SUPPORT

EXCLUSIVE

The Department of Finance greenlit disgraced consultancy PwC to continue making millions from taxpayers just days before the Senate inquiry into consultancies delivered its highly damning findings into the tax leaks scandal.

Finance, it can be exclusively revealed, quietly waived through PwC arm PwC’s Indigenous Consulting (PIC) behind-the-scenes, directly before the Senate inquiry handed down its findings, as scheduled, on March 27.

The Senate inquiry, comprised of members of all major Australian political parties, conducted a year-long investigation, including ten public hearings, testimony from over 100 witnesses and thousands of pages of submissions.

Its detailed report, titled “PwC: The Cover-up Worsens the Crime”, found PwC had failed to “genuinely change”, was engaged in an ongoing “cover-up”, and made “no genuine effort to fully investigate and address the issues”.

As exclusively revealed by The Klaxon and Crikey, Finance last week, on April 30, quietly published a surprise “procurement policy note”.

It not only paves the way for the Federal Government to again give PwC Australia contracts – and as soon as December – but approves PIC to be given Federal contracts immediately.

“Finance has…concluded a review into PwC Indigenous and found that it was appropriate for the Commonwealth to continue engaging with PwC Indigenous,” it states.

No information beyond that single sentence is provided, such as who conducted the “review”, how long it took, or what specifically it looked at or found – and Finance is refusing to comment.

It can now be revealed Finance not only “finalised” its secretive PIC “review” before the Senate inquiry released its highly anticipated March 27 report — but almost immediately before.

On March 26, in response to a series of questions, an unnamed Finance “spokesperson” told The Klaxon that a “review” into PIC had been conducted — and it had been “finalised” in March.

Finance refused to say which day in “March” it had finalised the review — or why Finance had “finalised” it directly before the Senate inquiry was to make public the findings of its year-long, highly-detailed PwC investigation, on March 27.

Finance on March 26: “The department finalised its review of (PIC) in March this year. The review concluded it was appropriate for the Commonwealth to continue engaging with (PIC)”

Senate inquiry on March 27: “PwC have still made no genuine effort to fully investigate and address the issues…The cover-up worsens the crime”

Support our quality journalism by CLICKING HERE

Department of Finance Secretary Jenny Wilkinson. Source: ABC News/Nick Haggarty

That the Senate’s report was likely to be critical of PwC was no secret.

PwC has drawn fierce rebuke for refusing to cooperate, including refusing to hand over a report PwC paid international law firm Linklaters to conduct into the tax leaks scandal.

On February 9, inquiry chair, Liberal Senator Richard Colbeck, said if PwC continued to refuse to handover the Linklaters report “it ain’t going to be pretty”.

“It’s not just an opinion from three or four people sitting around a table,” Colbeck told PwC Australia CEO Kevin Burrowes at the public hearing.

“This will be a document that will be endorsed by the parliament of this country.

“Can I tell you, if we don’t see the report, it ain’t going to be pretty,” Colbeck said.

“This will be a document that will be endorsed by the parliament of this country” — Senator Richard Colbeck

The Senate inquiry was not — and still hasn’t been— given a copy of the Linklaters report.

The secretive — and unexplained — move by Finance is a substantial win for PwC’s partners.

Department of Finance boss Jenny Wilkinson refused to explain why Finance had given PwC’s Indigenous Consulting the green light just days before the Senate report into PwC “endorsed by the parliament” of Australia.

Wilkinson refused to comment when asked whether she had approved the decision, and, if not, whether she considered it appropriate for the Commonwealth to “continue engaging with PwC Indigenous”.

Last financial year Wilkson received a taxpayer salary of $765,916.

Refusing to comment: Questions to Finance Secretary Jenny Wilkinson in March.

The Senate inquiry report states: “PwC have still made no genuine effort to fully investigate and address the issues”.

“The committee does not see how PwC can recover their reputation while it continues to cover up” — Senate inquiry

“The committee does not see how PwC can recover their reputation while it continues to cover up.

“Indeed, the cover-up worsens the crime”.

The March 27 Senate report. Source: Australian Senate

In January last year it was revealed PwC took confidential Federal tax policy information obtained while providing “advice” on stopping multinationals avoiding Australian tax — and sold it to multinationals seeking to avoid Australian tax.

On May 19 last year Finance released what was reported as an “effective ban” on PwC being given Federal contracts.

PwC subsequently “divested its government business” of 1,400 PwC partners and staff, selling it for the nominal sum of $1 to private equity group Allegro, which rebranded the business Scyne Advisory.

That deal was finalised in November, and it was widely considered PwC would no longer be given Federal contracts.

More PwC Indigenous exclusives from The Klaxon:

2024:

May 3 – Government restarts PwC gravy train with $700,000 cash splash

May 2 – Australian Government paves way to resume PwC contracts

2023:

October 10 — PwC’s “Indigenous” gets $121,000 taxpayer contract

September 7 — Meet the owners of PwC’s Indigenous Consulting

September 4 — PwC’s “Voice” given $837k in new contracts

August 30 — PwC’s multi-million “Voice to Parliament”

PIC was founded by former PwC Australia CEO Luke Sayers, who was in the role from 2012 to 2022 and so for the entire tax leaks affair.

It has been given over $44 million in Federal contracts, including a record $13.78m in 2022 alone.

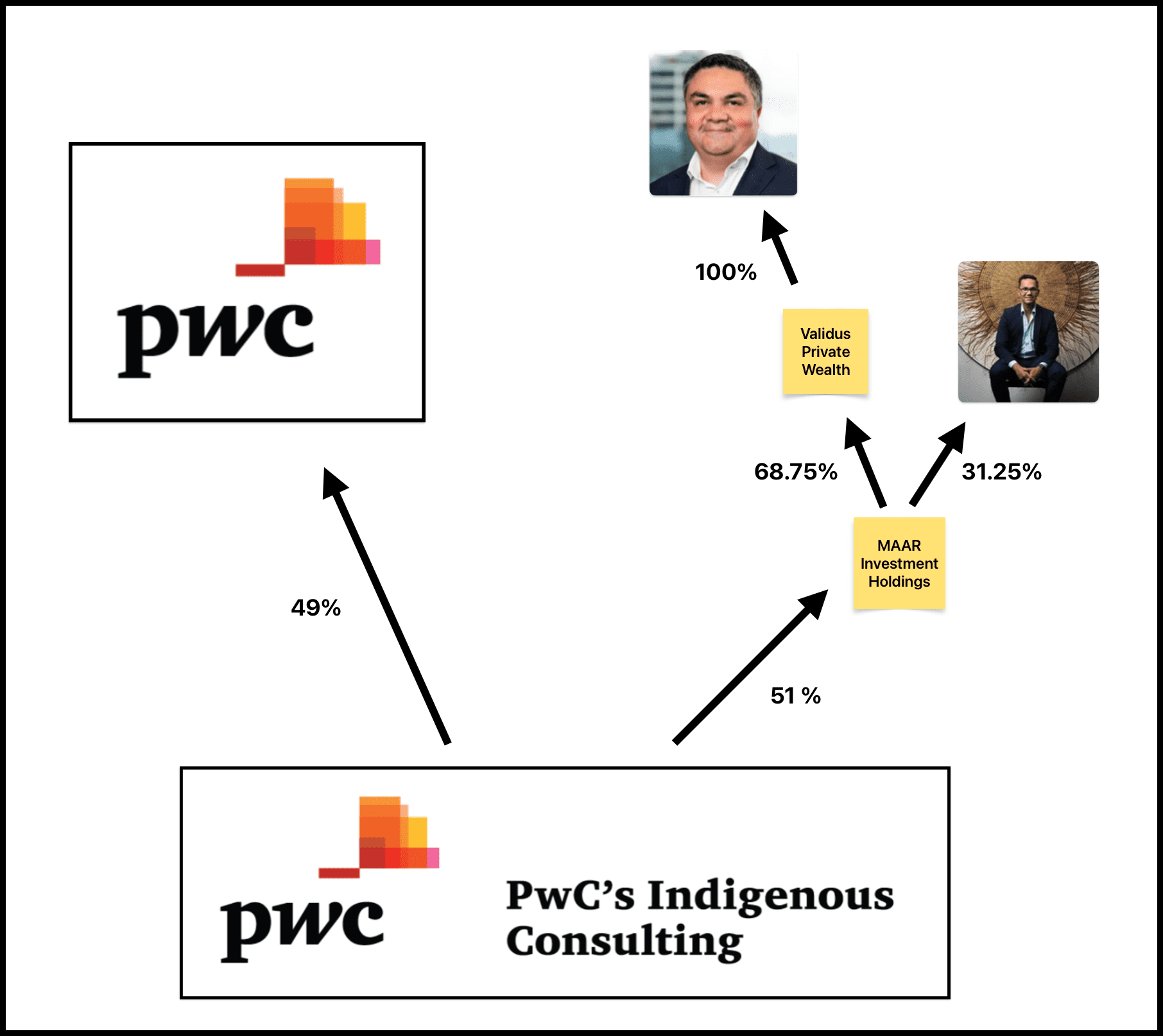

Other than PwC itself (which owns a 49% stake), PIC is owned by just two people, both Indigenous, who own 51% between them.

That structure means PwC can access “limited tender” Federal contracts intended for small Indigenous businesses (which require at least 51% Indigenous ownership).

PwC Australia owns the biggest stake (49%); Brown owns 35% (via his company Validus Private Wealth) and Button owns 16%.

PwC Australia, Brown and Button all refused to respond to requests for comment.

Support our quality journalism by CLICKING HERE

PIC’s ownership structure, including Gavin Brown (top) and Selwyn Button (right). Source: ASIC Graphic: The Klaxon

While providing no evidence, PwC — and now Finance — have claimed PIC is “separate” to PwC.

That’s despite its name — “PwC’s Indigenous Consulting” — that fact it is based inside PwC Australia’s headquarters; that it shares PwC Australia’s website; and that its directors include PwC Australia partners.

Finance’s secretive move is already delivering PwC dividends: PIC has been given two new Federal contracts totalling $711,544.

Flags spruiking PwC’s Indigenous Consulting inside PwC’s headquarters. Source: PwC Australia

All on the same day last week, April 30, there were three highly significant developments in the PwC saga.

Federal procurement portal AusTender was updated to show the two new contracts to PIC; Finance quietly posted its PwC “procurement policy note” (greenlighting PIC); and the Federal lobbyist register was updated to show PwC had engaged a political lobbying firm, which is run by two former senior ALP staffers.

Brookline Consulting is run by Lidija Ivanovski, former chief- of-staff to Labor deputy leader (and current Deputy Prime Minister) Richard Marles; and Gerard Richardson, who until last year was communications director to Federal Treasurer Jim Chalmers.

Finance is now in charge of the Federal Government’s response to the PwC tax leaks affair, last week’s procurement policy note states.

To “ensure a coordinated and efficient approach” Finance has “taken responsibility for managing the Commonwealth’s response” and “forming a whole of government view” on “PwC Australia’s ethical soundness”, it states.

“Finance has taken responsibility for managing the Commonwealth’s response” — Finance

The “procurement policy note” last week. Source: Department of Finance

On March 19 last year Finance issued an earlier “procurement policy note”, which was widely reported as an “effective ban” on PwC, although it did not name PwC.

Last week’s note does name PwC, and states for the first time that there are restrictions on PwC.

Although it is in the form of stating that Finance and PwC Australia have signed a “mutual agreement” and that PwC Australia will not bid for any new Commonwealth work – at least until December.

“PwC Australia has agreed with the Commonwealth that it will temporarily cease new contract engagements with Australian Government entities…until 1 December 2024,” it states.

“PwC Australia has agreed with the Commonwealth that it will temporarily cease new contract engagements…until 1 December 2024” — Finance

Finance does not state why any “agreement” with PwC was needed, why it was only now naming PwC for the first time, given the scandal broke over a year ago — and why it was only naming PwC in the context of again allowing it to be given Federal contracts.

DON’T CLICK AWAY: As you can see from the above, truly independent, quality journalism is vital to our democracy. Please SUPPORT US HERE.

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.