Appreciate our quality journalism? Please donate here

EXCLUSIVE

Westpac, one of the nation’s most corrupt major companies, has been aggressively recruiting prosecutors, lawyers and investigators from among the corporate regulator’s top brass, raising concerns the practice could further strangle its effectiveness.

Westpac now has at least ten former senior Australian Securities and Investment Commission (ASIC) figures in its ranks, including ASIC’s former chief prosecutor, the former chief-of-staff to ASIC chairman Greg Medcraft, a former senior ASIC forensic financial investigator and a string of other former key ASIC litigators and enforcers.

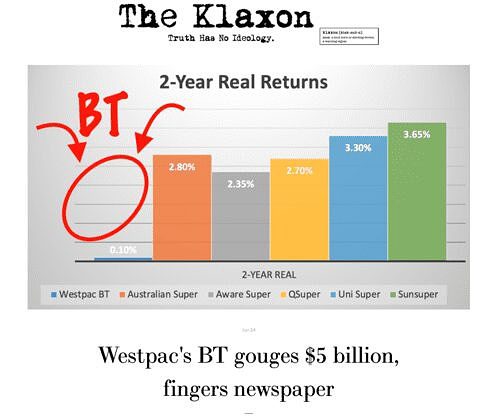

Former ASIC senior staffers now at Westpac include: Anita Curatolo, who immediately prior to joining the bank spent nine years at ASIC as Senior Lawyer, Enforcement; David Quinn, who was formerly both a senior ASIC investigator and a Commonwealth Department of Public Prosecutions lawyer; and Lidia Agioski, formerly a Regulatory Enforcement Officer within ASIC’s Market Integrity Enforcement and now Financial Markets Operational and Compliance Risk Manager at Westpac.

The Westpac positions of “Group Head of Regulatory Relationships”, “Executive Manager, Regulatory Relations“, “Manager, Financial Markets Operational and Compliance Risk”, “Senior Manager, Consumer Incidents Compliance”, “Head of Strategy and Customer Experience” and “Senior Manager, Anti-Money Laundering Intelligence”, are now all held by former senior ASIC employees.

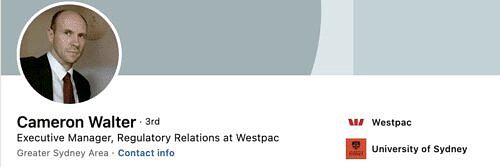

From ASIC to Westpac. Clock-wise from top left: Cameron Walter, Amber Rowland, Lidia Agioski, Felicity Minzlaff, Sean Polivnick, Kate Fowler, Anita Cuatolo and Irfan Malik. Source: LinkedIn

ASIC’s long-time chief prosecutor, Cameron Walter, joined Westpac in December as “Executive Manager, Regulatory Relations”.

In June last year, Westpac appointed from ASIC Irfan Malik, financial investigator with ASIC’s “Forensic Accounting Team”.

Malik is now “Senior Manager, Anti-Money Laundering Intelligence” at Westpac.

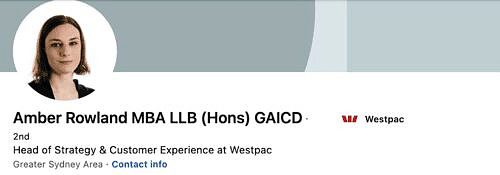

Also now at Westpac is Amber Rowland, who previously spent four years at ASIC, first as a senior lawyer, then as chief-of-staff to the then ASIC chairman Greg Medcraft.

Rowland’s role as chief-of-staff included providing “targeted advice to the chairman”, providing “input into the development of strategy” preparing “high-level briefings and speeches” and delivering “strategy across the organisation”, according to her LinkedIn social media bio.

The former ASIC executive, who started at Westpac immediately after leaving the corporate regulator, is currently head of “strategy and customer experience” at Westpac.

It appears Westpac is seeking to bolster its regulatory arsenal even further.

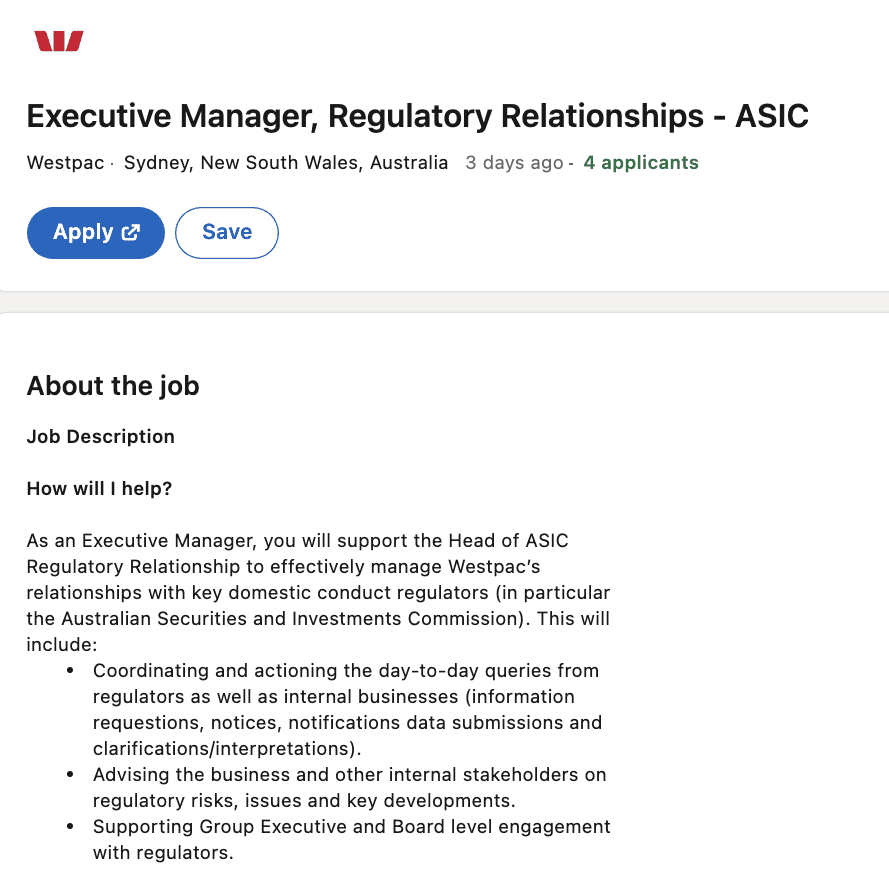

On Sunday the bank began advertising a position titled: “Executive Manager, Regulatory Relationships – ASIC”.

“As an Executive Manager, you will support the Head of ASIC Regulatory Relationship to effectively manage Westpac’s relationships with key domestic conduct regulators (in particular the Australian Securities and Investments Commission),” the advertisement says.

It is entirely legal for former ASIC employees, or employees of any other government regulators or agencies, to work for the private sector.

But the scale of Westpac’s poaching of key ASIC figures is raising eyebrows.

Not least because Westpac is one of the nation ’s most corrupt major corporates, having been subject to more regulatory action than almost any other company over the past five years.

In October it was fined $1.3 billion – the biggest civil penalty in Australian history – for breaking anti-money laundering laws thousands of times and facilitating child rape.

The Klaxon’s November 20 expose.

It is currently facing major action for insider trading and has been forced to pay hundreds of millions to customers for a range of illegal activities, including overcharging on credit cards and charging customers for financial advice that was never delivered.

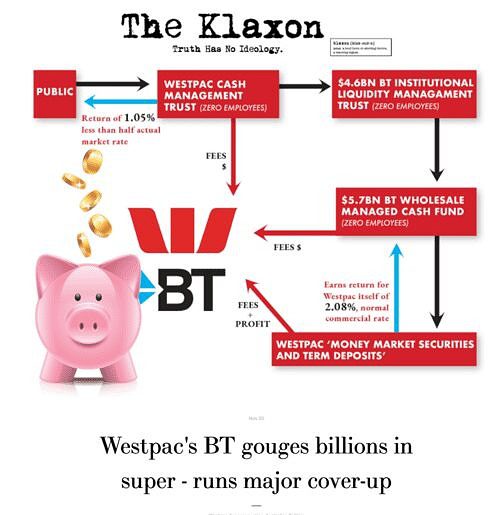

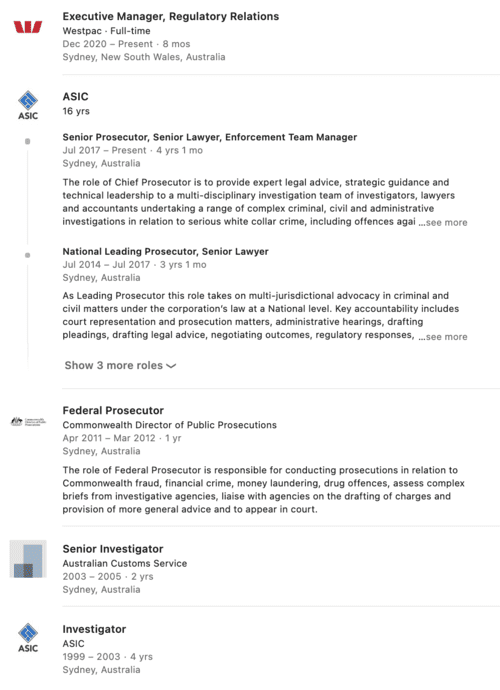

The swelling of Westpac’s ranks with former senior ASIC figures comes as ASIC is under mounting pressure to take substantive action against Westpac and its fully-owned subsidiary BT, over the ongoing gouging of almost 1 million Westpac-BT superannuation accounts.

As revealed by The Klaxon, Westpac and BT gouged over $8 billion from superannuation customers over the decade to 2018.

The Klaxon formally alerted ASIC to the scandal in November last year, however it appears the regulator has taken little to no action.

That’s despite the fact that the Westpac-BT gouging is ongoing, and collectively costing Westpac-BT superannuation members millions of dollars every day.

Jane Eccleston. The Klaxon’s June 28 story. Source: The Klaxon

As revealed by The Klaxon, between 2018 and 2020, the 900,000-plus members of the Westpac-BT Retirement Wrap earned returns of just 1/30th of actual market rates.

As previously reported, the person at ASIC responsible for taking action is Jane Eccleston, who was formerly in-house lawyer at Westpac.

ASIC declined to comment when asked whether it has taken any action to mitigate that possible conflict of interest.

Eccleston is currently ASIC’s “Senior Executive Leader, Superannuation”, in charge of the “Investment Managers and Superannuation team”, which is “responsible for ASIC’s oversight of superannuation, managed funds and custodians,” her bio states.

She was “Corporate Counsel” at Westpac from December 1993 to October 1996.

Despite a substantial amount of time having passed, governance experts said the circumstances around the Westpac-BT super gouging meant that it was incumbent on ASIC to be even more transparent and vigilant that would ordinarily be required.

That was to ensure there was no conflict of interest, either “real or perceived”.

More former senior ASIC employees now at Westpac. Clockwise from left: Rachele Troup, Alison Haines, and David Quinn. Source: LinkedIn

Turnstiles

Searches of social media site LinkedIn reveal that Westpac has been heavily active in recruiting top ASIC enforcement figures.

Westpac declined to comment when approached by The Klaxon.

December’s appointment of ASIC chief prosecutor Cameron Walter, to become senior Westpac executive manager in charge of “regulatory relations”, was particularly noteworthy, according to observers.

According to his bio, Walter had been with ASIC a total of 16 years before taking up the Westpac position, including as ASIC’s national leading prosecutor, senior prosecutor, senior lawyer and enforcement team manager.

Walter had also been “Federal Prosecutor” with the Commonwealth Director of Public Prosecutions in 2011 and 2012, according to his bio.

There he had been responsible for conducting prosecutions in a range of areas, including “Commonwealth fraud, financial crime (and) money laundering”.

Westpac “Group Head of Regulatory Relationships” is Felicity Minzlaff, who joined Westpac in July 2016.

Minzlaff joined Westpac straight from ASIC where she had been a “senior lawyer”, in “corporations and corporate governance enforcement”.

Earlier, Minzlaff had been responsible for “regulatory investigations” at ASIC, where she held the role “Lawyer, Enforcement (Market Integrity and Corporations and Corporate Governance)”, according to her bio.

It is Minzlaff to whom the successful applicant in Westpac’s advertisement for “Executive Manager, Regulatory Relationships – ASIC”, will report.

Westpac senior manager David Quinn, who specialises in “financial crime, compliance and conduct” at the bank previously worked as a lawyer and investigator at ASIC for six years.

(Quinn also spent over five years with the Commonwealth Director of Public Prosecutions and worked as a lawyer with the Australian Federal Police, according to his bio).

Westpac-BT returns almost non-existent (1/30th of market rates) between 2018-20. Story June 28. The Klaxon

Anita Cuatolo, formerly “Senior Lawyer, Enforcement” at ASIC, moved across to Westpac in June 2015.

Cuatolo, who according to her bio, is “highly experienced in regulatory investigations/matters and litigation”, and at ASIC “provided legal advice to, and conduct(ed) litigation on behalf of, ASIC in relation to breaches of the Corporations Act”.

She joined Westpac as “Lawyer, Regulatory Investigations and Litigation” and is now “legal stream lead – AUSTRAC matters.”

It was AUSTRAC, the nation’s “financial intelligence unit” that took action against Westpac under anti-money-laundering laws, leading to its record $1.3 billion fine.

Also at Westpac is lawyer Alison Haines.

Haines has been “Senior Manager, Consumer Incidents Compliance” at Westpac since February last year, and before that was Westpac’s “Executive Manager, Whistleblower Governance”.

According to her bio, Haynes had been a lawyer at ASIC from 2000 to 2003, where she had been a “decision-maker under the Corporations Act for general applications for relief from compliance with the Corporations Act”.

Westpac also appears to have been bringing in former ASIC muscle on a temporary basis.

Lawyer Rachele Troup, an “Associate in Disputes and Investigations” at law firm Allens has, according to her bio, been working as a “secondee” at Westpac since April last year.

On Tuesday Troup’s Westpac position was stated as “Lawyer, Group Legal Financial Crime (secondee), full-time”.

Troup, an “experienced lawyer with a demonstrated history of working in financial services regulation”, had been a lawyer at ASIC in its financial services enforcement team from February 2015 to September 2018, according to her bio.

Sean Polivnick, “Senior Manager, BT Financial Group” is senior manager responsible for “entity reporting and governance risk” at Westpac’s BT. According to his bio, Polivnick joined Westpac as “risk and compliance manager” in January 2016.

Between 2007 and 2014 Polivnick had been “financial services lawyer in ASIC’s Investment Managers and Superannuation Team”, according to his bio.

Also at Westpac is Kate Fowler, who has been with the bank since January as “Head of Business Assist”.

Between August last year and January Fowler had been working full-time at ASIC, where she worked on “secondment” from the Australian Taxation Office, her bio states.

We asked ASIC whether it had any concerns about so many of its senior workers being snapped-up by Westpac.

The regulator declined to comment.

More to come.