Appreciate our quality journalism? Please subscribe here

DONATE

Anti-Indigenous Voice campaigner Warren Mundine has struck another mining bonanza — and is set to be paid $120,000 a year as chairman of a struggling “minerals exploration” company that is seeking to raise millions from the public.

Fuse Minerals, which has never earned a cent in revenue and has conducted no significant minerals exploration, last week launched a “highly speculative” initial public offer seeking up to $10 million, at 20c a share, to list on the ASX.

The company’s prospectus shows Mundine has been issued 500,000 shares and 2 million options in the company, and was given an advance of “$55,250 plus GST” (no other directors were given an advance) when he was appointed in March.

Mundine’s salary for the part-time role as non-executive chair is to be $100,000 per annum plus superannuation, plus GST, if the company lists on the ASX next month as planned.

Fuse Minerals needs to raise a minimum of $6m under the offer for it to proceed.

The company had net current assets of just $178,749 at June 30, its prospectus shows.

Please support independent journalism and SUBSCRIBE HERE

Mundine’s latest mining bonanza. Source: Fuse Minerals prospectus

“On behalf of the Board of Fuse Minerals Limited, I am pleased to present this prospectus and to invite you to become a shareholder in the company,” Mundine says in a “letter from the chair” in the prospectus.

Mundine, along with Senator Jacinta Price, was the face of the “No” campaign against the Voice, aggressively campaigning against the “elite”.

TIMELINE:

-

Dec 21, 2021 — Mundine appointed Aura Energy director, $40,000 salary

-

Apr 1, 2022 — Mundine issued 2m “loan funded shares” in Aura Energy, worth $118,725

-

Dec 21, 2022 — Mundine issued 1m “loan funded shares” in Aura Energy, worth $209,734

-

Jan 30, 2023 — Mundine and Jacinta Price launch “No” campaign, “Recognise a Better Way”

-

Mar 11, 2023 — Fuse Minerals gives Mundine advance of $55,250 plus GST

-

May 10, 2023 – Mundine announces Recognise a Better Way will merge with Advance

-

May 29, 2023 – Fuse issues Mundine 2m share options, exercise price $0.334

-

Oct 14, 2023 – Indigenous Voice referendum

-

Nov 20 2023 – Fuse Minerals prospectus issued

-

Dec 18, 2023 — Fuse Minerals planned ASX float

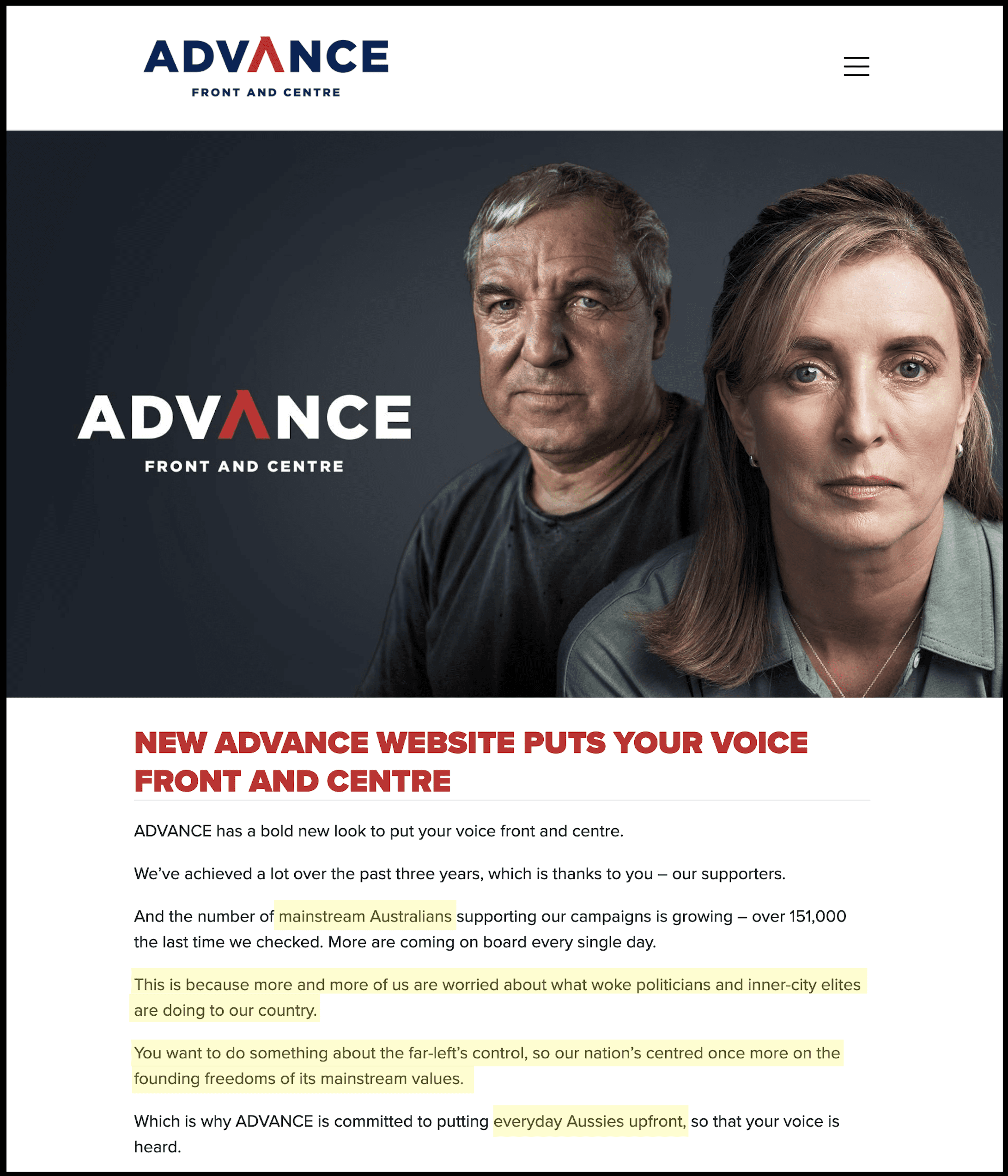

The “No” campaign, which was comprised of a shadowy network of entities centred around Advance Aus Ltd, had deep ties to mining and fossil fuels.

“I am pleased to present this prospectus and to invite you to become a shareholder” — Warren Mundine

Source: Advance/Australians for Unity

Mundine is also a director of uranium exploration company Aura Energy, which he joined in December 2021, in what appears to be his first directorship at a mining or resources company.

In his first 18 months Mundine was given 3 million “loan funded shares” in Aura Energy— worth an estimated $328,459 — on top of his annual salary of $40,000.

For the year to June 30 Aura Energy made a loss of $6.8m, double its loss of $3.4m the year before.

Its audited accounts state $2.47m in “share-based payments” to “directors, executives and senior consultants” were a “primary driver” of its $6.8m loss.

(One-third of Aura Energy investors rejected a proposal to give Mundine and other directors “loan funded shares” worth more than $2m, but it went ahead as it needed only 50 per cent to pass).

Since the Voice referendum was defeated on October 14 Mundine has been heavily spruiking Fuse Minerals in its bid to raise funds.

“I’m a big believer of [the] mining industry and what it does for Australia’s prosperity. That’s why I’m Chairman of Fuse Minerals,” Mundine posted to LinkedIn shortly after the referendum.

“Join me for lunch…and hear about the upcoming IPO”.

Please support us and SUBSCRIBE HERE!

Mundine has been heavily spruiking mining companies since the Voice referendum. Source: LinkedIn

Fuse Minerals says it has plans to search for “yet to be discovered copper, nickel, silver, lead, zinc, uranium and gold deposits” in WA and Queensland.

The company’s was created in September 2021 but has not undertaken any significant minerals exploration, shows its 402-page prospectus.

Mundine’s 2 million options in Fuse Minerals have an “exercise price” of 33.4c. That means Mundine has the option to buy up to 2m Fuse Minerals shares at 33.4c each, regardless of the share price at the time.

Mundine also has 500,000 shares which will rank equally with the shares issued under the current public raising, the prospectus shows.

It states the ASX will likely require shares and options issued to Mundine and other directors to be held in escrow (meaning they cannot be sold) for 24 months from listing date.

Mundine spruiking the launch of the Fuse Minerals IPO last week. Source: LinkedIn

Mundine launched “No” campaign group Recognise a Better Way on January 30.

On May 10 he announced Recognise a Better Way it would merge with Advance, and he and Price would be the two faces of the merged entity.

In its campaign against the Voice, Advance (officially Advance Aus Ltd) ran a network of at least seven interconnected entities, including Recognise a Better Way, Fair Australia, Australians for Unity and Christians for Equality.

It claimed to be a “grassroots” movement of “ordinary Australians” with “mainstream values” and railed against “inner-city elites”.

Source: Advance

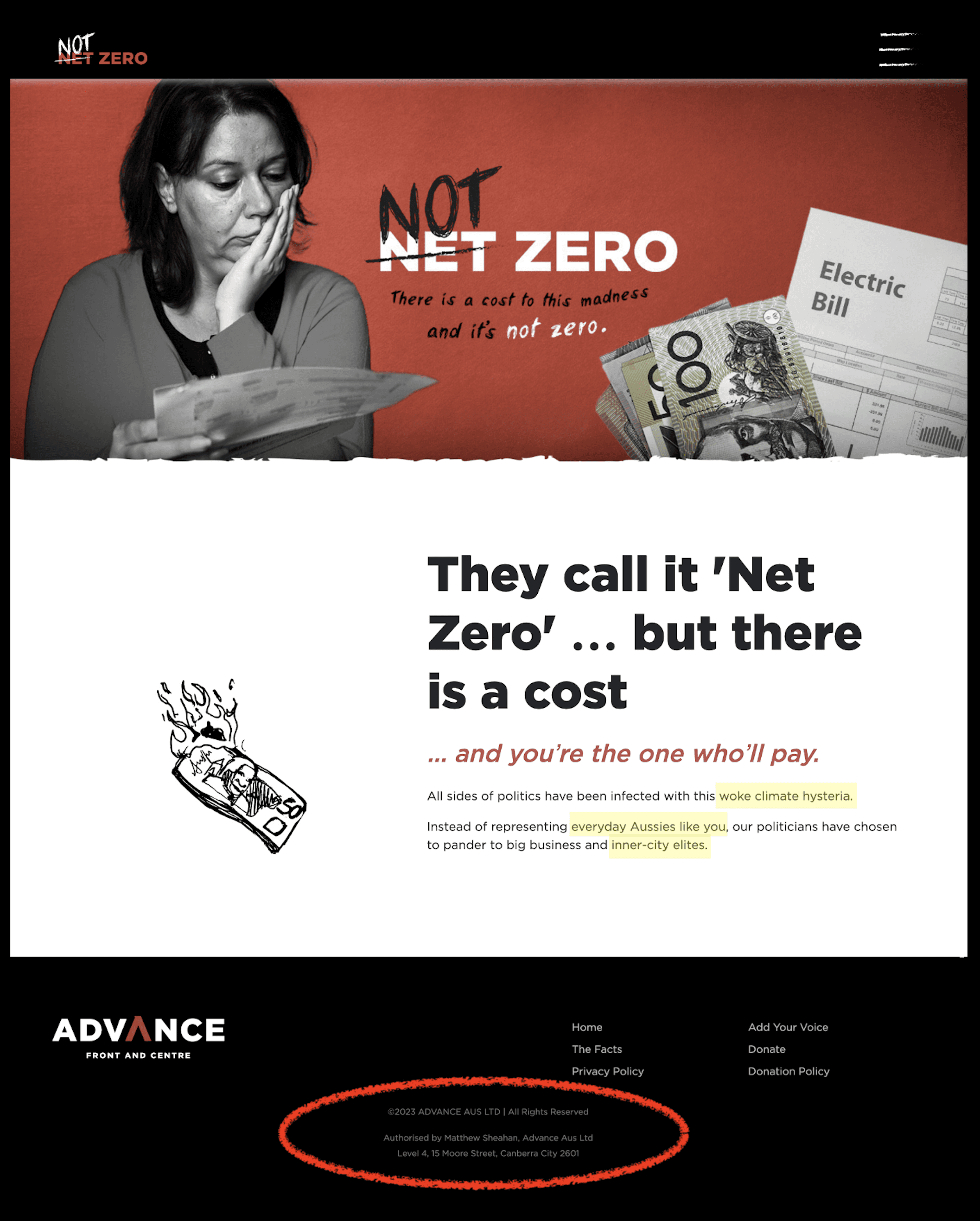

Advance has deep ties to mining and fossil fuels sector and has been been running “Not Zero”, an aggressive disinformation campaign in favour of fossil fuels and against renewable energy.

“They call it ’Net Zero’…but there is a cost…and you’re the one who’ll pay,” says Advance’s Not Zero site.

“All sides of politics have been infected with this woke climate hysteria,” the site says.

In near-identical tactics to its No campaign, Advance’s Not Zero campaign claims to represent “everyday Aussies” and attacks “inner-city elites”.

“Instead of representing everyday Aussies like you, our politicians have chosen to pander to big business and inner-city elites”.

Please support us and SUBSCRIBE HERE!

Advance’s climate disinformation arm, Not Zero. Source: Not Zero/Advance

In fact, Advance — and so both the “No” and “Net Zero” campaigns — is bankrolled by a handful of the nation’s super-rich.

As previously reported, the donors in the most recent filings for Advance for the year to June 2022, boil down to just ten entities.

Of those, all have net assets in the tens of millions of dollars — and at least seven have assets of $100m or more.

(As previously revealed, two of Advance’s three directors listed fake residential addresses with regulators; none of the at least seven entities in the shadowy network had a telephone number — and the whole outfit was “run” from a fake “national headquarters” in Canberra’s CBD).

“The securities offered pursuant to this Prospectus should be considered highly speculative,” the Fuse Minerals prospectus states.

More to come….