The man responsible for protecting the interests of all Westpac-BT super members has resigned abruptly, just days after we revealed members were being gouged $1.65 billion a year. Westpac’s David Plumb was also a director of iCare – the company accused of “immoral and unethical practices” and riven by scandal. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

The head “trustee” legally responsible for protecting the interests of Westpac’s entire superannuation businesses has resigned abruptly, having overseen over $8.5 billion gouged from over 1 million member accounts.

David Plumb has left the group, resigning just four days after The Klaxon revealed that Westpac, and its wholly-owned subsidiary BT, were gouging over $1.65 billion a year from members.

In just the past three years, $5 billion has been gouged.

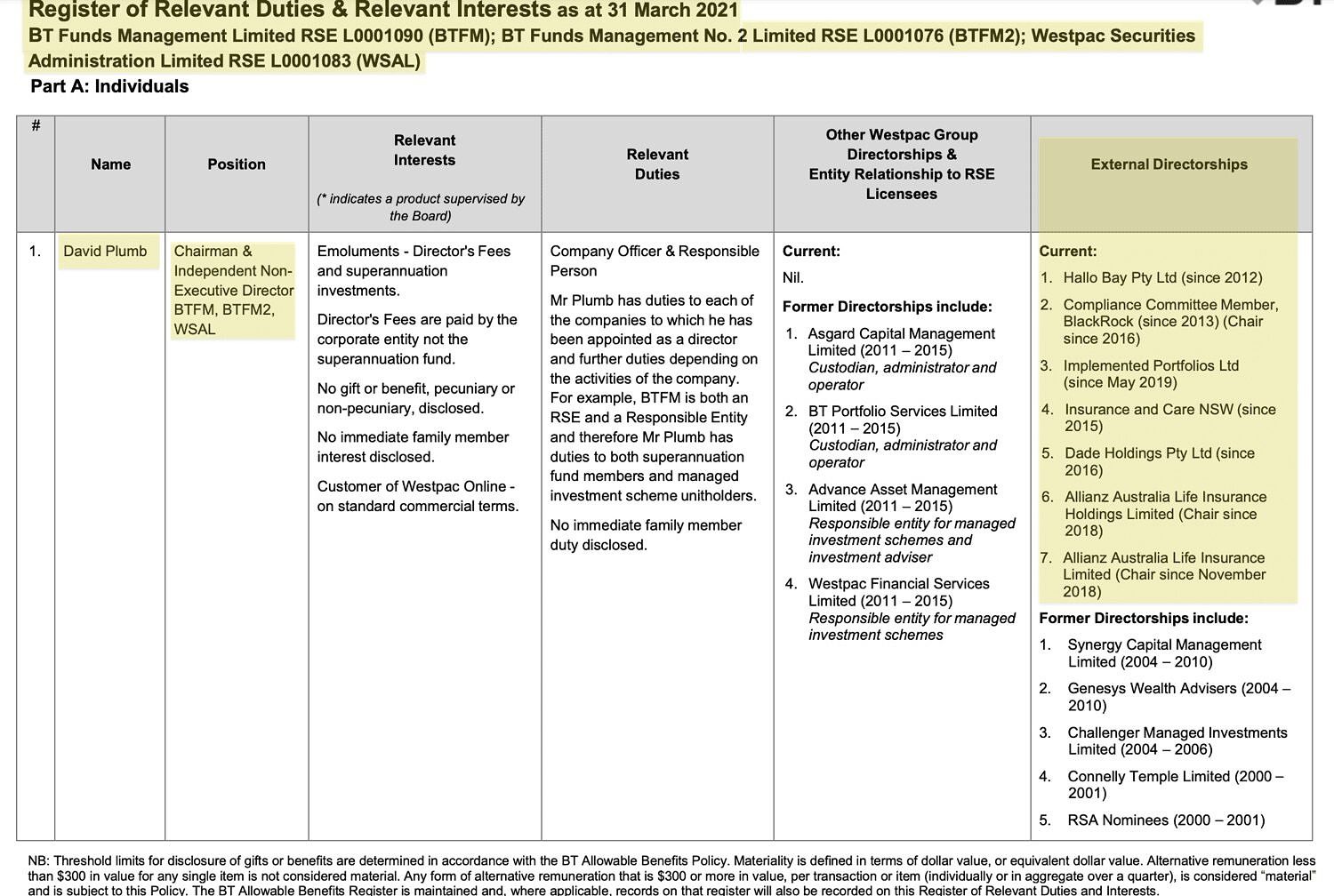

Plum, since November 2015, had been chairman of each of the three superannuation “trustee” companies that are legally responsible for all Westpac and BT super members.

Those three trustees are Westpac Securities Administration Limited, BT Funds Management No 2. Limited and BT Funds Management Limited.

The $8.6 billion man. David Plumb – resigned abruptly on June 28 amid BT gouging scandal. Source: LinkedIn

Under the Superannuation Industry (Supervision) Act (1993), superannuation trustees are legally required to act in the “best interests” of members.

If they don’t they can face severe penalties, including up to two years jail for each offence.

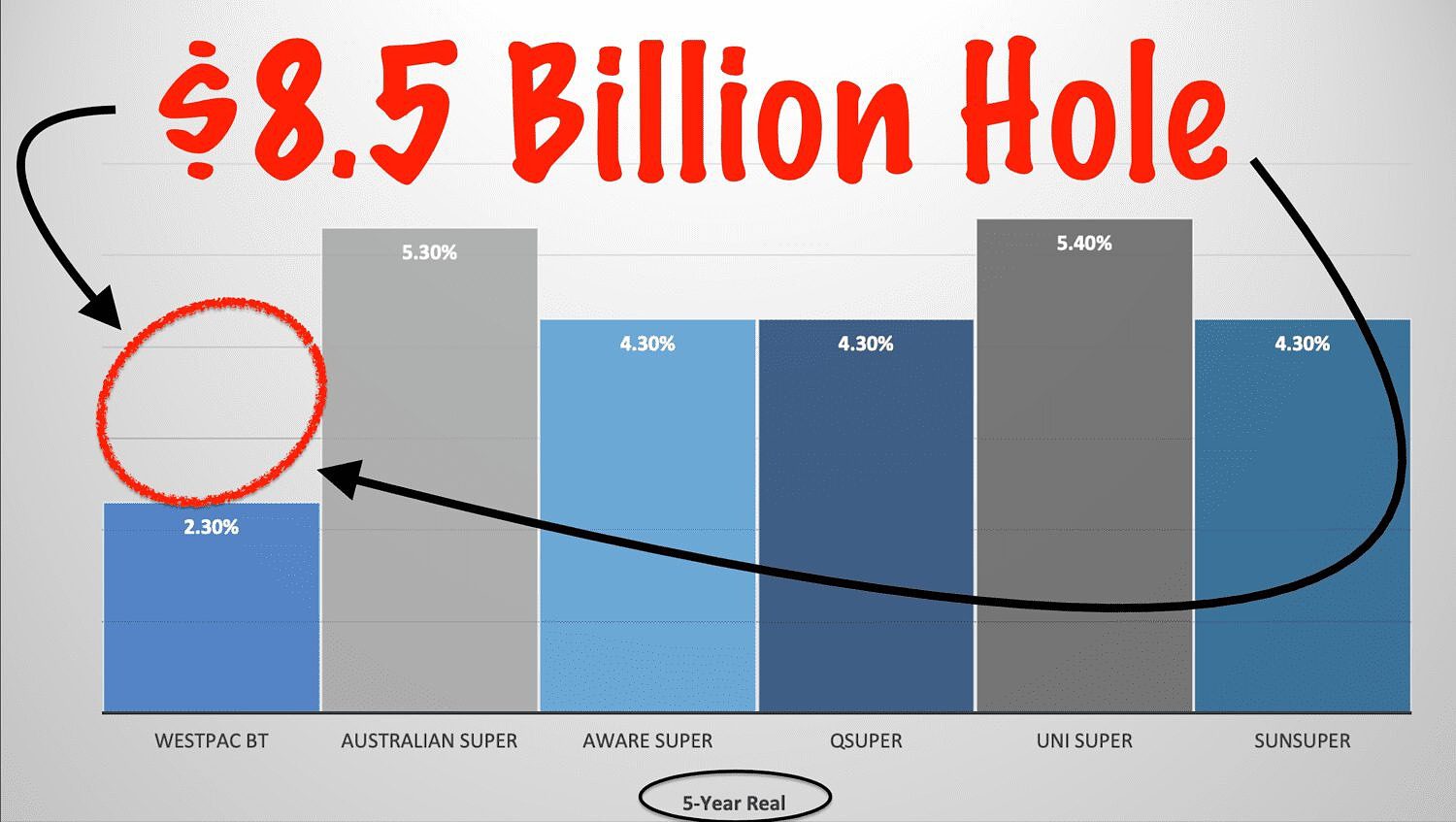

The Klaxon can now reveal that under Plumb’s watch as chairman, over 900,000 super members in Westpac-BT’s “Retirement Wrap” fund have lost $8.62 billion, compared to actual market rates.

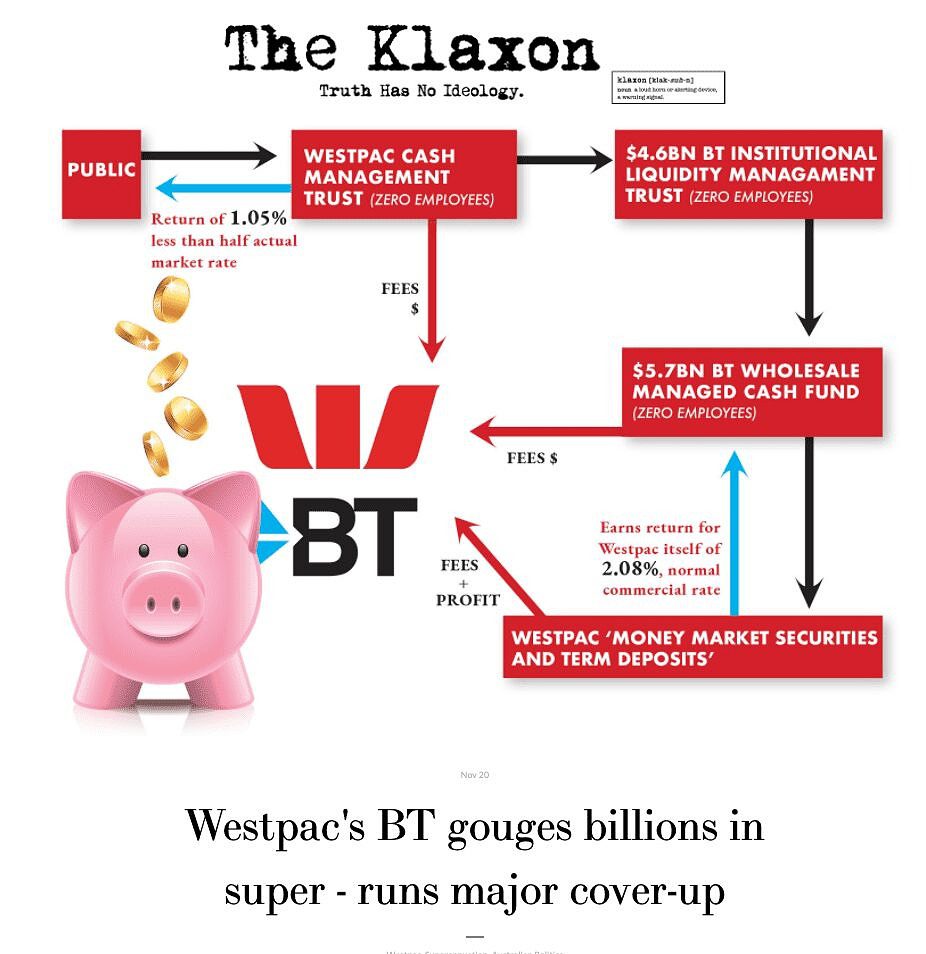

That was because Plumb, along with his fellow trustee board members, repeatedly invested members’ money with Westpac-BT entities, despite those entities consistently delivering extremely poor returns.

Westpac-BT’s Retirement Wrap has continuously, year-in, year-out, delivered returns at a fraction of market rates.

That’s because of systemic and rampant gouging by Westpac-BT.

As previously reported, between 2018 and 2020, the 900,000-plus members of the Westpac-BT Retirement Wrap earned returns of just 1/30th of actual market rates.

Regardless of Westpac’s decision to have its superannuation trustee boards owned and held within the Westpac Group, the trustees are legally bound to act in the best interests of superannuation members, and not Westpac Group.

The Klaxon repeatedly approached Plumb last week.

We asked how continuing to invest members’ money with Westpac-BT – despite the massive and consistent losses each year – was in line with his legal duty to act in the “best interests” of members.

Westpac-BT returns almost non-existent (1/30th of market rates) between 2018-20. Source: The Klaxon

Plumb repeatedly refused to comment.

His departure, simultaneously, from all three trustee boards, was announced on June 28, four days after The Klaxon’s Westpac-BT expose.

Last week Westpac – including its CEO Peter King – refused to respond to a series of detailed questions from The Klaxon.

Since November 2015, in his role as “independent director” and “non-executive chairman” of the trustee companies, Plumb was paid well over $1 million.

Because Plumb was a director of the three seperate trustee boards (though all part of Westpac Group) he received three pay checks.

In the year to September 2020, he received $73,280 from each of BT Funds Management, BT Funds Management No. 2 and Westpac Securities Administration Limited.

That’s a total of $219,840 for the year.

Westpac and BT did not respond when asked about the circumstances regarding Plumb’s sudden departure.

Sales block

Westpac is currently attempting to sell BT, with estimates it is “worth” over $2.5 billion.

Revelations of Westpac’s systemic gouging – which is what gives BT that massive “value” – suggest those sale attempts will be unsuccessful, at least at anything like that price.

Under Australian law, any buyer would need to ensure they had trustees in place to represent the best interests of the existing 1 million-plus Westpac-BT super members.

Yet, unless a new owner ceased the gouging of the funds (which is what gives BT its alleged “value”), then those trustees would be similarly exposed to criminal action, including up to two years imprisonment for each offence.

The Klaxon first revealed the Westpac-BT gouging – showing that over $8 billion had been gouged in the decade to mid-2018 – on November 20 last year.

Since then, the House of Representatives standing committee on economics, led by Labor MP Andrew Leigh, has been pursuing the matter.

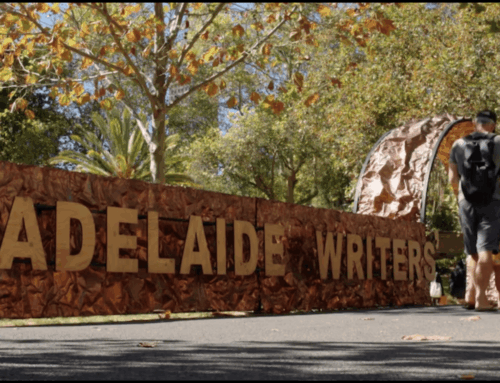

On Thursday The Australian Financial Review reported that Westpac, in response to questions taken “on notice”, had told the committee that in the year to September 2020 it had received $25 million in “dividends” from its subsidiary BT Funds.

Since 2016, that figure was $221 million.

While $221 million is an enormous amount to be taken by from Westpac-BT’s super members – who were under the “protection” of Plumb and his fellow trustees – the actual figure is vastly higher. (More to come).

Westpac-BT admits a small portion of the money it has obtained from its super members. Source: AFR

I care?

It has further emerged that for almost the entire time that Plumb was responsible for protecting the interests of Westpac-BT’s superannuation customers, he was also a director of Australia’s biggest workers compensation scheme, iCare.

The scheme is at the heart of a major mismanagement and underpayments scandal, worth up to $80 million, which an industry ombudsman describing problems at the group as being caused by “immoral and unethical practices”.

A NSW state-owned agency, iCare and was set up in 2015 to replace the existing WorkCover scheme.

A joint investigation last year between ABC’s Four Corners, The Age and The Sydney Morning Herald, revealed iCare was losing hundreds of millions of dollars a year and on the verge of collapse.

Concerns regarding the financial stability of the iCare insurance giant reportedly emerged as early as June 2018, and in March 2020 a Treasury briefing warned the fund’s “solvency is at risk”.

Yet “despite deepening concerns about the financial viability of iCare”, the investigation reported that its executives were “paid some of the biggest salaries of any NSW Government agency”.

Plumb was paid $130,000 a year as non-executive director at iCare.

He started at iCare in 2015.

Plumb’s roles at Westpac-BT, and “external directorships”. Source: Westpac BT.

There has been a major clean out of executives at iCare since the scandal broke, with CEO John Nagle and executives Rob Craig and Sara Kahlau all being replaced.

Plumb’s iCare directorship was not renewed and he left earlier this year.

Plumb is currently the chairman of Allianz Retire+, an Australian investment and life insurance company owned by German insurance giant Allianz and global investment group PIMCO.

He has held that position since 2018.

Westpac-BT “additional disclosure” documents state that Plumb has been “Compliance Committee Member” at BlackRock since 2013, and chair since 2016.

BlackRock is a global investment giant based in New York.

On his LinkedIn profile (where he appears as “David P.”), Plumb’s position at BlackRock is described as a “fiduciary role for responsible entity” which has around 140 funds and $20 billion of funds under management.

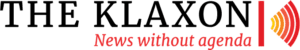

Over $8.5 billion missing in just five years, all under Plumb’s watch. Source: APRA, RBA. Graphic: The Klaxon

The Missing Billions

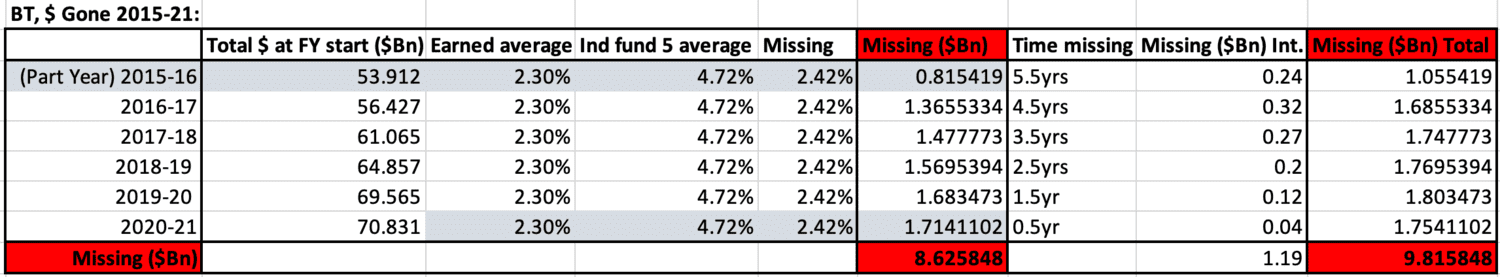

Plumb was chair of the trustees responsible for all Westpac-BT super members between November 2015 and June 28 this year.

In that time the 900,000-plus members of Westpac-BT’s Retirement Wrap umbrella fund have lost out on $8.63 billion worth of returns.

(The losses of all Westpac-BT super members are even greater. That’s because while the vast majority of Westpac-BT super members are ultimately part of the “Retirement Wrap” umbrella, not all are).

The losses, after adjusting for the impact of inflation, are shown above.

The major so-called industry funds, including AustralianSuper and QSuper, have consistently, year-after-year, delivered investment returns largely in-line with actual market rates.

The so-called “retail” funds, including Westpac-BT and CBA’s Colonial First State, have not.

The $8.63 billion figure is the sum of what should have been earned, on average, by Westpac-BT Retirement Wrap members each year (ie actual market rates) compared to what they actually earned.

The market rate is simply the average annual returns of the big five “industry” funds.

The Klaxon’s November 20 expose

The official fund returns are published by the Australian Prudential Regulatory Authority.

They have been adjusted for the impacts of inflation, as per the Reserve Bank of Australia.

The losses are shown in the table below.

They were $1.68 billion in the 2019-20 financial year, $1.59 billion in 2018-19, $1.48 billion in 2017-18 and $1.37 billion in 2016-17.

In 2015-16, for the seven months that Plum was trustee chairman, the losses were $815 million.

The APRA figures for the 2020-21 financial year have not yet been published.

Instead, we have used an average based on the previous years, given the rate of losses is highly consistent.

Adding these losses each year comes to $8.63 billion.

Yet the total losses to Westpac-BT’s almost 1 million super members are even greater.

That’s because of compound interest.

For example, losses to members were $1.37 billion in 2016-17.

That money was no longer earning the members interest – it was no longer their money.

If that money had instead not been gouged, and had been invested at actual market rates, it would be worth $1.69 billion – $320 million more.

Adding those extra losses, using a standard compound interest calculator, shows the true losses to Westpac-BT Retirement Wrap members since November 2015 are $9.82 billion.

$9.82 Billion missing from Westpac-BT super under Plumb’s watch. Source: APRA, RBA. Graphic: The Klaxon

SIS Act

The legal requirement that trustees act in the “best interests” of members is set out in Section 52 of the Superannuation Industry Supervision Act 1993 (Cth) (the SIS Act).

Trustees, as per s52(2)(c) of the act, are ‘to perform the trustee’s duties and exercise the trustee’s powers in the best interests of the beneficiaries’.

Jane Eccleston. The Klaxon’s June 28 story. Source: The Klaxon

Penalties for trustees breaching the SIS Act include up to two years imprisonment.

Westpac refers to its three trustee entities collectively as simply “the Superannuation Boards”.

“David (Plumb) was appointed as Chairman of the Superannuation Boards on 16 November 2015,” Westpac documents state.

Along with his responsibilities as trustee, Plumb was on the “Investment Committees” of the trustee boards.

Westpac documents state those “Investment Committees” are responsible for helping the trustees set the “investment strategy” for each super fund, as well as for monitoring the investments once they are made.

The Investment Committees also “oversee the appointment or termination of the investment managers of investment portfolios” and “monitors the performance of those investment managers”.

Throughout Plumb’s tenure, he and his fellow trustees consistently appointed Westpac-BT as the “investment managers” for the superannuation funds in their care.

The key agency responsible for enforcing the SIS Act is corporate regulator Australian Securities and Investments Commission (ASIC).

Last week The Klaxon revealed that ASIC had taken no action, despite being alerted to the scandal over six months ago.

In that time almost $1 billion more has been gouged from over 900,000 Westpac-BT Retirement Wrap superannuation accounts.

The person at ASIC in charge of taking action is Jane Eccleston, ASIC’s senior executive leader in charge of superannuation.

As revealed last week, Eccleston’s former roles include being “in-house” lawyer at Westpac.

Eccleston has repeatedly refused to comment when approached by The Klaxon.

More to come.