Appreciate our quality journalism? Please subscribe here

DONATE

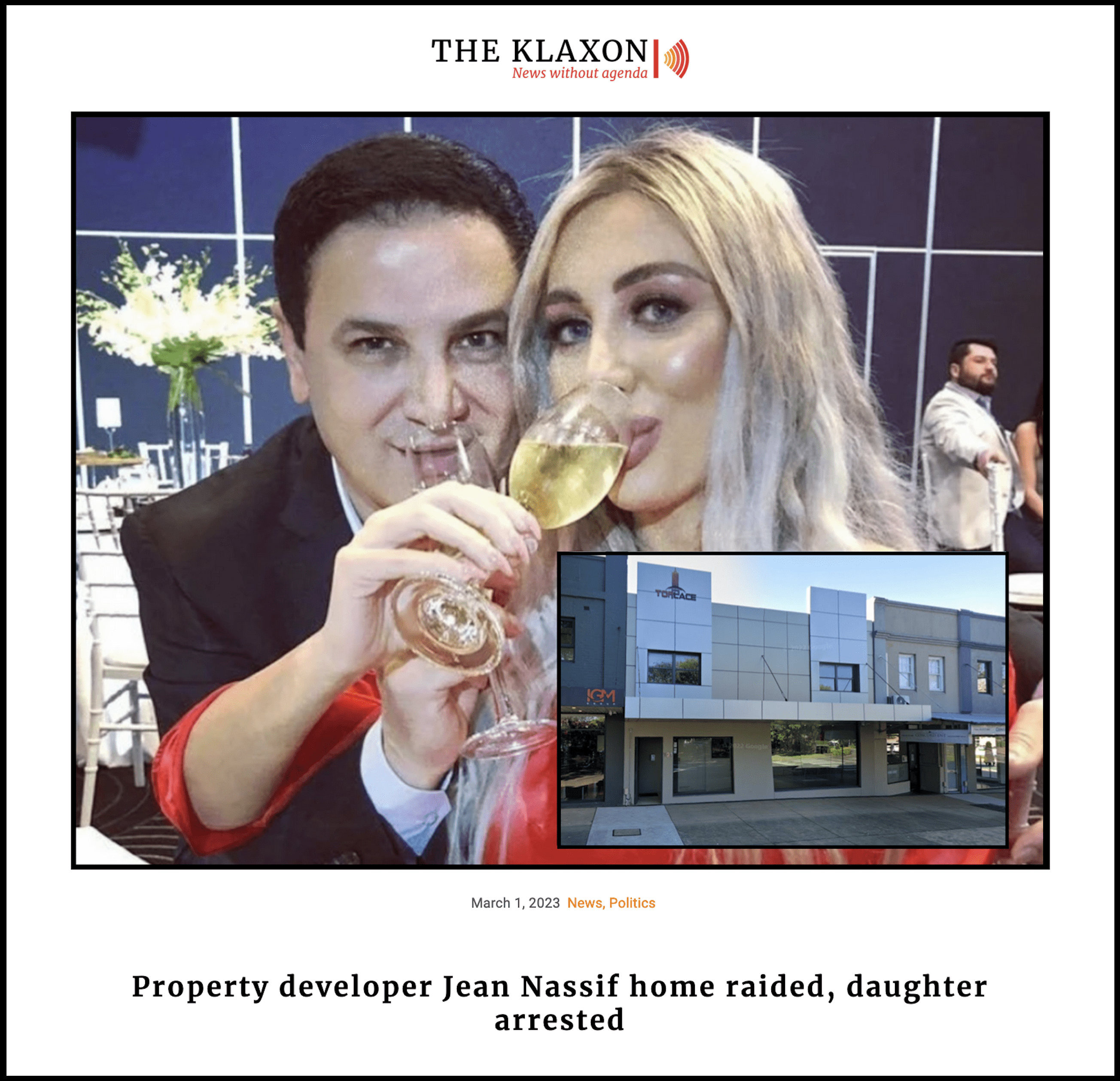

The ex-wife of fugitive property tycoon Jean Nassif is refusing to hand back a $120,000 Range Rover bought with money from the failed Toplace development empire — while a $300,000 Lamborghini is “missing”.

A bombshell administrators report into Toplace — which was one of Australia’s biggest private developers before being swept into administration last July — shows Nassif shifted more than $18 million offshore.

That included $17m transferred to two Beirut bank accounts, one owned by Nassif and the other owned by Bakhos Khazen Nassif, believed to be Nassif’s brother.

Nassif, who founded Toplace in 2009 and was its sole director, fled to Lebanon in the months before the group collapsed and there is an outstanding warrant for his arrest.

The report to creditors by administrators dVT Group reveals Toplace — which had estimated debts and assets of $1 billion — had likely been trading while insolvent since “at least” 2020.

In the unfolding saga surrounding the collapse of the Toplace development empire, the narrative takes a twist with Jean Nassif’s ex-wife’s refusal to return a $120,000 Range Rover, a luxury bought amidst the empire’s more prosperous days. This refusal adds layers to an already complex situation, with the empire’s assets under scrutiny. Amid this turmoil, a $300,000 Lamborghini has mysteriously gone missing, further complicating the financial unraveling of Nassif’s once-thriving property dynasty.

As investigations continue, those interested in the high-stakes drama of real estate can view parallels in the world of online gaming, where fortunes can also shift dramatically. In contrast, Cosmo Casino offers a steadier prospect with its $1 deposit feature, allowing players to embark on their gaming adventure with minimal risk, illustrating the diverse ways fortunes are pursued and protected in today’s world.

Assets of the group included a Sydney Harbour-front mansion in inner-west suburb of Chiswick — the “matrimonial home” of Nassif and his “ex-wife” Nisserine — and five luxury vehicles, the administrators said.

Mystery surrounds one of those vehicles, a Lamborghini 636, with an estimated value of between $263,000 and $325,000, which had been “transferred” to an “undisclosed party”.

“Vehicle transfer conducted pre-appointment to an undisclosed party,” says the report.

“Ongoing investigations underway to locate proceeds of sale of vehicle”.

In 2019 Nassif presented Nisserine “Nissy” Nassif with a Lamborghini 636, with the exchange making headlines after Nisserine posted it to social media.

Please SUBSCRIBE HERE and support our quality journalism

Nisserine “Nissy” Nassif with the Lamborghini 636. Source: Instagram

Other vehicles bought with Toplace money included two Range Rovers, a Mercedez Benz, a Ford Mustang and a dual-cab Dodge Ram pick-up truck, the report says.

One of the Range Rovers, with an estimated value between $104,000 and $127,000, “remains in the possession of (Nassif’s) ex-wife” — who is refusing to hand it back.

Nisserine Nassif had rejected an offer from administrators to help her purchase a “more affordable” vehicle, the report states.

The administrators had “proposed an offer to repossess the vehicle” and to hand over some of the proceeds to “provide a more affordable option to Nissine”.

“This offer was rejected,’ the report says.

“This offer was rejected” — Administrators dVT Group

The administrators said NSW Transport had put a freeze on the car being sold and the “broader strategy remains to sell the asset” once “legal proceedings have been resolved”.

The Mercedes, an M-AMG E63 S, with an estimated value of between “$103,000 and $126,000”, remained in the hands of Nassif’s 28-year-old daughter Ashlyn, a lawyer.

Ashlyn — who is due to appear in court on Wednesday on fraud allegations — had been provided with the vehicle as part of her employment at Toplace, the report states.

Ashlyn Nassif. Source: Supplied

The report states a transfer of ownership freeze had been also placed over the Mercedes, which administrator said it planned to repossess and sell.

No freeze had been placed over the Lamborghini, which had been transferred, to an “undisclosed party”, “pre-appointment” of the administrator.

The administrator’s report, dated February 1, states the bank account of Toplace Pty Ltd shows $60,000 in outgoings under the description “Loan Ashlyn” and $360,000 in outgoings under the description “Nissy Nassif”, the report shows.

The Toplace collapse is part of an even bigger political scandal, tied to a far-right “Christian” group called the NSW Reformers and allegedly involving two brothers of former NSW Premier Dominic Perrottet.

“The Toplace collapse is part of an even bigger political scandal”

The scandal is the subject of an ongoing formal probe by the NSW Independent Commission Against Corruption (ICAC), which is tipped to culminate in high-profile public hearings.

Key alleged figure in NSW Reformers scandal, Christian Ellis. Source: The Klaxon

In June 2022 NSW Liberal MP Ray Williams told state parliament that senior Liberal Party members had been “paid significant funds” by Nassif to get councillors elected to the Hills Shire Council to get developments approved.

A string of Liberal Party councillors had in December 2021 been ousted from the council, in Sydney’s outer north-west growth corridor, after unexpectedly failing to gain Liberal Party endorsement.

It is alleged Nassif financed the council stacking, with money allegedly funnelled to new Liberal councillors via “lobbying” or “consulting” companies.

It is illegal in NSW for property developers to finance elections.

Please SUBSCRIBE HERE and support our quality journalism

The Klaxon’s forensic coverage of the NSW Reformers scandal. Source: The Klaxon

The stacking of the council was allegedly tied to NSW Reformers, a little-known extreme “Christian” group allegedly tied to Jean-Claude Perrottet and Charles Perrottet.

Both men refused requests to attend the NSW upper house inquiry, with Jean-Claude avoiding being “served” and so legally forced to appear.

Both men deny wrongdoing.

Perrottet’s Liberal government was ousted at last year’s election.

Weeks before the election Chris Minns, then the NSW ALP Opposition leader, called for the Hills Shire Council to be suspended.

Weeks later, after winning the election and becoming NSW Premier, Minns announced the council would not be suspended because there was an ICAC investigation underway.

Administrators said they had met with NSW Police and the NSW Crime Commission.

Of the Toplace group of companies, 57 are currently in administration under dVT Group.

Jean Nassif. Source: Supplied.

Ashlyn was arrested last year when the NSW Police Organised Crime Squad raided four Nassif properties, including the waterfront mansion, Toplace’s headquarters in nearby Concord and Ashlyn’s Sydney CBD law firm EA Legal.

Her since deleted LinkedIn profile stated she had worked as a Toplace executive since July 2016 and had owned EA Legal since 2017.

Police allege Nassif and Ashlyn defrauded Westpac after lodging fraudulent pre-sales contracts to obtain a $150m loan for a property development, Skyview, in Castle Hill in Sydney’s west.

It is alleged Nassif described the contracts as “fake” in a secret phone taps.

The February 1 creditors report states Nassif “treated company bank accounts” as “his exclusive personal financial resources”.

“(Nassif) treated company bank accounts as his exclusive personal financial resources” — dVT Group

Company funds had been used to “cover various personal expenses”, including the deposit to purchase the Chiswick mansion, developments costs of the property, and to make its mortgage payments.

Police raided four Nassif properties last year and arrested Ashlyn Nassif. Source: The Klaxon

In April and May last year Nassif mortgaged his share of the Chiswick mansion to Toplace Pty Ltd as security for money he “borrowed” from the company, the report states.

The administrators had bank records for Toplace going back to January 2020, but the company’s accounts were riddled with inaccuracies and many transactions were undocumented.

In April and May last year Nassif mortgaged his share of the Chiswick mansion to Toplace Pty Ltd as security for money he “borrowed” from the company.

Records showed Nassif had declared owing Toplace Pty Ltd $3.26m.

Administrators said that figure was at least $7.15m, which including interest was now at least $7.66m, with interest accruing at “$1,826.58 per day”.

“We have commenced proceedings to recover those monies”, that were secured against the Chiswick mansion, the administrators said, adding they could not comment further due to legalities.

“Banking Beyond Borders”. Source: Bank of Beirut

Bank of Beirut

There was also $18.29m that had been transferred to Beirut bank accounts and a company in Nigeria.

In 2019 one of the Toplace group companies, JKN Property Group, drew down $10m from a loan facility with Westpac, the report states.

The funds were directly transferred to a Bank of Beirut account “owned by Mr Bakhos Khazen Nassif, whom we understand is Mr Jean Nassif’s brother”.

“Given the absence of identified repayments and the location of Mr Bakhos Nassif we believe this loan is unrecoverable,” the report says.

In a transaction in 2018 another arm of the group, Top Finance BOS, drew down $7m from the “Bank of Sydney”, which is an arm of the Bank of Beirut.

The funds were transferred to a Bank of Beirut account owned by Nassif “for the purpose of purchasing land in Lebanon”

The Bank of Sydney loan was then repaid by Toplace Pty Ltd.

Administrators said the $7m would also form part of its claim against Nassif.

Nassif was last month reportedly spotted in Lebanon. Source: Supplied

In June 2022 US$865,086 ($1.286m) was transferred from another Toplace company, JKN Finance, to a Nigerian company called “Zenpure Nigeria Limited”.

The payment description was “Warehouse project Nigeria”, administrators said.

A “loan agreement” had been located, which showed Nassif and a “Mr Elias Geagea” as lenders and Zenpure Nigeria as borrower.

“Furthermore, entities within the Toplace Group have made several payments to Mr Elais Geagea and associated companies,” the report states.

“According to information provided by senior management, Mr. Geagea’s consultancy company is responsible for designing and fitting out shops for various projects across the Toplace Group.

Regarding the Zenpure Nigeria Limited loans no repayments had been identified.

Last month it was reported Nassif had been spotted in Lebanon dining with a woman at an upmarket restaurant.

WAIT, BEFORE YOU GO: Truly independent, quality journalism is vital to our democracy. Please SUBSCRIBE HERE or support us by making a ONE-OFF DONATION. Thank you.

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.