— Hundreds of tax officials trained by Ex-PwC tax boss

— “300-plus” ATO staff trained last year alone

— Michael Bersten “removed from all teaching” says UNSW

— ATO “doesn’t know” if others tied to PwC scandal on payroll

— Law Council of Australia drawn into the mounting scandal

EXCLUSIVE

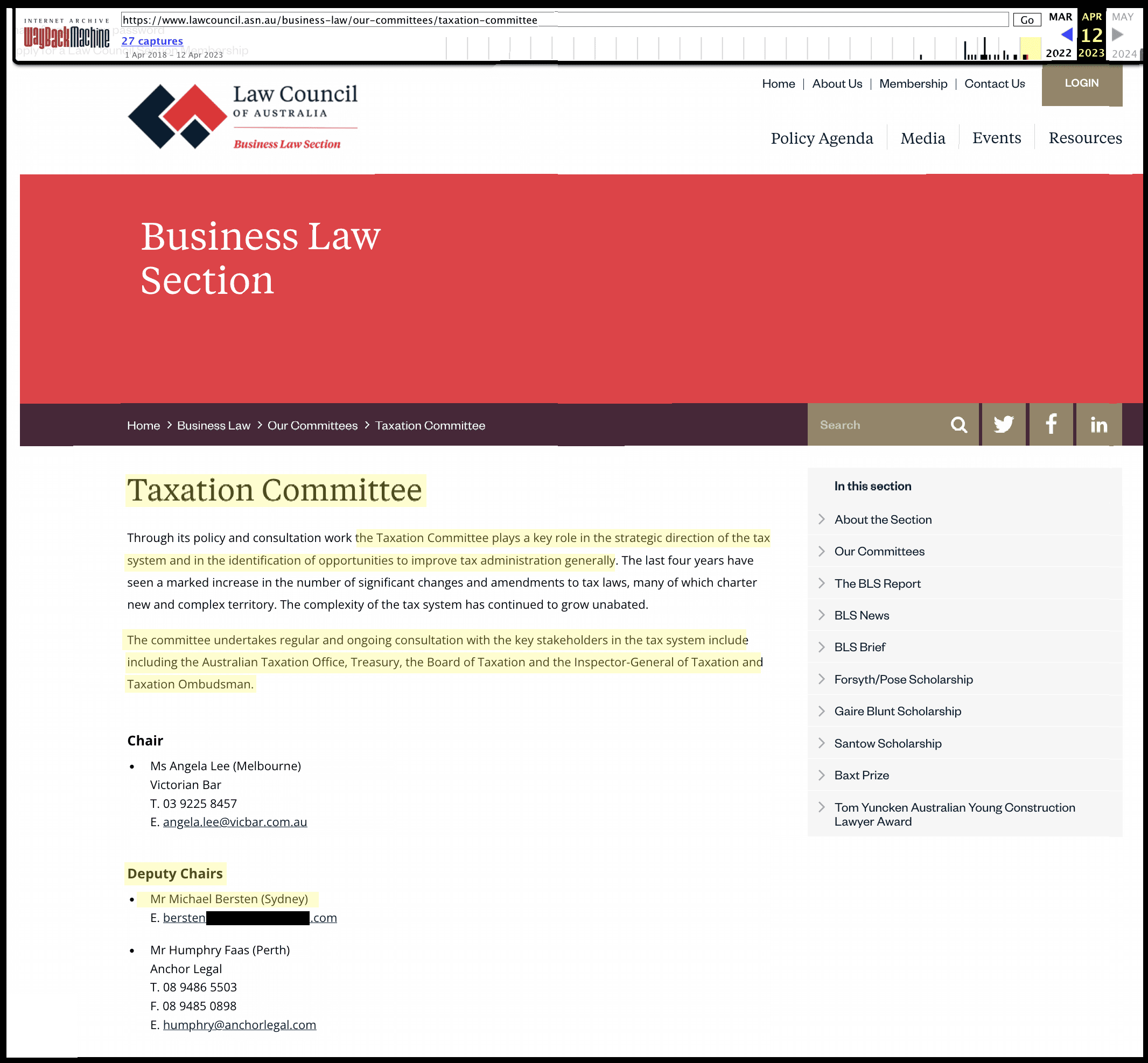

An alleged mastermind of the PwC global tax leaks scam has quietly left a role overseeing a powerful Federal Government tax advisory committee run by the peak body of the Australian legal profession.

The Klaxon can reveal former PwC Australia tax partner Michael Bersten was deputy chair of the Law Council of Australia’s influential Taxation Committee — which says it “plays a key role in the strategic direction of the tax system” — until a few days ago.

The Law Council of Australia made no statement about Bersten’s departure — instead quietly deleting his name from its website — but has confirmed his exit with The Klaxon, saying Bersten had “voluntarily stood down”.

“Mr Bersten has voluntarily suspended himself from his position as Deputy Chair of the Taxation Law Committee of the Business Law Section of Australia,” the Law Council of Australia said in a statement.

Bersten is one of four people PwC Australia named earlier this month as tied to its global tax scheme – all former partners – where PwC sold confidential government data to multinationals seeking to avoid Australian tax.

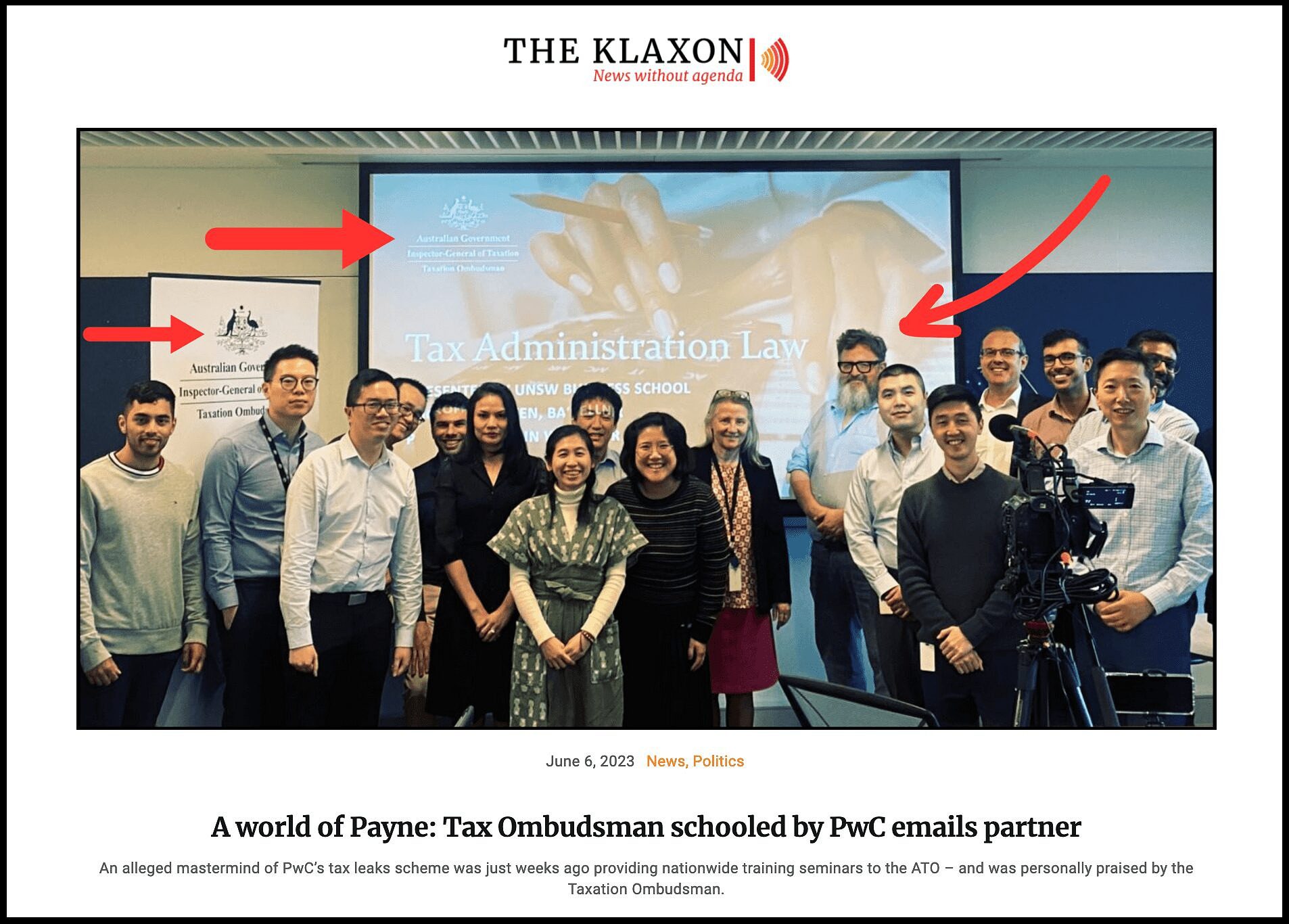

On June 6 Klaxon exclusively revealed Bersten was providing officials at the Australian Taxation Office (ATO) and the office of the Inspector General of Taxation and Tax Ombudsman (IGTO) training courses in “Tax Administration Law” and had been personally praised by the nation’s Taxation Ombudsman Karen Payne.

It can now be revealed the IGTO, ATO and the University of NSW (paid to provide the training) have ousted Bersten.

“The IGTO was unaware of any involvement of Mr Bersten in the PwC tax leaks at the time he delivered the first tranche of the UNSW course,” an IGTO spokeswoman told The Klaxon.

“Academics of UNSW unrelated to PwC will deliver any further parts of the course”.

Enjoying this article? CLICK HERE to support our important work

The ATO refused to comment. Though the UNSW said Bersten, who had been delivering “programs” for “the Australian Taxation Office”, had now been “removed from all teaching”.

“When Michael Bersten was appointed as one of the adjunct faculty who delivers the programs, the University was not aware that he was named as one of the former PwC partners who has been implicated in the taxation scandal,” it told The Klaxon.

“As soon as the University became aware of Mr Bersten’s implication in the taxation scandal, he was removed from all teaching”.

“As soon as the University became aware of Mr Bersten’s implication in the taxation scandal, he was removed from all teaching” – UNSW

WATCH: Senator Pocock grills ATO over The Klaxon’s expose. Source: Australian Senate

The Federal tax agencies and UNSW refused to comment when asked how many officials Bersten had trained.

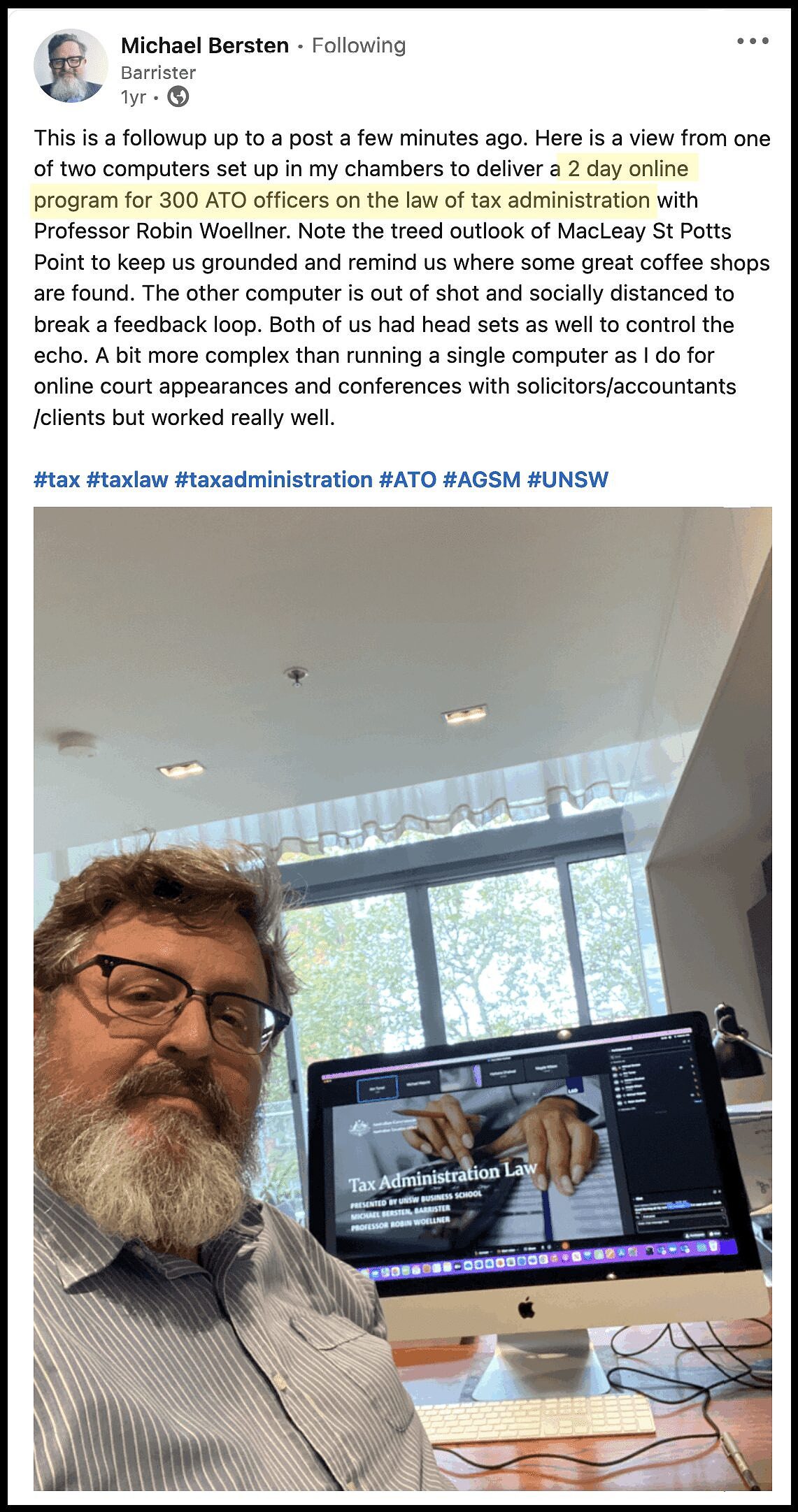

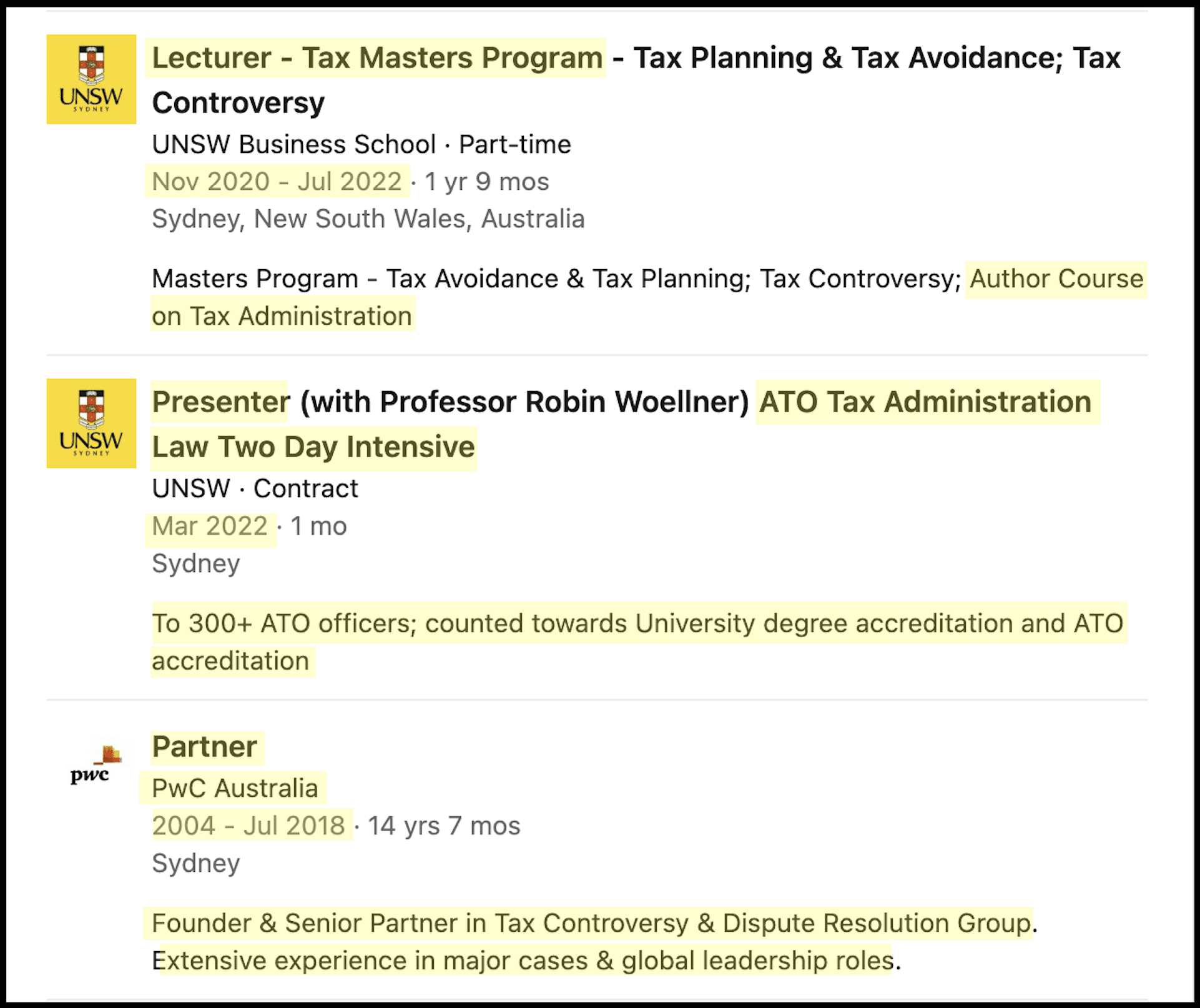

Searches reveal “300-plus” ATO officials were trained by Bersten in in March last year — at just one of three seminars he is known to have held for tax authorities over the past 15 months.

That “two-day, intensive” seminar was “to 300-plus ATO officers” and “counted towards University degree accreditation and ATO accreditation”, Bersten’s LinkedIn profile states.

In April this year, three months after the PwC scandal emerged publicly, Bersten held a similar seminar, “national online training”, for the ATO across three days.

As previously reported, the next week he delivered “a three-day program” on tax administration law to the office of the Inspector-General of Taxation and Taxation Ombudsman.

Bersten’s known Gov’t training:

2022 March: Two-day “intensive program” for “300-plus ATO officers”

2023, Apr 19-21: Three-day “national online training” for ATO

2020. Apr, 27-29: Three-day program for IGTO “in their Sydney office”

(Source: Bersten/LinkedIn)

The Klaxon’s Michael Berston expose last Tuesday. Source: The Klaxon

As a result of The Klaxon’s expose, the ATO was quizzed about Bersten by the Senate inquiry into consulting services at its public hearing on June 7.

“Last night we learned that former PwC Australia tax partner Michael Bersten, one of the four former partners of PwC named on Monday, as being involved in the scandal, he recently ran a three-day, ‘national online training course’ for the ATO,” Greens Senator Barbara Pocock told the inquiry.

“Mr Bersten was providing training seminars and legal advice to the highest levels of Australia’s tax authorities and was personally praised by the Taxation Ombudsman for the course”.

ATO Second Commissioner Jeremy Hirschhorn responded that the training had been “postponed” and the ATO was in “discussions” about the matter.

“We definitely read Mr Bersten’s name in the press recently and we’ve had discussions with the University of NSW following (that),” he said.

Pocock said: “And what’s your decision?”

“The course being delivered by Mr Bersten…has been postponed,” Hirschhorn said.

“Postponed? You may run it in the future?” asked Pocock.

“Well we are very likely to run the course in the future Senator because its a very useful course for our people. Who delivers it is another question,” Hirschhorn said.

Pocock responded: “I’m just asking you to be direct. You would be very brave to have any of the partners who’ve been named as being directly involved in the PwC breach of confidentiality to run a course for senior taxation officials”.

“You would be very brave to have any of the partners who’ve been named as being directly involved in the PwC breach of confidentiality to run a course for senior taxation officials” – Senator Pocock

Bersten posts about his tax law training program “for 300 ATO officials”. Source: LinkedIn

“Useful Information”

Remarkably, Hirschhorn told the inquiry the ATO didn’t know if it employed, or engaged the services of, any other people allegedly tied to the PwC scandal — despite it having been aware of the matter since 2017.

“We are not allowed to tell the procurement side of the business what we know from the tax side of the business,” Hirschhorn said.

Pocock said PwC “have released four of the names of 67 people allegedly involved”.

“Of the four names, one has ties to the ATO, are any of the other 63 people involved in the ATO in any way? Whether they’re running training sessions on taxation legal advice, sitting on advisory boards or now employed by the ATO?”

“Senator, we do not have that list of 63,” Hirschhorn said.

“That would be useful information for us”.

“We do not have that list of 63” – Australian Taxation Office

ATO Second Commissioner Jeremy Hirschhorn fronts the Senate inquiry. Source: Australian Senate

On June 5 it emerged PwC Australia interim CEO Kristin Stubbins had, after months of pressure, agreed to hand the senate inquiry the names of 67 PwC partners and staff allegedly contained in a cache of internal PwC emails.

Those emails had been obtained by little-known federal agency the Tax Practitioners Board (TPB).

The scandal emerged publicly in January after the TPB posted a statement to its website saying former PwC partner Peter Collins had been banned for two years over leaking confidential Federal Government plans to combat multinational tax evasion.

Collins had been engaged by the Federal Department of Treasury from 2014 to help create new laws to prevent tax evasion by multinationals.

Despite signing confidentiality contracts over several years, Collins shared secret government information widely within PwC, which sold it to multinationals seeking to avoid Australian tax.

PwC called the scam “Project North America”, the cache of emails revealed.

More on the PwC tax scandal:

June 9: “Network of tentacles”: Tax board forced to come clean on PwC ties

June 7: “Vanished” Tax Board boss was exec at pre-PwC

June 6: A world of Payne: Tax Ombudsman schooled by PwC emails partner

May 30: AFP refused to take action on PwC: ATO boss

May 30: PwC scores new $164,000 Fed Gov’t contract

May 24: You don’t Sayers? PwC Mini-Me in $6m Gov’t bonanza

WATCH: Senator Pocock quizzes Institute of Management Consultants regarding The Klaxon’s expose. Source: Australian Senate

The TPB provided the Senate inquiry with the emails on May 2, though all names had been blacked out except for that of Peter Collins.

In an internal email to PwC staff on June 5 (reported by the AFR but since confirmed by PwC) Stubbins said she had agreed to provide 67 names to the Senate inquiry.

She also named four former tax partners allegedly tied to the scheme.

“The four former partners include: Michael Bersten, Peter Collins, Neil Fuller, and Paul McNab,” Stubbins wrote, although she did not make any specific allegations.

Bersten has repeatedly refused to comment when contacted by The Klaxon, including via telephone, text message and in writing. (Continues below)

Bersten’s bio states he was a tax partner at PwC Australia from 2004 until July 2018. He became a barrister in NSW in 2018.

On June 8, after The Klaxon’s expose, Bersten told the AFR newspaper he did not “feel” he had “done anything wrong”.

The paper said Bersten “vehemently” denied “the allegations”, although did not state specifically which “allegations”.

“My family and I are finding the whole situation very stressful and unwarranted as I do not feel I have done anything wrong,” Bersten is quoted as saying.

(The AFR article repeats The Klaxon’s expose of Bersten’s training — including his praise from Tax Commissioner Payne — but does not acknowledge the reporting.)

The Senate inquiry has repeatedly called for PwC Australia to release the list of 67 names publicly, but it is refusing to do so.

There are protections associated with evidence provided to Senate inquiries, which means if it makes the material public, or provides it to a third-party, such as the ATO, those named might be protected from prosecution.

On June 7 The Klaxon revealed the former chair of the TPB, who oversaw its entire PwC probe, previously worked for almost a decade for Coopers & Lybrand, now PwC.

Responding to The Klaxon’s revelations, a “riled-up” Pocock has ordered the TPB to reveal whether Klug had disclosed his past at Coopers & Lybrand or recused himself in relation to the TPB’s handling of the affair.

Senate inquiry responds to The Klaxon’s Ian Klug expose. Source: The Klaxon

Collins, who departed PwC Australia late last year amid the TPB investigation, has made no public comment.

Neil Fuller has also made no public comment.

His LinkedIn bio, which appears to have been deleted, stated he retired from PwC in July 2019, after 31 years at the firm.

Former PwC tax partner Paul McNab worked at PwC from 1997 to 2020, before becoming a tax partner at global law firm DLA Piper.

Hours after McNab was named by Stubbins it was announced he had departed DLA Piper.

He has denied any wrongdoing.

State Capture

Despite the seriousness of the matter, the Law Council of Australia refused to say how long Bersten had been steering its influential Taxation Committee.

Searches show it was around two years.

Historical versions of the Law Council of Australia’s website, captured by web archive WayBack Machine, show he started as Taxation Committee deputy chair sometime between May 10, 2021, and July 23, 2021.

The “last four years” had seen “significant changes and amendments” to tax laws, the Law Council of Australia’s Taxation Committee webpage states.

“The last four years have seen a marked increase in the number of significant changes and amendments to tax laws, many of which charter new and complex territory,” it states.

“Voluntarily stood down”: Bersten was Deputy Chair of the Law Council of Australia’s Taxation Committee. Source: WayBack Machine

The Taxation Committee is part of the Law Council of Australia’s Business Law Section, which it says “is “a forum through which lawyers and others interested in law affecting business” can “contribute to the process of law reform in Australia”.

“Through its policy and consultation work the Taxation Committee plays a key role in the strategic direction of the tax system,” the Law Council of Australia states.

It states: “The (Taxation) Committee undertakes regulator and ongoing consultation with the key stakeholders in the tax system including the Australian Taxation Office, Treasury, the Board of Taxation and the Inspector-General of Taxation and Taxation Ombudsman”.

“Through its policy and consultation work the Taxation Committee plays a key role in the strategic direction of the tax system” – Law Council of Australia

Tax system “key stakeholders”:

- ATO

- Department of Treasury

- Board of Taxation

- Inspector-General of Taxation and Taxation Ombudsman (IGTO)

That means Bersten was both training hundreds of officials at the ATO and the office of the Inspector-General of Taxation and Taxation Ombudsman (IGTO), while also being allegedly involved in shaping “the strategic direction of the tax system” via “regular and ongoing consultation” with the ATO, IGTO, Treasury and Board of Taxation.

The three programs Bersten is known to have delivered to the ATO and IGTO were all titled “Tax Administration Law”.

The UNSW, ATO and IGTO refused to say whether Bersten had written all or part of that course.

“Author Course on Tax Administration” – part of Bersten’s LinkedIn bio. Source: LinkedIn

Bersten’s LinkedIn profile shows he was a lecturer in the UNSW “Tax Masters Program”, covering “Tax Planning & Tax Avoidance” and “Tax Controversy”, from November 2020 to July 2022.

His bio states: “Author Course on Tax Administration”.

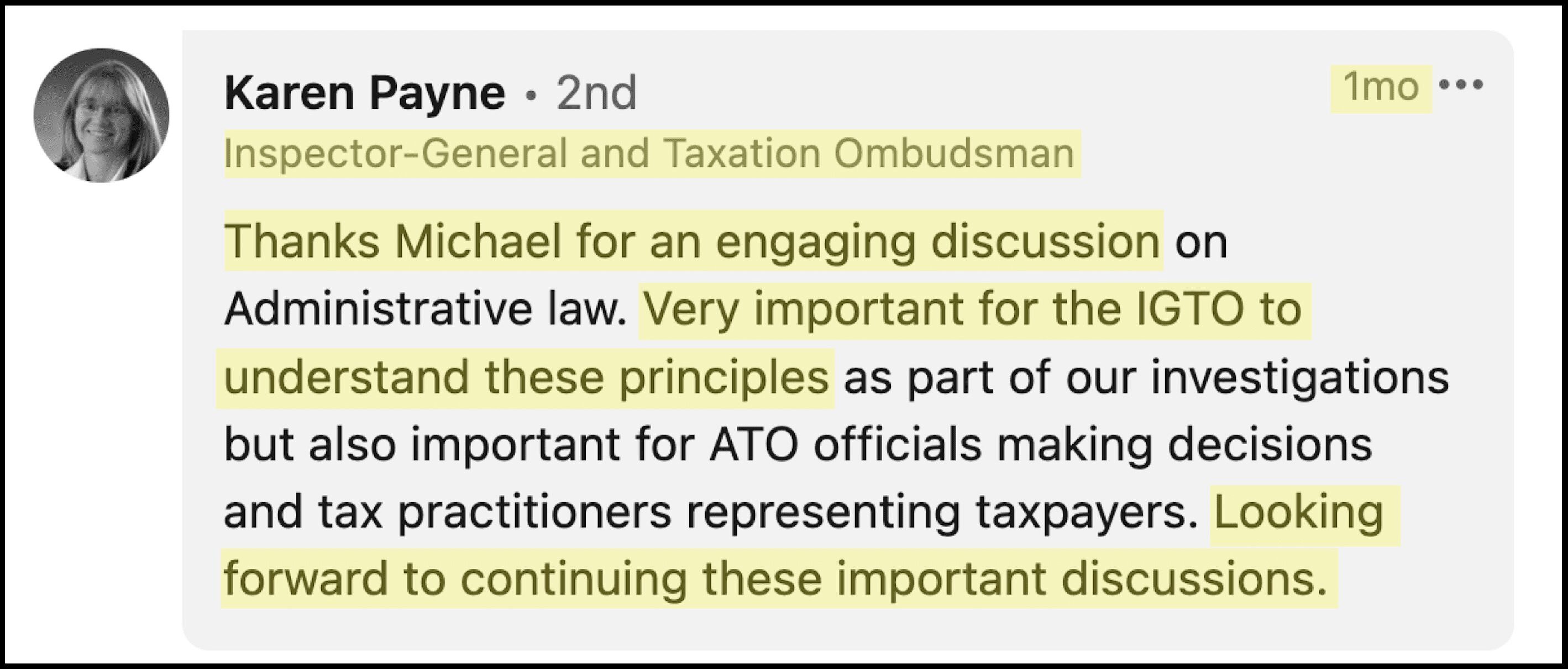

On April 27 Bersten posted to LinkedIn he was delivering “a three-day program on tax administration law to the Inspector-General of Taxation and Taxation Ombudsman team in their Sydney office”.

Taxation Ombudsman Karen Payne praises Bersten’s work on April 28, as revealed by The Klaxon on June 6. Source: LinkedIn

The next day Australia’s Inspector General of Taxation and Taxation Ombudsman Karen Payne thanked Bersten for his work.

“Thanks Michael for an engaging discussion on Administrative law, Payne posted to LinkedIn on April 28.

“Very important for the IGTO to understand these principles as part of our investigation but also important for ATO officials making decisions and tax practitioners representing taxpayers.

“Looking forward to continuing these important discussions,” Payne wrote.

BEFORE YOU GO – WE HAVE A SMALL FAVOUR TO ASK! Less than 2% of our readers currently contribute. Please help us stay afloat and telling these stories. Please SUBSCRIBE or CLICK HERE to make a one-off donation. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.