Appreciate our quality journalism? Please donate here

EXCLUSIVE

Westpac avoided being called to front the banking Royal Commission’s hearings on superannuation — unlike the other big four banks, AMP and nine other major funds — after falsely presenting itself as a “white knight” to government officials behind-the-scenes.

At that time the executive running corporate affairs for Westpac’s superannuation arm, BT, was Martin Codina, who is Treasurer Josh Frydenberg’s Chief-of-Staff.

As reported this week, Codina has had a revolving door between running Frydenberg’s office and working as a senior executive at Westpac-BT, repeatedly switching between the roles.

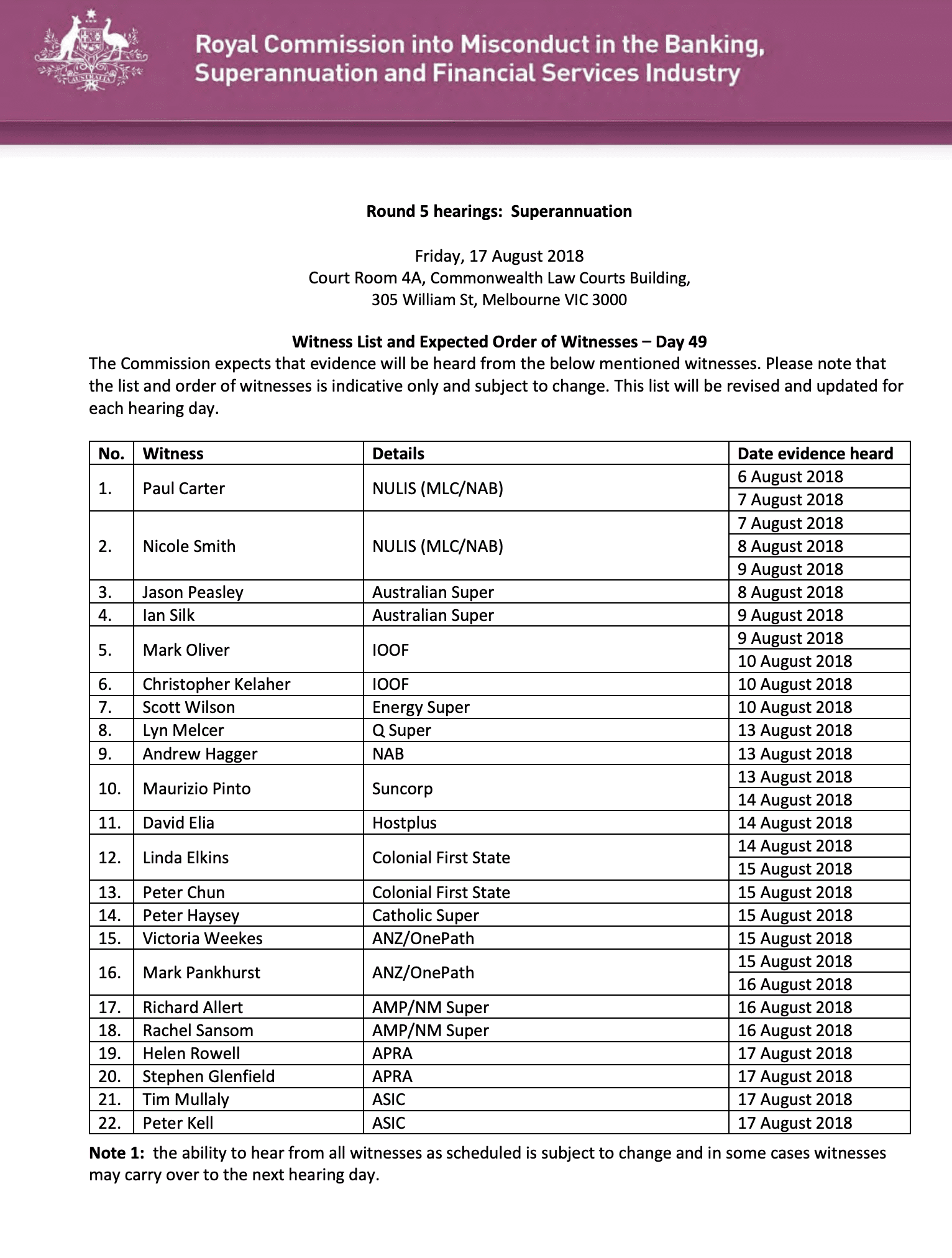

Westpac-BT was not called to give evidence to the banking Royal Commission’s August 2018 public hearings into superannuation.

The Klaxon can reveal that was after Westpac-BT had positioned itself as an informant to the then ongoing, three-year, Productivity Commission review into superannuation.

The Productivity Commission had a high degree of input regarding which entities were called to give evidence to the Royal Commission’s superannuation hearings, given it was then over two years into its three-stage review into the entire superannuation sector.

“It’s lucky, we’ve got a white knight,” one senior Productivity Commission official told this reporter in July 2018.

The official said that unlike most other “retail”, or bank-run, superannuation funds, Westpac and its super arm BT had, behind-the-scenes, been highly cooperative, ostensibly acting as an informant on wrongdoing in the sector.

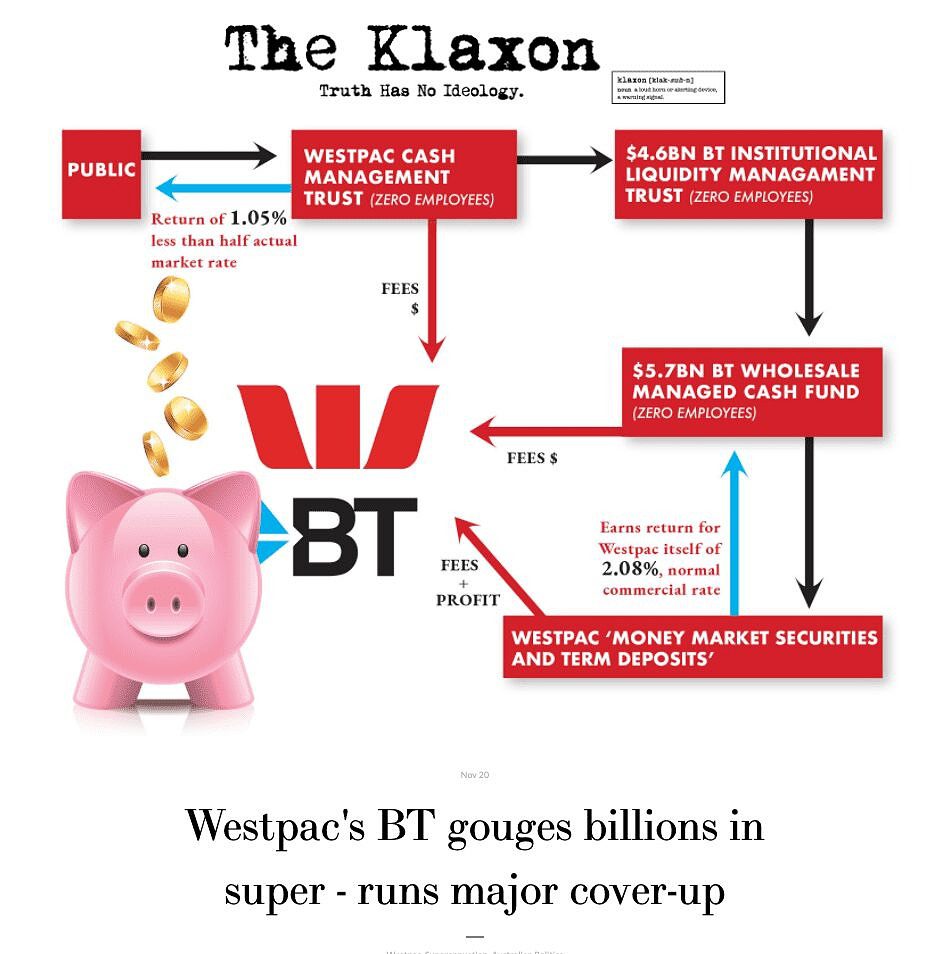

In fact, Westpac-BT was — and still is — one of the most egregious gougers of Australia’s compulsory superannuation system, currently siphoning around $1.5 billion a year from the nest eggs of almost one million workers and savers.

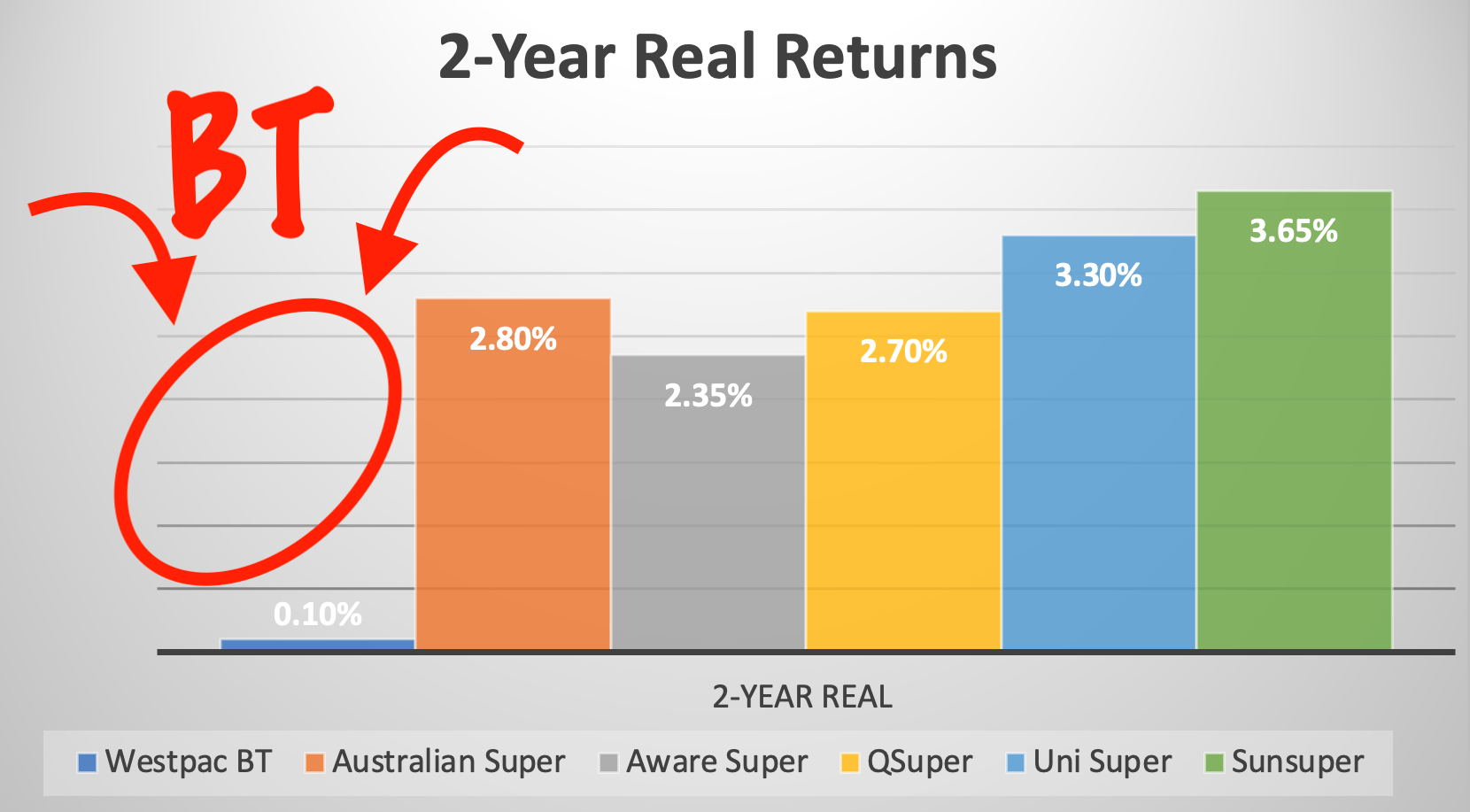

Between mid-2018 and mid-2020 over 900,000 super savers in Westpac-BT’s “Retirement Wrap” umbrella fund have earned returns of just 1/30th of actual market rates.

Westpac-BT returns almost non-existent (1/30th of market rates) between 2018-20. Story June 28. The Klaxon

Between July 1 2018 and now, over $5 billion has been gouged by Westpac-BT.

That process has included Westpac-BT operating a complex web of obscure paper companies, many of which generate huge fees despite performing no real service and having no employees.

Both Codina and Frydenberg have declined to respond to written questions from The Klaxon.

Westpac-BT has also refused to comment, failing to respond to requests for comment over several months.

Westpac is a major financial “donor” to the Federal Liberal Party.

Westpac-BT completely absent: The witness list for Royal Commission’s superannuation hearings. Source: Federal Government

Royal Commission

The banking Royal Commission was conducted over 2018 and had seven rounds of public hearings.

The fifth round, regarding superannuation, was conducted over two weeks, from August 6 to August 17 (witness list above).

Martin Codina. Source: Supplied

“Retail” super funds are those that are run by the major banks and commercial financial institutions, and which take members funds as profits for themselves.

“Industry” funds are those super funds that are overseen by employer and union representatives, and which do not take members funds as profits for themselves.

Despite the overwhelming majority of wrongdoing and gouging in the super sector being committed by the retail funds, the Royal Commission, under instructions from the Federal Coalition, called a string of industry funds, along with retail funds, to give evidence.

Six major retail funds were called to appear: NAB’s MLC; ANZ’s One Path; CBA’s Colonial First State; AMP; IOOF and Suncorp.

Five major industry funds were called to appear: Australian Super; Q Super; Hostplus; Energy Super and Catholic Super.

As was widely expected by industry insiders, the overwhelming majority of the wrongdoing uncovered was wrongdoing conducted by the retail funds.

The industry funds were overwhelmingly found to have engaged in no wrongdoing.

(The performance of Australian Super and QSuper, along with the three other biggest industry funds is shown below for mid-2018 to mid-2020. Also shown is the performance of Westpac-BT’s “Retirement Wrap” major umbrella fund.)

Missing: $3.29 billon gone in just the two years to mid-2020 as Westpac-BT super returns almost non-existent. From mid-2018 to now that figure is $5 billion. Source: APRA, RBA. Graphic: The Klaxon.

Codina

As reported this week, Martin Codina was BT’s Head of Government Affairs until he was appointed Frydenberg’s Chief-of-Staff in January 2014.

In August 2017 Codina returned to Westpac, as BT Head of Corporate Affairs.

Just over a year later, in September 2018 (the month after the Royal Commission’s superannuation hearings), Codina left Westpac-BT and, immediately afterwards, again became Frydenberg’s Chief-of-Staff.

The Revolving Door:

Sep 2018 – Present: Frydenberg Chief-of-Staff

Aug 2017 – Sep 2018: BT Head of Corporate Affairs

Jan 2015 – Aug 2017 : Frydenberg Chief-of-Staff

Jan 2014 – Jan 2015: BT Head of Government Affairs

Oct 2009 – Dec 2013: FSC Policy Director

In June and July 2018, before the Royal Commission’s August superannuation hearings, Westpac-BT ran an aggressive (and successful) campaign to prevent The Australian newspaper, and this reporter, from publishing a major expose.

The expose revealed, in high-detail, Westpac-BT’s systemic gouging of the nation’s superannuation and that over $8 billion had been gouged.

Codina was BT’s Head of Corporate Affairs at the time.

Also at the time, Westpac-BT was providing large amounts of money to The Australian newspaper, including through advertising, “sponsored content” and co-hosted corporate events.

It is extremely unlikely Westpac-BT would have avoided the Royal Commission’s superannuation hearings had the information about its super gouging been published.

The expose was ultimately published by The Klaxon on November 20 last year.

The Klaxon’s November 20 expose.

As revealed last week, despite being formally alerted to the scandal on November 23 last year, corporate regulator the Australian Securities and Investments Commission (ASIC) has taken no action to stop the Westpac-BT gouging.

That’s despite it being against the law for superannuation trustees to fail to act in the “best interests” of members.

On July 2 this year, after repeated approaches over many months, ASIC spokeswoman Angela Friend said the matter had been “referred to our Misconduct and Breach Reporting Team for review”.

ASIC has repeatedly refused to provide any further information.

The Westpac-BT gouging is currently costing members $4.5 million a day.

ASIC was heavily admonished by the banking Royal Commission, including for failing to protect the public and failing to take appropriate action against wrongdoing.

In particular, it was criticised for entering into “enforceable undertakings” with companies and people doing the wrong thing — essentially promises not to break the law again — rather than taking any significant action under the Corporations Act.

In response, ASIC said it had implemented a “why not litigate?” approach to enforcement.

In August 2019, ASIC said it had “established an Office of Enforcement within ASIC”, that it was “accelerating enforcement outcomes” and that it now had “strengthened penalties available to us”.

Yet this week Treasurer Frydenberg took action that is seen as directly reversing that new approach.

Frydenberg issued ASIC a “statement of expectations” that “is to be read alongside the laws that apply to ASIC”.

The first directive is for ASIC “to identify and pursue opportunities to contribute to the Government’s economic goals, including supporting Australia’s economic recovery from the COVID pandemic”.

Writing in The Conversation yesterday, international corporate governance expert Dr Andrew Schmulow, said Frydenberg’s directions to ASIC had “thrown the banking royal commission under a bus”.

“Treasurer Josh Frydenberg appears to have thrown the most important findings of the banking royal commission under a bus, in glorious double-speak,” Schmulow writes.

“Hayne said the first question ASIC should ask whenever misconduct was identified was ‘why not litigate?’.

“Frydenberg’s new statement of expectations turns that on its head.

“Rather than ‘why not litigate,’ it reads as ‘why not capitulate’,” he writes.

Schmulow writes:

“Indeed, as reported in The Klaxon in November, the almost one million customers in Westpac-BT’s “retirement wrap” umbrella fund had been gouged as much as $8 billion over the past decade, thanks to exorbitant fees.

“Between mid-2018 and mid-2020 returns to members were close to zero (0.1%).

According to Australian Prudential Regulation Authority data, had the performance of the Westpac funds been merely average, its customers would have been $5 billion better off.

The matter was reported to ASIC on November 23 last year. All ASIC has done since is ‘review’ the situation. In that time fund members might have lost a further $1.5 billion relative to the industry average.”

ASIC is the regulator with primary responsibility for policing wrongdoing in the superannuation sector.

As revealed by The Klaxon last month, Westpac has been aggressively recruiting prosecutors, lawyers and investigators from ASIC.

Westpac-BT now has at least ten former senior ASIC figures in its ranks.

From ASIC to Westpac. Clock-wise from top left: Cameron Walter, Amber Rowland, Lidia Agioski, Felicity Minzlaff, Sean Polivnick, Kate Fowler, Anita Cuatolo and Irfan Malik. Source: LinkedIn

They include ASIC’s long-time chief prosecutor, Cameron Walter, who joined Westpac in December; the former chief-of-staff to ASIC chairman Greg Medcraft; a former senior ASIC forensic financial investigator; and a string of other former key ASIC litigators and enforcers.

(The Westpac positions of “Group Head of Regulatory Relationships”, “Executive Manager, Regulatory Relations“, “Manager, Financial Markets Operational and Compliance Risk”, “Senior Manager, Consumer Incidents Compliance”, “Head of Strategy and Customer Experience” and “Senior Manager, Anti-Money Laundering Intelligence”, are now all held by former senior ASIC employees.)

The person at ASIC responsible for super is Jane Eccleston, whose title is Senior Executive Leader, Superannuation.

Eccleston is a former Westpac in-house lawyer, having been Westpac General Counsel between 1993 and 1996.

On October 7 last year, Eccleston released a statement on behalf of ASIC: “Support and protections for whistleblowers”.

“Jane Eccleston…reminds trustees of their obligations to support and protect whistleblowers and implement a whistleblower policy,” the document said.

Banking Royal Commission website, set to be decommissioned. Source: Federal Government

We reported the Westpac-BT gouging to ASIC six weeks later, on November 23.

ASIC has taken no action to stop that gouging.

Eccleston has repeatedly declined to comment when contacted by The Klaxon.

Separately, it has emerged that the website of the Royal Commission into Financial Services will be decommissioned and will only be available in the archives of the National Library of Australia.

The website had been “selected for preservation by the National Library of Australia,” the archives state.