As the Federal Government looks to slug the public with higher taxes to fund aged care, it can be revealed it has handed a mystery $25m bonus to a shadowy private operator that runs its books through a South Pacific tax haven. Concerns of serious tax dodging by TriCare, owned by one of the nation’s richest families, have been repeatedly flagged by experts over the past two years. Yet the Federal Government has done nothing – other than vastly increase the payments. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

A private, rich-lister owned, aged care giant at the heart of a string of abuse scandals – and which operates its sham “headquarters” from an offshore tax haven – has been inexplicably handed a massive $25 million bonanza by the Federal Government.

TriCare, owned by Queensland’s ultra-wealthy O’Shea family, received $103m from taxpayers last financial year, up from $77.7m on 2018, analysis of federal Department of Health data reveals.

That’s an unexplained $25.4m – or 33% – increase, despite TriCare now actually operating fewer beds.

At June 2018 TriCare operated 1568 beds across 15 aged care facilities in Queensland.

By June last year that had fallen slightly, to 1565 beds across the same 15 facilities.

Neither TriCare or the Federal Government provided any explanation for the additional $25.4m when contacted by The Klaxon.

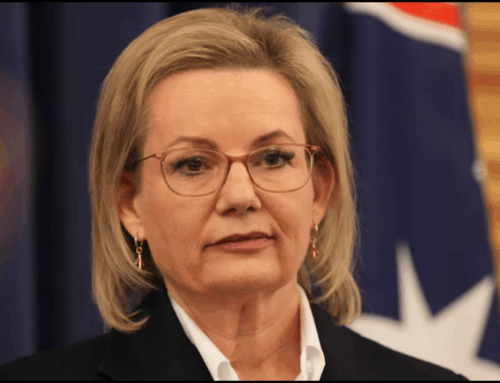

All of those funds have been sunk into what tax experts have described as TriCare’s “opaque” business structure, which is run through the “secrecy jurisdiction” of Norfolk Island.

That is despite TriCare having never operated a single bed on Norfolk Island and that TriCare is actually based in Queensland.

The revelations come as the Federal Government last week announced an immediate $452m of extra funds for the aged care sector and floated the idea of introducing a new Medicare-style levy on taxpayers to provide billions more in funding.

The $103m of taxpayer funds the Coalition pumped into TriCare in just the year to June was the equivalent of 150% of Norfolk Island’s entire GDP.

The mystery $25m boost alone is more than one-third of Norfolk Island’s GDP, most recently estimated at $68m a year.

(Revenues of companies running sham, paper only, “operations” are not included in the GDP).

The O’Shea family have become one of the nation’s richest families on the back of taxpayer funds and they are major political “donors” to Queensland’s Liberal National Party.

John and Peter O’Shea, who run TriCare, were the second biggest donors to the LNP in the 2017 financial year, each “donating” $35,000 cash to the party.

In the two years to 2017 the pair donated $130,000 to the LNP.

The timing of the $25m bonanza to the rich-listers – whose financial worth was estimated at over $330m as far back as 2013 – is particularly interesting given it came after serious alarm bells were raised over the group.

“Alarming”

In May 2018 the Australian arm of the Tax Justice Network, a global analyst and advocacy group that specialises in investigating tax-evasion and tax havens, produced a report exposing serious concerns about TriCare’s offshore structure.

The report, Tax Avoidance by For-Profit Aged Care Companies, described Tri-Care’s lack of transparency as “alarming” and found the company was involved in “significant related party transactions that could be used to minimise taxable profits”.

TriCare receives Federal Government money through a string of Australian subsidiaries, but all are “ultimately controlled” by the parent company, TriCare Group Pty Ltd, which is registered on Norfolk Island.

That meant it was classified under Australian law as an “Other Incorporated Entity” and so had no filings with corporate regulator, the Australian Securities and Investments Commission.

“It is alarming that a major aged care provider in receipt of at least $66 million in government subsidies is not required to have clear and concise publicly available reports and may have structured its various businesses to minimise income tax payments,” the report said.

“If there are no tax benefits for TriCare through the Norfolk Island ownership, then why maintain that complicated structure?”

— Jason Ward, CICTAR

There was no available financial information for TriCare’s Norfolk Island operations and its Australian financial statements “provide very little meaningful information”, the report found.

The report’s author, tax expert Jason Ward, an adjunct senior researcher with the Institute for the Study of Social Change at the University of Tasmania, called for immediate action.

Yet since then, not only has the Federal Government done nothing to rectify the situation, but from July 1 2018 it dramatically – and inexplicably – ramped up the taxpayer funds flowing to TriCare.

In 2016-17, before the report, TriCare received $66m in federal funds.

In 2017-18 it was $77.7m; in 2018-19 it was $94.5m; and in 2019-20 it was $103m.

In November 2018 Ward released another report, expanding on the concerns.

Then in May 2019, Ward, currently principal analyst at the Centre for International Corporate Tax Accountability and Research (CICTAR), produced a third, highly-detailed report examining the “tax and financial practices” of Australia’s largest family owned aged care companies.

It found several of those – including TriCare – had “complex financial structures, intertwined with trusts” that “appear specifically designed to avoid taxes”.

The report uncovered yet more highly specific, damning material regarding TriCare.

“Significant amounts of debt and equity move around the TriCare Group structure in ways that appear to be engineered to artificially minimise tax payments of the group as a whole,” the report found.

When contacted by The Klaxon last week, Ward said he was amazed nothing had happened.

“They’ve been rewarded with more money,” he said.

Ward said there was no evidence to suggest that the additional money was going toward services: “in fact there’s evidence to the contrary.”

“There’s evidence that during that time where funding per bed has increased dramatically, they’ve continued to slash staffing,” he said.

“If they were making a profit before, they’re now making a bigger profit.

“How is this a public benefit? For the owners of TriCare to be increasing their margins while conditions that have been very clearly exposed by the Royal Commission, and others, continue to go on?”

Ward said the major aged care operators had continued to operate “business as normal”.

“In the face of all of these allegations, all of these big operators continue to operate business as normal with the bottom line – profits or their return on investment – being their focus rather than actually caring for the people that are in their custody,” Ward told The Klaxon.

Kylie Kilroy blows the whistle on elder abuse at TriCare’s Toowoomba facility. Source: The Klaxon

Kylie Kilroy

TriCare, which also operates “retirement living” facilities in Queensland, NSW and Victoria – alongside the 15 Queensland aged care facilities it received the $103m for last financial year – has been at the heart of a string of serious elder abuse cases.

In August last year The Klaxon revealed the plight of terminally ill Kylie Kilroy, who, at 54, was one of the nation’s youngest aged care residents, and living at the TriCare Toowoomba Aged Care Residence in south-east Queensland.

Kilroy blew the whistle on systemic abuse of residents at the facility, including residents being left in soiled incontinence pads, being left to scream in agony, and workers being forced to administer powerful drugs despite being unauthorised to do so.

Nurses at the facility said Kilroy’s claims were “100% correct” and the problems were due to a “dire” lack of staffing.

The staff wrote to TriCare management outlining their serious concerns, but said they did not receive a response.

Staff told The Klaxon TriCare was profiteering and abusing taxpayer funds.

Each year the Toowoomba facility receives over $70,000 from the Federal Government for each of its 81 residents.

“It’s a lucrative business…it’s our opinion that the managers get paid large salaries and bonuses to cut costs and increase shareholder returns but do not consider the effect on residents,” staff told The Klaxon.

Aggressive Inaction:

2018, May: Tax Justice Network blows whistle, exposing details of TriCare’s offshore operations

2018, November: Tax Justice Network raises more serious concerns about TriCare’s tax structure

July 2018-June 2020: Federal Government inexplicably increases TriCare funding by $25m, one-third, despite no increase in bed numbers

May 2019: Tax Justice Network releases another report exposing highly-detailed concerns of TriCare and tax dodging

March 2021: Aged Care Royal Commission final report released. Federal Government announces “immediate” $452m in extra funds, proposes lifting taxes

1970-Present: TriCare runs sham “headquarters” from Norfolk Island tax haven. Federal Government takes no action, gives TriCare increasingly more taxpayer money

Norfolk

TriCare is based – physically, practically and literally – in Mt Gravatt, Brisbane, but for tax purposes it is “based” in Norfolk Island, despite it having never operated a single bed there.

Since 2016 Norfolk Island has been part of Australia’s tax system, however any assets – including “businesses” – owned before October 2015 do not attract capital gains tax.

Further, despite the 2016 changes, companies registered on Norfolk Island are still not required to make filings with Australia’s corporate regulator ASIC.

TriCare nurses raise the alarm over abuse of residents and “severe” understaffing. Source: The Klaxon

TriCare and its directors have repeatedly refused to comment when repeatedly approached for comment by The Klaxon over the past seven months.

Last week the company sent The Klaxon an email from its general email address – no name was provided – directing us to a statement the group made in September last year.

“There have been recent public statements regarding TriCare’s tax compliance. We wish to reiterate that all surpluses from TriCare’s business, including residential aged care, are fully taxed in Australia,” the statement says.

“No royalty payments, management fees or similar charges flow to any taxation jurisdiction outside Australia. Public statements to the contrary are false.

“The Australian Taxation Office has audited TriCare three times over the past decade without adverse findings,” it states.

Jason Ward said those claims were “virtually meaningless”.

It is correct that money TriCare receives from the Federal Government does not “flow to any tax jurisdiction outside Australia”.

Since 2016, Norfolk Island is, legally a “tax jurisdiction” of Australia.

The issue is that it continues to have a “grandfathered exemption from any capital gains tax” and that companies “based” there do not have to meet Australian financial reporting requirements.

Ward said was also noteworthy that TriCare had referred to “surpluses” and not to “profits”.

The statement appeared to “be an effort to include not just declared profits but the shifting of revenue before profits are recorded”.

“That’s where most of the games are played,” Ward said.

“That’s where most of the games are played”

— Jason Ward, CICTAR

Regardless, “surpluses would not be likely to encompass increased equity values of shares in Norfolk Island companies” which are “not subject to capital gains tax”.

“It’s also interesting that TriCare admit to being audited by the ATO three times in the last ten years,” Ward said.

It was unusual for a company to be audited so regularly, unless it was doing, or was suspected of doing, something wrong.

The fact that the ATO hadn’t technically issued any “adverse findings” also didn’t say much.

“The ATO could have required TriCare to pay more taxes, without issuing ‘adverse findings’,” Ward said.

“If there are no tax benefits for TriCare through the Norfolk Island ownership, then why do they maintain that complicated structure?

“Surely, it would be cheaper and easier to simplify the corporate structure and bring it onshore,” he said.

Federal Aged Care Minister Richard Colbeck refused to respond when approached for comment for this article, as he has for the past six months amid The Klaxon’s ongoing investigations into the sector.

The Klaxon sent the Department of Health a series of written questions last Friday.

The department said it was too busy to respond on account of dealing with queries related to Covid and that it would respond “early next week”.

We have received no response.