EXCLUSIVE

The directors of Optus owner Singtel were given major pay rises just weeks before the telco suffered one of the biggest data breaches in Australia’s history.

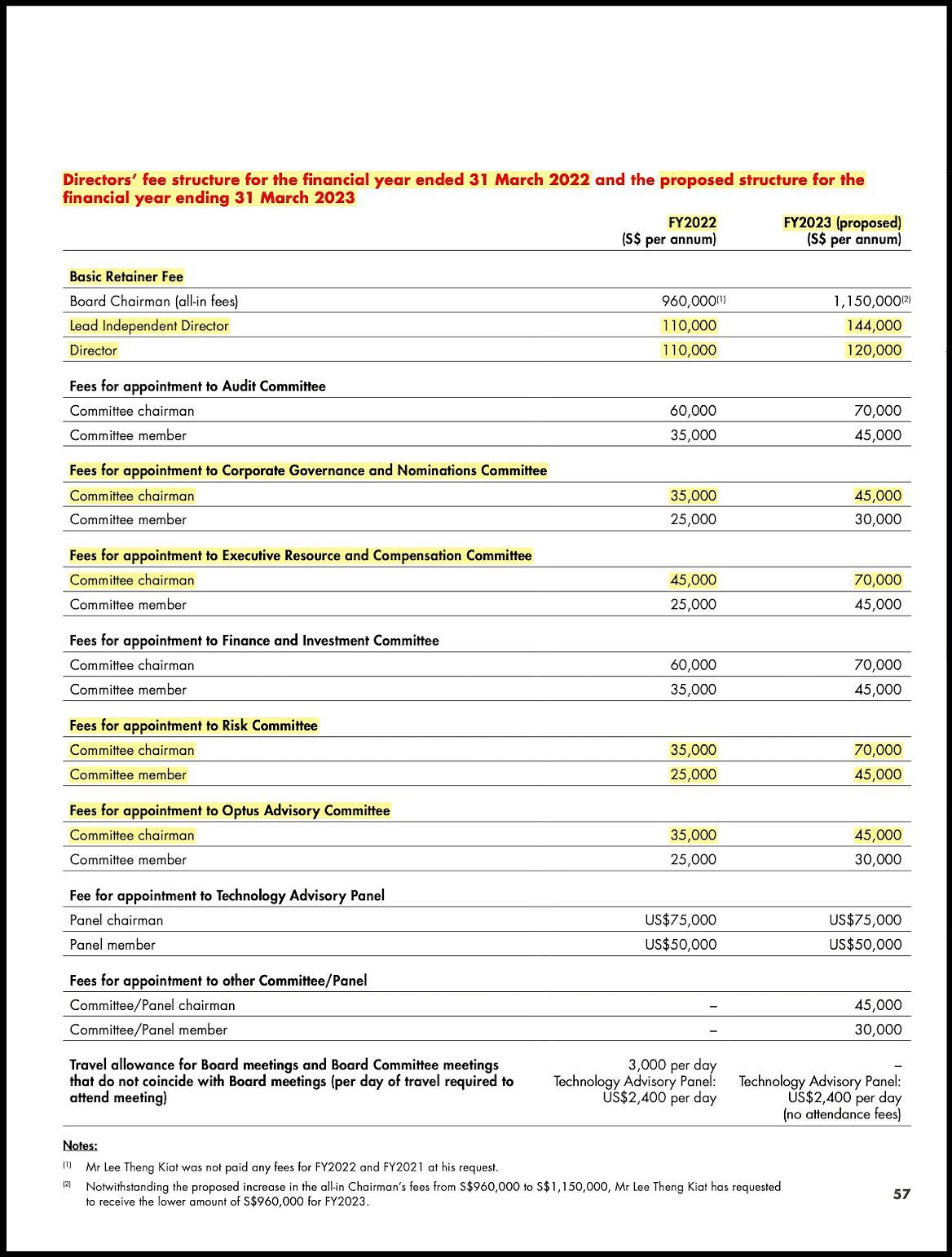

Payments to directors for sitting on various board “committees” – such as the Audit Committee, Risk Committee and the “Optus Advisory Committee” – surged by up to 100 per cent.

Singtel director Gail Kelly, formerly CEO of Westpac, oversaw the pay rises in her role as chair of Singtel’s “Executive Resource and Compensation Committee”.

Kelly was one of the biggest beneficiaries, Singtel’s annual report shows.

The role of Compensation Committee chair received a raise of almost 80 per cent, soaring from SD$45,000 ($49,450) a year to SD$70,000 ($77,000).

Singtel’s accounts show members of the Risk Committee received an 80 per cent pay rise, from S$25,000 ($27,480) a year to S$45,000 ($49,450).

Payments to the Risk Committee chair, Singtel director Leo Swee Lian, doubled – from S$35,000 ($38,550) a year to S$70,000 ($77,000).

“Payments to Singtel’s Risk Committee chair Leo Swee Lian doubled”

Those “committee” payments are on top of Singtel’s standard director fees, which also grew, from S$110,000 ($120,900) a year to S$120,000 ($131,890), Singtel’s annual report states.

The pay rises were approved on July 29, six weeks before Optus disclosed the mass data breach, where personal details of 9.8 million current and former customers were stolen.

Singtel’s accounts show that for the year to March 31, before the pay rises, Kelly was paid S$264,000 ($290,080) in total directors’ fees.

That included payments as Compensation Committee chair and S$35,000 ($38,460) “as the chairman of the Optus Advisory Committee”.

The Singtel accounts show “Optus Advisory Committee” members received a pay rise of 20 per cent, to $S30,000 ($32,970) a year.

Kelly was also the chair of the Optus Advisory Committee, a role that received a raise of almost 30 per cent, to S$45,000 ($49,460) a year.

“Members of the Optus Advisory Committee have received annual pay rises of 20 per cent”

“Singtel engaged an external independent consultant, Willis Towers Watson (Singapore) to undertake a bench-marking review for non-executive directors’ fees,” the annual report says.

“Pursuant to that review, it is proposed to revise the remuneration framework for the non- executive Directors to bring the Directors’ fees in line with market norms, and to ensure that the company is able to attract and retain the right calibre of directors necessary to contribute effectively to the Board in an ever-increasingly competitive market”.

The revelations come as Medibank, Australia’s biggest health insurer, this morning confirmed a ransomware group had begun releasing personal customer data, including health claims data, on the dark web.

Last month personal data of 9.7m current and former Medibank customers was stolen by hackers.

Medibank has refused to pay a ransom, saying doing so would encourage illegality, and today said it expects “the criminal to continue to release files on the dark web”.

Payments to directors for sitting on “committees” surge by up to 100 per cent. Source: Singtel 2022 Annual Report

In the days after its breach, some Optus customer data was released online by an entity threatening to release more unless a US$1m ($1.54m) ransom was paid.

Shortly afterwards, the posts detailing the threats were deleted and the person wrote “we will not sale (sic) the data to anyone”.

It has been reported that an Optus “spokesperson” has said no ransom was paid, however, unlike Medibank, Optus has made no written statement regarding whether or not it paid a ransom.

Optus CEO Kelly Bayer-Rosmarin refused to respond to The Klaxon when asked directly whether Optus had paid a ransom.

“Optus CEO Kelly Bayer-Rosmarin refused to respond to The Klaxon when asked directly whether Optus had paid a ransom”

Singtel, which is controlled and owned by the Singaporean Government, owns 100 per cent of Optus, which is Australia’s second biggest mobile carrier.

Most of Singtel’s profit comes from Australian consumers.

The Singaporean Government owns about 52 per cent of the shares in Singtel, through its sovereign wealth fund Temasek.

Singtel’s shareholders voted overwhelmingly in favour of the director pay rises at the group’s annual general meeting on July 29, with 99.74 per cent of the vote in favour.

Among the major beneficiaries of the Singtel pay rises is another long-time former Westpac executive, Australian businessman John Arthur.

He had been a member of Singtel’s Optus Advisory Committee since 2019, and was appointed to the Singtel board on January 1 this year.

Arthur held “various executive positions” at Westpac from 2008 to 2020, including chief operating officer and “consultant to the chief executive”.

(A 2012 media report describes Arthur as Gail Kelly’s “go-to man” at Westpac.)

On March 1 Arthur was appointed to Singtel’s Risk Committee and to its Audit Committee.

Gail Kelly, Paul O’Sullivan and John Arthur (L-R). Source: Supplied

Under the pay rises, Arthur’s director fee increased from S$110,000 to S$120,000; his fee for being a member of the Risk Committee went from S$25,000 to S$45,000; his fee for being on the Audit Committee went from S$35,000 to S$45,000; and his fee from being a member of the Optus Advisory Committee went from S$25,000 to S$30,000.

At March 31 there were nine Optus Advisory Committee members, of which four were Singtel board members.

They are Kelly, Arthur, Singtel CEO Yuen Kuan Moon and Singtel chair Lee Theng Kiat.

Other members of the Optus Advisory Committee include Paul O’Sullivan, who is the chair of Optus (though not Singtel) and ANZ Bank; John Morschel, a former director and chair of ANZ Bank; and businessman David Gonski, a former director of ANZ Bank and Westfield Australia.

“Other members of the Optus Advisory Committee include Paul O’Sullivan, John Morschel and David Gonski”

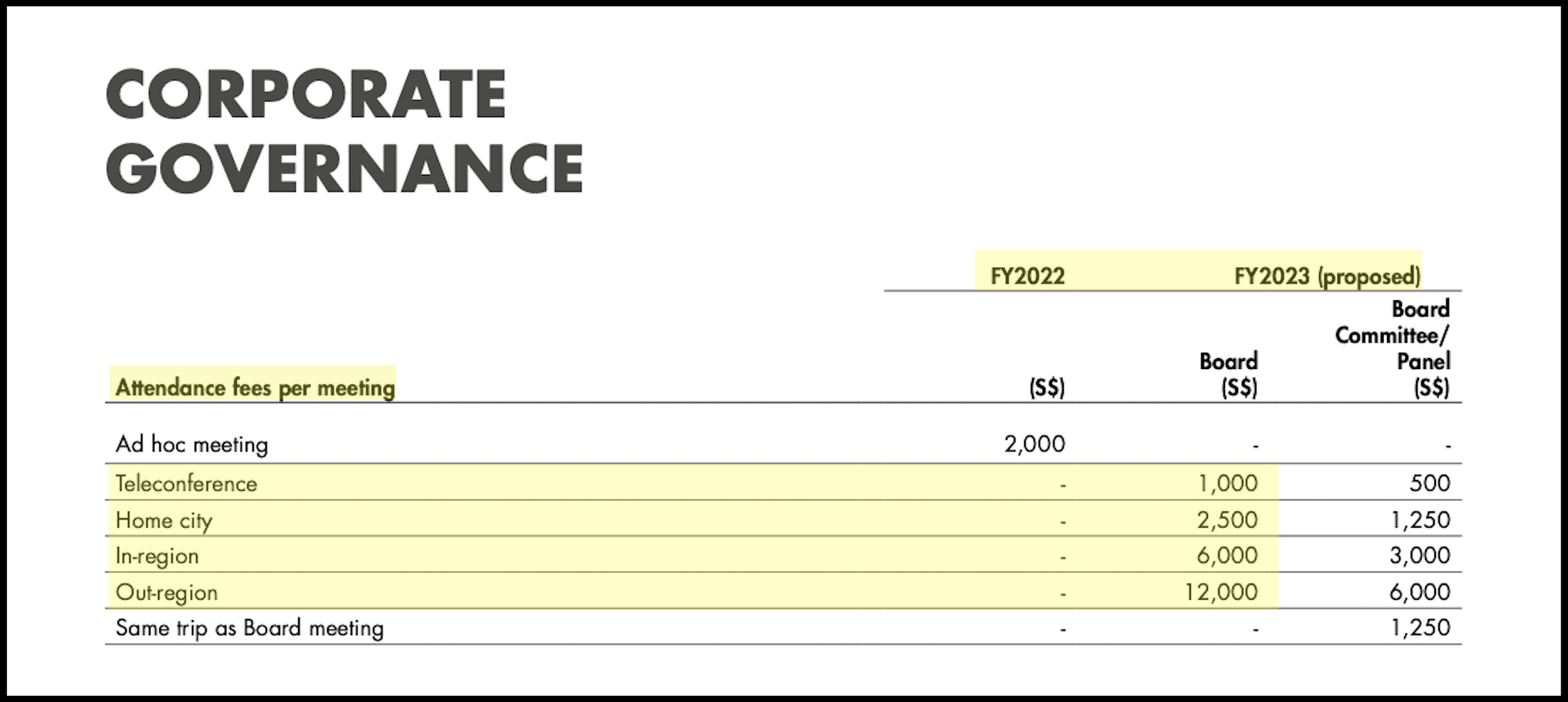

Singtel’s 2022 annual report shows directors were previously not paid extra for attending scheduled board meetings, but will now be paid S$1000 for each scheduled meeting they attend via teleconference and $2,500 for each scheduled meeting they attend in their home city.

A S$3000 ($3,300) a day “travel allowance for board meetings” has been scrapped – but replaced by payments of up to $S12,000.

How The Klaxon broke the Trustwave story, October 10. Source: The Klaxon

Directors will now be paid S$6,000 ($6,600) for scheduled board meetings they attend “in region”, and S$12,000 ($13,205) for meetings they attend “out region”, the report shows.

Despite the seriousness of the mass Optus data breach, neither Arthur or Kelly have fronted the media since the scandal broke.

Also notably absent has been Gladys Berejiklian.

Berejiklian resigned as NSW Premier in October last year after it was announced she was the subject of a state corruption probe.

In February Optus CEO Rosemarin announced she had appointed Berejiklian, the former NSW Premier, to a senior role.

Berejiklian resigned as NSW Premier in October last year after she was named as officially under investigation by a state corruption probe.

The NSW Independent Commission Against Corruption (ICAC) is yet to make its findings.

Bayer-Rosmarin is facing widespread calls to resign, including over her claims that the Optus breach was a “sophisticated” attack, which is almost certainly not true.

New fees for attending scheduled board meetings, including via “teleconference”. Source: Singtel 2022 Annual Report

The Australian Government, whose peak cyber body the Australian Cyber Security Centre conducted a week-long review at Optus into the incident, says it was a “basic” hack, directly and repeatedly refuting Bayer-Rosmarin’s claims.

Last month The Klaxon revealed that Singtel runs a “world-class” global cyber security business, Trustwave, that it bought for over $1 billion in 2015.

Since then Bayer-Rosmarin and Singtel chair Yuen Kuan Moon have repeatedly refused to comment when asked whether Trustwave had been in place to protect Optus customers.

Please DONATE HERE to help keep us afloat. Thank you!

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.