Corporate regulator ASIC is engulfed in a corruption scandal over $118,000 in personal “tax advice” allegedly provided to its boss by KPMG. It also has an “internal” audit team. That internal team has been co-run with a private firm. Guess who? Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Private consulting firm KPMG, which charged $118,000 for providing personal “tax advice” to the boss of the corporate regulator, has been running the regulator’s internal auditing operations.

The Klaxon can reveal that the Australian Securities and Investments Commission, currently embroiled in the biggest governance scandal in its 30 year history, has been in a “co-sourced arrangement” with KPMG to conduct its internal auditing.

It can also be revealed ASIC has an internal “Audit Committee” which reviewed the ASIC accounts containing the KPMG-Shipton payments, and gave advice to Shipton – and ASIC’s other key executives – before Shipton signed off on the accounts.

The ASIC filings showing KPMG providing ASIC “internal audit function”. Source: ASIC

The latest revelations follow our January 1 expose, which revealed that the Federal Government is refusing to take the key step in getting to the bottom of the scandal by refusing to actually “ask” the Remuneration Tribunal – the relevant federal body – whether the payments to Shipton were legal.

KPMG’s involvement running auditing within ASIC raises serious questions for ASIC’s internal Audit Committee, whose members include NSW Productivity Commissioner and former long-time Australian Taxation Office chief Peter Achterstraat.

The Klaxon can now also reveal:

– The last chair of the ASIC Audit Committee “retired” days after Shipton’s $118,000 KPMG bill arrived

– Shipton subsequently appointed Audit Committee member Lisa Woolmer on a premium, unexplained, $140,000 “limited tender” contract, which is littered with irregularities

– The Federal Government is refusing to release the findings of its “independent review”, which has been with Treasurer Josh Frydenberg for at least two weeks

– Frydenberg is refusing to say whether findings will ever be made public, or to even disclose what he set as the “terms of reference” of his review

– Shipton and ousted ASIC deputy chair James Crennan QC still owe taxpayers over $100,000, on top of the amounts they have agreed to repay

Peter Achterstraat – chair of ASIC’s “internal Audit Committee”. Former ATO boss. Source: Supplied

ASIC has repeatedly refused to comment and has directly refused to pass on questions The Klaxon has put to its internal Audit Committee.

Despite its central role – and the fact that its members include high profile public figures such as Achterstraat – no media has mentioned the existence of the ASIC Audit Committee since the scandal broke on October 23.

In October, James Shipton “stood aside” and ASIC deputy chair Daniel Crennan QC resigned after it was revealed the pair had benefitted from hundreds of thousands of dollars of allegedly illegal “relocation payments” from ASIC.

It emerged ASIC had been paying $750 a week towards the rent on Crennan’s luxury Sydney family home – totalling $69,621 – and that despite repeated official warnings, ASIC not only failed to take appropriate action but continued making the payments for over a year.

Yet more remarkably, it also emerged that ASIC paid for vastly expensive personal “tax advice” that ASIC claims KPMG provided to Shipton.

It cost $118,557.

ASIC also paid fringe benefits tax on the amounts, taking the allegedly illegal Shipton and Crennan payments to over $300,000.

It can now also be revealed Shipton and Crennan still owe taxpayers over $100,000 – the fringe benefit tax components – which is on top of amounts of $118,557 and $69,621 that they have agreed to repay.

The scandal – involving allegations of serious corruption at the top of the corruption regulator – is without precedent at ASIC, which began life as the Australian Securities Commission in 1991 under ALP Prime Minister Bob Hawke.

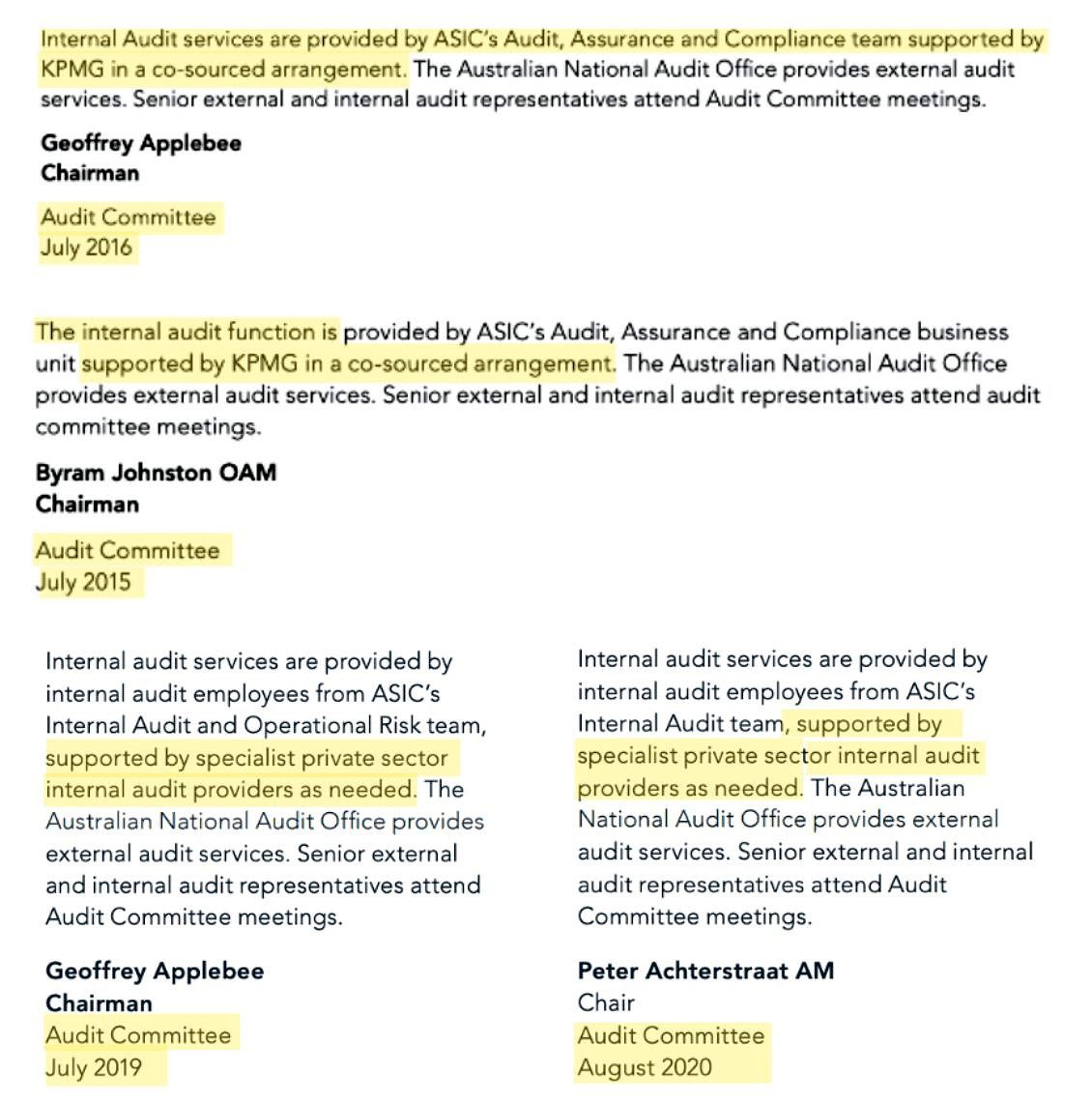

ASIC annual reports show that in at least the 2015 and 2016 financial years KPMG was in a “co-sourced arrangement” with ASIC, whereby KPMG provided “internal audit services” at the corporate regulator.

“Internal Audit services are provided by ASIC’s Audit, Assurance and Compliance team supported by KPMG in a co-sourced arrangement,” ASIC’s 2015-16 annual report states.

ASIC’s annual report for the year before makes an almost identical disclosure about KPMG and its “co-sourced arrangement” with ASIC.

From 2017 ASIC’s annual reports stop naming “KPMG” directly.

They state that ASIC’s internal audit services are “supported by specialist private sector internal audit providers as needed”.

“Internal Audit services are provided by ASIC’s Audit, Assurance and Compliance team supported by KPMG in a co-sourced arrangement,” ASIC

Both ASIC and KPMG have repeatedly refused to comment – for the past ten days – when asked by The Klaxon whether the “co-sourced arrangement” between them was still in place, or whether KPMG continued to provide internal audit services at ASIC.

KPMG Australia head of communications Kristin Silva; KPMG Australia associate director of communications Ian Welch; and KPMG Australia associate director of communications Whitney Fitzsimmons all refused to respond to written questions or to phone calls from The Klaxon over the past week and a half.

ASIC’s annual reports state: “Senior external and internal audit representatives attend Audit Committee meetings”.

That means KPMG, in working deep within ASIC, is able to attend the meetings of ASIC’s key internal governance mechanism, the ASIC Audit Committee.

How The Klaxon broke the story: The moves to cover-up the scandal within the corporate regulator. Treasurer Frydenberg in centre stage. Source: The Klaxon

In October Auditor-General Grant Hehir revealed that the $118,557 “tax advice” to Shipton from KPMG – all personally benefitting Shipton – did not follow Commonwealth Procurement Rules.

Further, “appropriate governance mechanisms were lacking”.

The KPMG-Shipton payments have been described as “outrageous” and far above what any employer would be expected to pay.

One very senior international taxation expert, and former top-tier accountancy partner, has told The Klaxon the Shipton payments are “completely ridiculous” and that they are almost certainly not legitimate.

Our independent, in-depth, investigations have uncovered nothing inconsistent with that view.

Deathly silence

Frydenberg has had the findings of his “independent review” into the ASIC payments for two weeks – at the very least – but has failed to release them.

“The government has received and is considering the independent review and will respond in due course,” Frydenberg spokesman Kane Silom wrote to The Klaxon on Tuesday January 5.

Frydenberg did not respond when we asked when the findings would be released – or whether they would be released at all.

The Treasurer also did not respond when asked what he had set as the actual “terms of reference” – the parameters of inquiry – of his review.

Despite Frydenberg labelling the review “independent” it was conducted by the Department of Treasury, which, like ASIC, is overseen by Frydenberg.

It is being conducted by Vivienne Thom, a former public servant with a “long background in running secret investigations” for the Federal Government.

ASIC Internal Audit Committee – reports directly to chair James Shipton. Source: ASIC

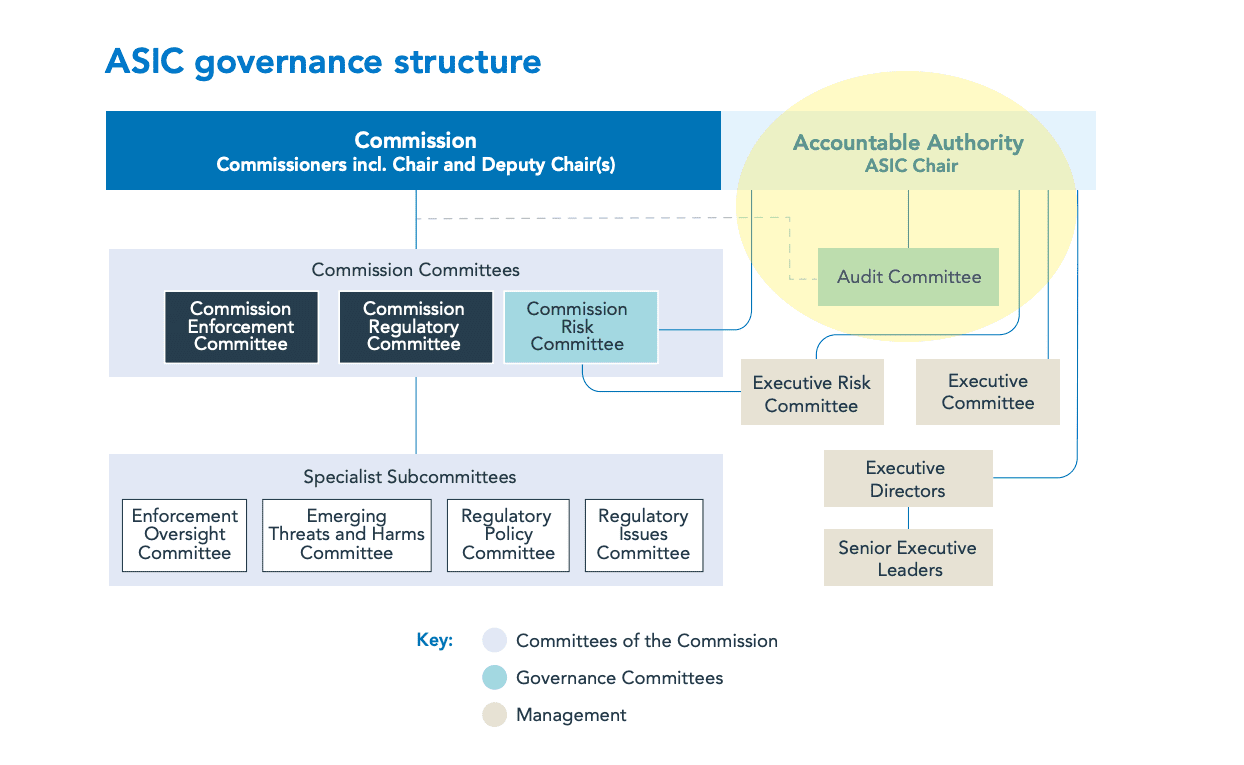

ASIC’s internal audit services are overseen by ASIC’s internal Audit Committee.

The Audit Committee, chaired by Achterstraat, reports directly to ASIC chairman James Shipton.

Shipton reports directly to Treasurer Josh Frydenberg.

One very senior public servant, who knows Shipton personally, told The Klaxon the ASIC boss had almost certainly been encouraged to take the $118,557 “tax advice” benefit.

“Look at who’s above Shipton – it’s not like he will have just gone and done this all on his own,” the source said.

“Someone’s encouraged him to do it.”

Hehir

ASIC has an external auditor (most auditors are external) as well as its “internal” auditors.

Each year its financial statements are audited by federal body the Australian National Audit Office.

The ANAO told ASIC in August 2019 that the payments of $750 a week towards Crennan’s rent were likely illegal.

Concerns deepened further when, that same month, KPMG billed ASIC $118,557 for the “tax advice” allegedly provided to Shipton.

ASIC not only failed to take adequate action, but kept making the Crennan payments for over a year.

The ANAO is overseen by Auditor-General Hehir.

Hehir, fearing no proper action would be taken, used his powers as Auditor-General to write an official, very rare, “section 26” letter to Frydenberg outlining his serious concerns.

That was in October, at least 14 months after the ANAO began raising formal, serious, concerns about the payments.

Frydenberg had almost certainly been aware of the matter long before receiving the “official” letter from Hehir on October 23.

But the fact Hehir wrote the section 26 letter – which he had also forewarned the government about – meant the matter was forced into the public arena.

ANAO

The pay rates of politicians and senior public servants are set by the Remuneration Tribunal, which set the relevant “total remuneration” pay rates of Shipton and Crennan, as chair and deputy chair at ASIC

In 2019-20 it was $775,910 for Shipton and $620,730 for Crennan.

One exception to the “total remuneration” caps are payments made for legitimate “relocation” purposes, when a senior public servant is required to move house or cities for work.

The Shipton “tax advice” and Crennan’s rental payments were on top of their respective total remuneration caps.

“Frydenberg never wrote to the Remuneration Tribunal. Not in 2019 after ANAO’s concerns were raised, not in May last year when ASIC drew up a draft request, not when the scandal broke in October – or at any time since.”

In August 2019 the ANAO told ASIC the Crennan rent payments did not appear to be legitimate “relocation” expenses and so were likely against the law.

The ANAO told ASIC to check their legality with the Remuneration Tribunal.

Internal ASIC notes claim that ASIC did this, and the Remuneration Tribunal said the same thing – they were remuneration not a “relocation” expense.

The internal ASIC notes also claim the Remuneration Tribunal – whose members were appointed by the current Federal Government – said that if ASIC wanted a concrete response, Frydenberg should send it a request in writing.

Frydenberg never wrote to the Remuneration Tribunal asking for the decision.

Not in 2019 after ANAO’s concerns were raised, not in May last year when ASIC drew up a draft Remuneration Tribunal request on Frydenberg’s behalf, not when the scandal broke in October – or at any time since.

(Frydenberg has repeatedly refused to respond when asked by The Klaxon why he has refused – and its refusing – to asked the Remuneration Tribunal for a decision.)

It has never been explained why the Federal Government has long refused – and continues to refuse – to “ask” the Remuneration Tribunal for a concrete decision; why ASIC needed this additional concrete response in the first place, given the Remuneration Tribunal had already allegedly stated that the Crennan payments appeared to be illegal; or why the Remuneration Tribunal hasn’t simply just provided a concrete response to ASIC, which is a fellow government body.

These yet-to-be-explained events have all favoured Shipton, in his apparent bid to remain at the helm of ASIC; Frydenberg, as Shipton’s boss; and, Prime Minister Scott Morrison, who was Treasurer when Shipton – a former Goldman Sachs banker and so-called “blue-blood” whose father had been a Federal Liberal MP – was appointed to head up ASIC.

When Shipton was appointed the Prime Minister was Malcolm Turnbull.

Like Shipton, Turnbull had formerly worked at Goldman Sachs, a global American investment bank that has become globally notorious for its corporate wrongdoing.

Taxing

After the ANAO raised concerns about the KPMG-Shipton payments, ASIC argued the payments were legitimate because they were “relocation” costs.

The $118,000 KPMG-Shipton payments are irregular on many fronts:

– They are incredibly high, even if they had been incurred by a person exercising tax evasion, or extremely aggressive tax minimisation

– They were allegedly incurred by the head of the corporate regulator

– They were budgeted at $4,050 and exploded 30-fold to $118,557

– They were billed to ASIC in August 2019, almost two years after Shipton was appointed ASIC boss

– They were documented as three instalments of $25,000 in ASIC’s “procurement workflow system”

– They break Commonwealth Procurement Rules

– Frydenberg is refusing to ask relevant body, the Remuneration Tribunal, whether they were legal

– Frydenberg’s “independent review” also failed to ask the Remuneration Tribunal whether they were legitimate

– Before making the payments, ASIC failed to ask whether they were legitimate

– They were provided by KPMG, which has now been revealed as being involved in “internal auditing” at ASIC

– The ANAO cannot find any documentary evidence that ASIC confirmed the KPMG services had actually been provided before ASIC paid the $118,557

– ASIC is refusing to disclose information about them that is substantive enough to ascertain their legitimacy

– ASIC has paid for and put forward “advice” from private law firm in bid to support the payments to Shipton, while failing to simply obtain the Remuneration Tribunal’s decision

– Shipton signed accounts on September 9 confirming the ANAO had been given “all relevant information” about the payments when this was not the case (ASIC handed more documents over on October 16 after receiving ANAO’s “draft audit”)

– ASIC says it will disclose the $118,557 payments to Shipton, and that Shipton had agreed to repay them, only after receiving ANAO’s draft audit on October 5.

– Shipton then buries the disclosure in fine print at the bottom of page 214 of ASIC’s 272-page annual report, two pages after the formal disclosures about his “total remuneration”.

ASIC Internal Audit Committee. Clockwise from top left: Chair Peter Aachterstraat; former chair Geoffrey Applebee; Lisa Woolmer; ASIC Commissioner Cathie Armour. Source: Supplied.

Shipton’s auditors

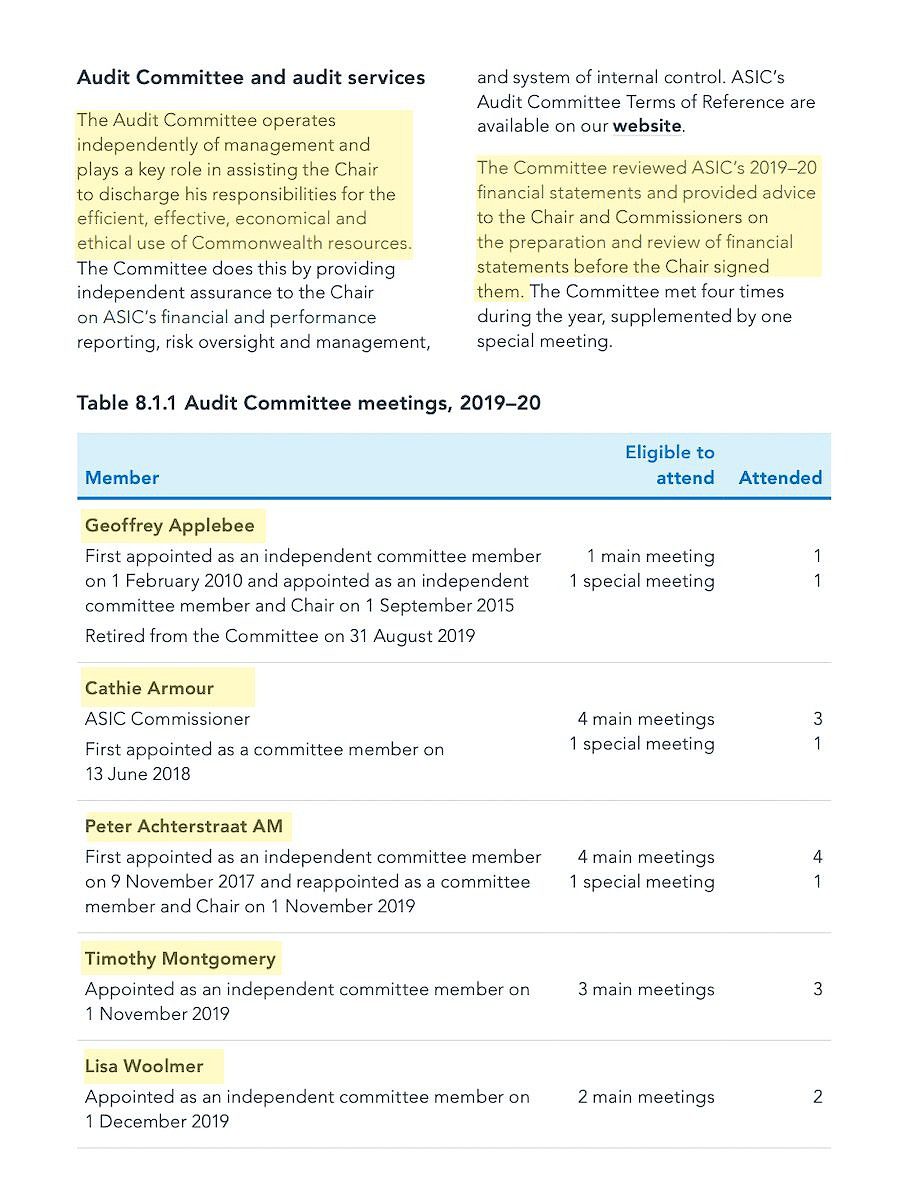

In both the 2018-19 and 2019-20 financial years – when the $300,000-plus Shipton and Crennan payments occurred – the Audit Committee reviewed ASIC’s financial statements and gave advice to Shipton – and the other ASIC commissioners – “before the Chair signed them”.

“The (Audit) Committee reviewed ASIC’s 2019-2020 financial statements and provided advice to the Chair and Commissioners on the preparation and review of financial statements before the Chair signed them,” Achterstraat wrote in ASIC’s 2019-20 annual report.

Similarly, in July 2019, the ASIC Audit Committee wrote: “The (audit) Committee reviewed ASIC’s 2018–19 financial statements and provided advice to the Chair and Commissioners on the preparation and review of financial statements before the Chair signed them.”

Despite ASIC facing the biggest governance scandal since it began life as the Australian Securities Commission in 1991, ASIC’s “independent” Internal Audit Committee has avoided the media spotlight entirely.

Until now.

Audit Committee chair Peter Achterstraat, the current NSW Productivity Commissioner, previously spent over a decade as the Deputy Commissioner of Taxation at the Australian Taxation Office and seven years as the Auditor-General of NSW.

As well as being the NSW Productivity Commissioner, Achterstraat is the chairman of Sydney’s Bankstown Airport Limited.

Taxation issues are a central component of the Shipton and Crennan payments scandal, with the pair yet to confirm whether they will repay the $100,000-plus in fringe benefits tax payments they allegedly improperly benefitted from.

During the 2019-20 financial year the ASIC Audit Committee had five members, led by Achterstraat.

The other members were Geoffrey Applebee, Cathie Armour, Timothy Montgomery and Lisa Woolmer.

ASIC’s Internal Audit Committee. Source: ASIC 2019-20 annual report.

Applebee is chair of accountancy firm Pitcher Partners in Sydney, is a director of NSW Government entity Forestry Corporation of NSW (where he also chairs its audit committee), and is a director of private property developer Village Building Co.

Applebee had been on ASIC’s audit committee for almost a decade before he departed on August 31 2019.

He was chair of the audit committee at the time of his departure, having been appointed chair of the committee in 2015.

Behind-the-scenes, August 2019 was a big month for ASIC.

On August 6, Grant Hehir’s ANAO warned ASIC it was “not convinced” payments to ASIC deputy chair Crennan were legal.

During the month KPMG billed ASIC for Shipton’s $118,557 personal “tax advice”.

The on August 31 Audit Committee chair Applebee “retired” from the position, with no other information provided.

ASIC has repeatedly refused to comment when asked questions that it says might be covered in Frydenberg’s “independent review”.

“Consistent with all previous responses to you, we are unable to discuss matters under consideration by the Vivienne Thom review, it would be inappropriate for us to do so, as has been previously explained,” ASIC national media manager Gervase Green wrote to us on January 7.

We explained that the Thom review was complete, and had been with Frydenberg since at least January 4, and so those matters were no longer “under consideration” by the review.

Green still refused to provide comment.

(Further, ASIC’s stance of silence on the expenses scandal is relatively new: ASIC had responded to questions from The Klaxon for several weeks after the scandal broke and Frydenberg’s review had been launched.)

The Audit Committee’s current chair, Achterstraat, started in the position on November 1 2019, two months after Applebee departed.

He had been a member of the Audit Committee since 9 November 2017, which was the week after Shipton was appointed ASIC chairman.

Shipton officially started work at ASIC in February 2018.

Two other Audit Committee members were more recently appointed.

Timothy Montgomery, “a senior information technology executive for a separate Commonwealth entity”, according to ASIC’s annual report, was appointed to the committee on November 1 2019.

Lisa Woolmer was appointed on December 1 2019.

The fifth member is “internal appointee” Cathie Armour.

Armour is an ASIC “commissioner”, who was appointed to the Audit Committee on 13 June 2018.

The ASIC Audit Committee is required to hold at least four meetings a year.

In 2019-20 it held four meetings and one “special meeting”, ASIC’s accounts show.

According to ASIC’s annual report, Achterstraat was paid $32,246 in the year.

It states Woolmer was appointed on December 1 2019 and was paid $15,304 in the financial year.

ASIC’s annual report lists payments to Montgomery as nil.

TIMELINE – 2019

– August 6 – ANAO raises serious concerns over Crennan rent payments, saying they are remuneration, not “relocation” expenses

– August 9 – Remuneration Tribunal allegedly tells ASIC it agrees: Crennan payments remuneration, not “relocation” expenses

– “August” 2019 – ASIC receives $118,557 invoices from KPMG for Shipton “tax advice”

– August 31 – Geoffrey Applebee “retires” as ASIC Audit Committee chair

– October 24 – Shipton appoints new Audit Committee member Lisa Woolmer on a premium, unexplained, $140,000 “limited tender” contract

– November 1 – Timothy Montgomery appointed new Audit Committee member

– November 3 – Shipton renews Peter Achterstraat’s position on the ASIC Audit Committee and appoints him chair

Lisa Woolmer- “limited tender” contract littered with irregularities. Source: Supplied

Woolmer

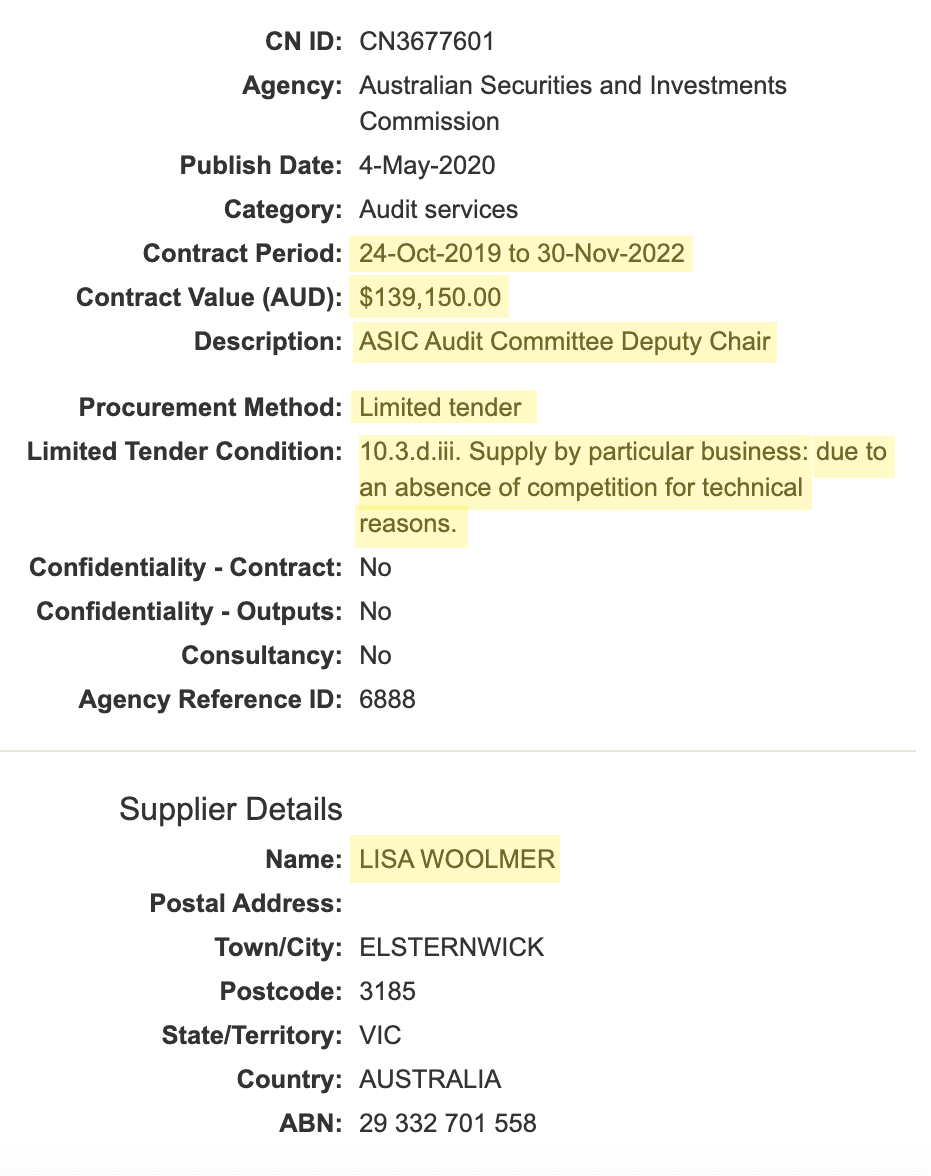

There are numerous anomalies surrounding Woolmer’s appointment to the ASIC Audit Committee.

The Federal Government’s tender database shows Woolmer was given a three-year contract of $139,150 with ASIC, starting on October 24, 2019.

The tender states Woolmer’s role as “ASIC Audit Committee Deputy Chair”.

The database shows Woolmer’s contract was made on a “limited tender” basis, which it states was “due to an absence of competition for technical reasons”.

No mention is made of what the claimed “technical reasons” were for the limited tender, or why there was an “absence of competition” for the high-paying contract.

Rather than being employed personally, the contract is between Woolmer’s private company, which she controls, and the Federal Government.

At $139,150 for three years, the annual payments to Woolmer’s company work out at $46,383.

That is substantially more than the $32,246 that ASIC’s annual report states was paid to Internal Audit Committee chair Achterstraat in 2019-20.

Further, the three-year Woolmer tender (published online on May 4 2020, and so before the end of the 2019-20 financial year) states that Woolmer was appointed as ASIC Audit Committee Deputy Chair.

Yet ASIC’s 2019-20 annual report makes no mention of there being a deputy chair of the Audit Committee.

It describes Woolmer as simply an “independent committee member”.

The federal tender states Woolmer’s three year contract began on October 24 2019.

That appears inconsistent with ASIC’s annual report, which states Woolmer was appointed on December 1 2019.

Also unusual are the reported payments to Woolmer.

ASIC’s 2019-20 annual report states that Woolmer’s “fees for the 2019-20 year” were $15,304.

The government tender for Woolmer through her business. Tender “limited” allegedly due to an “absence of competition due to technical reasons”. Source: Federal Government, AusTender.

From December 1 2019 to the end of the 2019-20 financial year is seven months.

At $46,383 a year, pay for seven months would be $27,056.

That is over 50% more than the $15,304 figure ASIC’s annual report states was paid to Woolmer.

Even allowing for possible in-built pay rises over the three year contract, and GST (although ASIC’s annual report makes no mention of any GST payments benefiting Woolmer) the figure reported for her remuneration in 2019-20 appears unusual.

Woolmer is also the chair of the internal Audit Committee of Comcare, the federal government workplace health and safety agency.

Her Comcare bio states she also chairs the internal audit committees of the Glen Eira and Bayside local councils in Melbourne, as well as the internal audit committee of Mornington Peninsula Shire.

A 2018-19 bio for Woolmer states she was “an Independent Audit Committee member” for Victoria’s Office of Public Prosecutions.

Woolmer did not respond to requests for comment that The Klaxon put to her via Comcare.

All Roads

The Klaxon’s attempts to obtain answers in the “relocation” payments scandal have been thwarted by the corporate regulator.

ASIC has repeatedly refused to respond when asked questions about the Audit Committee.

ASIC Chair James Shipton. “Stands aside” in October. Source: Supplied

Questions put to the committee, and to the Audit Committee members individually, have not been answered.

ASIC’s annual reports state its internal Audit Committee “operates independently of management”.

However it also says the committee “assists the Chair to discharge his responsibilities”.

It does so for the “efficient, effective, economical and ethical use of Commonwealth resources”, ASIC states.

“It also provides independent assurance to the Chair and the Commission on ASIC’s financial and performance reporting, risk oversight and management, and systems of internal control,” ASIC’s annual report states.

All of the members of the ASIC Audit Committee are appointed by the ASIC Chair.

“The Audit Committee comprises at least three and not more than six members, appointed by the ASIC chair,” the Audit Committee’s “Terms of Reference” state.

For all four current members of the Audit Committee, that ASIC chair was James Shipton.

More to come…

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.