Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE

An entire 47-person Australian Government tax “advisory” panel — which provided “real time policy advice” to the Federal Treasurer — has been scrapped after more than two decades as the PwC tax leaks scandal continues to unfold.

The “high-level” Federal Government “Advisory Panel” — which investigations showed was stacked with “Big Four” tax partners and global fossil fuel “tax specialists” — has been axed behind-the-scenes as questions swirl over ties between government and the tax industry.

It can be revealed the Board of Taxation’s Advisory Panel, set up in 2002, was quietly “dissolved” on June 29.

That was just days after The Klaxon put a series of highly detailed questions to it, and to the Department of Treasury, which oversees it, regarding former PwC tax partner Anthony Klein.

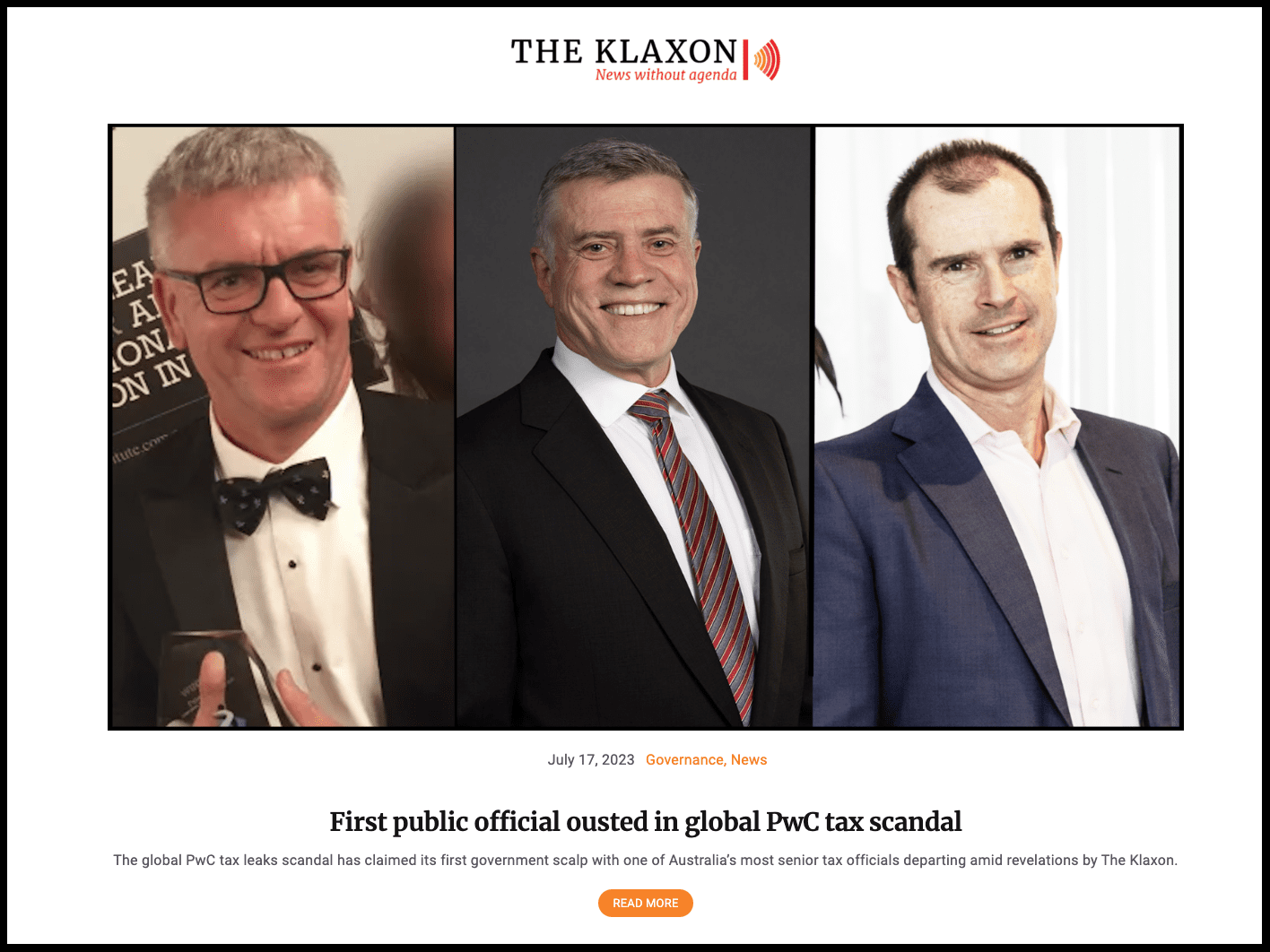

Klein, a tax partner with consultancy PwC for 17 years until July 2021, was appointed a director of Board of Taxation in October 2021, having been on the Board of Taxation’s “Advisory Panel” since 2015.

The Klaxon learned that while at PwC, Klein had worked in direct collaboration with at least two former partners named by PwC to date in connection with the scandal, Paul McNab and disgraced accountant Peter Collins.

How The Klaxon broke the story on July 13. Source: The Klaxon

Klein’s titles at PwC, where he “held a number of senior roles in PwC’s tax practice both within Australia and beyond”, included “Leader of PwC’s Corporate Tax Team in Melbourne”; “Leader of PwC’s Private Client Team in Melbourne”; and “PwC’s International Tax Leader for the Asia Pacific region”.

The Klaxon on June 24 put detailed questions to Klein, the Board of Taxation, and to Treasury, asking if Klein had been aware of, or been involved in, PwC’s tax leaks scam — or whether he was among the 63 on the “list” of current or former partners PwC says received at least one email in relation to the tax leaks scam.

All repeatedly refused to answer.

As revealed by The Klaxon yesterday, sometime between then and last Friday, Klein’s name was secretly scrubbed from the Board of Taxation website.

On Friday, in a statement from an unnamed “spokesperson”, the Board of Taxation told us Klein had “resigned”, but declined to comment further.

Please support us by SUBSCRIBING HERE

Anthony Klein becomes the first public official to depart the over the PwC tax scandal. Source: The Klaxon

Until then, Klein had been listed alongside the Board of Taxation’s other eight directors, including Treasury Secretary (head of the Department of Treasury) Stephen Kennedy and Australian Taxation Office (ATO) Commissioner Chris Jordan.

It has now emerged the entire Board of Taxation Advisory Panel — responsible for “advising on the quality and effectiveness of tax legislation”; “contributing to the Board [of Taxation’s] real time policy advice to the Treasurer”; and “recommending improvements to support the general integrity and functioning of the tax system” — has gone the same way.

Like Klein, there was no media statement (the most recent media statement on the Board of Taxation site is dated October 25, 2021 – announcing Klein’s appointment for a “three year period”).

Under “Advisory Panel” on the site, where there had been over 40 members listed, there are six paragraphs, at the bottom are the words “Page updated June 29”.

The third last sentence states: “the Board has decided to dissolve the current Advisory Panel”.

The existing list of panel members was deleted.

We saved a copy. (So did web archive WayBack Machine.)

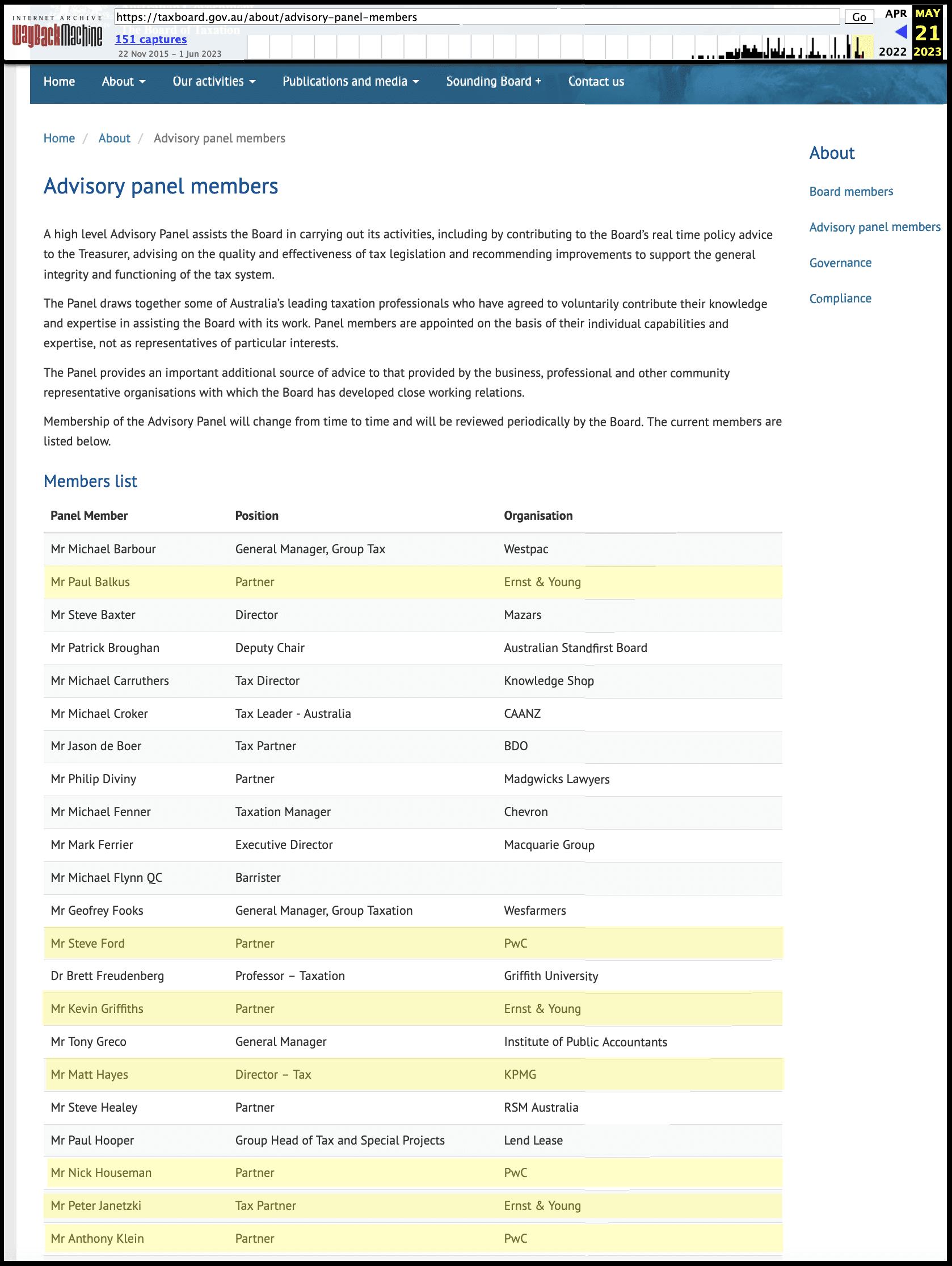

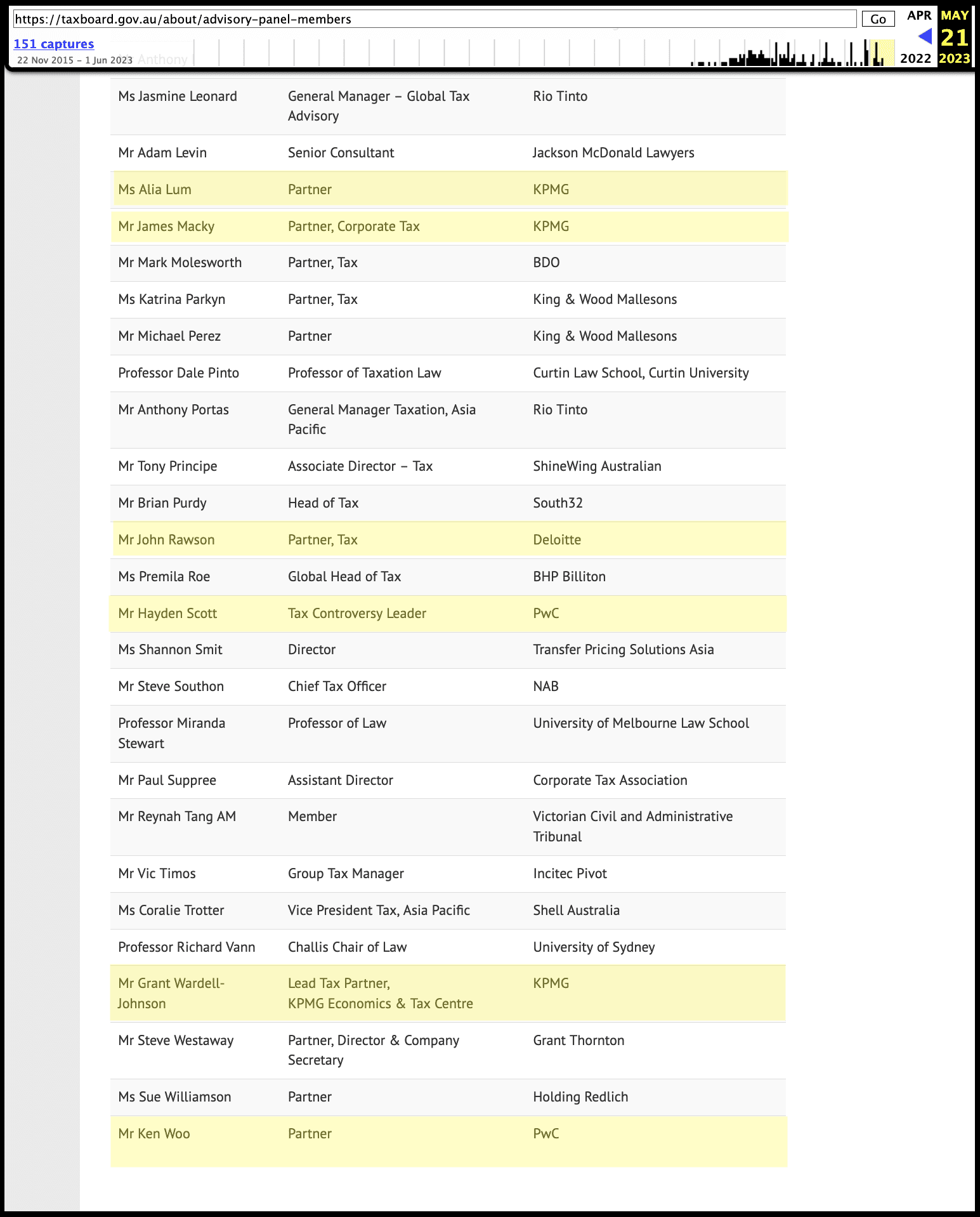

It states: “Membership of the Advisory Panel will change from time to time and will be reviewed periodically by the Board. The current members are listed below”.

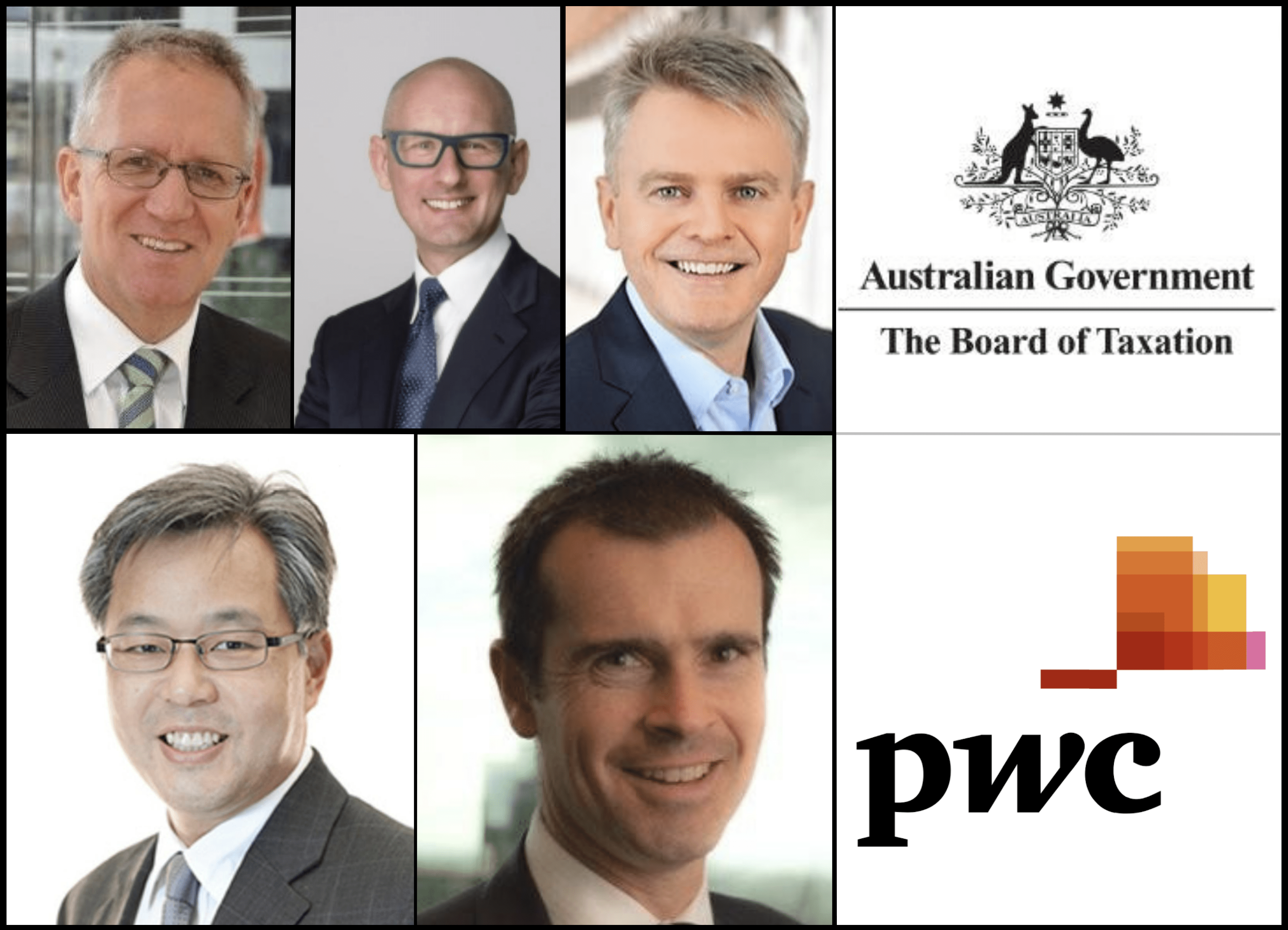

It shows that before it was dissolved on June 29, there were four — current — PwC Australia tax partners on the Advisory Panel: PwC Australia Global Tax Controversy and Dispute Resolution Co-Leader Hayden Scott; PwC Australia Transfer Pricing and International Tax Partner Nick Houseman; PwC Australia Tax Partner Steve Ford; and PwC Australia Tax Partner Ken Woo.

Please support us by SUBSCRIBING HERE

Clockwise from bottom left: PwC Australia tax partners Ken Woo; Steve Ford; Hayden Scott; Nick Houseman; and former PwC tax partner Anthony Klein Source: Supplied. Graphic: The Klaxon

Also on the list are three EY (Ernst & Young) partners including International Tax Practice Leader Peter Janetzki; a Deloitte tax partner; and four tax executives from KPMG, including tax director Matt Hayes, partner Alia Lum, corporate tax partner James Macky and KPMG lead tax partner Grant Wardell-Johnson.

Those tax executives from the Big Four consultancies – PwC, EY, Deloitte and KPMG – comprised 14 of the 47, or 30 per cent, of the Advisory Panel members.

There are also nine tax partners from other consultancies, including BDO (two tax partners); partners of Grant Thornton; RSM Australia; a group called Transfer Pricing Solutions; and deputy chair of Australian Standfirst Board, a “global investing specialist” which focuses on “Ultra High Net Worth (UHNW) wealth”.

Together the consultancies comprise 23 places, or 49 per cent of the Advisory Panel.

Board of Taxation Advisory Panel, “Big Four” members highlighted. Source: WayBack Machine

There are also six tax corporate lawyers, including two partners from King & Wood Mallesons and a partner of Madgwicks Lawyers.

Australia’s fossil fuels sector was also very well represented.

The Advisory Panel included Chevron Taxation Manager Michael Fenner; BHP Billiton Global Head of Tax Premila Roe; Shell Australia Vice President Tax, Asia Pacific Coralie Trotter; South32 head of tax Brian Purdy; and two Rio Tinto executives, General Manager Global Tax Advisory Jasmie Leonard and General Manager of Taxation Asia Pacific Anthony Portas.

Also on the panel was Westpac’s General Manager, Group Tax, Michael Barbour; NAB Chief Tax Officer Steve Southon; and Macquarie Group Executive Director Mark Ferrier; CAANZ Tax Leader Australia Michael Croker; Institute of Public Accountants general manager Tony Greco; and Paul Suppree, Assistant Director of Corporate Tax Association.

Board of Taxation Advisory Panel, “Big Four” members highlighted. Source: WayBack Machine

Four of the Advisory Panel members were from universities and one member was from the Victorian Civil and Administrative Tribunal,

Those five representing just over 10 per cent of the Panel.

Board of Taxation chair Rosheen Garnon, who receives a taxpayer salary of $122,460 a year plus expenses for the part-time role, has at all times refused to comment.

Garnon’s bio states she “has over 30 years experience” in tax, having “been a senior partner of KPMG”; including the “National Managing Partner for KPMG Australia’s Taxation Division” from 2009 to 2015.

Klein was appointed to a three-year term as Board of Taxation director, a part-time role with a taxpayer salary of $61,230 a year plus expenses, in October 2021.

Before that he had spent almost seven years as a member of the board’s “Advisory Panel”, starting in January 2015.

Advisory Panel positions were unpaid.

Please support us by SUBSCRIBING HERE

How The Klaxon broke the story on June 6. Source: The Klaxon

In January it emerged PwC took Australian Government data, gleaned from 2013 to 2018 while providing “advice” drafting multinational tax avoidance laws, and over many years shared it widely within the firm and with clients across the globe.

Under one 2015 scam, which PwC internally called “Project North America”, PwC sold data for millions of dollars to US-tech giants, offering them “work arounds” to incoming Australian laws, months before those laws were announced.

On June 5, and only following extreme pressure, PwC Australia interim CEO Kristin Stubbins named four former PwC tax partners as tied to the scandal: Collins (who had been named in January); Paul McNab; Neil Fuller; and Michael Bersten.

Collins quietly departed from PwC in October last year; McNab resigned from law firm DLA Piper, where he had been a tax partner since he left PwC after 22 years in May 2020, the night before PwC named him on May 2; and Fuller, according to his since-deleted LinkedIn resume, “retired” from PwC in 2019.

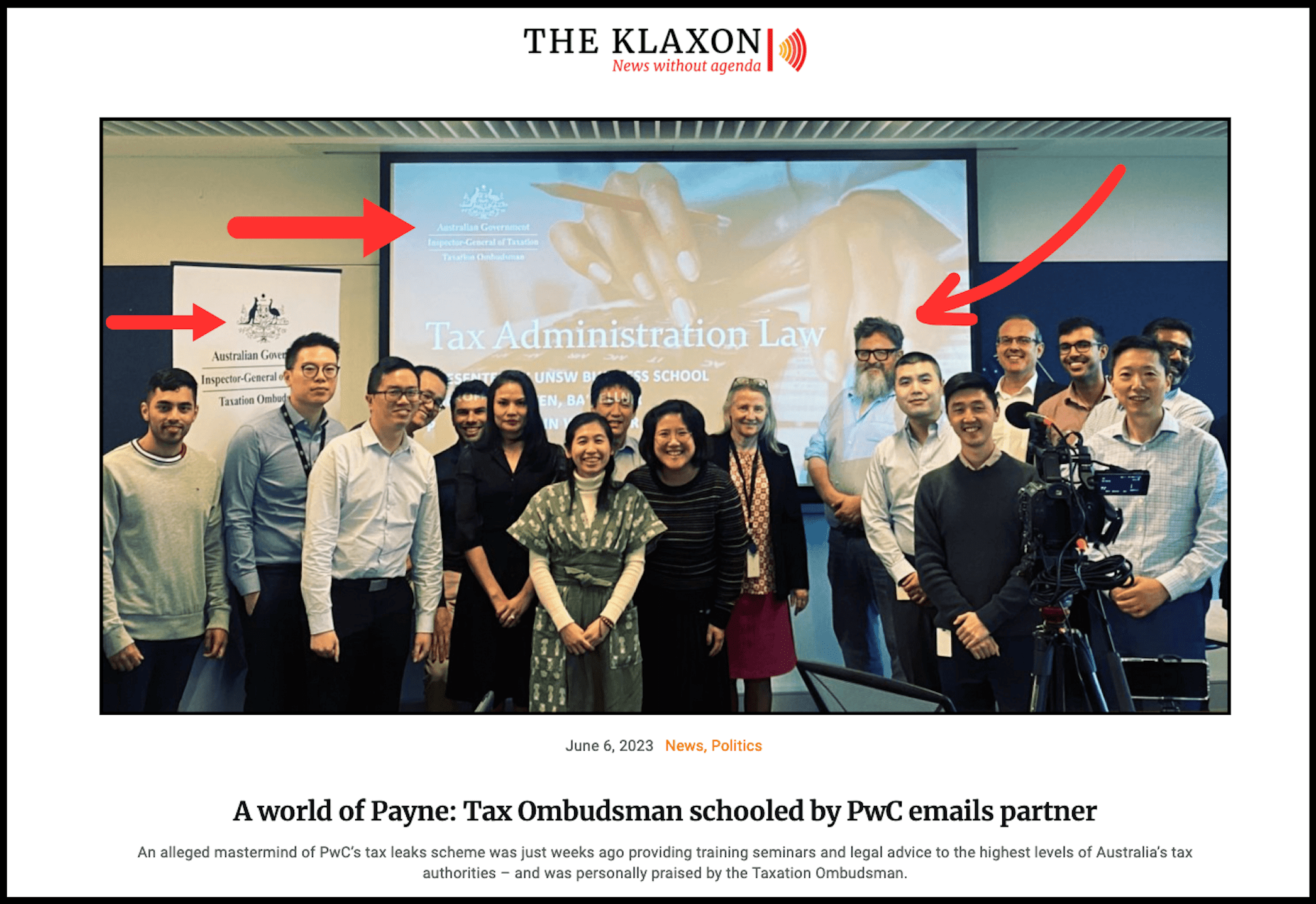

Bersten, who was at PwC Australia from 2004 to July 2018 and “founder” of its “tax controversy” arm, was last month ousted from roles teaching “Tax Administration Law” to hundreds of government tax officials at the ATO and fellow Federal agency, the office of the Inspector-General of Taxation and Taxation Ombudsman (IGTO), after The Klaxon revealed the arrangement on June 6. He had been contracted by the University of NSW.

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

Anthony Klan

Editor, The Klaxon