The $10 billion Clean Energy Finance Corporation has survived years of merciless attacks from the Coalition, including two attempts to abolish it and underhanded “mandate” changes which threatened to render it useless. Now it has become a darling of PM Scott Morrison, is under the control of Angus Taylor — and is staring at one of the biggest crossroads of its existence. This two-part investigation uncovers some questionable investments, a string of satisfied Liberal donors, a Coalition with a fossil fuel problem and a Macquarie Banker at almost every turn. This is part one. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

In just the past two weeks, a string of government agency reports has given a ringing endorsement to renewable energy and underscored its integral role in Australia’s future wellbeing.

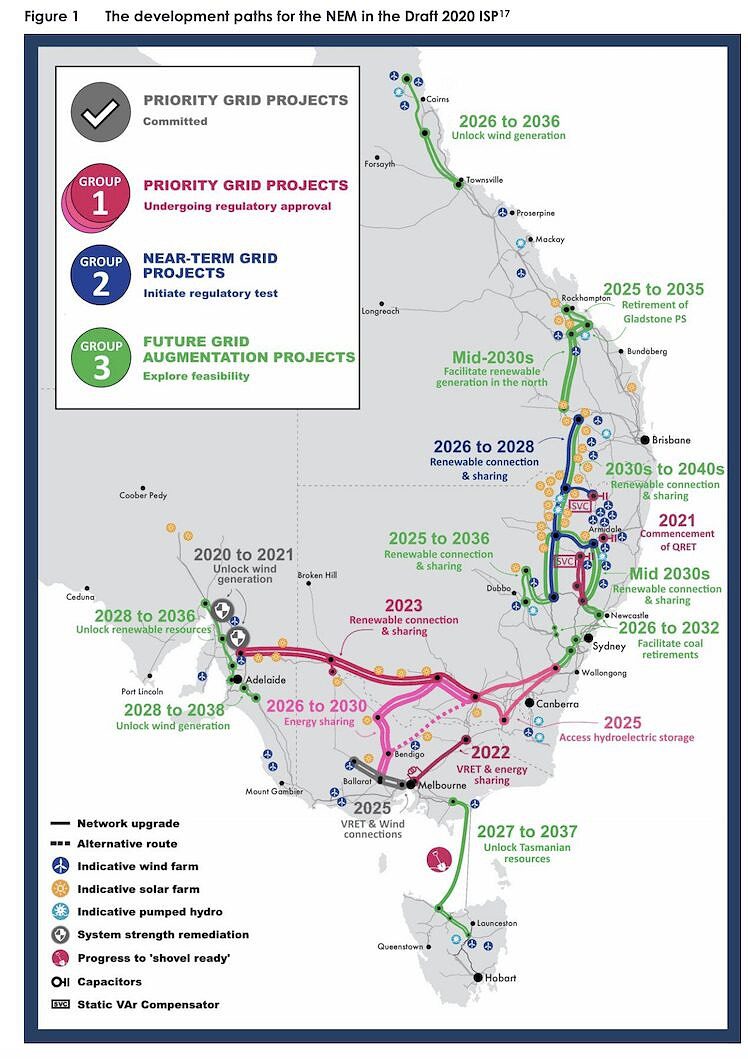

The Australian Energy Market Operator released a detailed, 20-year energy infrastructure map declaring the “domination” of renewables essential to meeting “cost, reliability and emissions” expectations of the public, the Department of Environment released data showing the government’s boast of meeting 2030 targets was almost entirely predicated on the shift to renewables, and the competition regulator called for more homes to be fitted with solar panels as it released figures showing household electricity bills had eased and wholesale prices in the eastern states had slumped by up to 40% in November and December.

Yet when Prime Minister Scott Morrison surfaced on Monday he was singing from a very different song sheet. The Federal Government would underwrite two new fossil fuel emitting gas-fired power stations, one in south-east Queensland’s Gatton and one in Dandenong Victoria.

Further, despite AEMO’s detailed and highly regarded Draft 2020 Integrated System Plan, which is backed by the states, coal is still very much on Scott Morrison’s agenda.

“You need the whole mix, there is no doubt about that,” the PM told talkback listeners on Sydney’s 2GB radio station.

“Firstly, there is a proposal for coal still up in North Queensland which we are accepting a report on very, very soon, there are some others in New South Wales and we will see where that goes.”

Parasitic modernity

After years of delays, false claims and piecemeal policy – all pickled with an unusually robust strain of climate-change denialism – the Coalition’s addiction to fossil fuels is poised to have some very real and long-term consequences for the nation’s bottom line.

It has been suggested that an inability by the Morrison Government to find the resolve to quit the junk may be the thing that ultimately kills it. Be that may, or not, Canberra’s desperate binges and sunset hits in the interim will have all Australians footing the bill — and for long into the future.

Renewables are cheaper, more efficient and endless. Building new coal plants, or upgrading existing ones, just don’t stack up, either environmentally or economically.

“When the Matt Canavans and the Angus Taylors (Coalition ministers) say we need energy 24/7, what they are really saying is we need nuclear and coal,” international energy analyst Tim Buckley tells michaelwest.com.au.

“But that baseload argument is totally flawed and outdated, we don’t need nuclear or coal anymore because we have really cheap solar.”

Buckley is the Australia and South Asia director of energy finance studies at global think-tank the Institute for Energy Economics and Financial Analysis. He is also a former investment fund manager and before that spent 16 years at Citigroup where he was the national head of equities research — so he is no soft-headed wishful thinker.

Buckley says the central flaw in the Coalition’s argument is that it fails to comprehend how “deeply destructive” solar now is to the entire fossil fuel model. Once your infrastructure is up and running, it costs next to nothing to pump out more electricity — sunlight’s free.

“Cheap solar is parasitic, it destroys the competition because it has zero marginal cost,” Buckley says.

The long-standing argument that grid reliability depends on coal and gas, because of the intermittent nature of solar and wind, is a now a nonsense, Buckley says.

Pumped-hydroelectricity, and to a lesser extent battery and other technologies, provide the storage and on-demand energy needed for grid reliability. Pumped-hydro involves pumping water uphill and holding it there until it’s required.

When energy is needed by the grid, some of the water is released, turning turbines and creating electricity. The water is pumped up the hill at times of low energy demand, using cheap electricity such as solar.

Least regret

The Australian Energy Market Operator is clear: new or refurbished coal plants play no role in Australia’s energy future. Its Draft 2020 Integrated System Plan details an essential long-term strategy for providing a “least-costs-and-regret” infrastructure strategy over the next two decades.

Almost two-thirds of Australia’s coal-fired generators will reach “the end of their technical lives and so likely retire” by 2040.

To deliver “low-cost, secure and reliable energy” to eastern Australia during the “transition phase”, in the interim (and to minimise “regrets”), the system needs to continue moving heavily into wind and solar, and to invest in storage, grid technology and “dispatchable” – or on-demand – energy sources such as pumped-hydro.

Gas projects could play a role, but they are largely an afterthought. “Flexible gas generators could also play a greater role if gas prices materially reduce,” AEMO says. Globally, gas prices have plunged. Here, prices are starting to fall and reliability standards won’t be breached in the coming few years.

AEMO’s sober and reasoned infrastructure plan is viewed as a vitally important bulwark against the Federal Government’s bumbling and piecemeal energy policy.

It’s the adult in the room, according to energy industry experts.

“We really need AEMO. Without it we’re completely stuffed,” one energy expert tell us.

The power of AEMO comes from the states. It’s operated by the Council of Australian Governments, whose members include all state and territory premiers as well as the PM, and so isn’t beholden to the blind fossil-fuel ideology of the federal Coalition.

But there are many chefs and a battle is underway. The sober analysis of the states-backed AMEO and energy experts are in one corner, the fossil fuel junkies of the Coalition in another.

Now the Clean Energy Finance Corporation is set to be dragged into the middle.

Whacky honeypot

The Clean Energy Finance Corporation was created by Julia Gillard’s Labor Government, in cooperation with the Greens, in 2012. As a “green bank” it was given access of up to $10 billion over five years, $2 billion each year from 2013 to 2018, with a mandate “to facilitate financial flows into the clean energy sector”; NB, not the dirty energy sector.

It would invest money where others were not yet willing, so as to pave the way for wholesale private investment in green energy.

Its goal was not to make a profit, but it was not to cost the Government anything either. The CEFC was to deliver a return, after costs, that was the same or higher than the Government’s five-year bond rate, about 3.4% a year at the time.

From the outset, the Coalition was no friend of the CEFC.

In 2011, in Opposition, then Coalition finance spokesman Andrew Robb said the proposed fund would be a

“honey pot to every white-shoe salesman imaginable”.

The money would be spent on “all sorts of wild and whacky proposals that the banks would not touch in a fit”.

After the Abbott Government was elected in 2013, the Coalition twice moved to have the CEFC abolished, each time being blocked in the Senate. Facing a possible double-dissolution if it failed a third time, the Coalition government changed tack.

In February 2015, then Treasurer Joe Hockey and Finance Minister Mathias Cormann took the remarkable step of issuing the CEFC with a mandate requiring it to almost treble the returns it earned the Government but to leave its risk profile unchanged.

The CEFC was now required to deliver annual deliver returns of between 4% and 5% above the bond rate — meaning it was required to deliver returns of 7.4% to 8.4% a year.

The demand was an absurdity, an underhanded attempt to kill the CEFC by stealth, and the green bank fought back.

Jillian Broadbent

Then chairman Jillian Broadbent submitted a report, co-authored by consultant and former Melbourne University professor Bob Officer, which said the new returns hurdle was far too high and that the CEFC would be forced to invest in high-risk assets if it was to achieve it.

In May 2016, the Government lowered the benchmark slightly, to between 3% and 4% above the bond rate, where it remains. Jillian Broadbent’s protestations that it still remained an “unrealistically high return for this market” fell on deaf ears.

In yet another swipe, in 2015, the Abbott Government announced it would block the CEFC from investing in wind farm projects and rooftop solar, though this policy would be later be reversed after Tony Abbott was deposed as PM by Malcolm Turnbull.

“The CEFC does a very good job, but the Government just shits all over it whenever it’s politically convenient for it to do so,” one energy veteran said.

Windfalls

Earlier this month, scandal-plagued Energy and Emissions Minister Angus Taylor courted international condemnation at UN talks in Madrid, after insisting Australia be allowed to meet its 2030 emissions target by using carryover credits under the Kyoto Protocol, a loophole condemned by most of the international community.

Relying on the manoeuvre, the Morrison Government boasted it was on track to meet emissions targets, including “reducing emissions to 26%-28% below 2005 levels by 2030”.

But Department of Environment and Energy emissions projections data realised on 9 December – just as Taylor jetted out to Spain – shows that without the ongoing transition to renewables, the Government would have had zero chance of meeting that target, loopholes or not.

The revelations are particularly jarring given that in the weeks before the May federal election, the Coalition relentlessly attacked the ALP’s stated policy of reaching 50% renewables by 2030 as an “economy wrecker”. Angus Taylor went further, claiming it would “de-industrialise the economy”.

The Government’s own data shows that meeting the 2030 target is, in fact, predicated on Australia’s main grid reaching 51% renewable by 2030.

The drop in emissions allowing that (massaged) 2030 target to be met is almost entirely due to a 23% plunge in emissions from electricity production over the next decade, a result of the “projected continued decarbonisation of electricity generation across the country” and the “large deployment of renewables”, the report states.

In 2012, renewables accounted for 9.5% of the National Energy Market (which comprises all states other than WA and NT). In the year to June, renewables accounted for 21.3%, more than double.

The CEFC has played a key role in the shift. Experts say the banks, highly risk averse, were refusing to fund major wind and solar projects until the CEFC led the way.

It has been so successful that the green bank’s involvement is no longer needed to get major solar projects off the ground.

At 30 June, the CEFC had money in 29 large-scale solar and wind farm projects, worth a total of $5.3 billion. The facilities would deliver a total of 2.7 gigawatt hours of energy, and be responsible for carbon emission reductions of 5.9 million tonnes a year, when operating at full capacity.

The surge in renewables has brought with it the need for better grid infrastructure and more on-demand energy sources such as pumped-hydro and battery storage.

A backflip?

In August, raising more than a few eyebrows, the Prime Minister declared the CEFC the best green bank in the world.

“The fact Australia leads the world in per capita investment in clean energy, we have the world’s most successful green bank in the Clean Energy Finance Corporation and that we’re on track to have around a quarter of our electricity needs met by renewables by 2020, all underscores the work underway to reduce our global emissions,” Morrison said in a statement.

(It seems few were more excited than the CEFC’s board and management: Morrison’s words are reproduced three times in the first 16 pages of its latest annual report.)

Then on 30 October, the PM’s office announced a further $1 billion would be given to the CEFC to establish a Grid Reliability Fund.

On the face of it, the Coalition has had a renewables awakening. But many are highly skeptical.

Against the backdrop of the Coalition’s multi-year attacks, and its recent announcements around coal and gas – including Monday’s announcement – they have every reason to be skeptical.

Taylor is rumoured to be pushing hard for CEFC to dive into “clean coal” (neither CEFC or Taylor would comment), while Cormann has said he will change the CEFC’s “enabling legislation”, raising concerns from the Greens and others that the Grid and Reliability Fund is a coal and gas Trojan Horse.

For his part, Scott Morrison does appear to have a motive for his professed newfound love for the green bank — aside from the fact his August comments came days before he fronted Pacific Island leaders enraged over Australia’s lack of climate action.

In recent years, the CEFC has made some substantial changes in direction, most of them to meet new Federal Government commands, and many of them of highly questionable merit.

Our investigations find major corporate donors to the Coalition are among the biggest winners.

This article first appeared at Michael West Media and is reproduced here with permission

Next: Part two – the megabucks flowing to key Liberal donors, and a MacBank reunion

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.