Appreciate our quality journalism? Please subscribe here

EXCLUSIVE

The Australian Electoral Commission has gone against its own published rules to waive through the billionaire Lowy family having made $550,000 in secretive “donations” to the Liberal Party via an obscure subsidiary.

In a startling admission — which favours the Lowy Family — the electoral body has given the green light to political “donors” masking their true identity by funnelling money to political parties and candidates via little-known corporate affiliates.

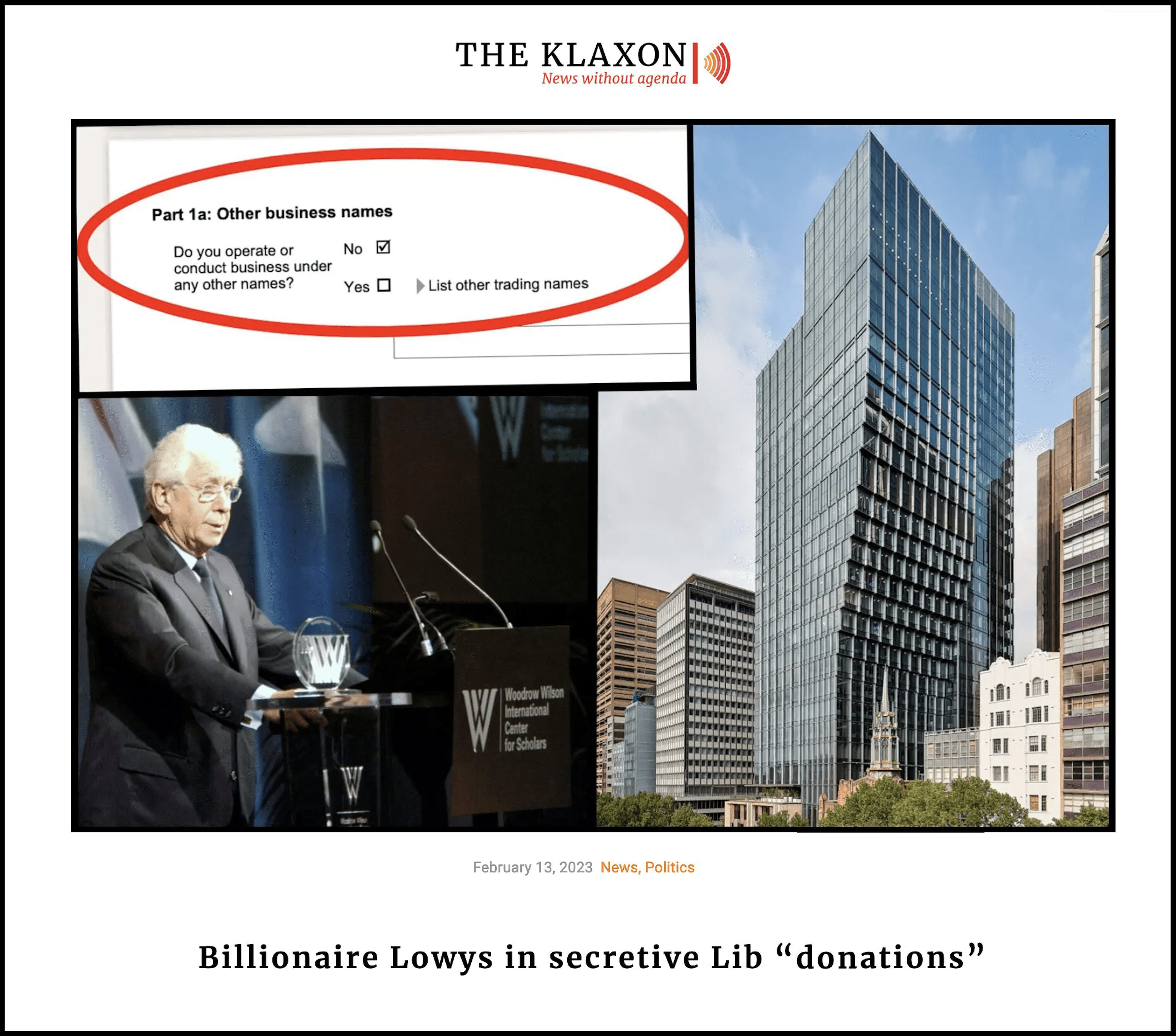

As revealed by The Klaxon last month, shopping centre tycoons the Lowy family made $550,000 in “donations” to the Liberal Party, just weeks out from last year’s federal election, through a company with no website, no telephone number – and no employees.

The “donations” were the among the nation’s biggest, and made from one of Australia’s best known business families, yet they were made through an obscure company called Oryxium Investments Limited.

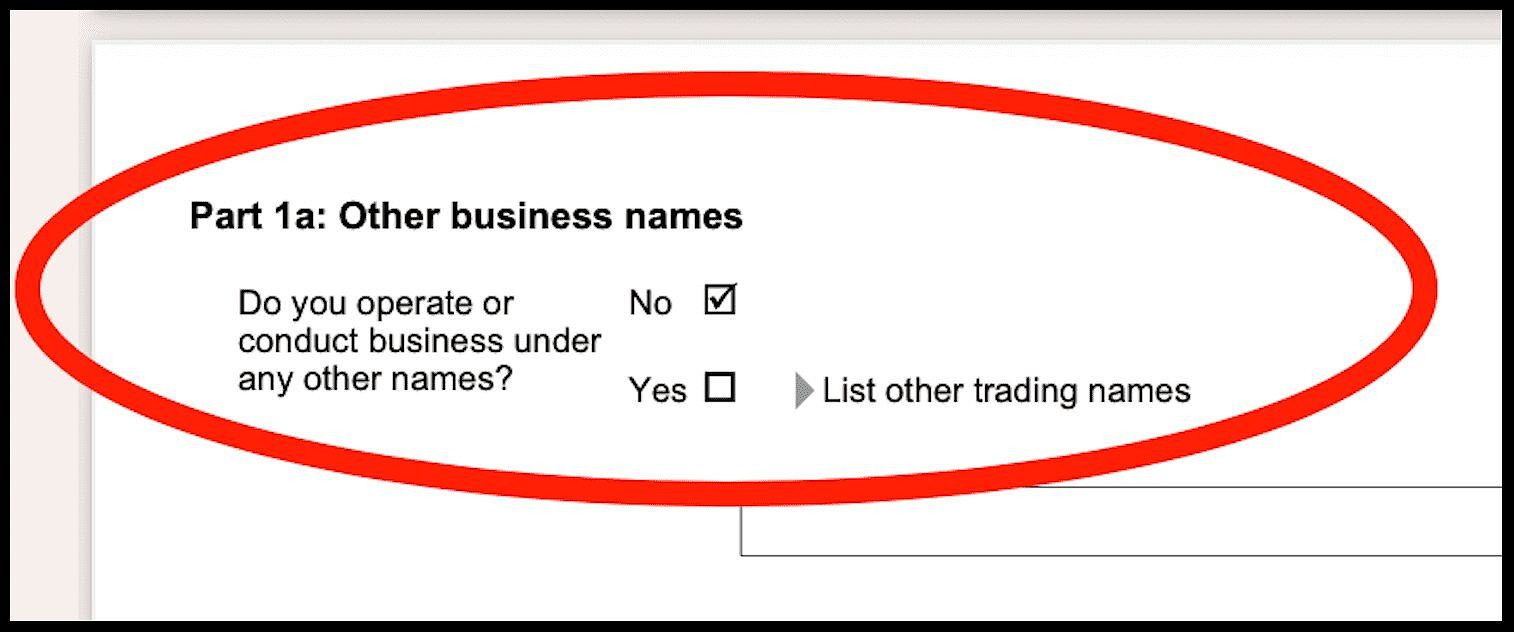

Investigations by The Klaxon show Oryxium Investments Limited is part of a complex web of at least a dozen companies forming the Lowy Family Group, or LFG: the $9.8 billion multinational business empire run by shopping centre tycoon Sir Frank Lowy and his sons David, Steven and Peter.

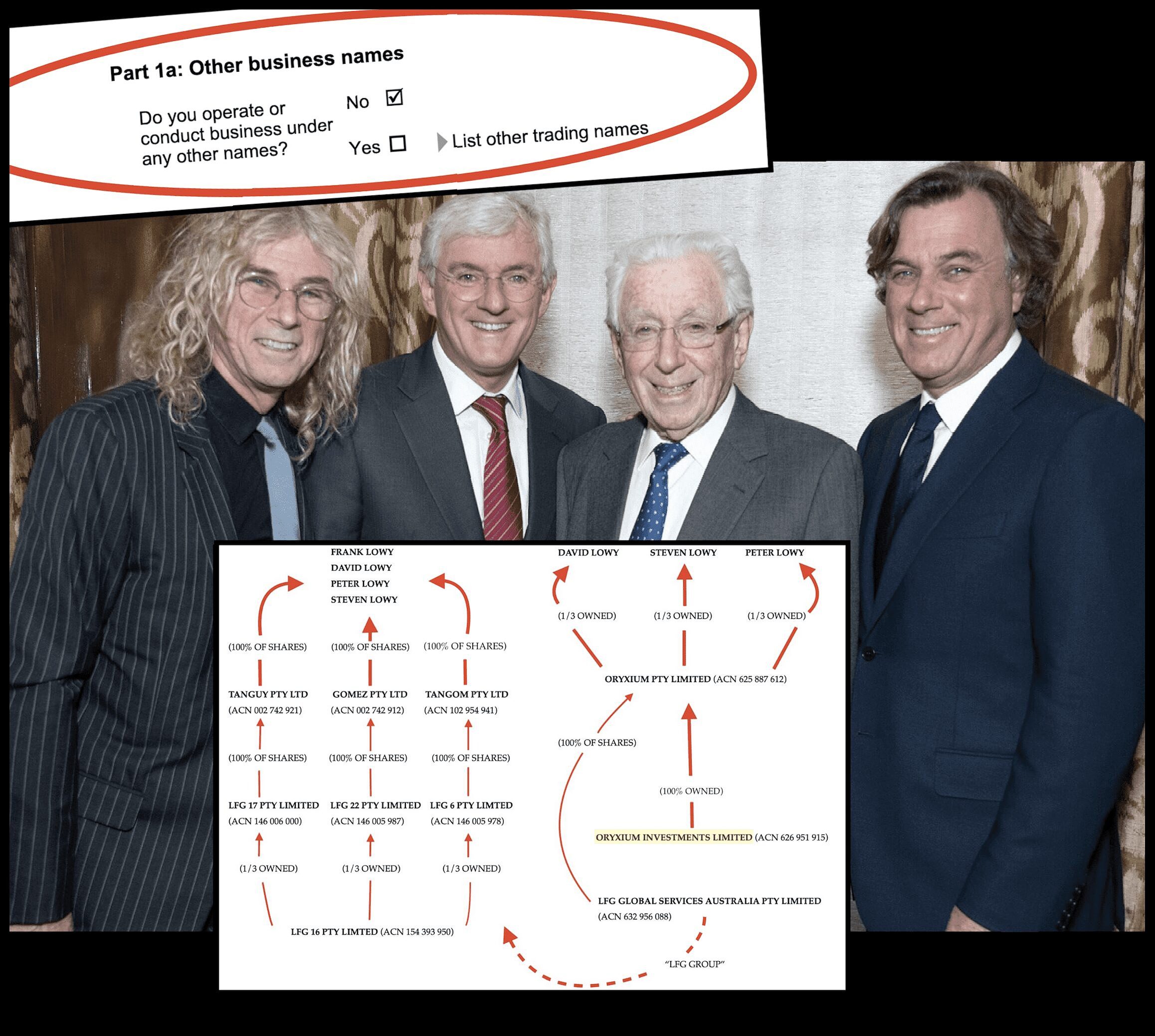

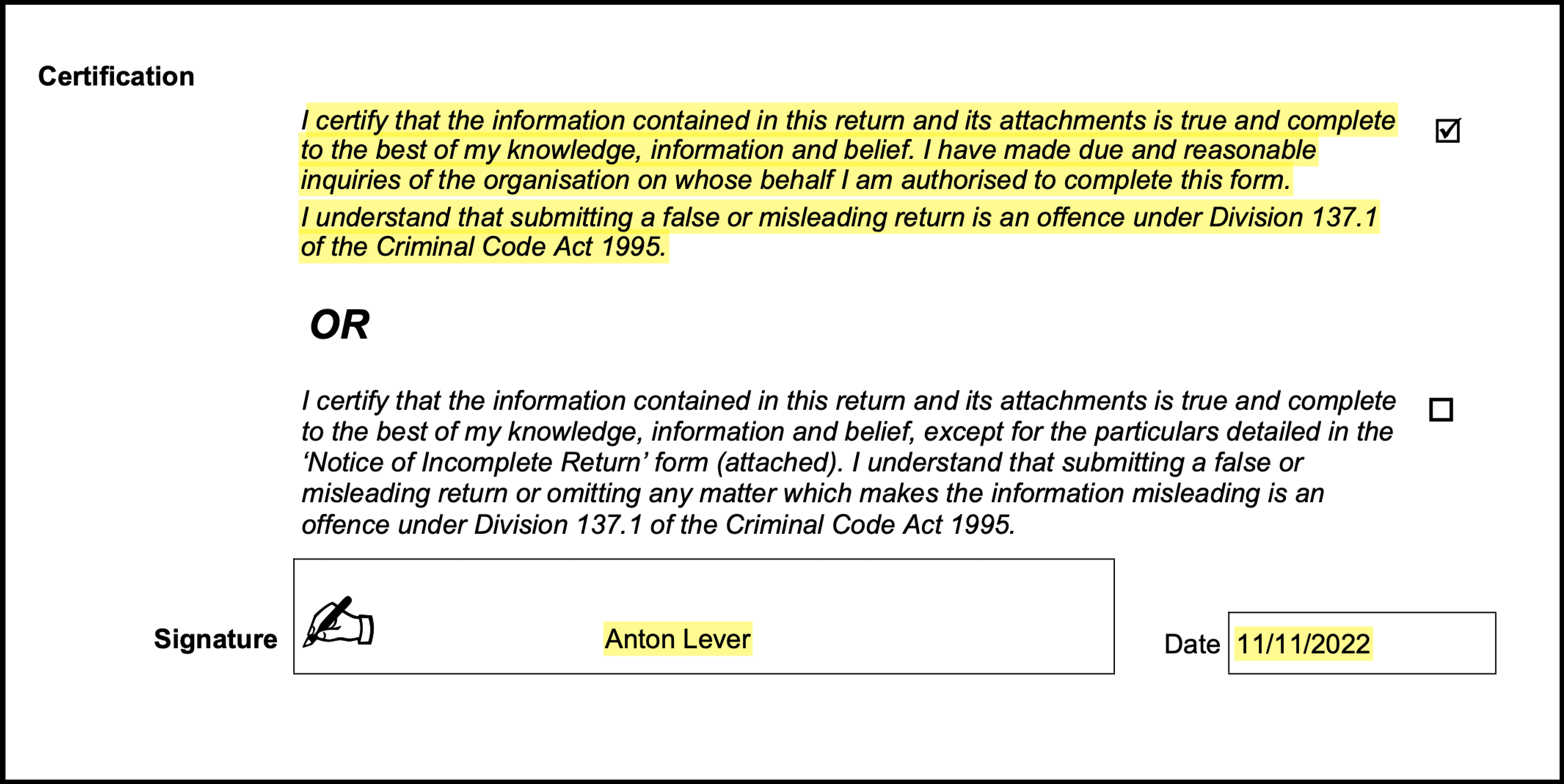

Yet on the signed, legal, “donation disclosure” form, when asked “Do you operate of conduct business under any other names?” the answer “No” is given.

Disclosure form filed for “Oryxium Investments Limited”. Source: AEC

Donation disclosure forms state: “submitting a false or misleading return is an offence”.

Yet the AEC, after multiple approaches from The Klaxon, has waived through the “disclosure”.

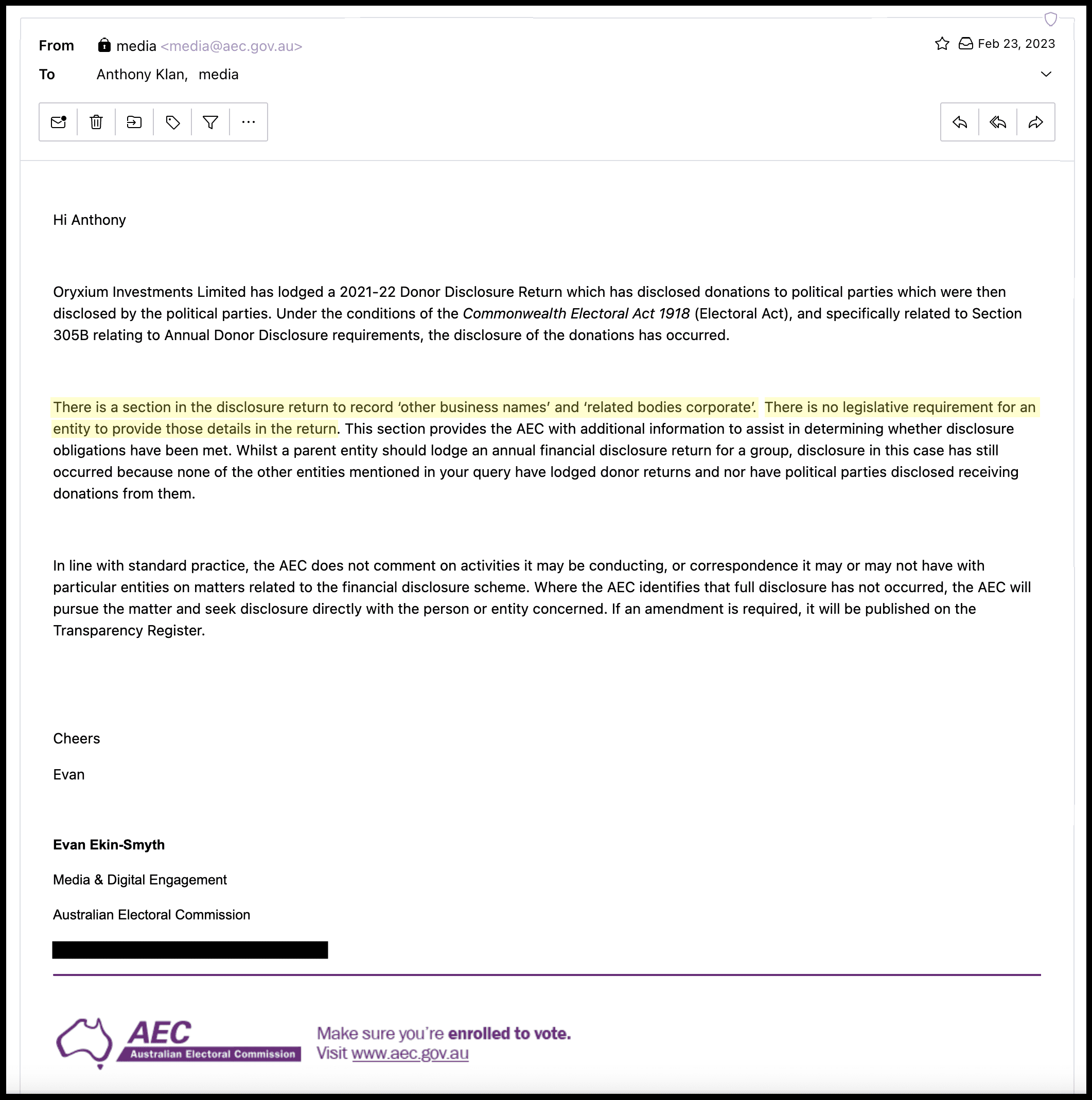

It has told The Klaxon “disclosure in this case has still occurred” because there is no “legislative requirement” to disclose whether a company conducts business under any other names — despite it being a stated requirement on the AEC’s donor disclosure forms.

It is also despite the AEC’s own official rules saying this information “must be disclosed”.

Frank, David, Steven and Peter Lowy have all repeatedly refused to comment.

Enjoying this article? Click here to support our important work

Part of the structure of the Lowy Family Group (LFG) web of companies. Oryxium Investments Limited in yellow. Source: ASIC/The Klaxon

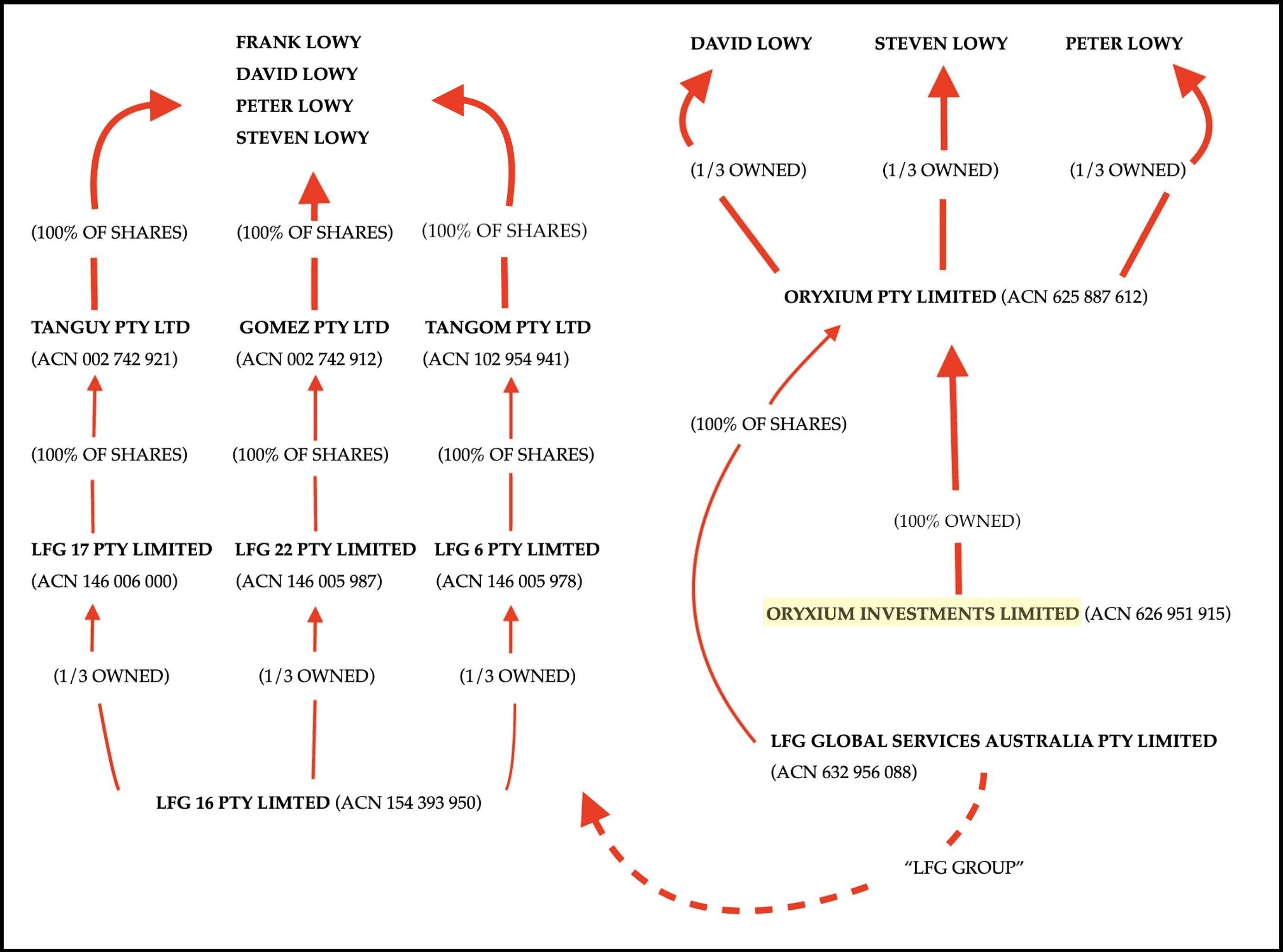

The AEC’s 25-page Financial Disclosure Guide for Annual Donors states donors must disclose “any other names under which it conducts business”.

“For an organisation”, the material states, “the following information must be disclosed in the return: other business names”.

It continues: “Part 1(a): An organisation should list any other names under which it conducts business”.

“Other business names…must be disclosed in the return” – AEC Annual Disclosure Guide

When asked whether this was improper for a company to fail to comply with this official stated requirement – even if not technically “illegal” because of this little-known loophole – the AEC refused to comment.

“There is a section in the disclosure return to record ‘other business names’ and ‘related bodies corporate’,” said AEC spokesman Evan Ekin-Smyth.

“There is no legislative requirement for an entity to provide those details in the return.

“So disclosure in this case has still occurred,” he said.

“There is no legislative requirement…so disclosure in this case has still occurred” — AEC spokesman

Other business names “must be disclosed” — the AEC Financial Disclosure Guide 2021-22. Source: AEC

Geoffrey Watson SC, director of the Centre for Public Integrity and a former NSW Court of Appeal Judge, told The Klaxon $550,000 was “huge money”.

“That is far too much money for one donor to be able to give to a campaign,” he said.

“It’s the type of money that could influence politicians and political parties”.

“It’s the type of money that could influence politicians and political parties” – Geoffrey Watson SC

“It’s very important the legislation provides to prevent against a related entity giving money under different names,” Watson said.

“No legislative requirement”, AEC sides with Lowy family.

AEC Failing, Officially

The AEC has been heavily criticised for failing to do its job and enforce the law.

In September 2020, the nation’s top auditor, the Australian National Audit Office (ANAO), found “the AEC does not appropriately act upon identified non-compliance” and “it is not making effective use of its enforcement powers”.

“The AEC does not appropriately act….it is not making effective use of its enforcement powers” — ANAO

In its 84-page final report, the ANAO said:

“The purpose of the financial disclosure scheme is preserve the integrity of the electoral system, maintain public confidence in the electoral process, and reduce the potential for undue influence and corruption”.

Yet the report, overseen by Australia’s Auditor-General, Grant Hehir, found the AEC’s “management of the disclosure scheme” was only “partially effective” and that the AEC “is not well placed to provide assurance that disclosure returns are accurate and complete”.

“The AEC is not well placed to provide assurance that disclosure returns are accurate and complete” — ANAO

How The Klaxon broke the story. Source: The Klaxon

The ANAO investigated disclosure forms over four financial years, “spanning two federal elections and eleven by-elections”, from 2015 t0 2020.

It found “not all required returns have been obtained”; there was “limited analysis of the returns that are obtained”; and there was “evidence that some returns are incomplete”.

The ANAO found that over one-fifth of annual returns were “lodged after the legislated due date”.

“There is insufficient evidence that annual and election returns are accurate and complete” — ANAO

It found the AEC had obtained 5882 “annual and election returns” over the five years to 2020 – and completed just 110 reviews.

Of those 110 reviewed, a massive 78 per cent “required amendment”.

“Yet, rather than increasing its scrutiny…the AEC significantly reduced the number of planned reviews, narrowed the scope of planned reviews, and reduced the value of of the transactions being tested,” the ANAO said.

“There is insufficient evidence that annual and election returns are accurate and complete,” the report found.

The AEC is the body tasked with policing the “foreign donor” laws introduced in 2019 in a bid to curb foreign interference.

“The AEC is the body tasked with policing foreign donor laws”

AEC Commissioner Tom Rogers. Source: AEC

The AEC is overseen by Electoral Commissioner Tom Rogers, who was appointed in 2014 by the Abbott Federal Government.

In December 2019 he was appointed to another five-year term by the Morrison Government.

Remarkably, in response to the ANAO’s findings, the AEC not only said it would not take key actions stated by the ANAO — it refused to admit there was a problem.

“The proposition that the AEC should be more heavy-handed is rejected” — Tom Rogers’ AEC

Rogers has repeatedly refused to respond to questions when contacted by The Klaxon over the past month.

Last financial year he received a taxpayer salary of $598,624.

The signed Oryxium Investments disclosure. Source: AEC

Donation disclosure forms state “submitting a false or misleading return” is “an offence under Division 137.1 of the Criminal Code Act”.

The Criminal Code Act 1995 states the penalty for breaching Division 137.1 is “Imprisonment for 12 months”.

The Klaxon asked whether any action would be taken over Oryxium Investments Limited having falsely declared it did not conduct business under any other names.

Rogers and the AEC refused to comment.

Do you know more? anthonyklan@protonmail.com

WE HAVE A SMALL FAVOUR TO ASK: We are entirely funded by you – our readers. Investigations like these take an enormous amount of time and resources. Please SUBSCRIBE to help keep us afloat and delivering stories that you won’t see anywhere else. If you prefer to make a one-off contribution you can do so by CLICKING HERE. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.