Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE

One-third of investors in a uranium exploration and mining company rejected plans to give Warren Mundine and other directors “loan funded shares” worth more than $2 million — but the lucrative remuneration was approved anyway.

Company filings for Aura Energy show just 65.7 per cent of shareholders approved the issue of 22 million “loan funded shares” to Mundine and four other directors last November, with 34 per cent opposed.

The company’s $2.47m in “share-based payments” to “directors, executives and senior consultants” were a “primary driver” of its $6.8m loss in the year, which was double its loss of $3.4m the year before, the company’s audited accounts state.

Mundine — who along with Senator Jacinta Price was the face of the “No” campaign against the Indigenous Voice to parliament, railing against the “elite” — is one of three directors on the company’s “remuneration committee”.

If 25 per cent or more of shareholders reject the annual “remuneration report” overall — rather than payments regarding individual directors — twice in a row, then a vote must be put to shareholders on whether to spill the board.

Resolutions regarding payments to individual directors only need a “simple majority” of 50 per cent or more to pass.

(At the last year’s meeting 14.7 per cent voted against the remuneration report overall. The next AGM will be held in two weeks, on November 29.)

It has also emerged Aura Energy previously broke listing rules by issuing too many shares and was banned by the ASX, from October 2020 until June 30 2022, from issuing new shares or other securities without “prior security holder approval”.

Aura Energy’s annual report, released last week, shows the “share-based payments” to “key management personnel” have caught the eye of its auditor Hall Chadwick, which flagged them as one of two “key audit matters”.

That was because of the “significance of the transactions” to the company’s “financial position and performance”, the company’s auditor said.

Please support us and SUBSCRIBE HERE!

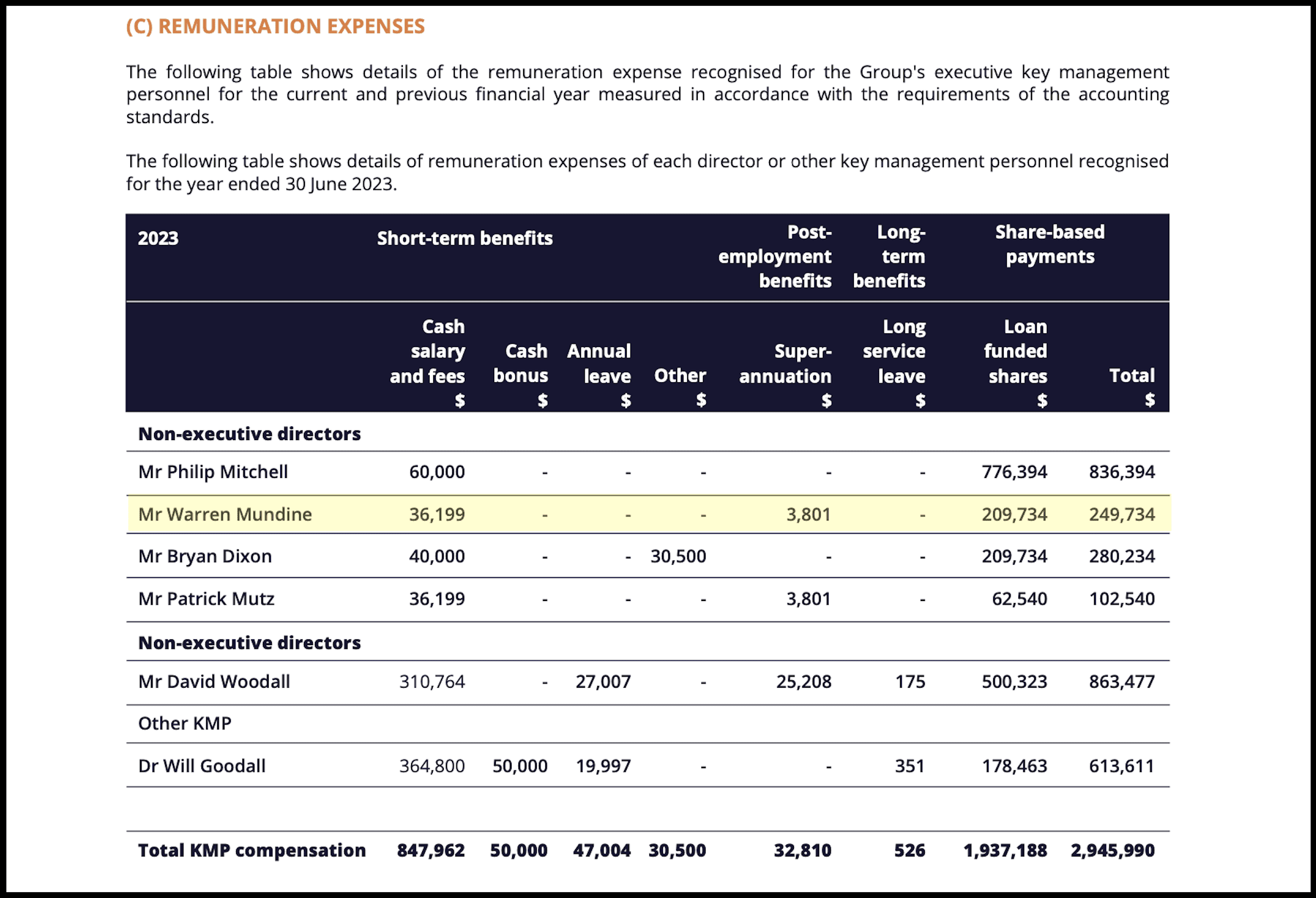

Mundine received “total remuneration” of $249,734 in the year to June 30. Source: Aura Energy Annual Report

It was also because of the “level of judgement required” in “evaluating management’s application” of the accounting standards that stipulate how such payments are to be valued.

In the report last week Aura Energy said it would “review of our overall approach to remuneration” and that it has “retained experienced international advisors to review the situation”.

It would provide details on “steps we have taken to strengthen our decision-making diversity” — in next year’s annual report.

Mundine, who was appointed a non-executive director in December 2021, was given 3 million “loan funded shares” in Aura Energy, receiving $390,000 reported “remuneration” in his first 18 months.

The shares, issued in three tranches, have “vesting” conditions that must be met before they can be sold, including share price hurdles (35c, 50c and $1.00 for each tranche).

Since being appointed to the part-time role, Mundine has received reported remuneration, including his cash salary, of at least $403,000.

That is comprised of the value of the 3m shares “recognised” as “remuneration expenses” up until June 30 this year ($328,459), and his cash salary of $40,000 a year.

The value of the loan funded shares, which depends on the company’s share price performance, has been calculated by the company “in accordance with the requirements of the accounting standards”, its accounts state.

Mundine and Price fronted the Advance network. Source: Advance/Fair Australia

Mundine and other directors were given shares in Aura Energy in two batches of “loan funded shares”, in December 2021, and November last year.

Each batch of shares was issued in three tranches, with each vesting on different dates — the first being December 22 next month — and at respective share price hurdles of 35c, 50c and $1.

Over the past month shares in Aura Energy have traded between 28c and 32c.

(The share price hurdles are required to be met 10 days of any 20-day period).

Mundine did not respond to multiple requests for comment.

Please SUBSCRIBE HERE and support our quality journalism.

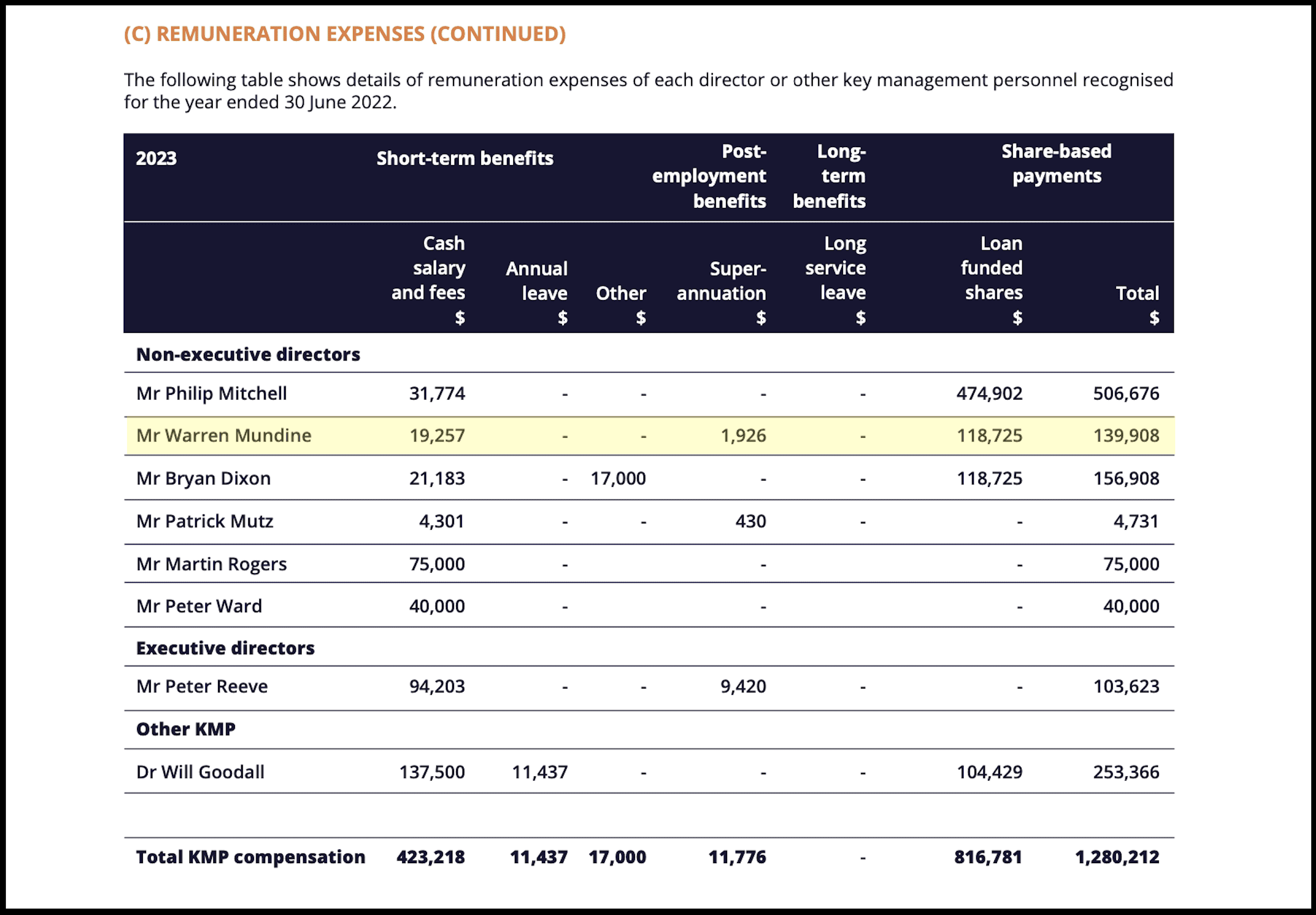

Mundine received “total remuneration” of $139,908 in the six months to June 30 2022. Source: Aura Energy Annual Report

The “No” campaign had deep ties to the mining and fossil fuels sector.

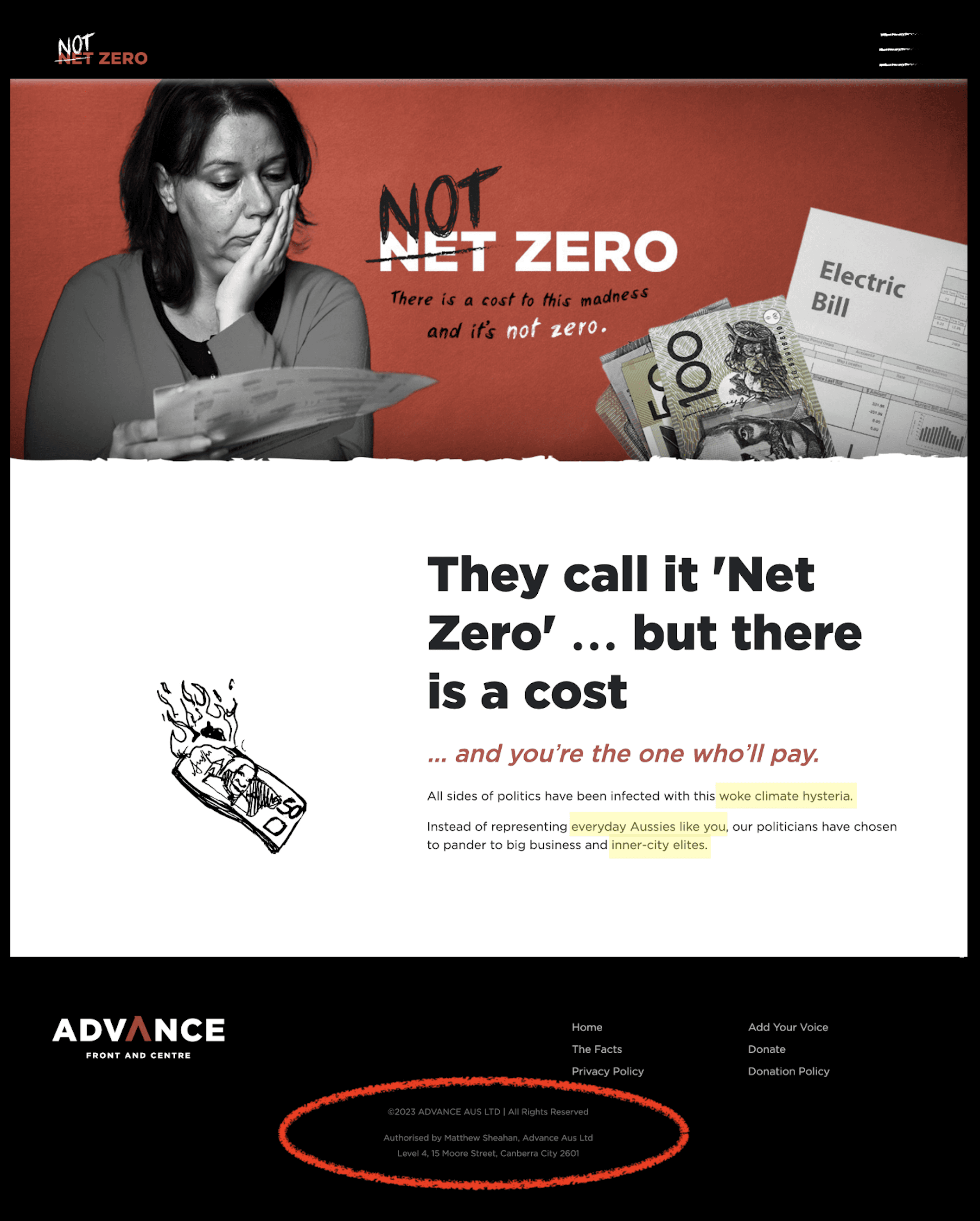

As previously reported, Advance (Advance Aus Ltd), the centre of the network of at least seven interconnected entities forming the No campaign (fronted by Mundine and Price), has been running an aggressive misinformation campaign in favour of fossil fuels interests.

The campaign by Advance, called “Not Zero”, claims to represent the interests of “everyday Aussies” and attacks “inner-city elites”.

Source: Advance

Similarly, Advance’s “No” campaign — which falsely claimed to be a “grassroots” movement — claimed to represent “ordinary Australians” with “mainstream values”, and railed against “inner-city elites”.

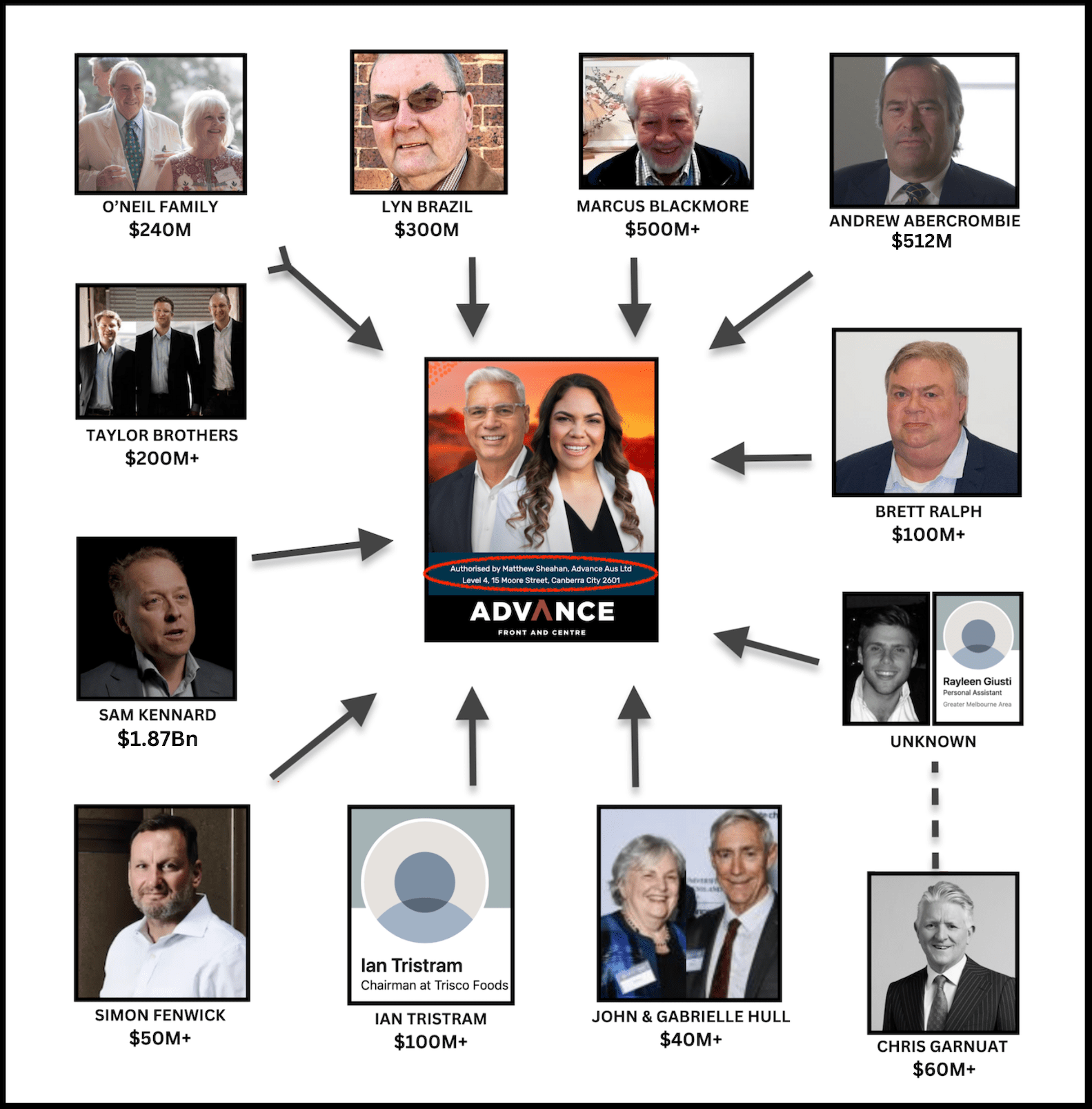

As previously reported, it was in fact bankrolled by a handful of the nation’s super-rich: the donors disclosed in the most recent filings for Advance, for the year to June 2022, boil down to just ten entities.

Of those, all have net assets in the tens of millions of dollars — and at least seven have assets of $100m or more.

As revealed by The Klaxon, two of the three directors of “Advance” listed fake residential addresses with regulators; none of the at least seven entities in the shadowy network had a telephone number — and the whole outfit was “run” from a fake “national headquarters” in Canberra’s CBD.

Mundine is also a director of Fuse Minerals, having been appointed to the company as chairman in March.

Please support us and SUBSCRIBE HERE!

The listed donors to Advance. Source: AEC/Various. Graphic: The Klaxon

According to his LinkedIn bio, Mundine’s first appointment to the board of a mining company was his appointment as non-executive director to Aura Energy on December 21, 2021.

On that same day, the day of the company’s 2021 annual general meeting, shareholders were asked to approve the “remuneration report” as well as to approve the issue of the 20m “loan funded shares”, including 2m to Mundine.

On the day of the AGM, managing director and CEO Peter Reeve resigned, as did directors Peter Ward and Martin Rogers.

New appointments that day were Phillip Mitchell as non-executive chairman and Mundine and Bryan Dixon as non-executive directors.

The remuneration report overall was overwhelmingly adopted, with 99.6 per cent of shareholders voting in favour.

For the “loan funded shares” there was less support.

Regarding issuing the shares to Mundine, who started as director that same day, 82 per cent voted in favour, and 18 per cent against.

Votes for and against the issuing of shares to other directors ranged between 85.5% and 86.5% in favour, and between 13.5% and 14.5% against.

(The 2021 shares were granted and issued on April 1 last year.)

Advance claims to represent “mainstream Australians” and attacks “inner-city elites”. Source: Advance

Objections to the second batch — 22m of “loan issued shares” put to shareholders at the following AGM, on November 29 last year — was stronger.

So too were objections to that year’s remuneration report – 14.2 per cent of shareholders voted against it, with 85.6 per cent in favour (0.3 per cent abstained).

The board put to shareholders the issuing “loan funded shares” to Dixon (1m), Mitchell (2m), Mundine (1m), Mutz (2m), and 16m to Woodall, who had been appointed Aura Energy managing director and CEO the month before, in October 2022.

For each of the directors individually, shareholders voted 34 per cent against and 65.7 per cent in favour (0.3 per cent abstained).

The 22m shares were issued regardless, with the 22m shares “granted” that same day.

Please SUBSCRIBE HERE and support our quality journalism.

Since the Voice referendum Mundine has been spruiking Fuse Minerals, which is seeking to raise money in a planned IPO. Source: Twitter/X

The annual report released last week shows Mundine was one of three members of the “remuneration committee”, along with Bryan Dixon and Patrick Mutz.

The annual report states the $6.8m loss for the year to June was “primarily driven by general and administrative expenses of $2,808,555; employee benefits expenses of $913,929; (and) share based payments of $2,472,578”.

The $2.47m in share based payments to was “offset by interest income of $62,892”, making the impost $2.41m, it states.

The audits for both 2021-22 and 2022-23 flag the “share based payments” as one of two “key audit matters”.

Share based payments a “key audit matter“. Source: Aura Energy FY22 Annual Report

“During the year, the Consolidated Entity incurred share-based payments totalling $2,472,578 from the issue of loan funded shares,” states the audit by Hall Chadwick’s Doug Bell.

“Share-based payments are considered to be a key audit matter due to…the significance of the Consolidated Entity’s financial position and performance; and the level of judgment required in evaluating management’s application of the requirements of AASB 2 Share-based payment.

“A Monte Carlo model was used to value the loan funded shares with market based vesting conditions. This process involved significant estimation and judgement required to determine the fair value of the equity instruments granted,” the audit states.

The audit for 2021-22 makes the same statements regarding the “share-based payments totalling $1,187,254” from the issue of the “20 million loan funded shares” incurred by the company that year.

Aura Energy, based in Melbourne, has “two key projects” — the “Tires Project” in Mauritania, which it is “preparing for development”; and a proposed “Haggan Project” in Sweden.

It is not unusual for mining exploration companies to post losses in early years of operation. It is also not unusual for small mining exploration companies to fail.

Aura Energy has raised tens of millions from the public via various share raisings.

It has accumulated losses of $45.733m and has $39.803m in total equity.

Please support us and SUBSCRIBE HERE!

Peter Dutton has been agressively pushing non-existent small-scale nuclear technology. Source: The Klaxon

Under leader Peter Dutton the federal Liberal Party has been aggressively advocating nuclear energy, in particular “small modular reactors” as an answer to curbing emissions.

That’s despite the fact the technology doesn’t exist in any cost-effective form (it is estimated to be up to nine times more expensive than renewables).

On July 7, which happened to be as the world recorded its hottest week on record, Dutton delivered a speech attacking “renewable zealotry” and calling for Australian taxpayers taxpayers to fund research of the nuclear micro-reactors — which experts say are a decade away from being viable, if ever.

“The only feasible and proven technology which can firm up renewables and help us achieve the goals of clean, cost-effective and consistent power is next-generation nuclear technologies, which are safe and emit zero emissions,” Dutton’s said.

“Namely, small modular reactors or SMR’s.”

“The only feasible and proven technology which can firm up renewables and help us achieve the goals of clean, cost-effective and consistent power is…small modular reactors” — Peter Dutton

Aura Energy is pushing a very similar line.

Last week’s annual report states that “20th century nuclear power featured very large, capital-intensive reactors” which were “burdened by long construction lead times, pervasive project delays and cost overruns”.

“This image of early nuclear power generation will be a tale from the past,” it states.

“Fast-growing economies of the 21st century such as China, India, and elsewhere can choose more cost-effective, flexible options promised by the incipient development of Small Modular Reactors (“SMRs”) which offer an entirely new, low capital, replicable, incremental development cycle for nuclear power”.

“China, India, and elsewhere can choose more cost-effective, flexible options promised by the incipient development of Small Modular Reactors” — Aura Energy

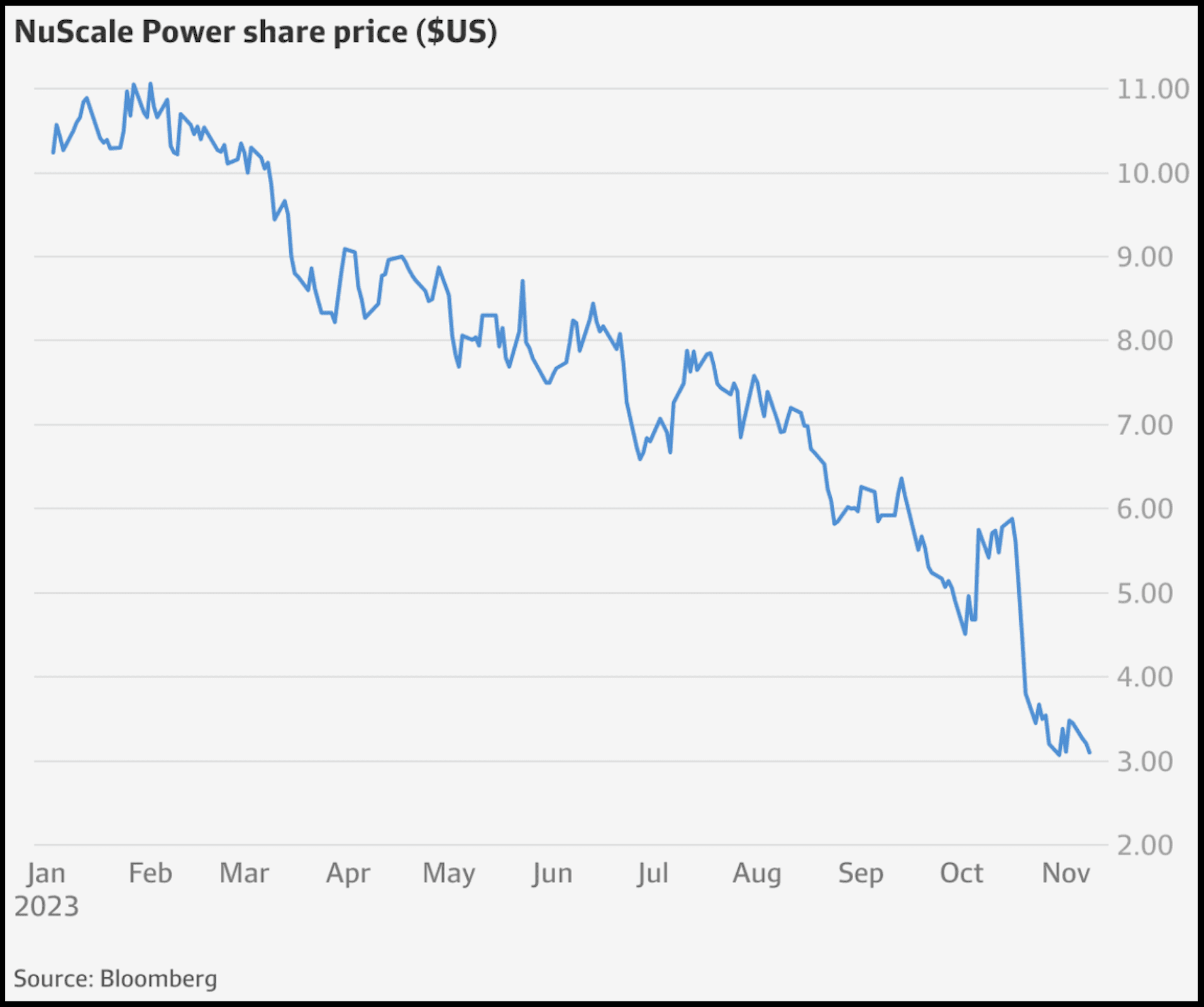

On Thursday a “flagship” small modular nuclear reactor project in the US collapsed, “taking with it $US600m ($930m) of American taxpayers money”.

US companies Develop NuScale and Utah Associated Municipal Power Systems said they would terminate the project “after cost blowouts scared off potential customers”, reports The Australian Financial Review.

“On Thursday one of a handful of modular nuclear reactor projects in the US collapsed, costing American taxpayers $US600m ($930m)”

The planned 462-megawatt “small modular reactor” in Utah was “one of a handful aimed at demonstrating the commercial viability” of the reactors.

NuScale said in a statement: “It appears unlikely that the project will have enough subscription to continue toward deployment.

NuScale Power’s share price this year. Source: Bloomberg/AFR

Aura Energy’s annual report last week shows that of its five current directors, all attended its eight “full meetings of directors” held in the year to June 30, with the exception of Mundine, who was absent from two of the meetings.

Six of the eight meetings were held online and two were held in-person, the report states. (The attendance of online versus in-person meetings is not stated.)

The annual report states Mundine was eligible to attend two meetings of the “audit committee” (of which he attended one); while its two other members (directors Munz and Dixon) attended both.

Regarding the remuneration committee, Mundine attended both meetings, as did its two other members Munz and Dixon.

Anti-Voice campaigning by Advance and its arm “Fair Australia”. Source: Advance/Fair Australia

Aura Energy’s 2021-22 annual report states the ASX in October 2020 “concluded that the Company had exceeded its placement capacity under Listing Rule 7.1”.

“Consequently, the Company is unable to issue new securities without prior security holder approval until 30 June 2022, unless the issue comes within an exception in Listing Rule 7.2.

“The ASX has also determined that the Company is ineligible to seek shareholder approval pursuant to Listing Rule 7.1A to entitle it to an additional 10% placement capacity until at least its annual general meeting after 30 June 2022,” Aura Energy states.

Last week’s annual report states it is conducting a “review of our overall approach to remuneration” and has “retained experienced international advisors to review the situation” and in next year’s annual report it will provide details on “steps we have taken to strengthen our decision-making diversity”.

Chairman Mitchell states: “I will join the (remuneration) committee”.

“The remuneration approach that we have taken to date, where the predominant long-term incentive tool for both executive officers and Non-Executive Directors’ has been loan funded shares, was satisfactory for an exploration company but is not appropriate for a near-term producer,” its FY 22-23 annual report states.

“To this end, Patrick (Muntz) is leading a review of our overall approach to remuneration and has retained experienced international advisors to review the situation”.

Do you know more? anthonyklan@protonmail.com

WAIT!! BEFORE YOU GO!! Truly independent, quality journalism is vital to our democracy – as you can see from the above. We receive zero funding from anywhere other than support from our readers. We need your help to keep doing this work. Please SUBSCRIBE HERE or support us by making a ONE-OFF DONATION. Thank you!

BEFORE YOU GO! Help us stay afloat and telling these stories. Please SUBSCRIBE HERE or support us by making a DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.