Appreciate our quality journalism? Please subscribe here

DONATE

One of the gatekeepers of the report PwC International is refusing to hand over to authorities works at PwC Australia in Sydney alongside CEO Kevin Burrowes — and has herself faced action over the tax leaks scandal.

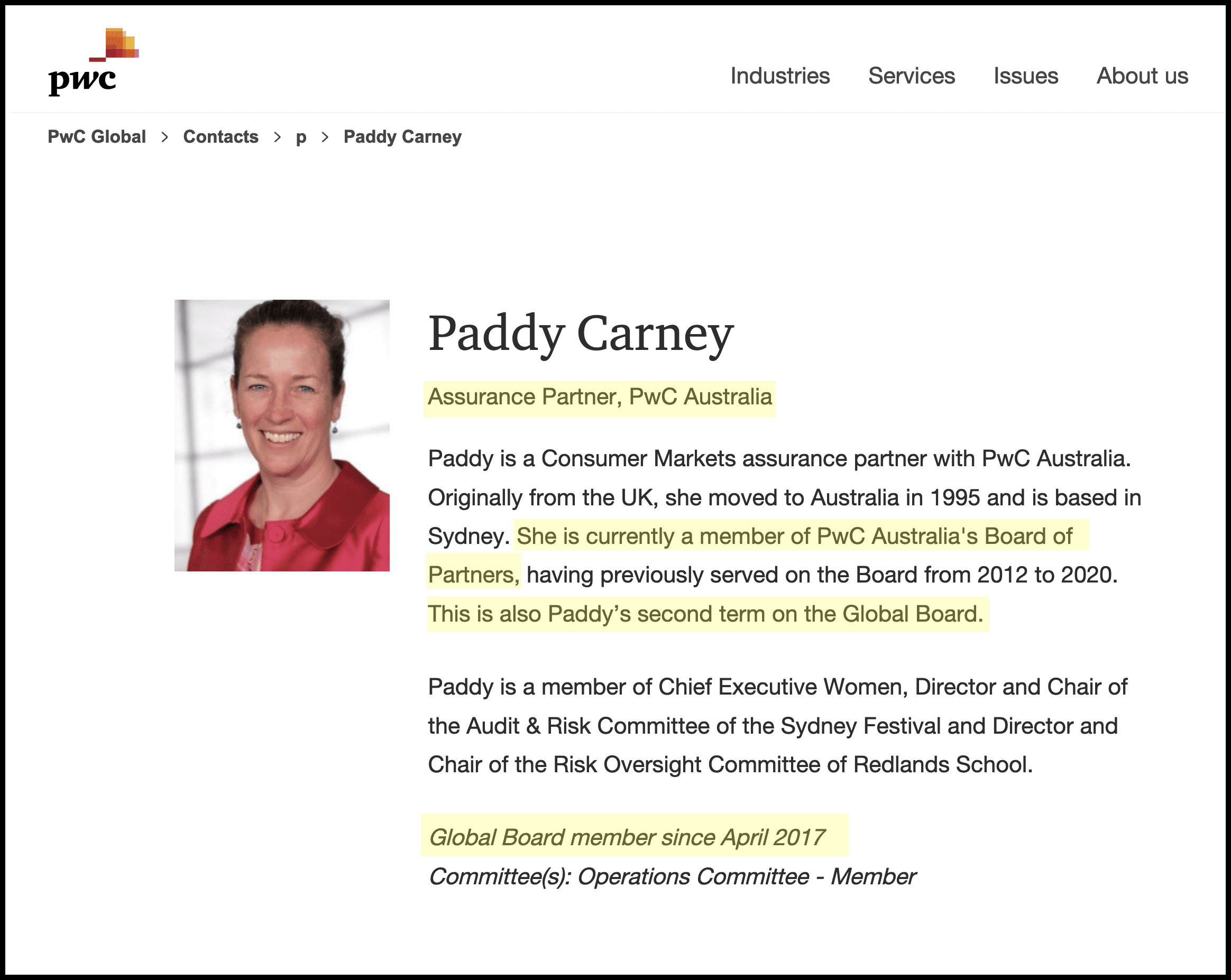

Patricia “Paddy” Carney is not only a director of UK-based PricewaterhouseCoopers International Limited — and so is legally entitled to all its documents — but is also one of PwC Australia’s top executives.

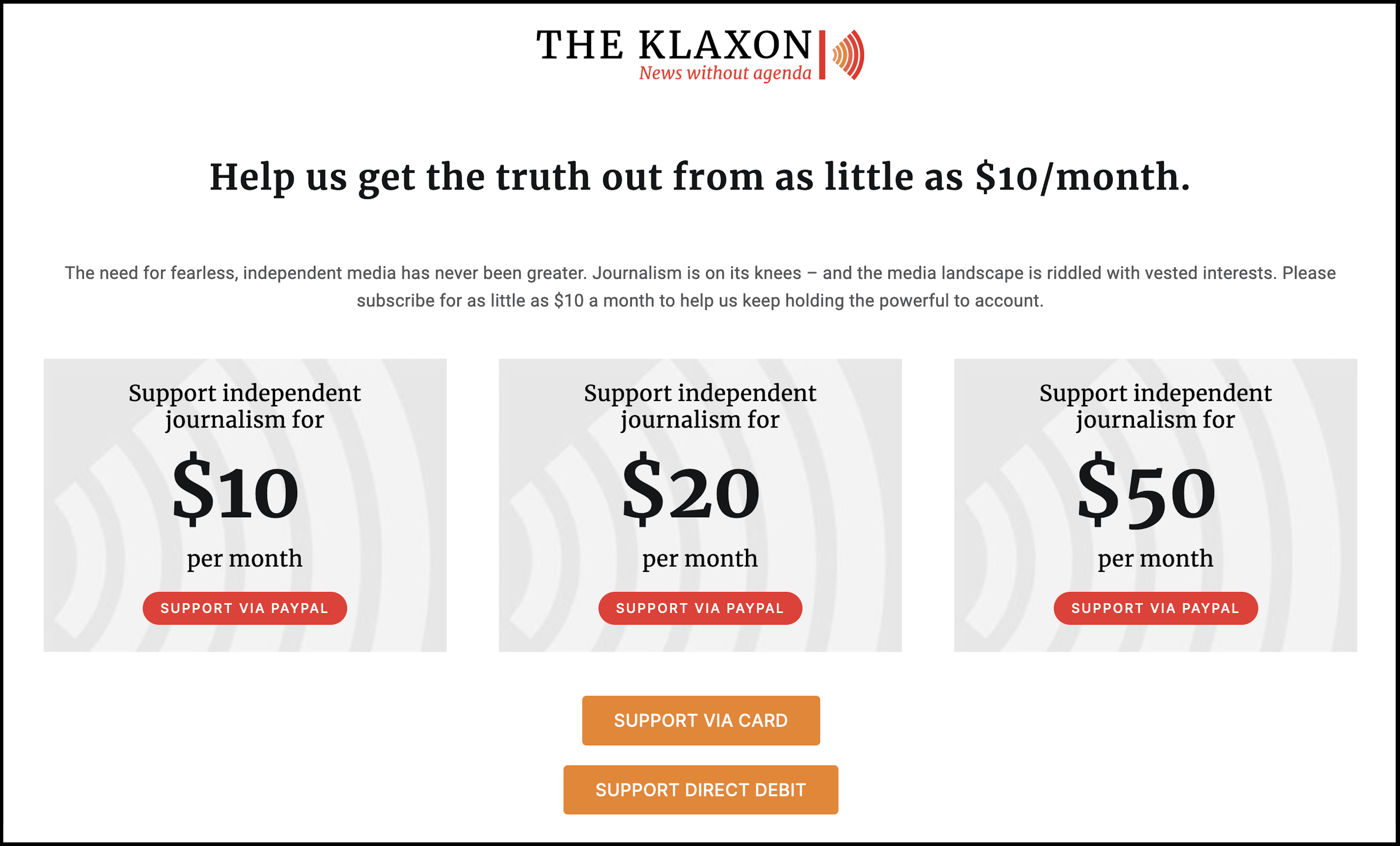

Carney sits on PwC Australia’s board, which has just nine members — including Burrowes — and is the “oversight body for PwC Australia”.

“Paddy is a senior partner of PwC Australia, a member of the Global Board of the PwC International network and a member of the PwC Australia Board of Partners,” states her LinkedIn bio.

She has been a “Member of the Global Board of the US$53b PwC International network” since “April 2017”, it states.

Please SUBSCRIBE HERE and support our quality journalism

Carney and Burrowes both on PwC Australia’s “Governance Board”. Source: PwC Australia

PwC’s global operations commissioned law firm Linklaters to examine international aspects of the tax leaks scandal, yet PwC is refusing to hand it over to authorities.

PwC Australia CEO Burrowes — who PwC global parachuted into the role after the tax scandal broke — earlier this month told the Senate inquiry into consultancies he can’t hand over the Linklaters report because PwC International won’t give it to him.

“I’ve sent emails and requests to PwC International Limited, and on the basis of confidential legal advice they highlighted to me that they would not make it available to me,” Burrowes told the inquiry on February 9.

“I do not have the report”.

Under legal “professional privilege” communications between a lawyer and its client can be kept confidential. PwC is claiming the report is confidential because it constitutes “advice” from its “lawyer”, Linklaters.

Inquiry chair, Liberal Senator Richard Colbeck told Burrowes PwC was treating the inquiry — comprised of members of each of Australia’s major political parties — with “disrespect” and the inquiry was “deadly serious” about obtaining the report.

“I don’t differentiate between you as PwC Australia and PwC as an organisation,” Colbeck said.

“If we don’t see the report, it ain’t going to be pretty”.

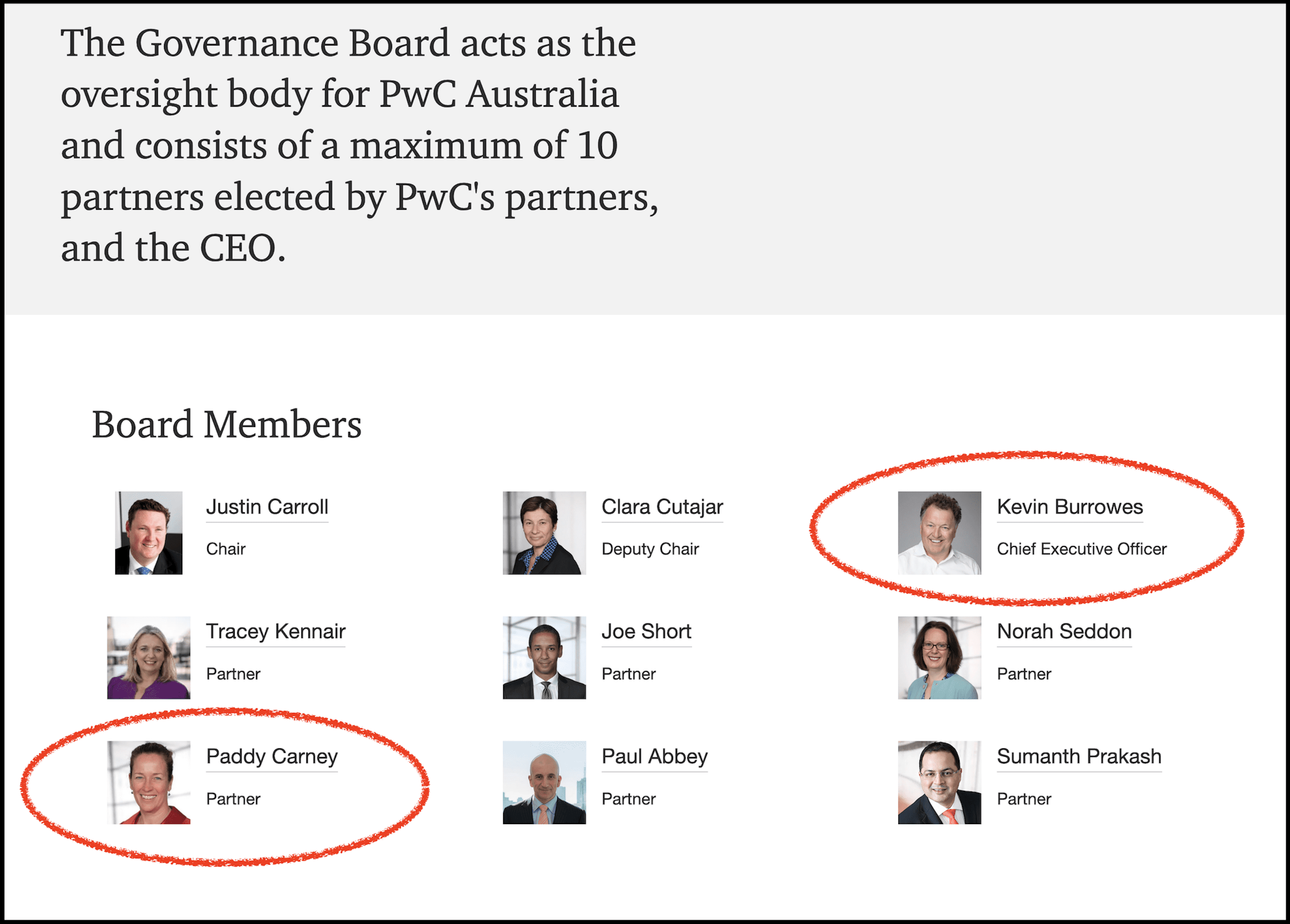

Patricia Carney is a current director of PwC International. Source: UK Government

The inquiry heard the Australian Tax Office (ATO) and fellow federal agency the Tax Practitioners Board (TPB) have also not been given the report, which was completed by at least September 27 last year.

“We have asked for the report formally, and the response we got was that PwC Australia don’t have a copy and are not able to give it to us,” said TPB chair Peter deCure.

ATO Second Commissioner Jeremy Hirschhorn said PwC was “deliberately hiding” the Linklaters report, using the “difference between their local firm and the international firm”, which are different legal entities.

The Linklaters report contains the names of at least half-a-dozen PwC officials internationally, dubbed a “dirty six” by the Senate inquiry into consultancies.

The Australian Taxation Office says PwC is deliberately hiding the report. Source: The Klaxon

Since the scandal broke in January last year PwC has aggressively fought to keep the scandal confined to Australia.

That’s despite a 144-page cache of heavily redacted internal PwC emails from 2014-18 showing the involvement of PwC officials around the world.

PwC Australia took secret Australian Government tax data — obtained while providing advice on new laws to prevent multinationals avoiding tax — and used it to tout for business from multinationals seeking to avoid Australian tax.

Corporate governance expert Dr Andrew Schmulow, an associate professor at the University of Wollongong, told The Klaxon Burrowes’ claims appeared to be “part of a strategy”.

“Far from being an anonymous PO Box in a galaxy far, far away, this is a master entity, whose directors include an Australian partner — a partner under the authority of Kevin Burrowes, the CEO,” Schmulow said.

“This excuse is part of a strategy: plausible deniability” – Dr Andrew Schmulow

“The notion, therefore, that Burrowes himself can’t get hold of the report would be absurd if you didn’t realise that this excuse is part of a strategy: plausible deniability”.

Both Burrows and Carney refused to comment when contacted by The Klaxon.

UK regulatory filings state Carney is a “tax specialist” and has been a director of PwC International at all times since April 28, 2017.

PwC International has 20 current directors. Carney is the only director listed as residing in Australia.

“PwC is the brand under which the member firms of PricewaterhouseCoopers International Limited (PwCIL) operate,” says the group’s website.

“Together these firms form the PwC network. ‘PwC’ is often used to refer either to individual firms within the PwC network or to several or all of them collectively,” it states.

Please SUBSCRIBE HERE and support our quality journalism

Paddy Carney, a member of PwC Australia’s “Board of Partners” and PwC Global board member. Source: PwC

Carney’s LinkedIn bio states she is a “senior partner of PwC Australia”, a “member of the Global Board of the PwC International network” and a “member of the PwC Australia Board of Partners”.

The board overseeing PwC Australia is also called its “board of partners” or “governance board” and comprised of a “maximum of ten partners”, including PwC Australia’s chair and CEO.

Last year Carney “stood down” as chair of the “risk committee” of the PwC Australia board over the tax scandal, but she remains on the board itself.

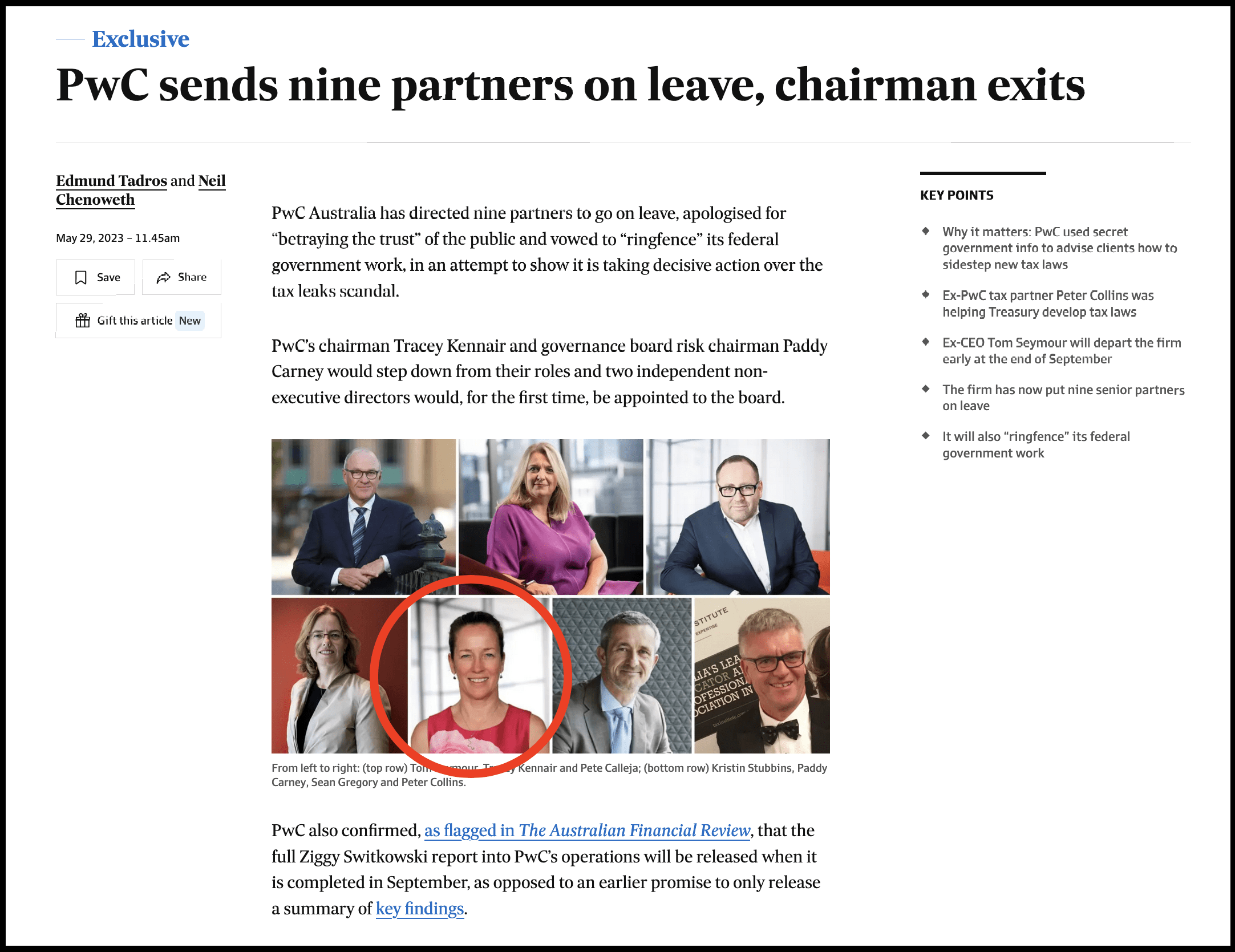

On May 29 PwC Australia announced it had “directed 9 partners to go on leave, effective immediately”, pending its investigations.

“In addition, the Chairs of the Governance Board and [of] its designated risk committee have decided to step down from their respective roles,” PwC Australia said.

The PwC Australia chair was Tracey Kennair. She departed the board and was replaced as chair by Justin Carroll.

“The Chairs of the Governance Board [Kennair] and [of] its designated risk committee [Carney] have decided to step down from their respective roles” — PwC Australia

Carney was stood down as “governance board risk chairman” over the tax scandal, but continues to hold other senior roles. Source: AFR

Carney has been with PwC for 32 years and it was her “second term on the Global Board” of PwC, her LinkedIn bio states.

She is currently a board member of SCECGS Redlands, an exclusive private school on Sydney’s lower north shore, and a director of Sydney Festival.

When contacted by telephone by The Klaxon last week, Carney would not answer questions and instead directed us to PwC Australia’s public relations department.

At the February 8 hearing Burrowes said he had “sent emails and requests” to “PwC International Limited” but did not say who he approached.

Burrowes refused to answer a series of written questions from The Klaxon, including who at PwC International he had approached and whether he had asked Carney for a copy of the Linklaters report — and if not why not.

Instead, in response to questions put to both Carney and Burrowes, PwC Australia head of media and reputation Patrick Lane responded:

“The matter was discussed at length in the inquiry on Friday and we would refer you to those exchanges”.

Yet Burrowes made no mention of any PwC Australia employees having access to the Linklaters report at the hearing, and Carney’s name was not mentioned at all.

Unanswered: Questions The Klaxon put to Burrowes on February 12.

In May last year, following months of pressure over the tax scandal, PwC Australia announced it had appointed private businessman Ziggy Switkowski to conduct an “independent review”.

As revealed by The Klaxon PwC Australia refused to disclose the “terms of reference”, or instructions, it had set Switkowski.

A NSW Senate inquiry later forced the disclosure, revealing PwC had only tasked Switkowski with investigating matters from the date of his appointment — and so none of the tax leaks affair.

PwC released the sham report on September 27 last year.

That same day PwC global posted online a one-page statement stating the “PwC Network” had in May engaged Linklaters to examine PwC Australia sharing confidential information “with PwC personnel outside of Australia”.

“The review found that six individuals should have raised questions as to whether the information was confidential,” the statement said.

“To the extent that they are still with PwC, their firms have taken appropriate action,” it said, providing no further details.

Last week TPB chief executive Michael O’Neill told a Senate Estimates hearing those claims were “not consistent with our reading of the emails”.

The matter was “much broader” than six people, O’Neill said.

The Senate inquiry into consultancies holds its next hearing tomorrow.

BEFORE YOU GO: Truly independent, quality journalism is vital to our democracy. Please SUBSCRIBE HERE or support us by making a ONE-OFF DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.