Appreciate our quality journalism? Please subscribe here

DONATE

ANALYSIS

A mining company being heavily spruiked by anti-Indigenous Voice campaigner Warren Mundine is in danger of collapse, with investors at risk of losing millions of dollars.

Just weeks after fronting the shadowy “No” campaign — which spread disinformation to prevent Indigenous Australians being given a constitutional Voice to parliament — Mundine posted to social media promoting his latest side venture.

He was chairman of exploration company Fuse Minerals — and seeking to raise up to $10 million from the public in an initial public offering (IPO), at 20c a share.

“As a big believer in mining for prosperity for Australians I am the chairman of Fuse Minerals,” Mundine announced.

Mundine campaigning against the Voice. Source: Advance

Fuse Minerals was “focused on copper and other critical metals” and is directly targeting ordinary investors.

Potential investors were invited to “join me for a lunch and hear about the upcoming IPO” at an event to be held in Sydney on November 13.

Fuse Minerals has “projects in the Pilbara and Gascoyne in WA and in Central QLD”, Mundine said.

Only it doesn’t.

For starters Fuse Minerals has no “projects” — it is referring to exploration licences.

And in almost all cases Fuse Minerals doesn’t even own those licences.

The “projects” of Fuse Minerals. Source: Fuse Minerals prospectus

Of the nine “tenements” (that is, exploration permits, rather than the ownership of any land) listed in the group’s prospectus, Fuse Minerals owns just one: an exploration licence over an area in north-west Western Australia.

Another of the “tenements” listed in the 402-page prospectus refers to an adjacent area that Fuse Minerals has lodged an “application” to obtain an exploration licence over.

(It applied in March last year, but it hasn’t been granted).

The other seven “tenements” are owned by companies owned by Fuse Minerals directors themselves.

“The other seven are owned by companies personally controlled by Fuse Minerals directors”

Much of the $10m Fuse Minerals is seeking to raise from the general public, the so-called “mum and dad” investor market, will go to acquiring these exploration licences from those directors.

Please SUBSCRIBE HERE and support our quality journalism

Mundine spruiks Fuse Minerals to the public. Source: Twitter/X

The company’s 402-page prospectus is extremely complex – almost impossibly so for the type of investors it is targeting.

But analysis by The Klaxon reveals extremely concerning details.

On page 268 it specifically states that are both “potential” — and “actual”— “conflicts of interest” involving Fuse directors.

“Certain directors are also directors and officers of other companies engaged in mineral exploration and development and mineral property explorations,” it states.

“Although these Directors have been advised of their fiduciary duties to the situations that could arise in which their obligations to, or interests in, the Company, there exists actual and potential conflicts of interest among these persons”.

“There exists actual and potential conflicts of interest among these (directors)” — Fuse Minerals prospectus

But it gets even worse.

Fuse Minerals is actually in danger of collapse.

That’s according to its own expert: Ernst & Young partner Ryan Fisk.

Fisk made that written assessment on November 10 — the same day Fuse Minerals lodged its prospectus with corporate regulator the Australian Securities and Investments Commission (ASIC).

That was three days before Mundine took to social media spruiking for investors to join him for lunch.

Source: Fuse Minerals prospectus

There was a “material uncertainty” over the ability of the company to continue as a “going concern”, wrote Fisk.

Fisk had been engaged by Fuse Minerals to produce an “Independent, Limited Assurance Report”, which forms part of the prospectus.

In his four-page assessment, Fisk states:

“We draw attention to Section 6.2(d) of the Prospectus which describes the principal conditions that raise doubt about Fuse’s ability to continue as a going concern. These conditions indicate the existence of a material uncertainty that may cast significant doubt about the Companies’ ability to continue as a going concern”.

“(There is) doubt about Fuse’s ability to continue as a going concern” — Ryan Fisk

The section Fisk is referring to appears on page 275.

It states that at June 30 last year the company had a stated “historical net current asset position” of just $178,749.

“The Directors believe that the current cash resources will not be sufficient to fund the planned execution of Fuse’s principal activities and working capital requirements,” it states.

Fuse Minerals was broke.

“Fuse Minerals was broke”

Mundine spruiking Fuse Minerals. Source: LinkedIn

It gets even worse.

Fuse Minerals was so broke that between 6 November and 10 November (when it lodged the prospectus with ASIC) it conducted an emergency $150,000 raising.

It did so by issuing 1.5m shares at a price of 10c a share — half the public asking price.

“Fuse issued shares at half the public asking price just days before its IPO”

On November 20 the offer was opened to the public at 20c a share.

Mundine is used by “right wing” media outlets to stoke division. Source: Twitter/X

Mundine has refused to respond to requests for comment from The Klaxon over the past three months.

The other Fuse Minerals directors have also repeatedly refused to comment.

As chair, Mundine is responsible for corporate governance at Fuse Minerals.

The company’s prospectus states he is to be paid $120,000 a year for the part-time role.

It also shows Mundine was given an “advance” of $55,250 plus GST when he was appointed chairman in March.

He has also been issued 500,000 shares in the company and 2 million options.

Mundine’s 500,000 shares and 2m options. Source: Fuse Minerals prospectus

The 500,000 shares are to rank equally with the shares issued to the public, the prospectus states.

The options have an exercise price of 33.4c, meaning Mundine profits if and when the share price reaches that point.

(If the raising does not proceed, they will be effectively worthless).

Mundine is also a director of uranium exploration company Aura Energy.

As previously reported, his reported remuneration (which includes option-style remuneration) since being appointed to the company in December 2021 is at least $403,000.

In the year to June 30 the Aura Energy doubled its annual loss to $6.8m.

“Share based payments” of $2.47m to “directors, executives and senior consultants” being a “primary driver” of the loss, the company’s audited accounts state.

Aura Energy, which lavished Mundine with hundreds of thousands in remuneration, received fierce rebuke from shareholders. Source: The Klaxon

The prospectus for Fuse Minerals shows it has never earned a cent in revenue.

The company was created on paper in September 2021, when it was first registered with ASIC.

The directors of Fuse Minerals are Mundine, Todd Axford (who is managing director), Vernon Tidy and Stephen Pearson.

Its “exploration manager” is Thomas Bartschi.

Fuse Minerals managing director Todd Axford. Source: LinkedIn

Five of the nine “tenements” listed in the prospectus are referred to by Fuse as the “Eastern Isaac Project”, in Central Queensland.

Of those, four are exploration licences owned by “HBBM” and a fifth is an exploration licence HBBM has applied for.

HBBM is HB Base Metals Pty Ltd — whose ultimate owners include Axford, Pearson and Bartschi.

The remaining two “tenements” are referred to by Fuse as the “Mt Sandman Project”, in the north-west of Western Australia.

One of those exploration licences is owned by “GTTS” and the other is jointly owned by GTTS (49%) and by “Cobre” (51%).

GTTS is GTTS Generations Pty Ltd, a company owned by Axford, Bartschi and Pearson.

Cobre is Cobre Limited, a struggling ASX-listed minerals exploration company whose share price has plummeted 58 per cent over the past 12 months.

Please SUBSCRIBE HERE and support our quality journalism

Just one of the nine “tenements” is actually owned by Fuse Minerals. Source: Fuse Minerals prospectus

The Fuse Minerals IPO, seeking to raise “between $6m and $10m” from the public was supposed to close on December 4, with the company to list on the ASX on December 18.

Instead, as previously reported, it failed to raise enough funds and its two-week IPO period was extended five-fold, with the close date pushed back to February 8.

Suggesting things had not been going well, the last business day before the offer had been due to close on December 4 Mundine appeared spruiking the company in paid radio segments syndicated on Sydney’s 2GB, Melbourne’s 3AW and Perth’s 6PR.

(The “Bulls N’ Bears Report”, a syndicated “sponsored public company news” segment said Fuse’s “upcoming ASX listing” will “focus on some outstanding old exploration results that were never followed up properly”.)

The Fuse Minerals raising was due to close on December 4. Source: Fuse Minerals prospectus

Yet, according to Mundine, his invitation to the public to join him for lunch in Sydney on November 13 had attracted strong interest.

So much, in fact, that Fuse Minerals had been forced to book a bigger venue, Mundine posted to social media, shortly after his initial post.

“Sold out yesterday!” Mundine said.

“Love the support from everyone. We have changed venues to accommodate everyone”.

Mundine posts to social media. Source: LinkedIn

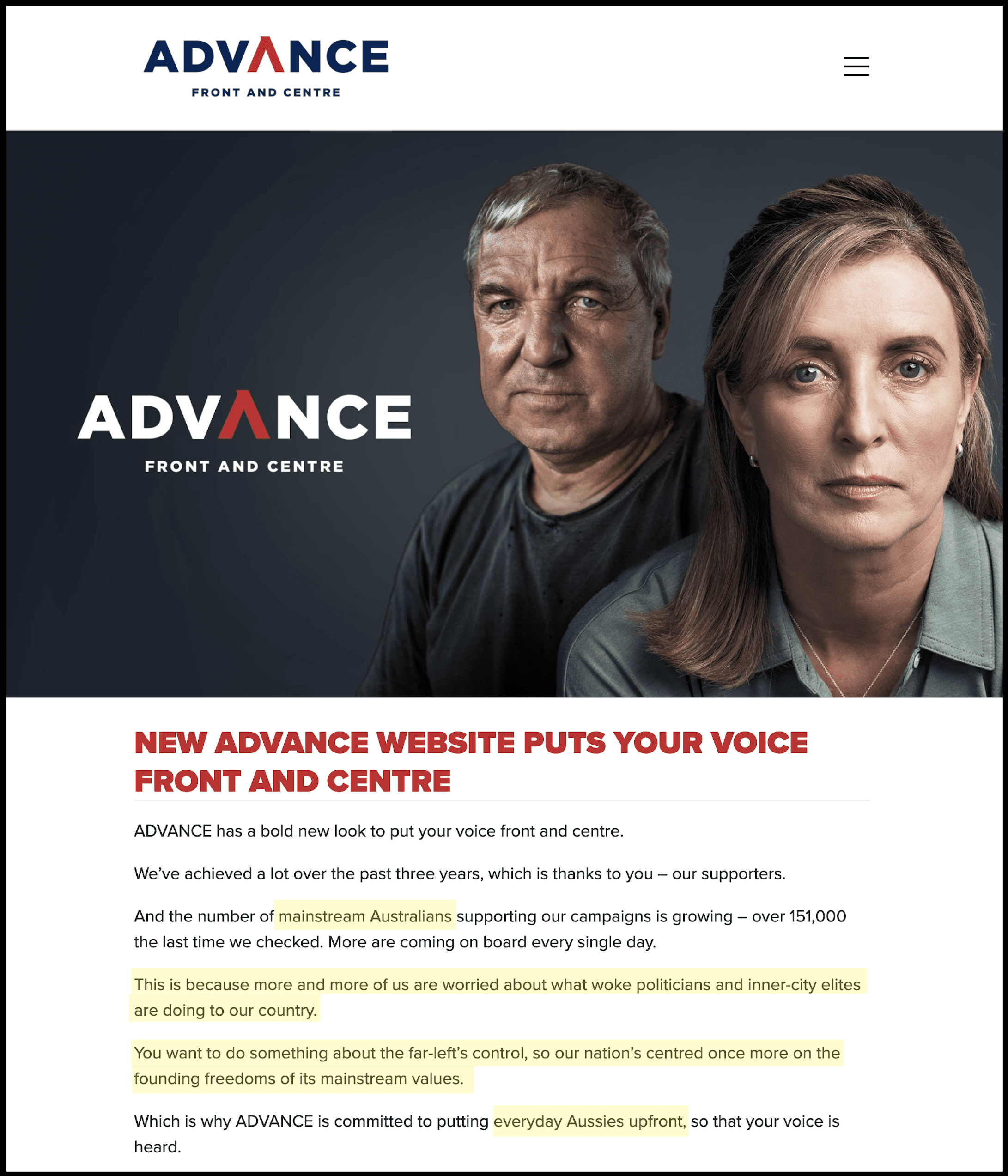

Weeks earlier, on October 14, the proposed Indigenous Voice to parliament was defeated at a national referendum.

Mundine and Federal Senator Jacinta Price were the two most prominent faces of the “No” campaign

As previously revealed by The Klaxon, the No campaign was a sham.

Two of the three directors of the fake “grassroots” campaign network have fake residential addresses filed with regulators; none of the at least six arms in the murky network had a telephone number — and the entire operation was “based” at a fake national headquarters.

It was also a fake “grassroots campaign” of fake “ordinary Australians”.

The “elite” and “inner-city woke” were the enemy, according to “Advance Aust Ltd”, the shadowy outfit at the heart of the whole operation.

The sham campaign of “ordinary Australians”. Source: Advance

In fact, it was bankrolled by a small handful the extremely wealthy — the super elites.

Of the ten entities disclosed as donors in the most recent filings for Advance at least eight have estimated wealth of $100m or more.

The “No” campaign was deep tied to the fossil fuels and mining lobby.

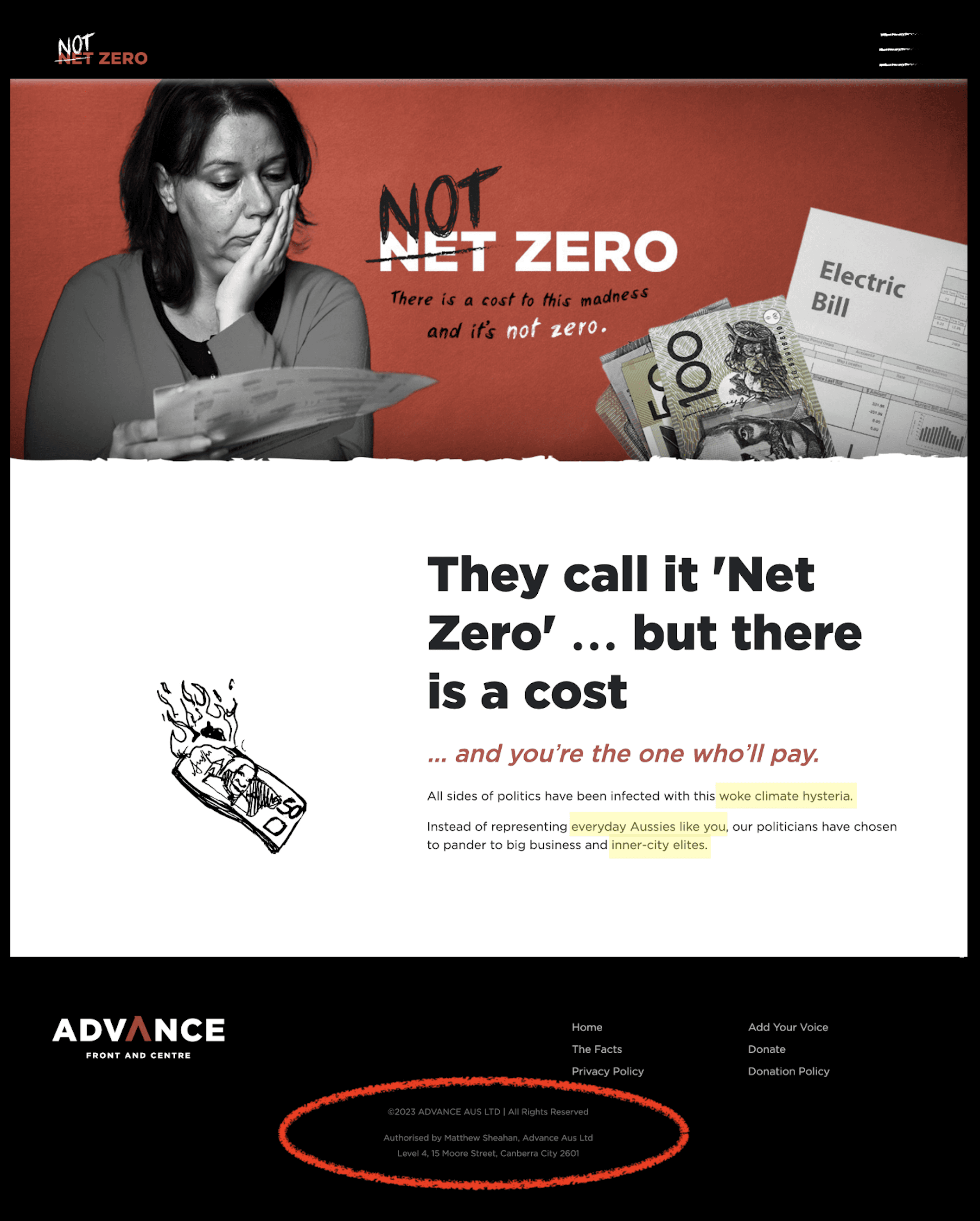

Advance runs aggressive disinformation campaigns against renewable energy in favour of fossil fuels through an arm called “Not Zero”.

Please DONATE here and support quality, independent journalism

Source: Not Zero/Advance

Indigenous land rights have in recent years proven to be one of the biggest impediments to fossil fuels expansion — and so profits — globally, particularly in the US.

Fossil fuels executives — though behind closed doors, not publicly — often refer to Indigenous issues as “black tape”.

“Indigenous issues are often referred to as ’black tape’ by fossil fuels interests”

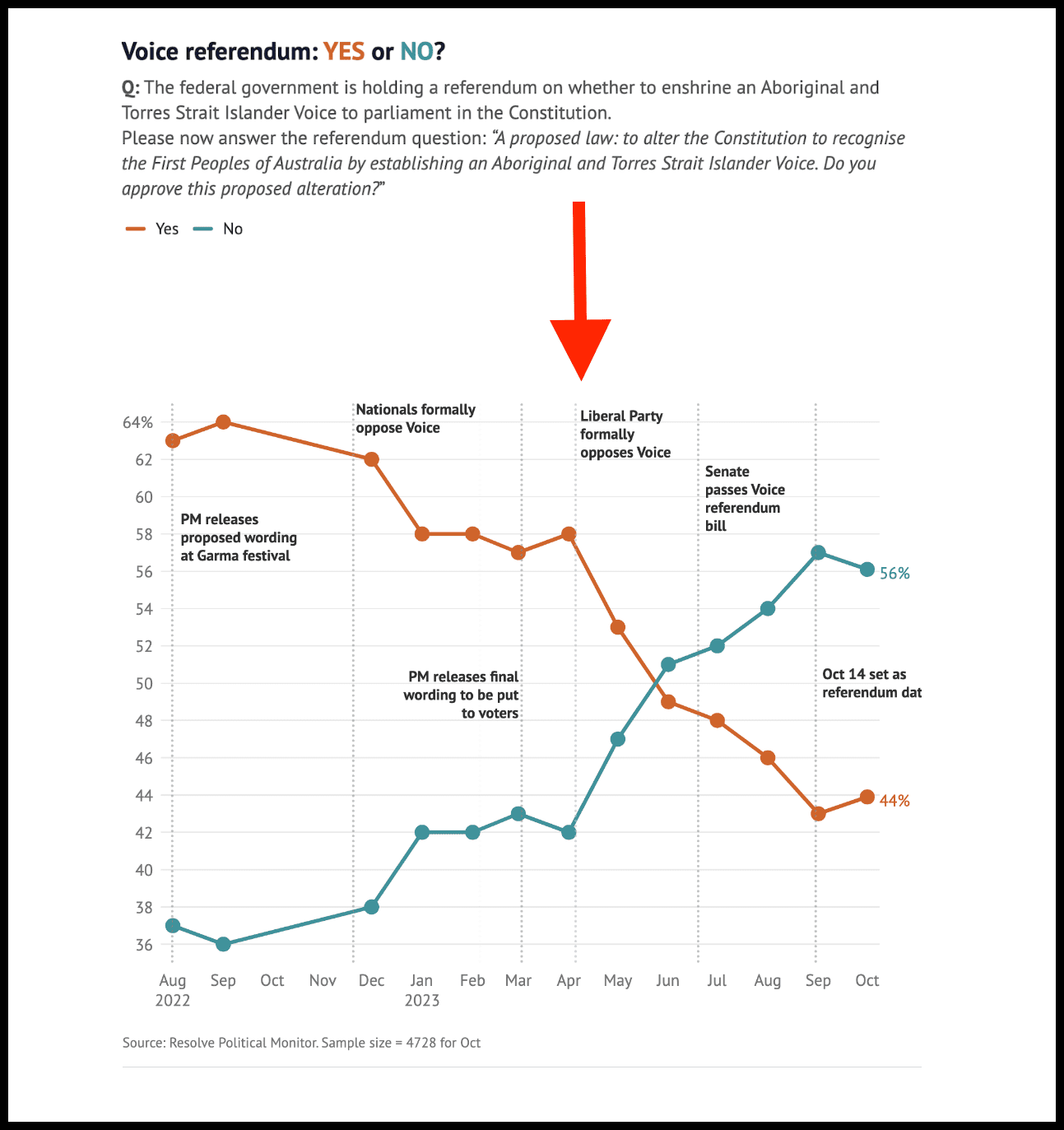

Source: Resolve Political Monitor

Having enjoyed strong levels of public support, after the Advance disinformation went into overdrive, when Peter Dutton’s Liberal Party formally rejected the proposal, support nosedived and the Voice was rejected.

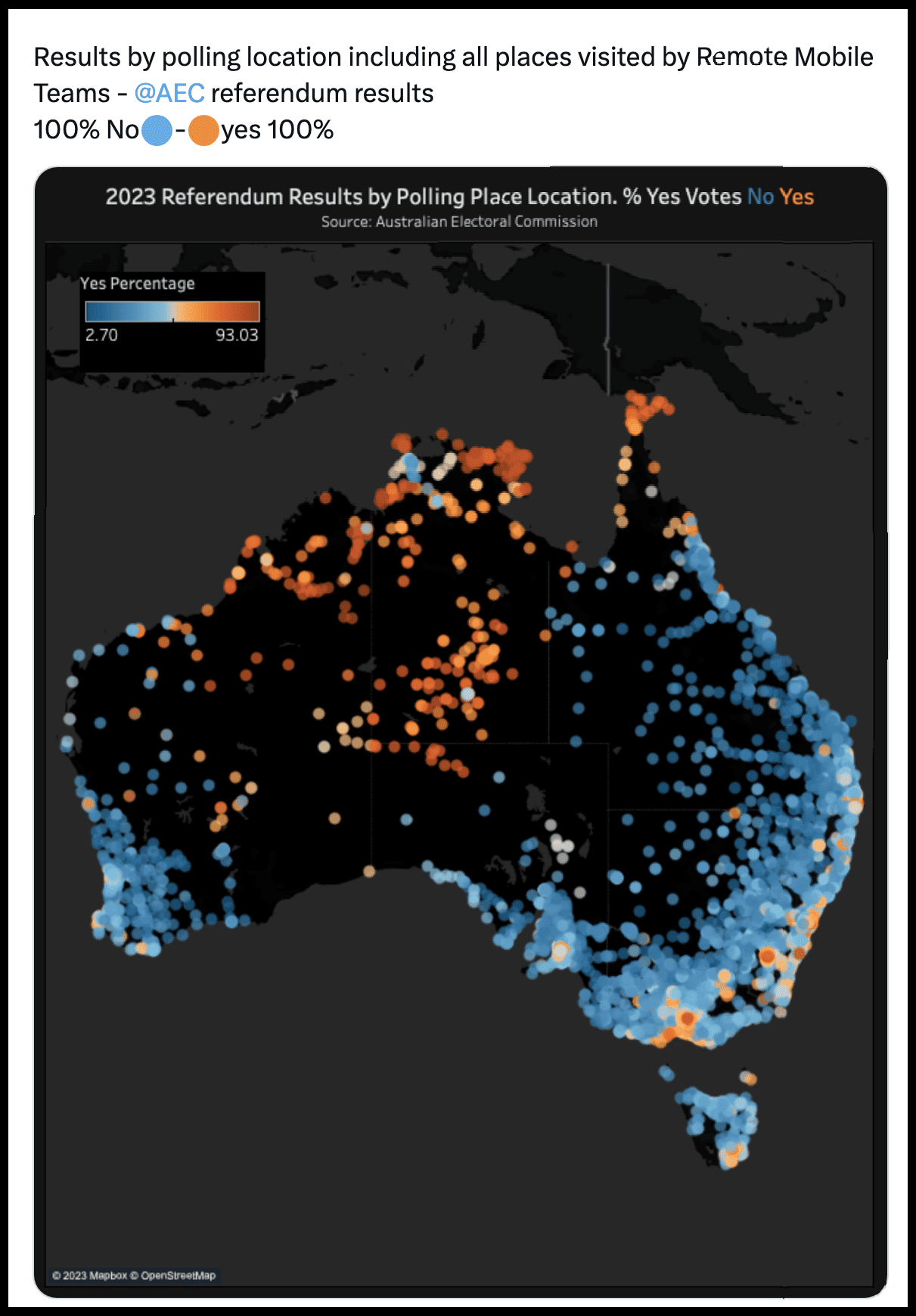

That was despite overwhelming support in areas with high proportions of Indigenous voters.

Referendum results by polling place location. Source: Australian Electoral Commission

On the night of the referendum, after voting closed the “No” campaign event, at the salubrious Hyatt Regency in Brisbane, was held in secret.

In unprecedented scenes, Media were at the hotel but refused entry —while handers refused to say who was in attendance.

The only person identified, having been spotted by a reporter, was Australia’s richest person, mining multi-billionaire Gina Rinehart.

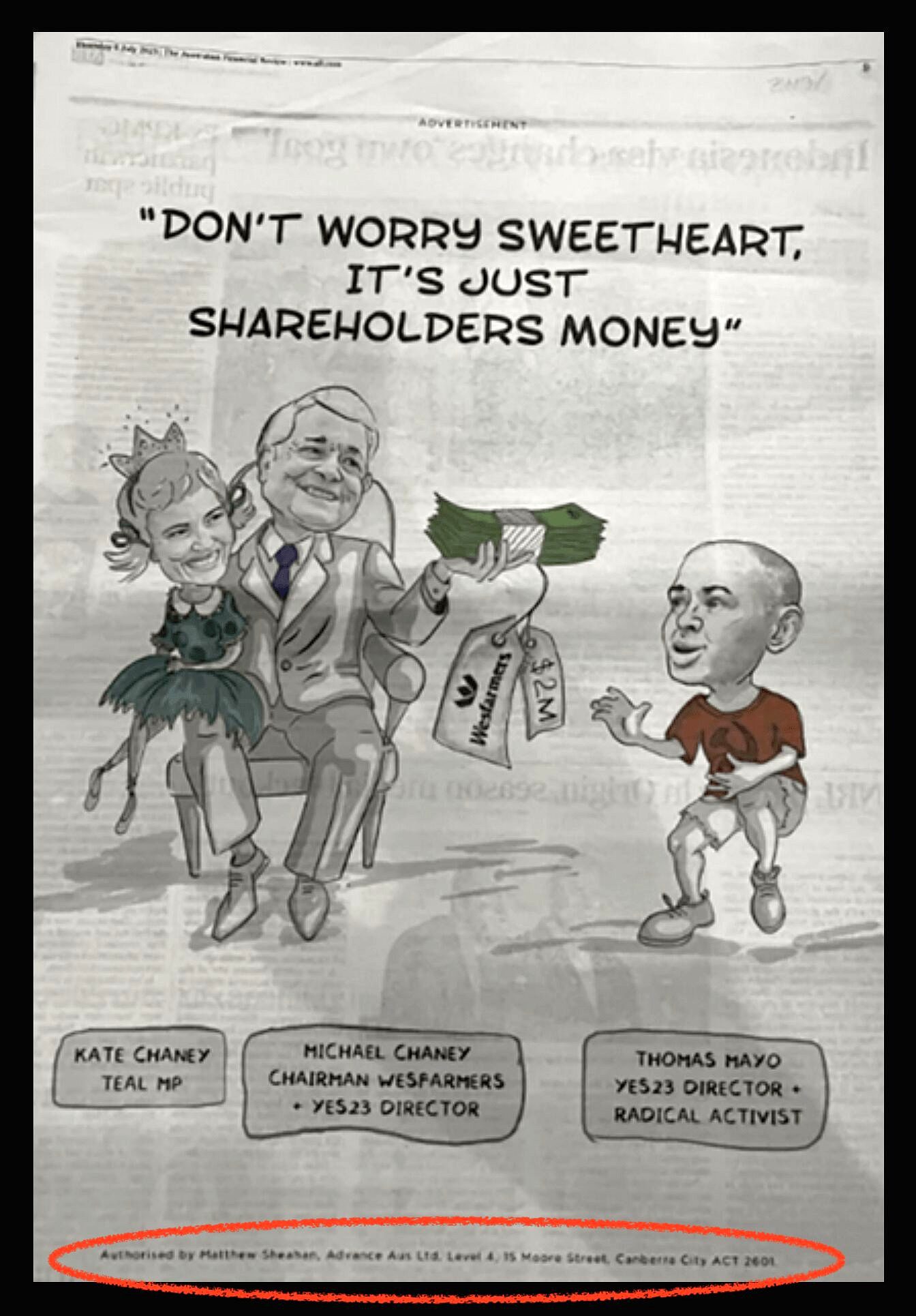

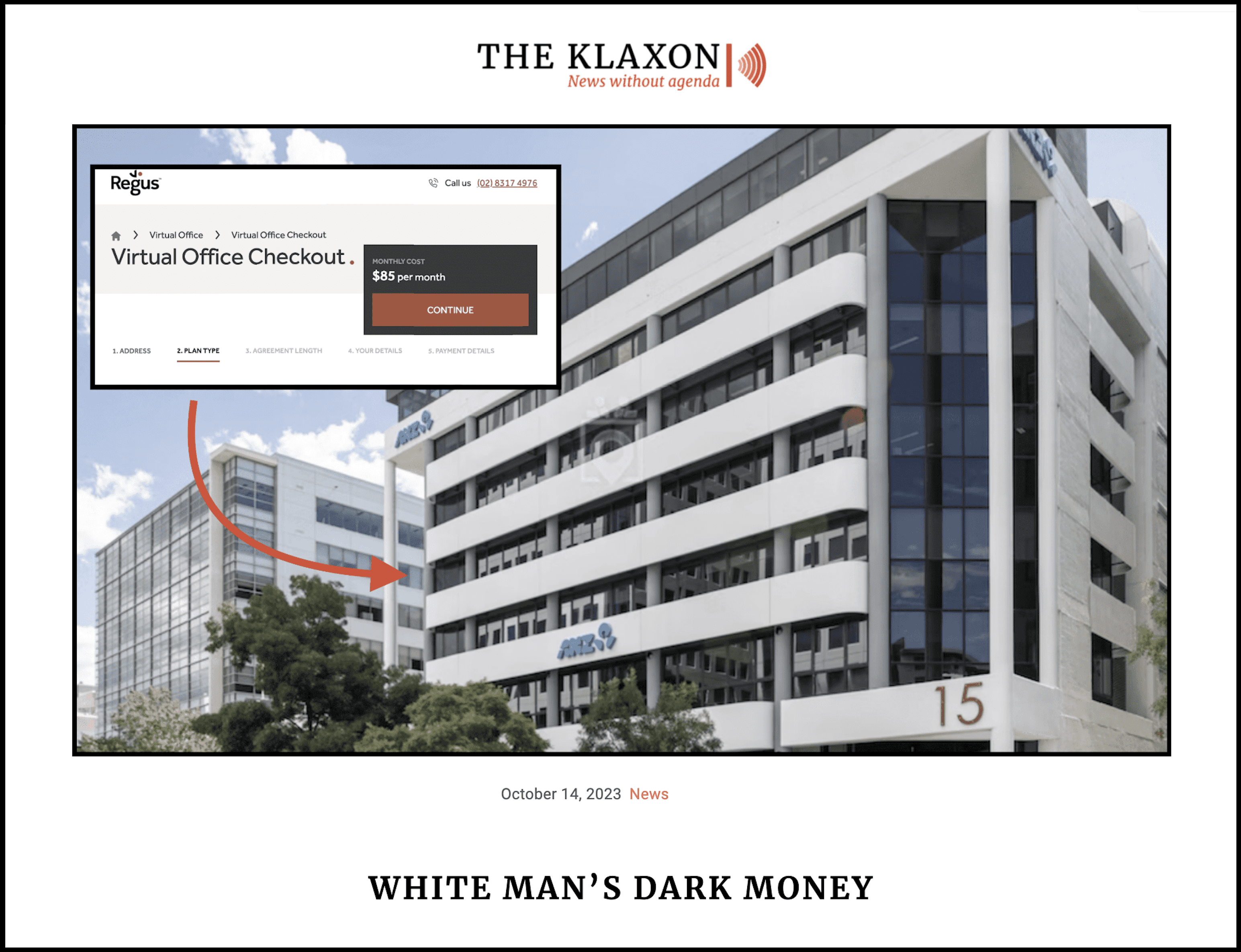

The Canberra CBD “address” of the No campaign was plastered around the nation — on campaign flyers, on pop-up internet sites, in disclaimers on political ads flooding social media.

On a full-page racist advertisement in The Australian Financial Review.

“Authorised by Matthew Sheahan, Advance Aus Ltd Level 4, 15 Moore Street, Canberra City 2601”. Source: Australian Financial Review

Level 4, 15 Moore Street, was the supposed national headquarters of the campaign, in an office tower known as ANZ House, one block back from Canberra’s main thoroughfare.

But it was a sham — neither Advance, or any one of its network of shadowy affiliates, operated from the building.

And they never had.

In fact, it was a “virtual office”, a “business address” provided by a company called Regus, which offers a “virtual presence anywhere” for $85 a month.

Please SUBSCRIBE HERE and support our quality journalism

The Klaxon’s expose in October. Source: The Klaxon

There are also question marks over the business address of Fuse Minerals.

On its website, in its advertising material — and in its prospectus — the stated address is at a business park in western Sydney.

Unit 56, Level 1, 11-21 Underwood Road Homebush NSW.

In fact, that is the address of a small accounting practice, called “Reset Group”.

Reset Group offers a range of services, among them a “virtual CFO” and a “virtual finance department”.

It also offers to provide “directors” to foreign companies, who are required to have “Australian” board members to create an Australian company.

The company offers the “Provision of resident Director/s”, “Provision of Company Secretary” and “Provision of Registered Office”, its website states.

BEFORE YOU GO: As you can see from the above, truly independent, quality journalism is vital. We receive zero funding from anywhere other than support from our readers. We need your help to keep doing this work. Please SUBSCRIBE HERE or support us by making a ONE-OFF DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.