Appreciate our quality journalism? Please donate here

SUPPORT

EXCLUSIVE

ANTHONY KLAN

Australia’s corporate regulator delivered the Federal Government a record $1 billion effective profit last financial year, with small business owners footing the vast majority of the bill.

The revelations come as the Australian Securities and Investments Commission (ASIC) has this week attracted widespread criticism for refusing to take any action whatsoever against 10 former executives and directors of systemically corrupt casino operator Crown Resorts.

ASIC’s latest annual report shows it raised a massive $1.513bn in “fees and charges” for the Federal Government in 2020-21, but received just $437.1m back in government funding.

That’s a massive $1.078bn windfall – by far the biggest profit any government has extracted from the regulator in its three-decade history.

When created in 1992 (then the Australian Securities Commission), the regulator was to charge limited fees to the public to cover its operating costs.

Instead, the corporate regulator – which experts say is less effective than it has ever been – has been used to quietly extract an ever growing pool of cash from the public via hidden taxes.

Since its creation, ASIC fees and charges have exploded – mostly under the current Federal Coalition – with the regulator now extracting fees that are 3.7 times its total operating costs.

The “revenues” of ASIC, which is the responsibility of Treasurer Josh Frydenberg, have soared by over 60 per cent in the past four years alone.

ASIC’s 2020-2021 annual report shows “fees and charges collected for the Commonwealth” grew from $920 million in 2016-17 to $1.513bn in 2020-21.

In the year to June 2013, just before the Federal Coalition came to power, ASIC and cost $350m to run and earned the government $717m in fees and charges – roughly double.

In 2020-2021, ASIC cost $437m to run but delivered the government $1.513bn – 3.7 times more.

“Fee for no service”

The vast majority of ASIC’s “revenues” come from “fees and charges” it levies on small business owners for so-called “annual reviews” – which, it can be revealed, it doesn’t actually perform.

ASIC charges every Australian business (including every self-managed superannuation fund, as funds are required to register as a company) an “annual review fee”.

“Each year, we send your company an annual statement shortly before the annual review date,” ASIC states.

“Your annual statement will contain a statement of your company’s details (and) an invoice for your company annual review fee.”

Yet despite the misleading terminology, ASIC doesn’t actually conduct any “review”.

ASIC simply sends each company a statement, usually a single page, of its current details.

If those details, such as the company’s registered address, have changed, the company is required to contact ASIC to update its details – for another fee.

ASIC terms sending companies a brief statement about their own details an “annual review”.

Much has been made – including by ASIC – of Australia’s big four banks illegally charging customers “fees for no service”, where customers were charged for financial advice that was never delivered.

The “annual review” fees charged by ASIC, particularly given the wording and the way they are presented, similarly represent a “fee for no service”.

“ASIC’s ‘annual review’ charges are a fee-for-no-service”

The ASIC annual review fee is currently $276.

If the payment is a day late, there is an additional $83 fee. If the payment is 30 days or more late, that fee explodes to $344, taking the total payment to $620.

Those “fines” delivered ASIC a monster $241.25m last financial year, up on $149.27m the year before – a leap of 62 per cent.

“Public” information

The overwhelming majority of money ASIC raises from the public is by charging companies to lodge information in its register – and then charging companies and the public to access that “public” data.

That’s despite the actual costs to ASIC of running the register being relatively minor.

The ASX conducts a similar service, for every company listed on the stock exchange, for free.

Its total cost of providing that function is so small it’s not set out in the ASX’s financial accounts, as it’s “immaterial”.

Despite widespread community concerns, the Federal Government continues to charge highly excessive, almost punitive, fees for the public to access the information on ASIC’s “public” business database.

This red-tape has a substantial impact on transparency and adds heavily to the cost of doing business.

The sky-high costs mean that undertaking normal business functions, such as conducting simple background checks, or due-diligence on a company, are generally out of reach of most Australians.

ASIC makes a very small amount of data available for free, including a company’s name and its address.

But for the vast majority of “public” information, ASIC gouges massive fees.

Accessing a single set of a company’s annual accounts that are over 10 pages costs an eye-watering $42.

Search costs quickly run into the hundreds and thousands of dollars.

Corporate governance experts warn the charges are having a major impact on transparency.

Of all the searches of ASIC’s register, 98 per cent are searches of the free, very limited data.

The vast majority of the database costs large amounts of money to access – and so accounts for just 2 per cent of all searches.

The exorbitant fees are among, if not the highest, in the industrialised world.

In many countries, such as the UK, US and New Zealand, such searches for “public” company information is free.

In 2014 then ASIC chairman Greg Medcraft famously described Australia as a “paradise” for white-collar crime.

The inaccessibility of “public” company information adds substantially to that problem.

Journalists are particularly hard hit.

Searches of ASIC’s database are the same as the ASX, or any other major database.

They are online and instantaneous.

In July 2018 the Federal Government announced that company searches for journalists would become free.

“The Government will extend the fee exemption that is currently available to some journalists for certain registry searches…to all journalists, for all registry searches,” then Finance Minister Mathis Cormann said at the time.

However, for reasons that neither the Federal Government or ASIC has explained – despite our repeated questions over several years – ASIC only allows journalists to conduct a limited type of searches online.

For the remainder, despite the register being fully electronic and instantaneous (for anyone with a credit card), ASIC makes journalists print out a form and send it in. ASIC then takes “up to ten business days” to provide the information.

This often renders the service meaningless, as journalists regularly operate to tight deadlines, very often requiring information the same day.

The Klaxon’s requests to ASIC for information regularly take the entire ten days business days – two full weeks – to come back.

ASIC and the Federal Government have provided no valid reason as to why most journalist searches have been carved out from the online function.

(ASIC’s latest annual report boasts: “In total, 99.97% of applications to register a company or business name are now made online”.)

On one occasion, ASIC told The Klaxon it took it so long to conduct the (unnecessarily) “manual” searches because of “staffing”.

Yet making many of the journalist searches “manual” is entirely unnecessary. It’s an inexplicable and explicit waste of public resources.

“Making journalist searches ‘manual’ is entirely unnecessary and an explicit waste of public resources”

The impact on the broader community resulting from journalists not being able to access key information in any reasonable timeframe is far greater again.

IT experts have told us that removing the inexplicable electronic block on searches by journalists would cost ASIC next to nothing – its entire site works that way – and it could be achieved in a couple of hours.

Last financial year ASIC raised $64.9m for the government by charging for the “public” company information, up from $59.7m the year before.

“Fee for service”

The surge in revenue the government is collecting via ASIC has been further fuelled by the Federal Government’s introduction, in mid-2017, of an “industry funding model”.

Companies now pay an annual “levy”, ostensibly to cover ASIC’s cost of operations.

Yet even at the time – a point picked up by very few in the media – the government was already using ASIC to cover its costs – more than 2.5-times over.

In 2016-17 ASIC received $341.64m in funding but raised (mostly from small business registrations) $920m – 2.7 times more.

In 2017-18 ASIC received $348m from the government and, after including the new “industry funding” levies, raised $1.227m – 3.5 times more.

Further highlighting the fact that “annual review” charges are “fees for no service”, is the fact that ASIC states its industry levy is a “fee-for-service” (covering ASIC’s operating costs).

When announcing the industry levy, ASIC said it was to “recover the regulatory costs of the ASIC though annual levies and fees-for-service.”

Last financial year ASIC collected $314.5m via the industry levy, almost three-quarters of its $437m total operating cost.

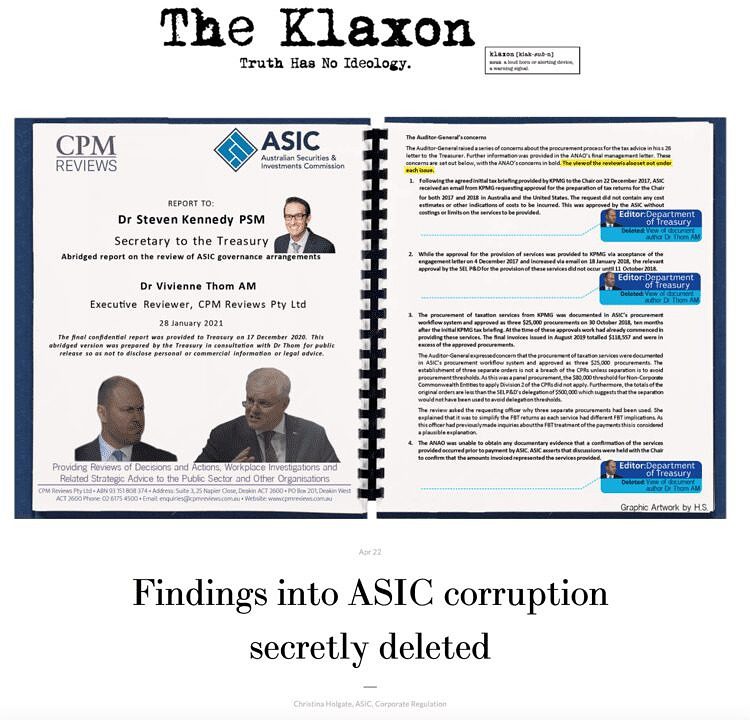

The Klaxon’s April 22 expose. Source: The Klaxon

The Federal Government’s record-breaking $1.078bn profit from ASIC came in the same year that ASIC’s two Federal Coalition-appointed executives were forced to resign in a major expenses scandal.

Both ASIC chair James Shipton – a former senior executive with notorious global investment bank Goldman Sachs – and Daniel Crennan QC, a Melbourne barrister, were illegally paid almost $200,000 more than they were entitled to.

Treasurer Frydenberg announced a “review” into the scandal, but, as previously revealed by The Klaxon, he released a doctored version of the subsequent report, from which three-quarters of its key findings had been secretly deleted.

Despite the severity of the situation – a cover-up of corruption at the top of the corporate regulator involving the nation’s Treasurer – not one other media outlet has reported the scandal to date.

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.