DONATE

EXCLUSIVE

The multi-million dollar PwC’s Indigenous Consulting — the nation’s “largest Indigenous consulting business” — is now owned by just one Indigenous person, after the second owner exited his stake.

It can be revealed Selwyn Button — recently appointed a boss of the nation’s Productivity Commission — has exited his holding, leaving former Sydney financial advisor Gavin Brown the only owner of PwC Indigenous other than PwC itself.

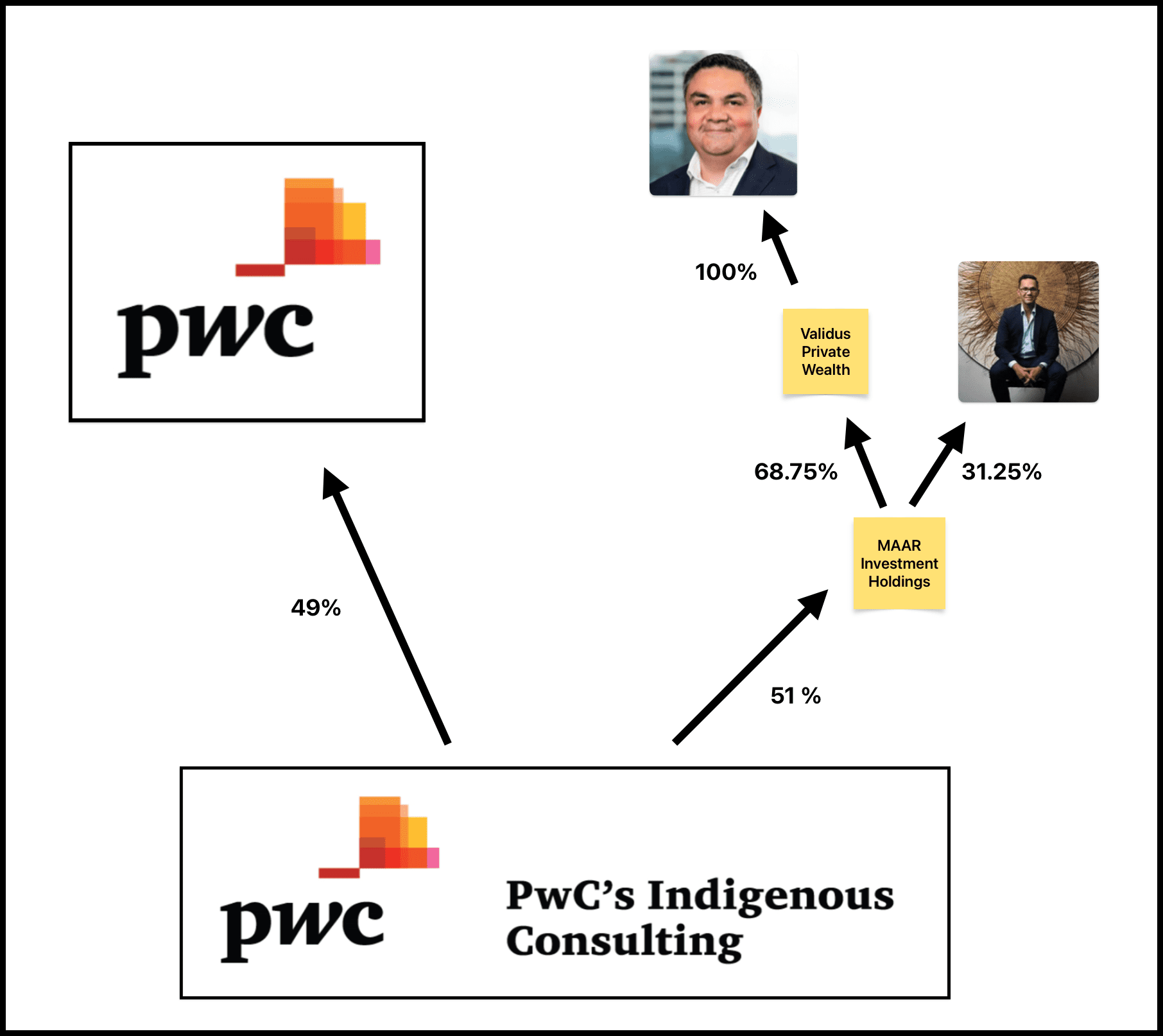

As previously revealed, the only owners of the business other than PwC were Button and Brown, both Indigenous, who owned 51% between them.

PwC owns the other 49%, which it is in the process of selling to rival “Big Four” accountancy and consulting giant Deloitte, with that deal yet to be completed.

Two weeks ago Deloitte announced it was buying a “minority stake” in PwC Indigenous — which Deloitte has confirmed is the 49% owned by PwC — after PwC put it on the market amid the ongoing tax leaks scandal.

The ownership structure of PwC Indigenous gives PwC — soon Deloitte — special treatment, including access to millions of dollars in Federal contracts that are not required to be put to open tender because it is “more than 50% Indigenous owned”.

A massive $9.5 billion has been disbursed under the Federal Government’s Indigenous Procurement Policy since 2015.

“A massive $9.5 billion has been disbursed under the Indigenous Procurement Policy since 2015”

Company searches reveal Button offloaded his 16% stake to Brown last week for an unknown sum — with Brown now owning 51% of PwC Indigenous.

On June 25 Button started a five-year term as a full-time Commissioner of the Productivity Commission, in the role of Indigenous Policy Evaluation Commissioner.

How the Klaxon broke the story last year. Source: The Klaxon

Deloitte spokeswoman Kari Keenan confirmed the “minority stake” that Deloitte announced it is buying is PwC’s 49% stake, but said the deal was yet to be finalised.

“Company records won’t reflect the new deal because the new deal hasn’t been completed yet,” Keenan told The Klaxon.

Like what Button received for his 16% stake, what Deloitte has agreed to pay PwC for its 49% stake is unknown — and all parties are refusing to say.

Since it was created in 2013, PwC Indigenous has been awarded more than $44 million in Federal contracts — including $13.78m in 2022 alone — suggesting the total value of PwC Indigenous is in the tens of millions of dollars.

Based on the corporate structure of PwC Indigenous, the 51% stake owned by Button and Brown — and now entirely owned by Brown — would be worth more than the 49% stake Deloitte is buying from PwC.

In that case, the Brown and Button stakes would be worth many millions of dollars each.

Yet the true profit and equity split arrangements of PwC Indigenous are not known — and all parties are refusing to say.

Support our quality journalism for just $10 a month

The corporate ownership structure of PwC Indigenous before Button’s exit last week. Gavin Brown (top) and Selwyn Button (right). Source: ASIC / Graphic: The Klaxon

PwC Indigenous can be awarded Federal contracts without them being put to open tender because it is a “small-to-medium Indigenous enterprise”, despite being 49% owned by one of the world’s biggest companies.

And because it is considered a “small proprietary company” under corporations law — and despite it being almost entirely funded by taxpayers — it is not required to file financial statements and other key financial information with the Australian Securities and Investments Commission (ASIC).

That means its true profit and equity split arrangements — which can be different to the corporate ownership structure — are hidden from the public.

In the statement announcing the PwC Indigenous deal, Deloitte chief executive Adam Powick said PwC Indigenous was the “largest First Nations consulting business in Australia”.

The exit of Button last week means the largest First Nations consulting business in Australia is owned by one Indigenous person.

“The nation’s largest Indigenous consulting business is owned by one Indigenous person”

Searches of Australian Securities and Investments Commission (ASIC) filings show Button resigned as a director of PwC Indigenous several weeks ago.

On Wednesday last week The Klaxon put questions to Button noting he had resigned as a director but still retained his 16% ownership of PwC Indigenous, through a company called MAAL Investment Holdings.

Responding the same day, Productivity Commission spokesman Simon Kinsmore said Button was no longer a director of PWC Indigenous and “does not hold any shares or financial interests in PWCIC” or MAAL.

The following day, on Thursday last week, the ASIC register was updated to show Button’s 16% stake had been transferred to Brown.

Through his company Validus Private Wealth, Brown now owns 100% of MAAL Investment Holdings, which in turn owns 51% of PwC Indigenous.

Button did not respond when asked how much he had sold his 16% stake in PwC Indigenous for.

“Any further inquiries about PWCIC should be directed to PWCIC or Deloitte or Mr Brown,” said Kinsmore of the Productivity Commission.

Brown, who is both CEO of PwC Indigenous and one of its five directors, did not respond to a series of questions, including regarding the company’s structure.

PwC spokeswoman Lucy Hinton said the deal with Deloitte “involved the full 49% stake”, but declined to respond when asked what Deloitte was paying, or whether Brown or Button received any payment or other consideration under that deal.

Hinton also declined to respond when asked whether the “profit share” of PwC Indigenous was the same as its corporate ownership structure.

More PwC Indigenous exclusives:

2024:

May 23 – Finance’s secretive move unlocks PwC millions

May 10 – “PwC Indigenous” greenlit days before explosive Senate report

May 3 – Government restarts PwC gravy train with $700,000 cash splash

May 2 – Australian Government paves way to resume PwC contracts

2023:

October 10 — PwC’s “Indigenous” gets $121,000 taxpayer contract

September 7 — Meet the owners of PwC’s Indigenous Consulting

September 4 — PwC’s “Voice” given $837k in new contracts

August 30 — PwC’s multi-million “Voice to Parliament”

PwC has repeatedly stated PwC’s Indigenous Consulting is a “seperate entity”, despite its name, the fact that it is 49% owned by PwC, that it is based in PwC’s Sydney headquarters — and it having PwC partners as directors.

PwC Indigenous has “offices” listed across Australia. In each case the address is PwC’s head office in that state or territory.

Aside from Brown, the current directors of PwC Indigenous are Thomas Bowden, Roanna Edwards and Rohit Antao — all PwC Australia partners — and Donna Murray, ASIC searches show.

Antao is the head of PwC Australia’s consulting business and a member PwC’s “leadership management team”.

According to PwC’s website, PwC Indigenous provides “advice to government” on “Indigenous matters”; “aims to be an emblem for Indigenous self-determination”; and “works together with governments to “close the gap”.

Website for PwC’s Indigenous Consulting. Source: PwC Australia

The revelations come as Productivity Commission data released yesterday found the number of First Nations people taking their own life, imprisoned and losing children to out-of-home care have all increased.

The Productivity Commission’s Annual Data Compilation report, based on 2023 figures, found just five of 19 Closing the Gap measures it monitors are on track. The findings have been labelled “deeply troubling” by new minister for Indigenous Australians, Malarndirri McCarthy, who was appointed to the role in this week’s cabinet reshuffle.

“These figures are deeply troubling, but I am determined to work in partnership with First Nations Australians, the Coalition of Peaks and state and territory government’s to bring about positive change, McCarthy said in a statement.

PwC has been mired in scandal since it emerged last year it had taken confidential Australian tax policy data — aimed at preventing multinationals avoiding tax — and spruiked it to multinationals seeking to avoid Australian tax.

The disgraced consultancy is set to make headlines again Friday, with a strong of current and former executives — including CEO Kevin Burrowes and former CEO Luke Sayers — called to give more evidence before a Senate inquiry.

Sayers founded PwC Indigenous one year after he became PwC Australia CEO in 2012.

Sayers launching PwC Indigenous in 2013. Source: PwC Australia

“Black cladding”

The PwC Indigenous ownership dealings put the spotlight on Indigenous procurement policy more broadly, amid concerns corporates are increasingly engaging in “black cladding” to access billions of dollars in “Indigenous” contracts.

Since the Commonwealth Indigenous Procurement Policy was created by the Abbott Coalition Government in 2015, $9.5 billion has been disbursed under the scheme.

Federal Government agency Indigenous Business Australia states “black cladding” is “the unethical practice of non-Indigenous businesses passing themselves off as Indigenous businesses in order to benefit from Indigenous policies and programs”.

Under the scheme “certified Indigenous business” are required to be “51% or more Indigenous-owned, managed and controlled”.

They must be “at least 51% owned by Indigenous Australians”; “led/and or managed by a Principal Executive Officer who is an Indigenous Australian; and “controlled by an Indigenous Australian who makes the key business decision regarding the company’s finances, operations, personnel and strategy”.

Yet experts say there are many avenues for gaming the system — importantly, around who actually gets the money.

A company can be “at least 51% Indigenous owned” but can have structures in place behind-the-scenes where corporate co-owners get the lion’s share of cash flows.

Where the ownership and profit share is different to the corporate structure (which is filed with ASIC), such arrangements are typically recorded in a company’s constitution or “shareholders’ agreement” — both documents that small proprietary companies are not required to provide to ASIC.

“Joint venture company income can be distributed to shareholders through shares — company structure can offer flexible structuring [ie differential rights, preferential shares],” states Indigenous Business Australia.

“Share classes can be open to unwanted exploitation if the shareholders agreement or constitution is not drafted with in Indigenous interests in mind — e.g. majority Indigenous shareholding but Indigenous parties not obtaining majority financial benefits due to share structures.

“Black cladding…significantly undermines” the aims and objectives of Indigenous business programs ”taking away the benefit intended for Indigenous people”, the agency states.

HONESTY BOX: Only around 1% of our readers current contribute – please support us for as little as $10/month or make a one-off donation here.

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.