Appreciate our quality journalism? Please donate here

EXCLUSIVE

The man in charge of Treasurer Josh Frydenberg’s office was running corporate affairs at Westpac’s BT when the superannuation giant was aggressively covering-up a major scandal involving it gouging billions of dollars from its members.

The Treasurer’s chief-of-staff, Martin Codina, has had a revolving door between running Frydenberg’s offices in Canberra and working as an executive and corporate lobbyist at Westpac-BT – repeatedly switching between the two roles.

Codina was Head of Government and Industry Affairs at Westpac’s BT, immediately becoming Frydenberg’s Chief-of-Staff in 2015.

In 2017 Codina left Frydenberg’s office to return to BT, as Corporate Communications manager before – remarkably – returning again work as Frydenberg’s Chief-of-Staff in Canberra.

Martin Codina. Source: Supplied

BT is the “wealth” and superannuation arm of Westpac.

As revealed by The Klaxon on Sunday, corporate regulator the Australian Securities and Investments Commission (ASIC) is steadfastly failing to take action to stop Westpac-BT systemically gouging its superannuation members.

Despite being responsible for policing wrongdoing in the superannuation sector, ASIC has taken no action to stop the Westpac-BT gouging, despite it being formally informed of the matter, in high-detail, nine months ago.

ASIC reports directly to the Federal Treasurer, Josh Frydenberg.

Neither Codina or Frydenberg responded to a series of questions The Klaxon put to them on Friday.

The Revolving Door:

Sep 2018 – Present: Frydenberg Chief-of-Staff

Aug 2017 – Sep 2018: BT Head of Corporate Affairs

Jan 2015 – Aug 2017 : Frydenberg Chief-of-Staff

Jan 2014 – Jan 2015: BT Head of Government Affairs

Oct 2009 – Dec 2013: FSC Policy Director

In June and July 2018, when Codina was head of Corporate Affairs at BT, Westpac-BT ran an extremely aggressive – and successful – campaign to have The Australian newspaper spike a major expose.

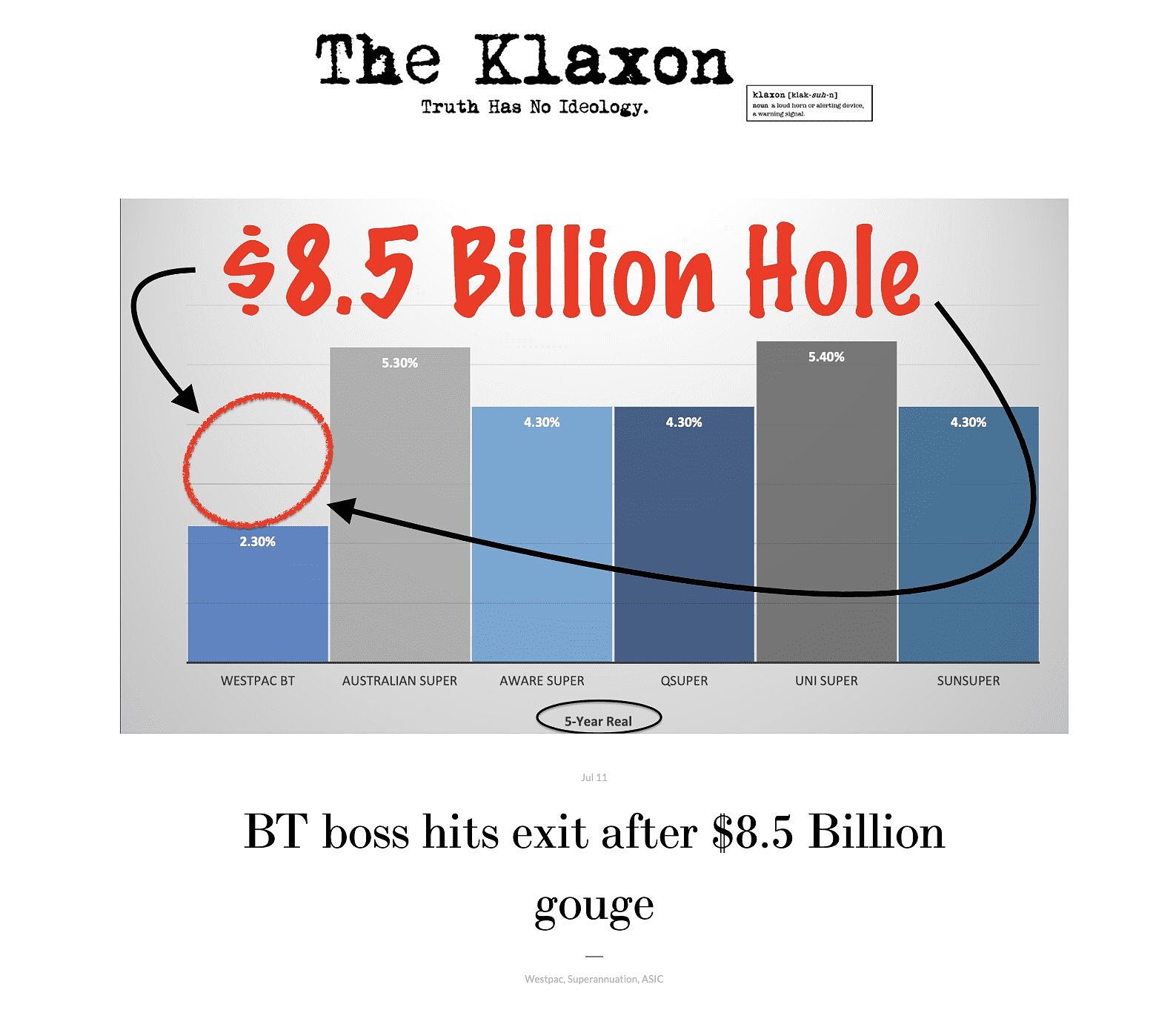

Westpac-BT had been systematically gouging its superannuation members, with $8 billion gouged in the decade to 2018 alone.

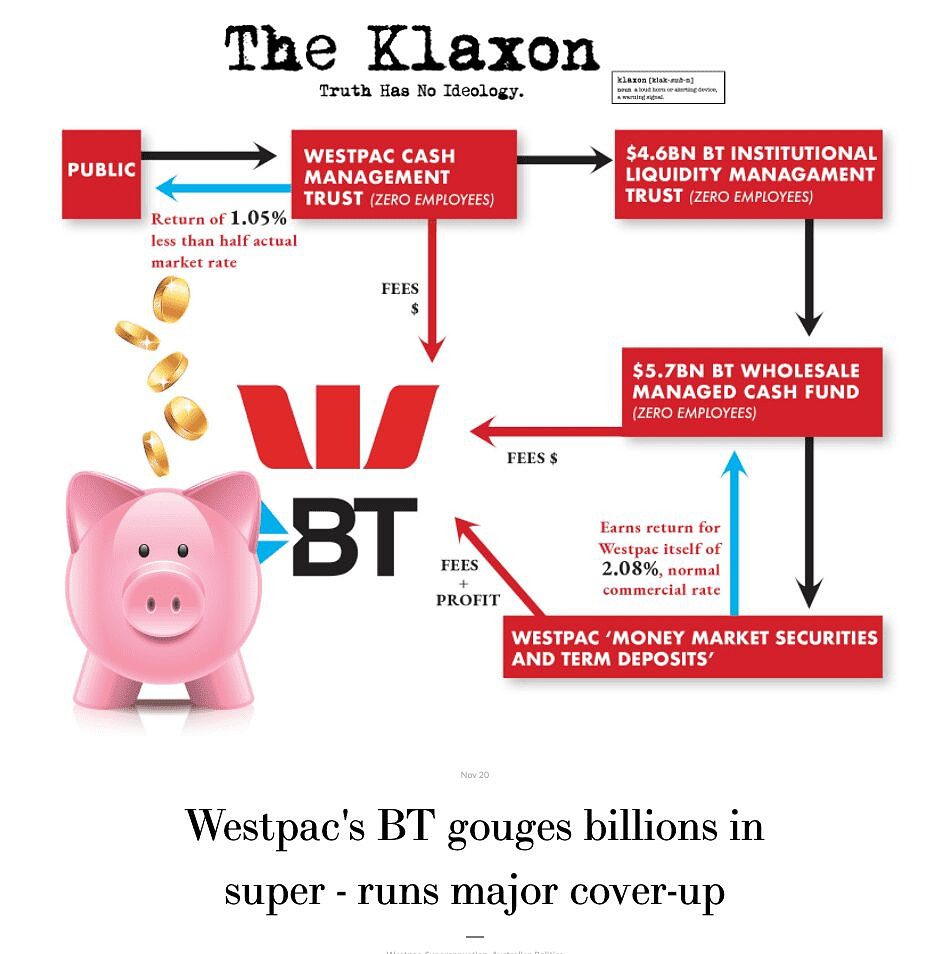

The process includes Westpac-BT operating a complex web of obscure paper companies, many of which generate huge fees despite performing no real service and having no employees.

The Klaxon’s November 20 expose.

The bank was successful and the newspaper never published the expose.

The Klaxon subsequently ran the article, on November 20 last year.

On November 23 we wrote to ASIC informing it of the matter.

ASIC has taken no action to stop the Westpac-BT gouging, which is ongoing and currently costing the public $1.5 billion a year – $4.5 million a day.

Action to prevent or stem the Westpac-BT gouging (such as under section 63 of the Superannuation Industry (Supervision) Act 1993 which gives regulators the power to freeze new contributions) would cost ASIC just a fraction of the amount being gouged from the public each week.

The loss to Westpac-BT members since November last year, when The Klaxon formally warned ASIC of the gouging, is now $1.23 billion.

That’s the equivalent of over three times the regulator’s entire annual budget ($403 million in 2019-20).

Since mid-2018, Westpac-BT has gouged over $5 billion from almost 1 million super members.

Westpac-BT returns almost non-existent (1/30th of market rates) between 2018-20. Story June 28. The Klaxon

Between mid-2018 and mid-2020, the 900,000-plus members in Westpac-BT’s umbrella “Retirement Wrap” fund earned average returns that were just 1/30th of actual market rates, after adjusting for inflation.

Codina was Head of Government and Industry Affairs at BT Financial Group before Frydenberg appointed him to work for the Federal Government in January 2015.

Immediately before he joined Westpac-BT in 2014, Codina had been Director of Policy at lobby group the Financial Services Council.

The Financial Services Council actively lobbies the Federal Government to advance the interests of its members, major banks and financial institutions, operating so-called “retail” superannuation funds.

Retail super funds include those run by Westpac, NAB, AMP and IOOF.

Retail funds have been repeatedly proven to be systemically gouging members, with retail funds estimated to be “creaming up to $10 billion a year” from members.

A news report describing the power wielded by Codina as Frydenberg’s COS. Source: Supplied

The Klaxon’s report, July 11. Source: The Klaxon

Westpac-BT is among the worst offenders.

Last month Westpac sparked headlines when it disclosed BT had delivered it $220 million in profits in the five years to June 2020.

Detailed investigations by The Klaxon show the actual figure is much higher.

According to Codina’s LinkedIn bio, he was Head of Government and Industry Affairs at BT Financial Group from January 2014 to January 2015, when he became chief-of-staff to Frydenberg, who was then Australia’s Assistant Treasurer.

In September 2015 Frydenberg became Federal Minister for Resources and Energy, and in July 2016 he became Minister for the Environment and Energy.

In August 2018, after deposing Malcolm Turnbull as Prime Minister, Scott Morrison appointed Frydenberg as Treasurer of Australia and Deputy Leader of the Liberal Party.

Codina’s LinkedIn profile contains incorrect, or out-of-date, information.

It states Codina has been chief-of-staff to Frydenberg consistently since January 2015.

In fact, Codina returned to BT in August 2017, as head of Corporate Affairs.

Codina was at BT until September 2018, when he returned to being Frydenberg’s chief-of-staff.

“BT has appointed Martin Codina as its new director of corporate affairs, marking his return to the company after departing to work for then Assistant Treasurer Josh Frydenberg in January 2015,” Investor Daily reported in July 2017.

In December 2017 the Federal Government announced the year-long Royal Commission into banking and financial services.

The Federal Coalition – along with the banking and finance sector – had spent several years fiercely opposing holding a Royal Commission.

It was forced to act after several National MPs threatened to cross the floor to support the ALP.

Codina has a long-history as a corporate lobbyist.

According to his Linked-In bio, Codina was with the Financial Services Council, and its earlier incarnation, the Investment and Financial Services Association, for eight years, between 2005 and 2014.

Codina was Director of Policy at the Financial Services Council from 2009, before leaving the lobby group to join Westpac-BT In January 2014.

He was Senior Policy Manager at the Investment and Financial Services Association from 2005 to 2009, when it became the Financial Services Council.

Before that, between 2001 and 2004, Codina worked for the Commonwealth Treasury, his bio states.

In that role he advised the Federal Government “on business taxation and financial services reforms”.

Turnstiles

Despite the rampant gouging of super funds by the vast majority of “retail” super funds, including the dire findings of a Productivity Commission review into super released in 2019, Treasurer Frydenberg, the Federal Government and ASIC have taken no substantive steps to stop the gouging.

That’s despite the gouging of superannuation being illegal.

From ASIC to Westpac. Clock-wise from top left: Cameron Walter, Amber Rowland, Lidia Agioski, Felicity Minzlaff, Sean Polivnick, Kate Fowler, Anita Cuatolo and Irfan Malik. Source: LinkedIn

Super fund trustees are required by law to act in the “best interests” of members.

As revealed by The Klaxon, Westpac has been aggressively recruiting prosecutors, lawyers and investigators from ASIC and now has at least ten former senior ASIC figures in its ranks.

They include ASIC’s long-time chief prosecutor, Cameron Walter, who joined Westpac in December; the former chief-of-staff to ASIC chairman Greg Medcraft; a former senior ASIC forensic financial investigator; and a string of other former key ASIC litigators and enforcers.

(The Westpac positions of “Group Head of Regulatory Relationships”, “Executive Manager, Regulatory Relations“, “Manager, Financial Markets Operational and Compliance Risk”, “Senior Manager, Consumer Incidents Compliance”, “Head of Strategy and Customer Experience” and “Senior Manager, Anti-Money Laundering Intelligence”, are now all held by former senior ASIC employees.)

ASIC is the regulator with primary responsibility for policing wrongdoing in the superannuation sector.

The person at ASIC responsible for super is Jane Eccleston, whose title is Senior Executive Leader, Superannuation.

Eccleston is a former Westpac in-house lawyer, having been Westpac General Counsel between 1993 and 1996.

“Jane Eccleston…reminds trustees of their obligations to support and protect whistleblowers and implement a whistleblower policy” — ASIC

Jane Eccleston. Source: ASIC

On October 7 last year, Eccleston released a statement on behalf of ASIC: “Support and protections for whistleblowers”.

“Jane Eccleston…reminds trustees of their obligations to support and protect whistleblowers and implement a whistleblower policy,” the document said.

We reported the Westpac-BT gouging to ASIC six weeks later, on November 23.

ASIC has taken no action to stop that gouging.

Eccleston has repeatedly declined to comment when contacted by The Klaxon.

Last week Federal Opposition leader Anthony Albanese put the spotlight on perceived failures in government agencies, warning that if Labor were elected he would not guarantee the jobs of public service chiefs.

More to come…