Treasurer Josh Frydenberg’s “independent review” into corruption at ASIC failed hopelessly at its first hurdle. It somehow “missed” that KPMG – at the centre of the scandal having provided the $118,557 in personal “tax advice” that cost ASIC chair James Shipton his job – had also been conducting ASIC’s “internal audit services”. The Thom review was, transparently, a sham on many fronts. This latest revelation cements it. And there is now another explosive revelation: KPMG was the “reviewer” of all ASIC’s “internal auditors” at the same time that it hiked its fee for Shipton’s “tax advice” – by an eye-watering 1,500%. Guess who’s missed that too? Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Treasurer Josh Frydenberg’s “independent review” into corruption at the corporate watchdog failed to identify that private company KPMG – which charged $118,557 for providing the regulator’s chair James Shipton with illegal, personal “tax advice” – had also been running the watchdog’s own internal auditing operations.

That abject failure, going to the heart of Frydenberg’s review, comes as The Klaxon can reveal explosive new – yet publicly available – evidence showing KPMG was in 2018 involved in a second, key, “internal governance” arrangement inside Shipton’s Australian Securities and Investments Commission.

On January 18 The Klaxon revealed that ASIC’s “internal audits” had been run by KPMG.

For the past four weeks, KPMG and ASIC have outright refused to comment on that tie-up.

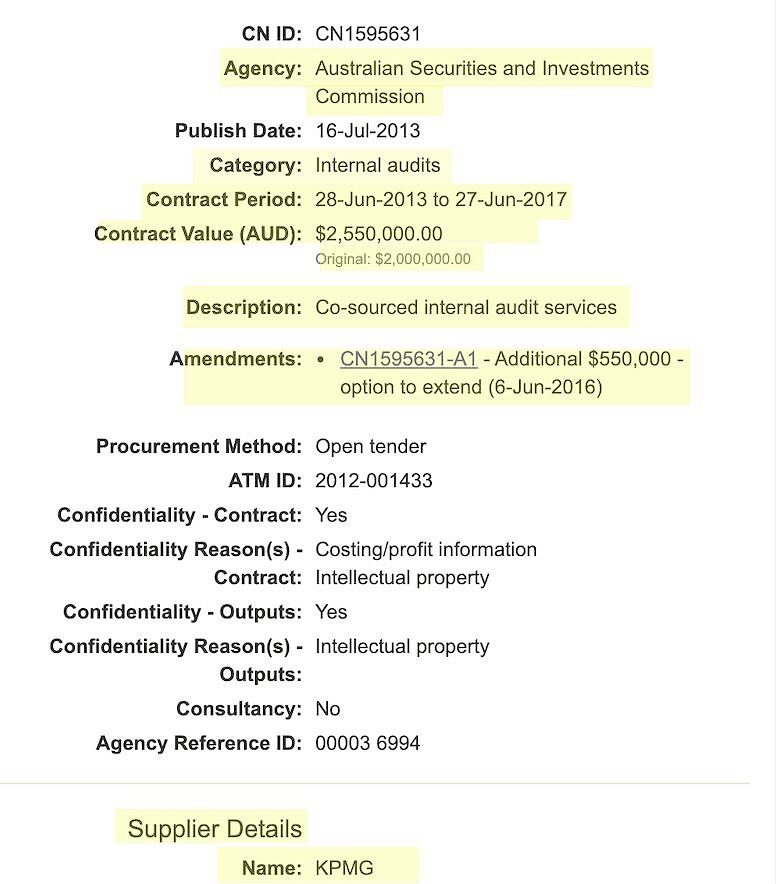

However The Klaxon has now confirmed the arrangement ran for at least four years, and that KPMG was paid around $550,000 a year for the role, totalling $2.55 million.

ASIC paying KPMG $118,557 for personal “tax advice” for Shipton is the core of the ASIC scandal, which has now cost Shipton his job, little over halfway through his minimum tenure.

As reported last week, ASIC’s actual auditor (its “external” auditor), the Australian National Audit Office, has found that only the $1917 payment was actually legal.

(Shipton has said he will repay the full $118,557, but has not said whether he will repay the additional $78,266 in connected fringe benefits tax, which ASIC also paid on his behalf).

The legal $1917 payment was for a two-hour, “initial tax briefing”, that Shipton’s lawyers say was provided to Shipton by KPMG, via teleconference, on December 22, 2017.

Shipton, a former investment banker with globally notorious financial services firm Goldman Sachs, started at ASIC on February 1, 2018 was appointed under then Treasurer (now Prime Minister) Scott Morrison.

“KPMG was paid around $550,000 a year, totalling $2.55 million”

That KPMG had run ASIC’s “internal audits” for several years was entirely “missed” by Frydenberg’s “independent review” into the scandal.

Frydenberg announced the Thom review on October 23, after Auditor-General Grant Hehir, concerned about an ongoing cover-up, took extremely rare action and issued Frydenberg with a “section 26 letter”, outlining his concerns and forcing the matter into the public arena.

Rather than it being independent, the review was conducted by Frydenberg’s own appointee, Dr Vivienne Thom, and run through Frydenberg’s Department of Treasury.

As revealed last week, Frydenberg secretly muzzled from the review from the outset – issuing it with “terms of reference” that ensured it would not “find” any illegality or wrongdoing whatsoever.

That Thom “missed” that fundamental and egregious conflict of interest, provides yet more evidence that the entire process was a whitewash from day one.

It gets even worse.

Private company KPMG was actually involved in a second arrangement to provide “governance” within ASIC – and at a highly sensitive time.

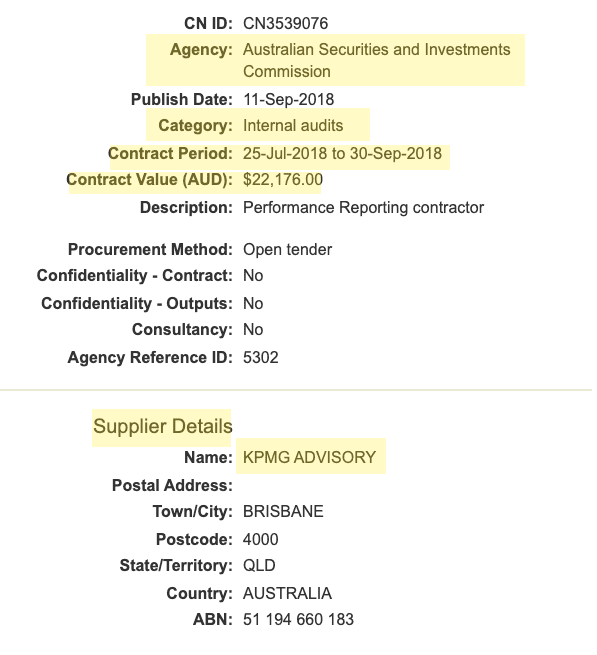

KPMG contracted a second time in relation to “internal audits” at ASIC, this time July-September 2018. Source: AusTender

That arrangement ran from July to September 2018 and involved KPMG conducting “performance reporting” in a role overseeing ASIC’s entire “internal audit” operations.

In other words, KPMG was reviewing, judging and reporting (to ASIC management) on ASIC’s internal audit providers.

At that time those providers, according to ASIC’s 2018-19 annual report, were ASIC employees and unspecified other “external” companies.

Under ASIC’s procurement guidelines, the 2018 PMG arrangement would need to have been directly approved by Shipton himself, or by someone Shipton had personally “delegated”.

information filed with the Federal Government’s AusTender system shows KPMG was engaged as “Performance Reporting contractor” in the category of “Internal audits” at ASIC between July 25 2018 and September 30 2018,

It was during this precise two-month period that:

- Shipton “requested additional assistance” from KPMG regarding his personal tax affairs and KPMG increased its proposed fee more than 14-fold, from an initial agreed price of $4,200 to “$60,000 to $70,000”

- KPMG “completed” Shipton’s overdue US tax return for the 2017 calendar year, which ASIC illegally paid for as a “relocation” expense. (Shipton didn’t even arrive in Australia or start working at ASIC until 2018)

- ASIC was completing its 2017-18 financial reports

This second ASIC-KPMG internal “governance” tie-up was also entirely “missed” by Treasurer Frydenberg’s self-described “independent review”.

That is despite Auditor-General Grant Hehir, In his October “section 26” letter to Frydenberg, explicitly citing concerns that in September 2018 (which was during KPMG’s “internal audit” contract at ASIC) KPMG had told Shipton that ASIC representatives had said anything above $9,500 would have to be paid for by Shipton himself.

Hehir wrote to Frydenberg: “The Chair was advised by KPMG in September 2018 that its fees for taxation services would be approximately $60,000-$70,000 and that its fees for taxation services would be approximately $60,000-$70,000 and that discussions with ASIC representatives confirmed a total of $9,500 would be covered by ASIC with any additional fees (will require) a separate engagement with the Chair on an individual basis”.

Two weeks after ASIC rejected the $60,000-$70,000 fee and told KPMG the most it would pay was $9,500, an underling to Shipton backflipped.

Hehir writes to Frydenberg: “On 11 October 2108 advice provided to the chair by ASIC was that the full amount would be paid by ASIC”.

Governance

As revealed by The Klaxon last week, key evidence buried in Frydenberg’s “redacted version” of Thom’s final report shows just $1917 of Shipton’s “tax advice” from KPMG, the “initial tax briefing” on December 22 2017, was provided legally.

That’s the formal position of the Australian National Audit Office, ASIC’s actual auditor.

The ANAO has obtained official legal advice specifically about the Shipton-KPMG “tax advice” matter.

How The Klaxon broke the KPMG story on January 17. It was “missed” completely by Frydenberg’s “independent review”. Source: The Klaxon

ASIC, Treasury and Frydenberg have all refused – for the past 18 months – to simply ask relevant body the Remuneration Tribunal whether or not the Shipton payments were legal.

That’s despite the ANAO, ASIC’s actual auditor under federal legislation, pushing it to do so since at least August 2019.

ASIC is the nation’s corporate governance regulator.

KPMG is a private company.

KPMG has made millions of dollars from taxpayers by providing “governance” advice and “internal audit” services to ASIC, the nation’s corporate governance regulator.

KPMG is a major “donor” to the Federal Liberal Party.

The Liberal Party – like the ALP – uses “donations” to run campaigns at election time to get its representatives voted in to parliament, where they make key decisions, such as appointing the heads of ASIC and the government Remuneration Tribunal.

As revealed last month, past ASIC annual reports show that KPMG was in a “co-sourced arrangement” with ASIC to conduct its “internal auditing”.

Both ASIC and KPMG have repeatedly refused – for the past month – to provide any information whatsoever about the taxpayer-funded tie-up, which was made under the auspices of good “corporate governance”.

Thankfully, analysis of Federal Government tenders sheds some light on the situation.

KPMG’s four year, $2.55m contract running “internal audit services” at ASIC. Source: AusTender

Documents reveal that, at the very least, KPMG provided ASIC’s “internal audit function” from June 2013 to June 27, 2017.

It was initially a three-year agreement, costing $2 million, but in 2016 it was extended by a year, to June 2017, and all up cost taxpayers $2.55m.

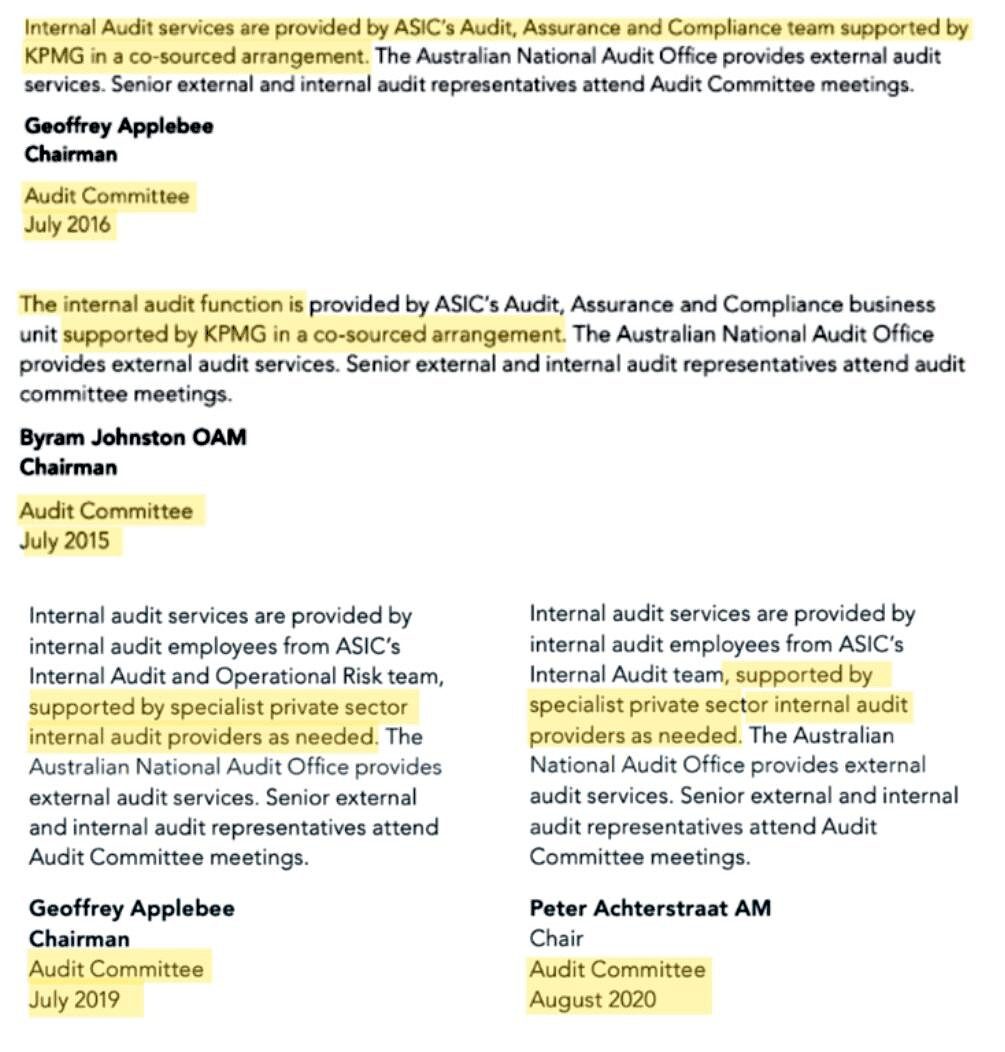

Only ASIC’s 2015 and 2016 annual reports mention that the 2013-2017 KPMG internal auditing “co-sourced arrangement”

ASIC’s 2016 annual report states:

“Internal Audit services are provided by ASIC’s Audit, Assurance and Compliance team supported by KPMG in a co-sourced arrangement. The Australian National Audit Office provides external audit services. Senior external and internal audit representatives attend Audit Committee meetings”. (Our emphasis).

(ASIC’s “Audit, Insurance and Compliance” business unit is seperate to ASIC’s “audit committee”. The “audit committee”, which is chaired by NSW Productivity Commissioner Peter Achterstraat, oversees the “Audit, Assurance and Compliance” business unit.)

That final sentence (in bold above) reveals that, remarkably, “external” audit representatives attend ASIC’s internal Audit Committee meetings.

That means KPMG, co-providing ASIC’s “internal audit services” was almost certainly present – and so setting and overseeing ASIC governance standards – at meetings of ASIC’s internal “Audit Committee” from June 2013 to June 2017.

ASIC’s Audit Committee reports directly to Shipton.

KPMG in “co-sourced” arrangement to provide ASIC’s “internal audit function”. Source: ASIC annual reports

Since 2016, external providers have continued to be involved with ASIC’s internal auditing, although ASIC doesn’t name them.

Rather, ASIC’s annual reports state its internal audit function is “supported by specialist private sector internal audit providers”. All annual reports continue to disclose that “senior external… audit representatives attend Audit Committee meetings”.

As “internal audit reviewer” from July to September 2018 – during which time KPMG increased its fee for providing Shipton’s “tax advice” more than 14-fold – senior KPMG representatives would have have been eligible to attend meetings of ASIC’s Audit Committee.

The role of the Audit Committee is to uphold good governance at the corporate regulator.

The timing of the second KPMG arrangement (July to September 2018) is also significant as it occurred when ASIC was preparing and finalising its annual report for the year to June 30 2018.

ASIC’s annual reports show ASIC’s internal Audit Committee provided Shipton with “advice”, before he signed-off on each of the 2018, 2019 and 2020 annual reports.

The Thom Sham

Frydenberg received Thom’s “final report” on December 17 but he is refusing to release it.

On January 29 Frydenberg released a statement along with a 41-page “abridged version” of Thom’s report, which was “produced” by his Department of Treasury.

Silence: ASIC “independent review” author Vivienne Thom. Source: Supplied

That “abridged” report shows that Thom failed to mention, even once, the fact that KPMG had been running ASIC’s internal audits – or that it had been engaged to undertake “performance reporting” over ASIC’s entire internal auditing operations in 2018.

The report contains a large amount of evidence that both Shipton and former ASIC deputy chair Daniel Crennan QC engaged in illegality and serious wrongdoing at ASIC.

(During 2019 and most of 2020 ASIC illegally paid $69,621 towards the rent on Crennan’s luxury family home in Sydney. He resigned when the scandal broke in October).

Despite the large amounts of evidence of serious wrongdoing, Frydenberg, on January 29, used his earlier “terms-of-reference” fudge to – highly misleadingly – announce that Thom had made “no adverse findings” against Shipton or Crennan.

Also on January 29, Frydenberg further announced that Shipton had engaged in no wrongdoing whatsoever regarding the Shipton and Crennan payments.

Frydenberg’s 41-page “abridged version” of Dr Vivienne Thom’s review. Source: Department of Treasury

Frydenberg provided zero evidence to support this.

The Treasurer’s claim was despite the fact ASIC has announced Shipton and Crennan would repay $118,557 and $69,621 respectively; Crennan resigned when the scandal broke in October; and the fact, also on January 29, that Frydenberg announced that Shipton would be replaced within three months – just halfway through his minimum five-year tenure.

In response to Frydenberg’s fudge, almost all major Australian media outlets falsely reported that Thom’s review had “cleared” Shipton of any wrongdoing.

Thom is a controversial figure and has been described as the Federal Government’s “go-to investigator”, who has a “long background running secret investigations” for the Coalition.

Thom has not responded to requests for comment from The Klaxon over the past week.

More to come…

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.