Appreciate our quality journalism? Please subscribe here

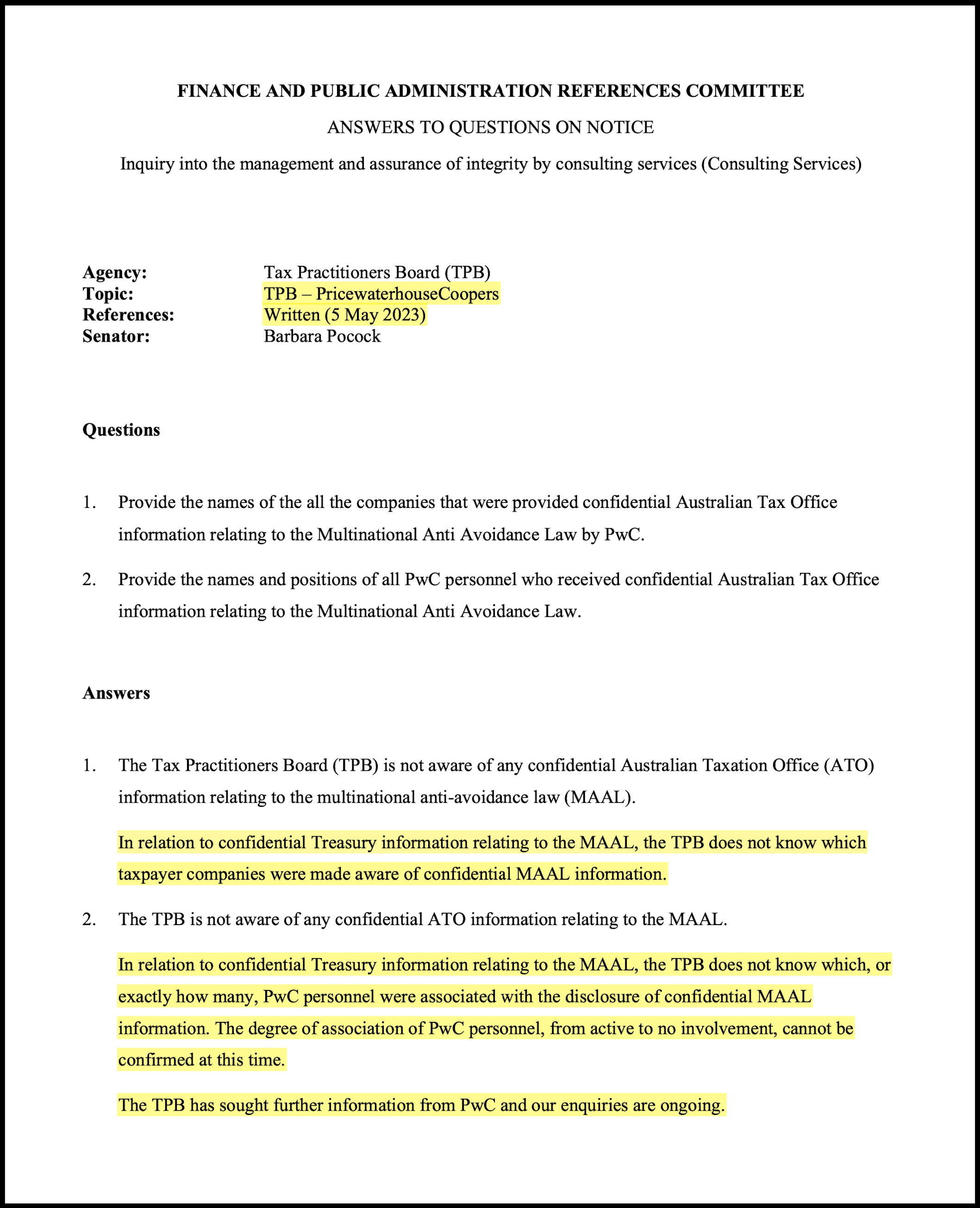

The Australian Government agency that completed “investigations” into PwC and tax partner Peter Collins — nine months ago — says it doesn’t know “which” or “exactly how many” PwC partners and staffers were involved in the tax leaks affair.

The Tax Practitioners Board (TPB) has also said it’s unaware of the “degree of association” of PwC partners and staff in the scandal — and it doesn’t know which multinationals that PwC “made aware” of the secret government information.

In response to Senate questions put to it more than three months ago, the TPB said the “degree of association” of PwC partners and staff in sharing confidential government tax information “cannot be confirmed at this time”.

The TPB says it has “sought further information from PwC”.

In a scam it called “Project North America”, PwC took top-secret Australian Government data it gleaned while providing “advice” on new laws to stop multinationals avoiding Australian tax — and sold it for millions of dollars to multinationals seeking to avoid Australian tax.

It is one of the biggest corporate scandals in Australian history.

The latest revelations cast yet more serious doubt over PwC’s own, already widely criticised, “independent review”, after it was reported last week that new PwC Australia CEO Kevin Burrows had told insiders the “review” was likely to give PwC’s international partners a “reasonably clean bill of health”.

The Tax Practitioners Board (TPB) statement says:

“In relation to confidential Treasury information relating to the MAAL, the TPB does not know which, or exactly how many, PwC personnel were associated with the disclosure of confidential (multinational anti-avoidance law) MAAL information.

“The degree of association of PwC personnel, from active to no involvement, cannot be confirmed at this time.

“The TPB has sought further information from PwC and our enquiries are ongoing”.

“The degree of association of PwC personnel, from active to no involvement, cannot be confirmed at this time” – Tax Practitioners Board

The TPB completed multi-year investigations into both Collins, one of the PwC partners who accessed and shared the secret government data, and “PwC” in November last year.

It has been heavily criticised for perceived leniency. Collins was given a two-year ban, of a possible five, and PwC received no penalty, other than to have its staff complete some extra training.

Greens Senator Barbara Pocock put the questions to the TPB on May 5, the TPB responded on August 7, and they were published by the Senate inquiry into consultancies this week.

The TPB’s claims are particularly significant because they indicate PwC is continuing to refuse to cooperate with authorities — and is almost certainly shielding many of the partners and staffers involved.

They also support claims from multiple governance, tax and finance experts that there were vastly more PwC partners and staffers involved than the 63-odd suggested by PwC Australia — particularly overseas partners.

TPB’s response, received on August 7 and published by the Senate inquiry this week. Source: Australian Senate

PwC’s Scam for $1 Billion Club

Between 2013 and 2018 Collins and other unnamed PwC Australia partners were engaged by the Department of Treasury and the Board of Taxation to provide advice on 2013 OECD “action plan” to crackdown on multinational tax evasion, or Base Erosion and Profit Shifting (BEPS).

In late 2015, applying from January 1 2016, the Australian Government introduced a multinational anti-avoidance law, known as MAAL, targeting multinationals with over $1 billion in annual income, as part of a suite of new laws in response to the 2013 OECD guidelines.

PwC took confidential government information it gleaned behind-the-scenes, shared it with widely within PwC — both across Australia and overseas — and spruiked it to multinationals, helping them rearrange their company structures to avoid the new laws.

The Australian Taxation Office (ATO) has said it became aware of the matter in early 2016.

From there the matter eventually ended up with the TPB, with the TPB and ATO having “initial discussions” in “late 2019”.

The TPB started an “investigation” into Collins in January 2021 (and into “PwC” in March 2021), completed them both on November 16 last year, and on January 19 “updated the public register” with its “reasons for decision” in both investigations — causing it to become public.

The scandal erupted further on May 2 after the TPB met a months-long request from the Senate inquiry into consultancies and handed over a 144-page cache of internal PwC emails, from 2014 to 2018, which the TPB had heavily redacted.

They show PwC partners and staffers in Australia and around the word, including partners in the US, UK, Singapore and Ireland, receiving, sharing and discussing confidential Australian Government tax information — and PwC’s illegal use of it.

The only name not blacked out by the TPB is that of Collins.

TPB chair de Cure (left) and CEO O’Neill being probed by Senator Pocock on June 7. Source: Australian Senate

“Hundreds” at PwC Likely Involved

The number of PwC partners and staffers involved — or at least knew of the illegal action and failed to report it — is almost certainly in the hundreds, despite PwC Australia stating there were 63-odd people who had “received at least one email”.

PwC has steadfastly refused to provide the Senate inquiry into consultancies with an unredacted version of the emails (that show names other than Collins).

Rather it has provided the inquiry with its own “list” of 63-odd people.

Importantly — and something that appears to have been missed to date — PwC hasn’t said that “only” those 63-odd people received emails.

The Senate inquiry into consultancies on June 21 produced an interim report, called “PwC: A calculated breach of trust”.

It found PwC had engaged in a “cover-up”; that it was continuing to obfuscate and “does not appear to understand proper process” or the “need for transparency and accountability”; and asked, “when is PwC going to come clean?”

Hidden “Group” Emails

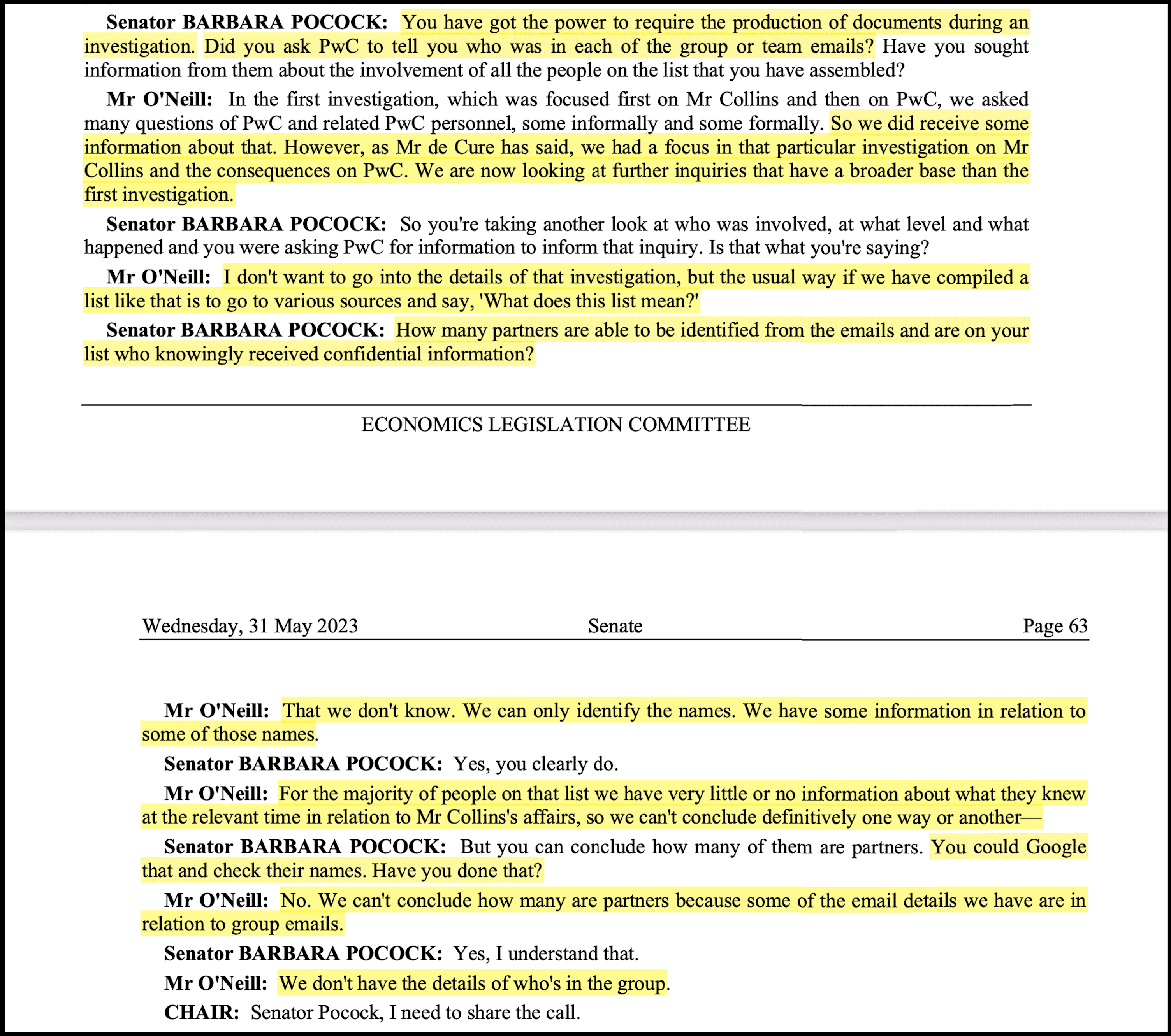

Of significance is statements made at Senate Estimates hearings on May 31 by the TPB, which has the unredacted 144-page email cache.

Those emails contain the names of individuals — at the very least, the 63-odd on PwC’s “list” — but they also include emails to individual “groups” of PwC partners and staffers.

They do not identify the names of the individual recipients in those groups.

On May 31, TPB CEO Michael O’Neill, having been repeatedly pressed by Senator Pocock, said the TPB was unable to say how many “partners knowingly received confidential information” because “some of the email details we have are in relation to group emails”.

“We don’t have the details of who’s in the group,” he said.

Please DONATE HERE to help keep us afloat!

“We don’t have the details of who’s in the group” – O’Neill at Senate Estimates hearing 31 May. Source: Australian Senate

Analysis of the email cache shows many of the emails were addressed to certain partner and staff groups.

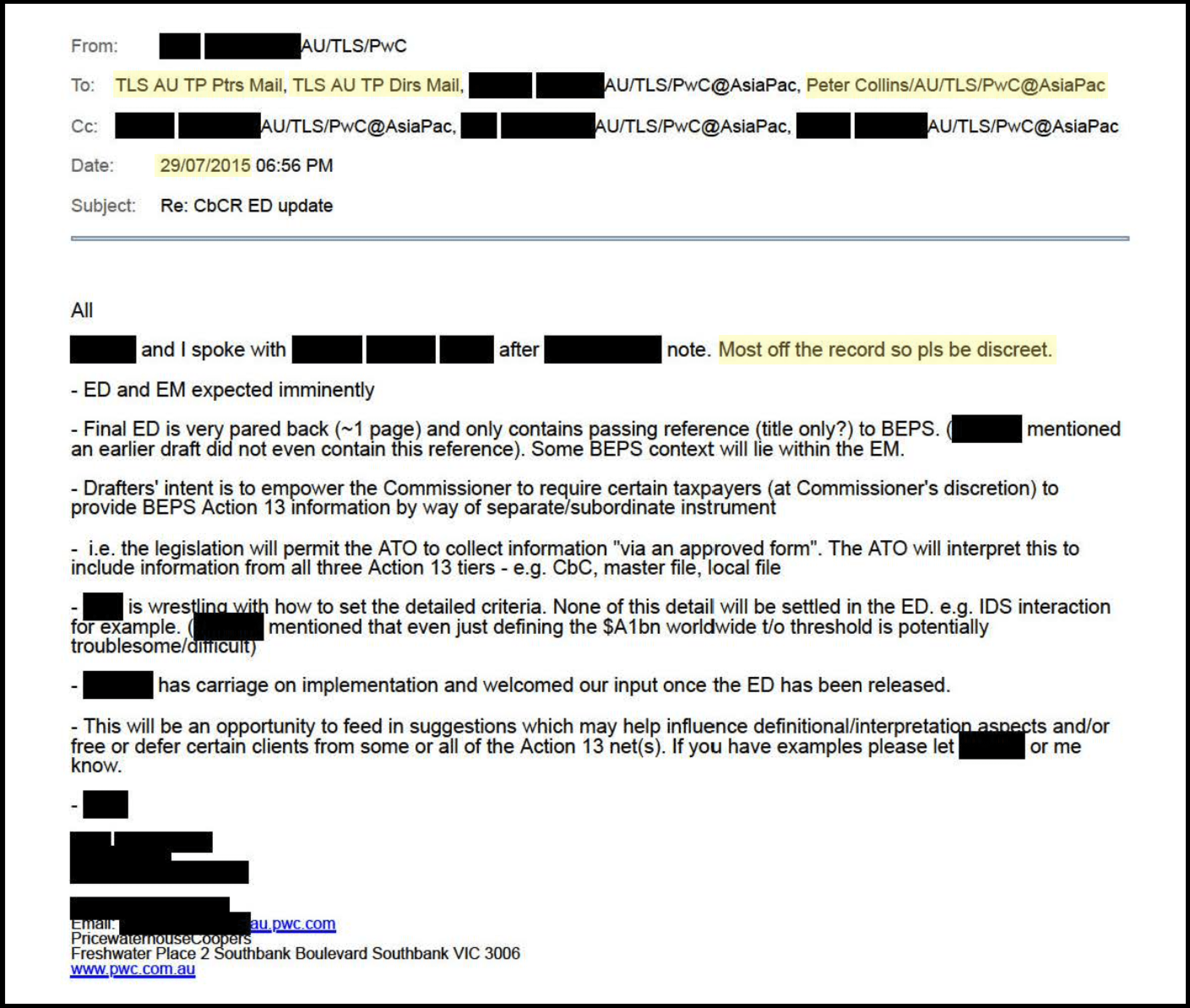

One email explosive email is dated 29 July 2015.

It states: “most off the record so pls be discreet”, and then details a host of confidential government information, including the details of yet to be released Exposure Draft (ED) and Exposure Memorandum (EM) on proposed new tax laws.

In it, the author — who is not Collins, he is one of the recipients — describes in detail what will be in the unreleased Exposure Draft.

It includes confidential information about government policy positions, including regarding BEPS Action 13, part of the planned crackdown.

The author calls for the recipients to “let me know” if they have any “examples” to help PwC clients avoid “some or all of the Action 13 net(s)”.

“This will be an opportunity to feed in suggestions which may help influence definitional/interpretation aspects and/or free or defer certain clients from some or all of the Action 13 net(s),” it says.

The email is sent directly to two PwC Australia “groups” — its transfer pricing partners and its transfer pricing directors.

Please DONATE HERE to help keep us afloat!

Transfer pricing is what multinationals charge different arms of themselves, in different countries, for their own goods and services (such as inter-company loans).

It is often used to avoid tax in a process called “international profit shifting”, where a multinational shifts profits from (higher taxing) countries where they were actually earned, to countries that charge little or no tax.

Along with all members of the transfer pricing “partners” and “directors” emails groups, the email was sent to Peter Collins and another (redacted) PwC staffer. It was also “cc’d” to three other (redacted) people at PwC.

PwC Australia’s website says transfer pricing “remains critical in an increasingly targeted, transparency business environment” and “as the Base Erosion and Profit Shifting (BEPS) debate leads to greater international tax regulation and review”.

“With more than 3,000 professionals in over 80 countries, PwC’s transfer pricing network is well positioned to advise you on a strategy that can help advance your goals within the ever-shifting compliance landscape,” it says.

“With more than 3,000 professionals in over 80 countries, PwC’s transfer pricing network is well positioned to advise you on a strategy” – PwC Australia

The email cache shows emails to certain “groups” at PwC was far from occasional.

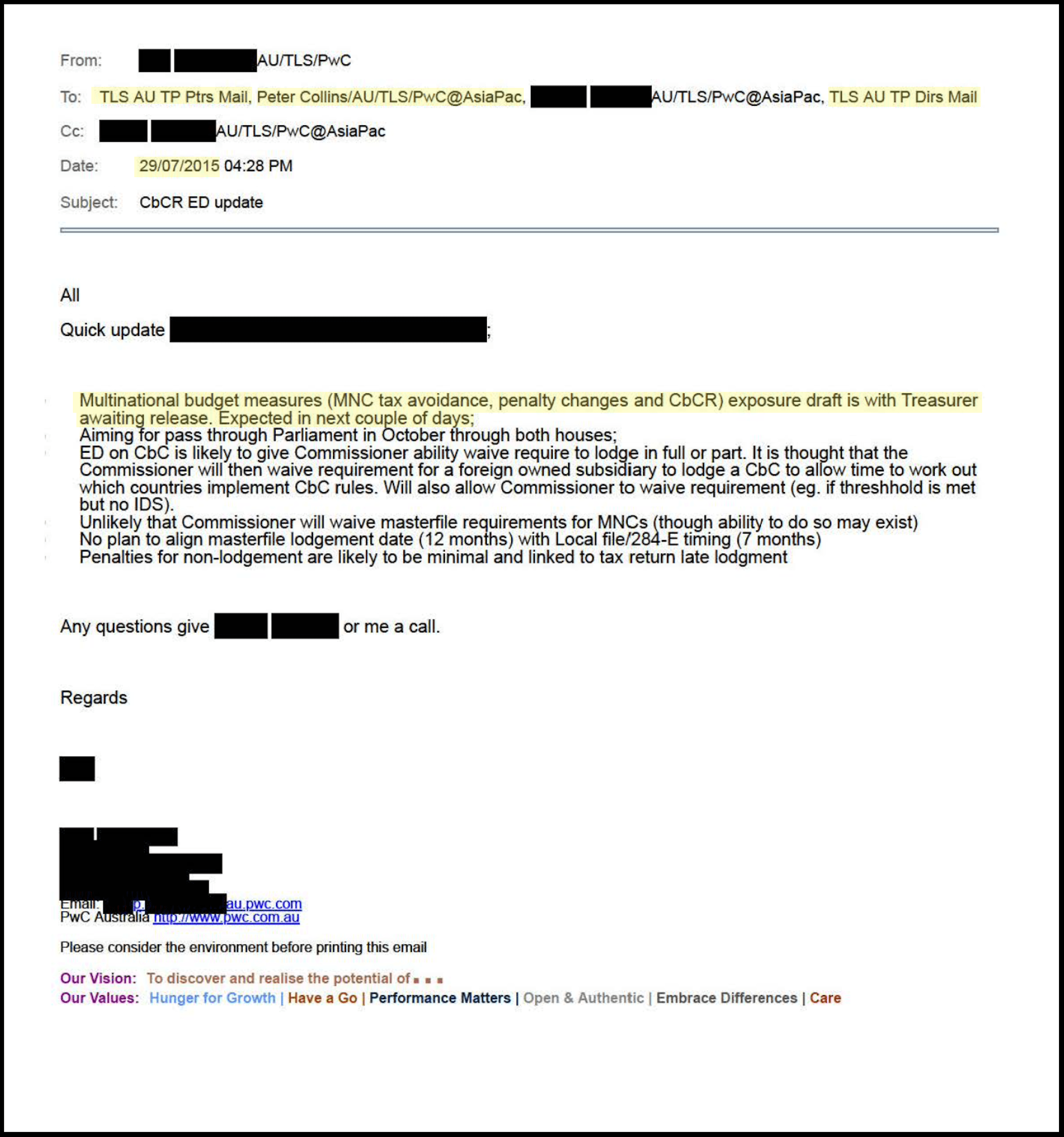

Hours earlier, on 29 July, another email was sent.

This one was to PwC Australia transfer pricing partners (TP Ptrs Mail) and transfer pricing directors (TP Dirs Mail), Collins and one other (redacted) PwC employee. It was “cc’d” to one (redacted) PwC employee.

It similarly discusses confidential government information, including about its likely plans regarding multinational corporations (MNCs) and country-by-country reporting (CbCR) laws.

“Multinational budget measures (MNC tax avoidance, penalty changes and CbCR) exposure draft is with Treasurer awaiting release,” it says.

“Aiming for pass through Parliament in October through both houses”.

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.