Factual reporting is more important than ever. But a prominent analyst’s report into Virgin Australia’s $1.4 billion taxpayer bailout is riddled with demonstrably false statements. The report reads like a Virgin advertisement and despite claims to “unrivalled integrity” and independence, CAPA-Centre for Aviation won’t even tell us who wrote it. Plus, we reveal Energy Minister Angus Taylor, forced to update his pecuniary interests register just last week, has even more undisclosed “gifts” from Virgin Australia. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

An “independent” analyst report being used to push Virgin Australia’s bid for a $1.4 billion taxpayer bailout is loaded with false statements, misrepresentations and glaring inaccuracies, every one of them in favour of the embattled foreign-owned carrier.

A report from the Sydney-based CAPA – Centre for Aviation, released on Wednesday last week, just hours after it was reported the Federal Government was unlikely to give Virgin Australia another handout, overstates by more than double the impact of the 2001 Ansett collapse on domestic aviation.

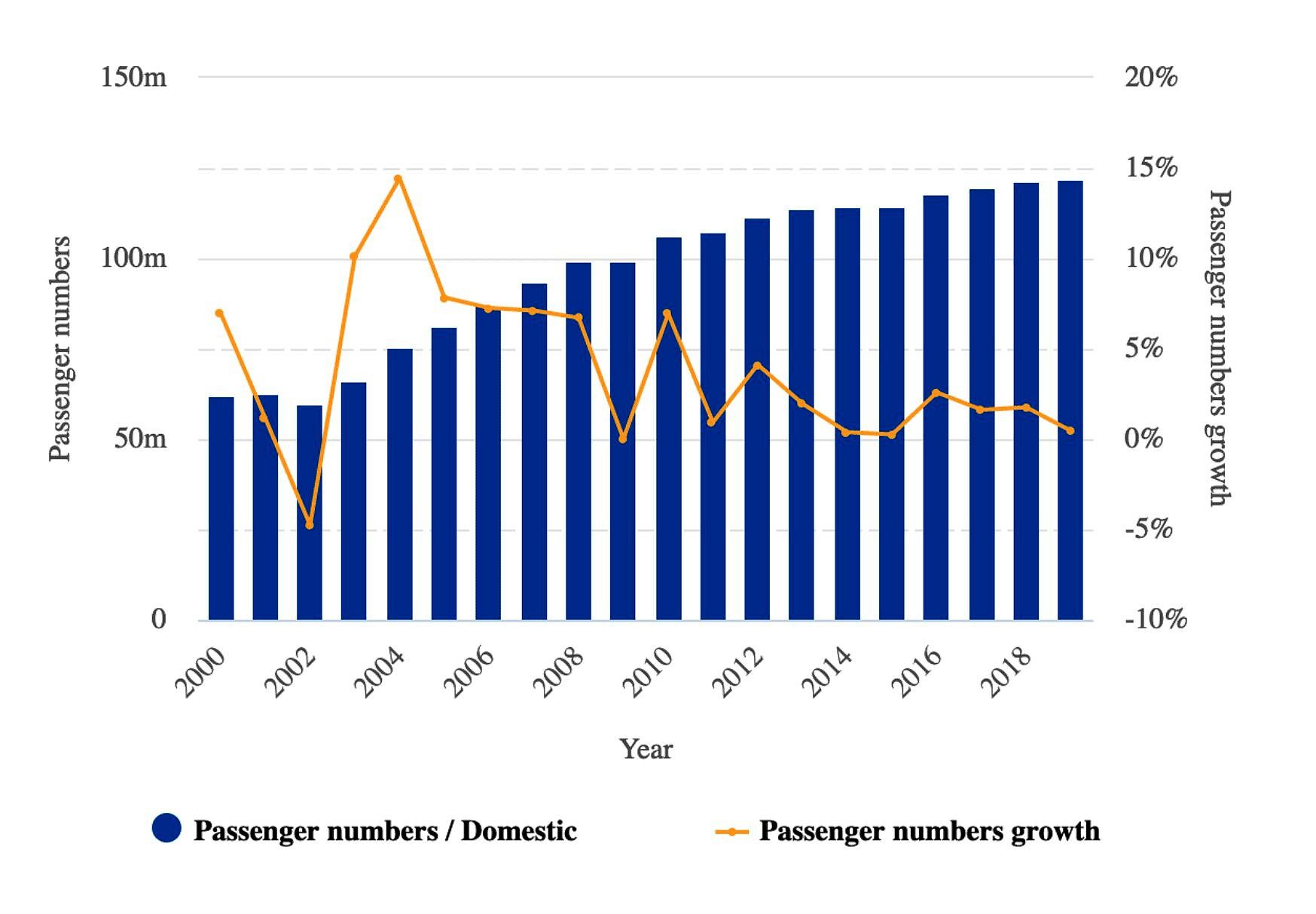

It also claims passenger numbers dropped and “took a long time to recover” after Ansett’s collapse – but data in CAPA’s own report shows the exact opposite occurred.

The accuracy of CAPA’s report, titled “Why Australia needs Virgin Australia to Survive” (read it here) is important because it is being circulated by proponents of Virgin Australia in the airline’s bid to gain taxpayer funds, and because CAPA and its representatives are widely and regularly quoted in the media.

Despite the seriousness of the matter, and CAPA claiming, among other things, to have an “unrivalled reputation for independence and integrity”, the group has not responded to our repeated requests for comment over the past two days, or to a series of detailed written questions we have put to it.

The CAPA report on Virgin Australia does not name its author or authors, and CAPA repeatedly declined to comment when asked to provide this information.

CAPA also declined to comment when asked whether it had received any payments from Virgin Australia over the past 12 months (and if so how much) and why its report contains multiple, brazen false statements, all in favour of Virgin Australia’s current agenda.

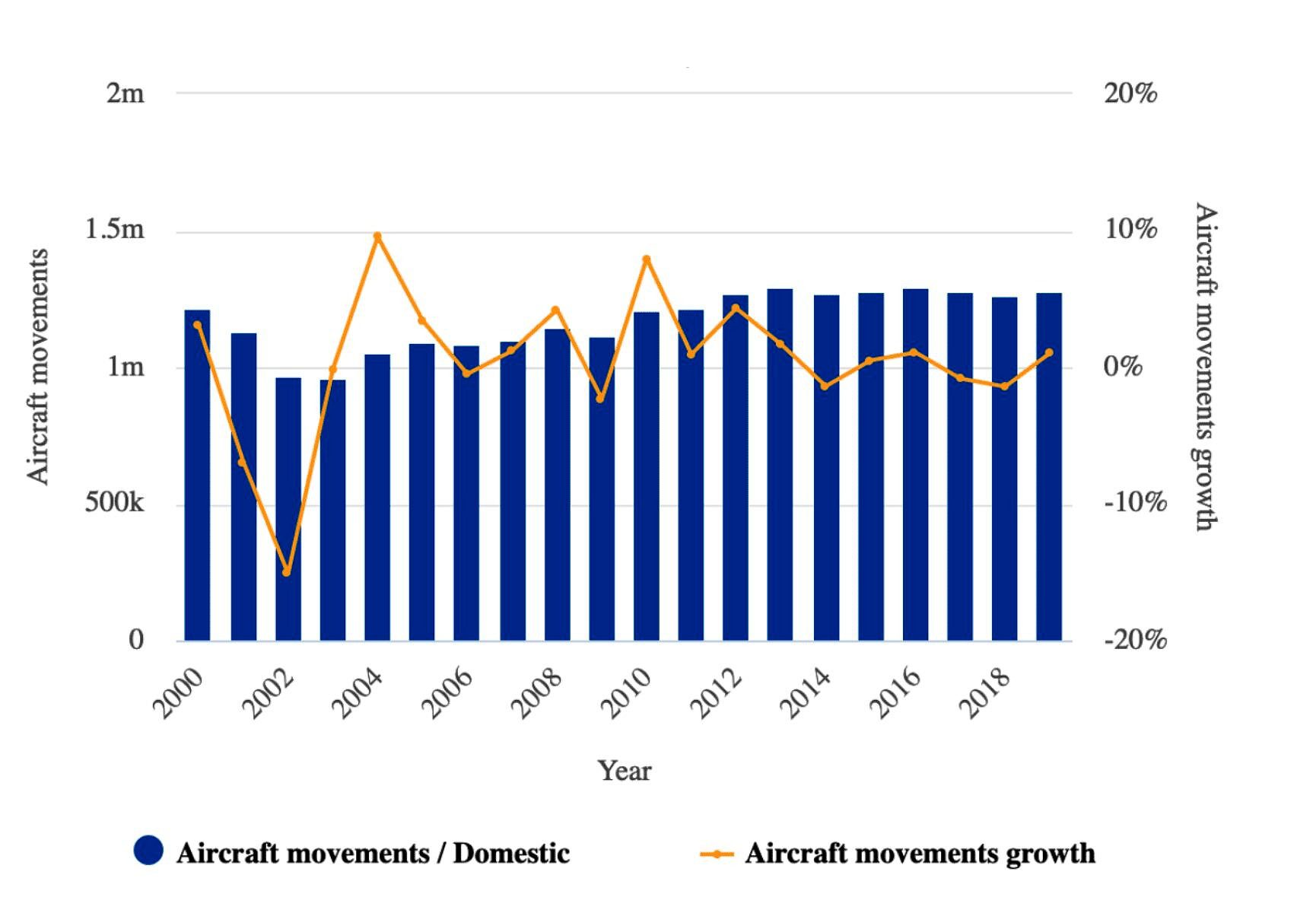

The CAPA report states “Australia’s domestic aircraft movements fell nearly 30 per cent in 2002, after Ansett’s collapse”, and includes a graphic of aircraft movement data to illustrate.

But the graphic, based on Federal Department of Transport figures, shows the fall in domestic aircraft movements between 2001 and 2002 was actually less than half that, at just 14 per cent.

Further, CAPA’s own data shows that while there was a drop between 2002 and 2003, that drop was so small it is almost imperceptible (below), while aircraft movements rebounded strongly and have continued a strong growth trajectory since.

“Why Australia needs Virgin Australia to survive”. Source: CAPA.

The aircraft movements are shown in the blue bar chart, with the corresponding numbers on the left hand axis.

The yellow zig-zag line reflecting “aircraft movements growth”, and its corresponding scale on the right hand side, is largely irrelevant because it just reflects the annual changes in aircraft movements already shown by the blue bar chart, just in a far more exaggerated form. (Regardless, the exaggerated yellow line suggests aircraft movements exploded upwards from 2002, the opposite of CAPA’s claims).

CAPA’s analyst report on Virgin Australia contains only two sets of data – and CAPA has misrepresented the second set of data even more brazenly than it has the first.

The report states: “passenger numbers also took a long time to recover” and provides the graphic below:

“Why Australia needs Virgin Australia to survive”. Source: CAPA

But the graphic itself clearly shows the passenger numbers didn’t take any time to recover at all.

There was a very small drop between 2001 and 2002 (Ansett collapsed towards the end of 2001), but passenger numbers actually grew in 2003 and have continued to grow solidly since. (Again the yellow is largely irrelevant and exaggerates the figures. Regardless, it shows huge lift in passenger numbers growth from 2002 to 2004).

Further, even though the impact of Ansett collapse was a fraction of that claimed by CAPA, the report fails to make any mention of the fact that Ansett collapsed on September 13 2001 – two days after the attacks on the World Trade Centre sparked the biggest aviation crisis the world had seen.

One of the reasons cited by experts for the September 2001 collapse of the long-failing Ansett was the fact Virgin, then Virgin Blue, had aggressively entered the market offering vast discount fares.

Virgin Blue started flying in August 2000 and in 2001 it launched 14 new routes, “expanding to a true national domestic network”, according to Virgin itself.

In June 2001, three months before Ansett collapsed, Virgin Blue welcomed its “millionth guest on board”.

Who is CAPA?

CAPA is a Sydney-based company of about 100 employees, established in 1990.

In January last year, Informa, a British “multinational publishing, business intelligence and exhibitions group” bought CAPA for AUD$24.8m cash, although CAPA’s existing management was retained.

CAPA is now part of the Aviation Week Network, a part of Informa’s “Informa Markets” division.

Aviation Week Network states it provides “business-critical information”, “award winning journalism” and “deep data and analytics”.

CAPA describes itself as having an “unrivalled reputation for independence and integrity”, which means those reading its reports “get the whole story”.

It also claims to be “the leading provider of independent aviation market intelligence, analysis and data services covering worldwide developments” and “the world’s most trusted source of market intelligence for the aviation and travel industry”.

The company declined to respond when we asked whether it had any firm evidence to support those claims.

Cheerleading

CAPA’s report, published at 4.22pm last Wednesday (April 2), states “the Australian government is reportedly planning to reject Virgin’s request for an AUD$1.4billion support package”.

That referred to the Australian Financial Review article published that morning that the Federal Government was likely to favour facilitating a new carrier into the Australian market, rather than bailing out Virgin.

The CAPA report states that in 2001 the “Howard government bravely – and rightly – allowed Ansett to collapse”, because it had “slid downhill for (a) decade” and was “a basket case that successive CEO’s had tried to turn around and failed to do so”.

However much the same could be said for Virgin Australia, which consistently posts losses and has not paid tax in years, despite engaging in share buybacks and paying its CEO’s millions of dollars a year in salary and bonuses.

Regarding the future of Ansett being left to market forces, the CAPA report says “those were different times”.

“Even then, though economic conditions were perfect…it took years to get back to long-term market growth rates,” the report states (even though its own data shows the recovery in travel numbers was immediate).

The report then doubles down stating: “Virgin Australia is another matter, and these are (very!) different times”.

It states that “when we emerge from this social, medical and economic disaster with perhaps 15-20% unemployment, do we really want a single monopoly airline?”.

That is despite the likelihood of Australia having an unemployment rate as high as 15-20% when it emerges from the current crisis being unlikely, and vastly above the predictions of most experts.

“In the months-long period it takes for a new airline to be authorised to fly, there would be a hiatus, as Qantas consolidated its position,” the report states.

Virgin Australia and its proponents have claimed that airports would move to quickly lease Virgin’s infrastructure to Qantas if Virgin collapses.

However this has been refuted on the grounds airports are unlikely to encourage a Qantas monopoly because it would be against their own interests – if Qantas had a monopoly and raised airfares then fewer people would travel and airports would make less money.

Ownership

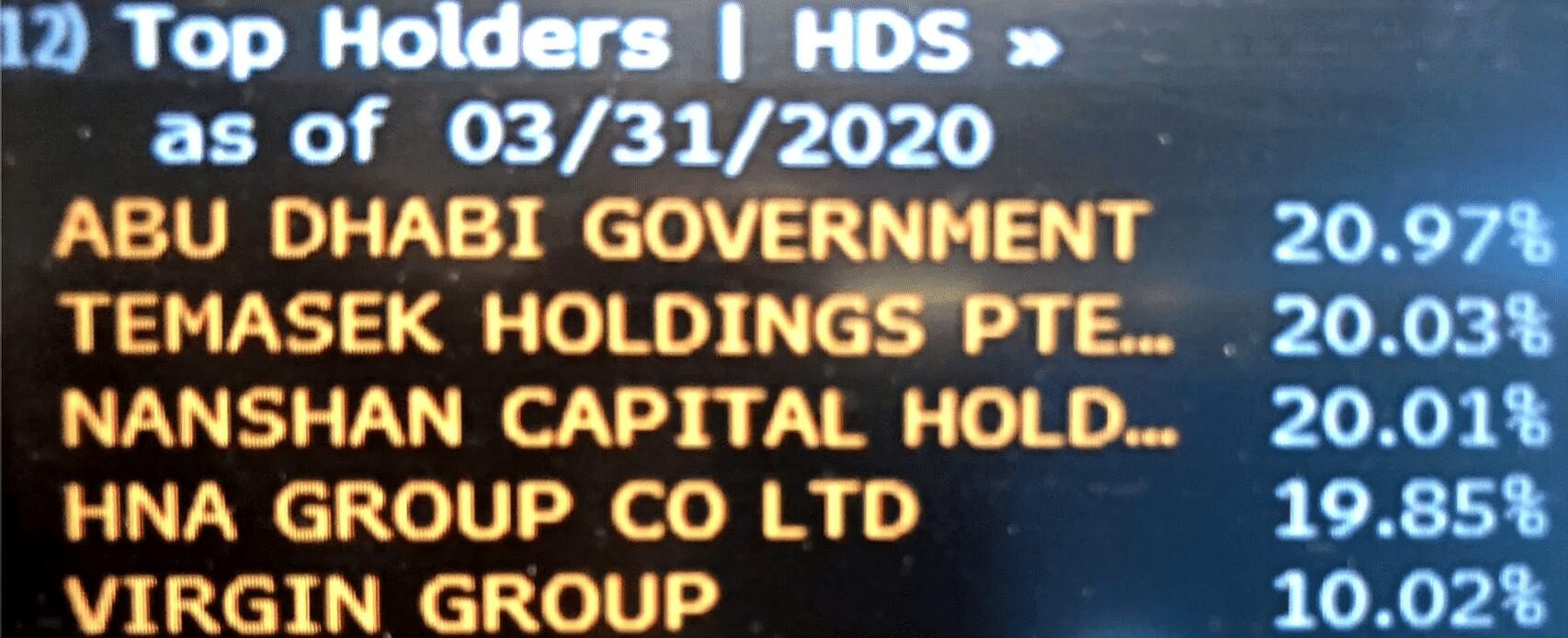

One of the biggest reasons many say Virgin Australia should not be given a taxpayer handout is that it is 91% owned by five major foreign conglomerates, two of which are owned by extremely wealthy foreign governments, and two of which are closely connected to the Chinese Government, a global super power.

Virgin Australia’s ownership structure is shown below:

Virgin Australia’s biggest shareholders. Source: Bloomberg

The biggest shareholder, Abu Dhabi, is the wealthiest city in the UAE; Temasek Holdings is the sovereign wealth fund of the extremely wealthy Singapore government; both Nanshan Capital and HNA Group, between them holding just under 40 per cent of Virgin Australia, are Chinese conglomerates closely connected to the Chinese Communist Party, and the remaining major shareholder is Richard Branson’s Virgin Group, with 10% – half that of the other four major investors.

The CAPA report states: “Maybe Etihad and/or Singapore Airlines should bail Virgin out – but this is no way to go about it.”

It continues: “Virgin Australia certainly has some substantial airlines as large minority shareholders on its registry”.

“They are there because the Australian market is very important to them. Surely they should be the ones to support Virgin Australia in its hour of need?”

The CAPA report then responds to its own question: “That does overlook the simple fact that this storm isn’t all plain sailing for them either, even if both airlines are largely government owned”.

Remarkably, the CAPA report then goes on to make this assertion: “other major shareholders are Chinese investors, and presumably if Huawei is not acceptable to this administration, neither would a Chinese owned airline be.”

The implication being that the Federal Government would somehow not welcome two of the actual owners of Virgin Australia assisting it.

CAPA provides zero evidence to support the claim, and instead ties it to the unrelated matter of the Federal Government, and other allies such as the US, having serious security concerns over the Chinese giant Huawei operating key telecommunications infrastructure.

Examining the financials of one of Virgin Australia’s major shareholders puts in perspective the airline’s demands that Australian taxpayers bail it out.

The latest accounts of the Singapore Government’s Temasek Holdings show it has S$313bn (AUD$364bn) in total assets, which is 1,300 times its share of the $1.4bn sought by Virgin Australia, based on Temasek’s stake in Virgin Australia.

Temasek has more in assets that the Federal Government has spent in all its “unprecedented” COVID-19 stimulus packages combined.

It has been reported that Virgin Australia’s owners are unable to bail out the airline because they have “liquidity” issues.

Temasek’s accounts show that 36 percent of its assets are liquid, such as held in the form of cash or “cash equivalents”, representing A$131bn.

That is enough to provide the whole $1.4bn sought by Virgin Australia 93.6 times over.

And that is just one of Virgin Australia’s five major investors.

Virgin Australia’s owners have indicated they have no intention of bailing out the airline and are instead, through Virgin Australia CEO Paul Scurrah, the airline’s political lobbyists, and its close ties to some sections of the media, attempting to have Australian taxpayers foot the bill, in a move that would to protect their investments.

Virgin Australia’s struggles are nothing new, with the airline described as “at tipping point” last August, after posting its seventh consecutive annual loss.

Virgin’s Scurrah has launched an expensive marketing campaign (below) trying to convince the government to have the taxpayer foot the bill, with advertisements reading much like CAPA’s “independent” report.

A Virgin Australia advertisement running last week. Source: Supplied

Angus Taylor

Virgin Australia is throwing considerable resources at its already extensive and multi-pronged lobbying and influence network – much of which occurs behind closed doors – and serious concerns have emerged over whether taxpayer interests will be properly protected as the foreign-owned airline tries to fight its way into the public purse.

As previously revealed, Virgin Australia’s Scurrah, or his predecessor, John Borghetti, have, over the past two years alone, personally handed Prime Minister Scott Morrison, Treasurer Josh Frydenberg and more than 50 other Coalition MP’s, “gifts” collectively worth hundreds of thousands of dollars in the form of members to The Club, the airline’s top-tier executive lounges.

The Club, is the Virgin equivalent of the Qantas Chairman’s Lounge.

Qantas also lavishes memberships to its most exclusive club on scores of MP’s, and their spouses, across the political divide, which also raises concerns over that airline wielding undue political influence at a time when it too has its hand out for taxpayer funded support.

Our investigations have found numerous MP’s have either failed to disclosure their memberships to The Club, or have failed to disclose those gifts properly.

On Friday it emerged Federal Energy Minister Angus Taylor was among those MP’s who had failed to disclose having been offered, and accepted, valuable airline memberships.

The disclosure register for Mr Taylor, who has been in federal parliament since 2013, did not disclose any memberships or flight upgrades from any airlines between 2013 and last week.

After two days of questions, Mr Taylor’s office on Thursday evening said the MP’s register had been updated to show that both he and his wife had been gifted memberships to both Virgin’s The Club and the Qantas Chairman’s Lounge.

However only the disclosures register for the current parliament was updated, meaning thousands of dollars of gifts from Virgin Australia to Mr Taylor and his wife could remain undeclared if either of them were members of the exclusive airline club before the federal election in May last year.

When we put this to Mr Taylor’s office, a spokesman said the minister was seeking advice as to whether earlier gifts needed to be disclosed.

“We are looking into that and if that is required we will update as appropriate,” the spokesman said.

No updates have yet appeared.

This article first appeared at anthonyklan.com