forced to respond at Wednesday’s Senate hearing in Canberra.

The Klaxon exclusively revealed Klug’s hidden past shortly before O’Neill and de Cure took the stand.

“You have to work as a bit of a detective, it seems, to uncover this relationship, a nine-year relationship, with PwC’s precursor body,” said Pocock, referencing The Klaxon’s expose.

“You have to work as a bit of a detective, it seems, to uncover this relationship” – Senator Pocock

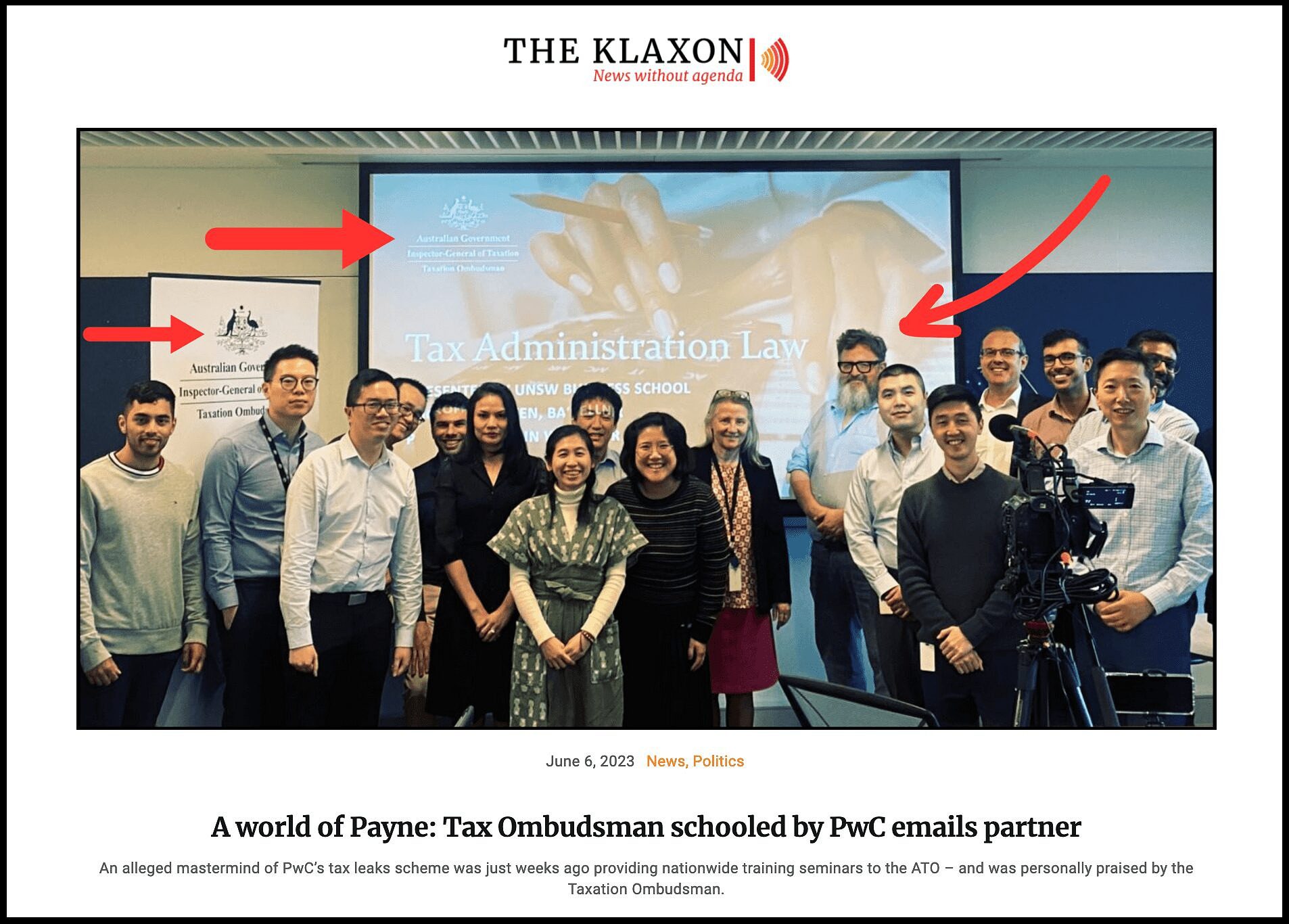

How The Klaxon broke the story Wednesday. Source: The Klaxon

“Mr Klug…oversaw the three-year review of Mr Collins and the PwC matter, is that correct?” Pocock asked.

“Yes he was chair at the time,” de Cure responded.

Both de Cure and O’Neill told the inquiry they didn’t know if Klug had declared his past at Coopers & Lybrand, in relation to the PwC probe.

“Did he (Klug) disclose, as would be appropriate, his previous employment with PwC’s precursor body, for almost a decade?” asked Pocock.

“I’d have to check what he said. I’m not sure what that detail is, we can take that on notice,” O’Neil responded.

De Cure said: “I’m not in a position to answer that. I don’t know whether he did or didn’t”.

“Well from my reading he worked for nine years for Coopers & Lybrand then he worked for another firm,” Pocock said.

“This association is not, I understand, declared on the TPB website, or in his LinkedIn bio”.

O’Neill said Klug “was never involved in any operational decisions” regarding the PwC probe.

“That’s not my question Mr O’Neil,” Pocock responded.

“My question is, did he disclose, as would be appropriate, his previous employment with PwC(’s)…precursor body, for almost a decade?”

“Hmm. Senator, can I say that disclosure, Mr Klug’s disclosure to us, I’d have to check what he said, I’m not sure what that detail is, we can take that on notice,” replied O’Neill.

“We can take that on notice”. TPB CEO Michael O’Neill. Souorce: Australian Senate

The importance of whether Klug recused himself from board meetings involving the PwC matter is highlighted in responses to questions taken “on notice” when Klug appeared before Senate Estimates in February.

The response, which names only TPB executives Sullivan and Hogan as having ties to PwC, says: “Importantly, Mr Sullivan and Mr Hogan have made declarations of interest to the TPB about their connection to PwC”.

In continues: “Further, to address any actual or perceived conflicts of interest, Ms Sullivan and Mr Hogan…were not involved in any other relevant matters, decisions and discussions related to Peter John Collins and PwC, including at board meetings”.

On Wednesday de Cure said the TPB used an electronic “board pack program”.

“When there were board papers in relation to this (PwC) matter, the version that went to Mr Hogan and Ms Sullivan, was blank,” he said.

More on the PwC scandal:

June 6: A world of Payne: Tax Ombudsman schooled by PwC emails partner

May 30: AFP refused to take action on PwC: ATO boss

May 30: PwC scores new $164,000 Fed Gov’t contract

May 24: You don’t Sayers? PwC Mini-Me in $6m Gov’t bonanza

Both de Cure and O’Neill told the inquiry they were aware that Klug had worked at Coopers & Lybrand, although they did not say when they had become aware of this.

O’Neil said he had been “advised” that Klug did not receive any ongoing remuneration from Coopers & Lybrand/PwC while he was at the TPB.

“No senator he wasn’t, he told us he was not,” said O’Neill, although he did not state when this disclosure occurred.

The Klaxon put detailed questions about the matters to the TPB and Klug late last week.

“He left Coopers and Lybrand, we’re advised, as a relatively junior person and he received no continuing remuneration from Coopers or its later iteration as PwC,” O’Neill told the Senate inquiry Wednesday.

Klug discusses his past at Coopers & Lybrand in an obscure podcast interview he gave in 2017.

“I was fortunate enough to get a job with what was then Coopers and Lybrand, which became…PwC,” Klug says.

“I spent nine years then with Coopers and Lybrand, two of which I spent in the UK, working in the London office. I specialised in taxation.

“I had really only worked in two different firms, the former Coopers and Lybrand and at Douglas Heck & Burrell, which then morphed into Pitcher Partners,” he says.

Klug’s LinkedIn bio states he started at Pitcher Partners in 1990 (no month is stated).

Peter Collins’ LinkedIn bio states he started at PwC Australia in “January 1990”, suggesting he and Klug may have — at the very least — worked at the same firm within months of each other.

Ian Klug’s LinkedIn bio – no mention of Coopers & Lybrand. Klug is refusing to comment. Source: LinkedIn

Coopers & Lybrand became PwC in 1998 when it merged with fellow accountancy Price Waterhouse.

Searches show there are multiple current PwC partners who worked at Coopers & Lybrand at the same time as Klug.

Klug was appointed a director of the Tax Practitioners Board in December 2015 and was appointed chair in February 2019.

As chair, a part-time role, he received a taxpayer-funded salary of $144,000 a year.

Klug is currently chair of the Museum of Brisbane, engineering company Place Design Group and infrastructure company The Water and Carbon Group.

He did not respond to written questions The Klaxon put to him via each of those companies last week.

BEFORE YOU GO – WE HAVE A SMALL FAVOUR TO ASK! Less than 2% of our readers currently contribute. Please help us stay afloat and telling these stories. Please SUBSCRIBE or CLICK HERE to make a one-off donation. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.