Appreciate our quality journalism? Please donate here

A major superannuation lobby group says the nation’s super savers earned “record returns” this financial year – but is refusing to say how things went for Westpac-BT’s 900,000-plus members, who are losing over $1.5 billion a year to systemic gouging.

The Association of Superannuation Funds of Australia (ASFA) this afternoon released a statement claiming the nation’s super funds had delivered “exceptional benefits to members”, who earned “average annual returns of nearly 20 per cent”.

ASFA CEO Martin Fahy. Source: ASFA.

“We would normally expect super funds to report annual returns in the order of 6, 7 or 8 per cent,” ASFA CEO Dr Martin Fahy is quoted as saying.

“Clearly this is a remarkable result – the system’s strongest performance in the nearly thirty years since compulsory superannuation began.”

Yet ASFA, which describes itself as the nation’s “peak research body” for super has refused to provide any data whatsoever to back up that claim.

The “voice of super”, as ASFA calls itself, has also expressly refused to provide any information regarding the returns received by the 915,000-odd members in Westpac-BT’s “Retirement Wrap” umbrella fund.

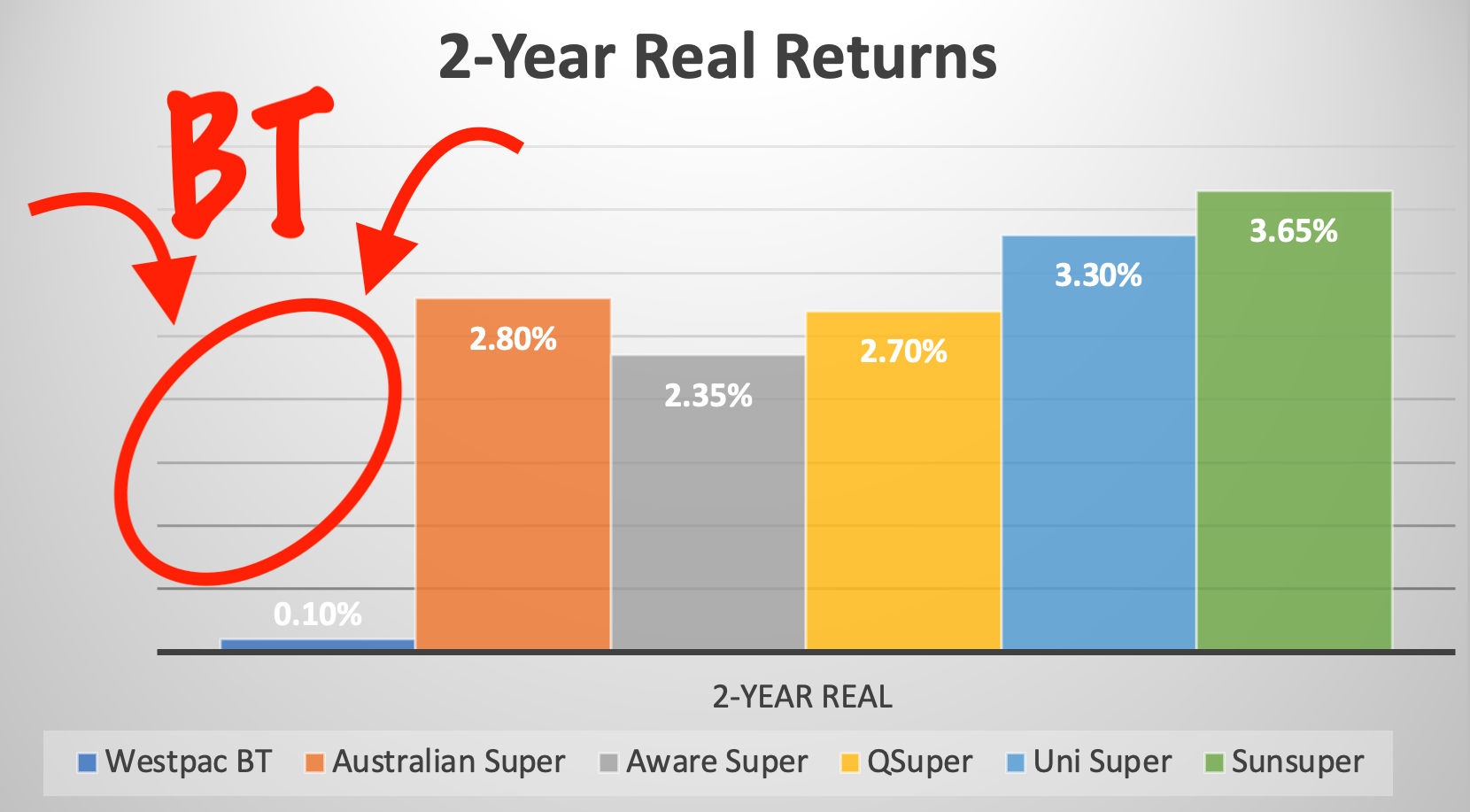

Those members, as The Klaxon revealed last week, had $3.29 billion gouged from their life savings over just the 2018-19 and 2019-20 financial years. Including this financial year the figure is about $5 billion.

Missing: $3.29 billon gone in just two years as Westpac-BT super returns almost non-existent. Source: APRA, RBA. Graphic: The Klaxon.

While stock markets have seen a major rebound since they crashed with the emergence of Covid-19 in February last year, millions of Australians will have earned nothing like returns of 20 per cent on their superannuation.

That’s because of systemic gouging of super by so-called “retail” funds, such as Westpac-BT, which are run by major banks and financial institutions.

The Klaxon revealed the systemic gouging by Westpac-BT in November last year and formally reported the practice to corporate regulator the Australian Securities and Investments Commission (ASIC).

However, as revealed yesterday, ASIC has taken no action and almost $1 billion more has been gouged from Westpac-BT members in the seven months since.

Jane Eccleston, ASIC Senior Executive Leader, Superannuation. Source: Supplied.

It also emerged yesterday that the ASIC “senior executive leader” responsible for policing wrongdoing by super funds, Jane Eccleston, is herself a former “in-house” lawyer at Westpac.

In its statement, ASFA says that “average balanced super funds” have “delivered around 9% per year for the five year returns” and “around 8.5% for the ten year average return”.

ASFA’s claims today regarding super fund performance are particularly remarkable given the group has repeatedly refused to even acknowledge the systemic underperformance of “retail” funds.

That’s despite the three-year Productivity Commission review into the nation’s super sector finding retail funds underperformed so-called “industry” funds (such as AustralianSuper and QSuper) by almost 40%.

Over the past two years this reporter has repeatedly requested ASFA identify a single “retail” fund considered by ASFA to have performed well.

Yet ASFA and Fahy have consistently failed to do so.

In January 2019 we requested Fahy provide us with a list of the ten “retail” funds he considered had been the best performers.

ASFA general manager Katrina Horrobin responded: “We don’t agree with the premise of your question”.

“We don’t agree with the premise of your question” – Katrina Horrobin. Source: APRA.

In the year to June 2020 Fahy was paid a salary of $612,311, about 5% of ASFA’s $13 million budget.

ASFA is funded by its superannuation fund members, who are in turn “funded” by their members.

Today we asked APRA to show us where APRA came up with the figures in its statement, including the figures behind its assertion that super funds have “delivered average annual returns of nearly 20%”.

ASFA media manager Jacqui Maddock responded: “We are using a combination of data from Chant West, SuperRatings and daily unit pricing data for major super funds”.

We replied, asking for that data.

Maddock came back: “We would prefer if you went directly to the organisations in question”.

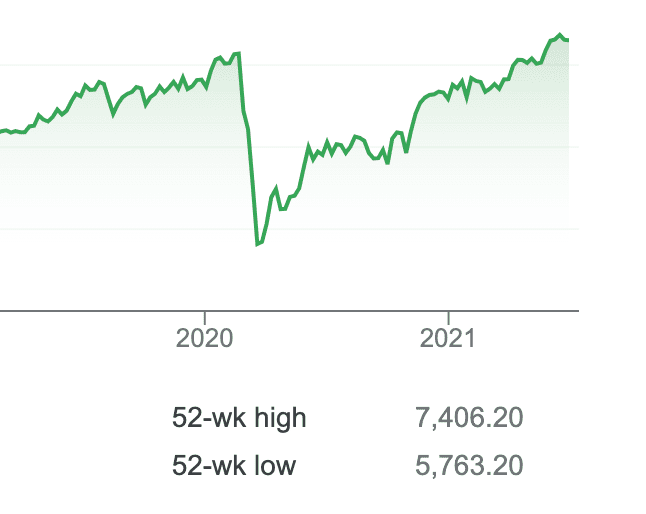

The 2020 market crash, starting February last year. Source: ASX

We explained the importance of ASFA providing data to back up its claims, and the importance of accuracy around the reporting of super fund performance.

We received no response.

ASFA describes itself as the “peak policy, research and advocacy body for Australia’s superannuation industry”.

Chant West super data is highly unreliable and fails to give an accurate picture of performance because it doesn’t measure the actual returns that members receive.

SuperRatings produce a highly regarded data set, however they refuse to disclose the worst performers in the sector, only the best.

The operators of the worst performing funds, including Westpac-BT and AMP, have long been among SuperRating’s major clients.

The Australian Prudential Regulatory Authority (APRA) produces the most accurate data, however its data will not be published for some time, given the financial year only ends tomorrow.

“Australian superannuation funds have delivered exceptional benefits to members in FY 2021, delivering average annual returns of nearly 20%,” ASFA’s statement says.

Curiously, it makes no mention of the 2020, Covid-19, stock market crash.

On February 21 last year, just before the crash, the ASX-200 was at 7319 points.

It closed at 7301 points today.

That means that the ASX-200 is now just 0.25% above its pre-crash level.

ASFA statement – highly questionable. Source: ASFA.

The ASFA statement also appears to downplay the ongoing rampant gouging in the sector.

“Of the around $800 billion in MySuper funds on average during the year, this equates to $160 billion in FY2021 investment returns. In the same period, fees on MySuper accounts totalled around $7.5 billion. Returns were over 21 times the total amount of fees paid,” the statement says.

MySuper funds are not gouged as heavily as so-called “choice” retail funds and so generally deliver higher returns.

While returns may have been 21 times the amount of fees paid, the situation was very different the year before (which ASFA makes no mention of).

That’s because while returns were tiny to non-existent (in the case of Westpac-BT they were negative) for the 2019-20 financial year, the amount of fees extracted by super fund managers remained much the same.

That’s because funds charge members a proportion of their entire balance each year, rather than taking a proportion of profits.

“The Government’s 2021 Intergenerational Report (IGR) highlights the increasingly important role of Australia’s superannuation system in supporting the living standards of future generations of retirees,” the ASFA statement says.