Appreciate our quality journalism? Please subscribe here

DONATE

EXCLUSIVE

INVESTIGATION

The Secretary-General of the OECD, former Australian Finance Minister Mathias Cormann, stands to have made substantial gains from secretive share dealings with the man who was CEO of PwC Australia for the entire tax leaks affair.

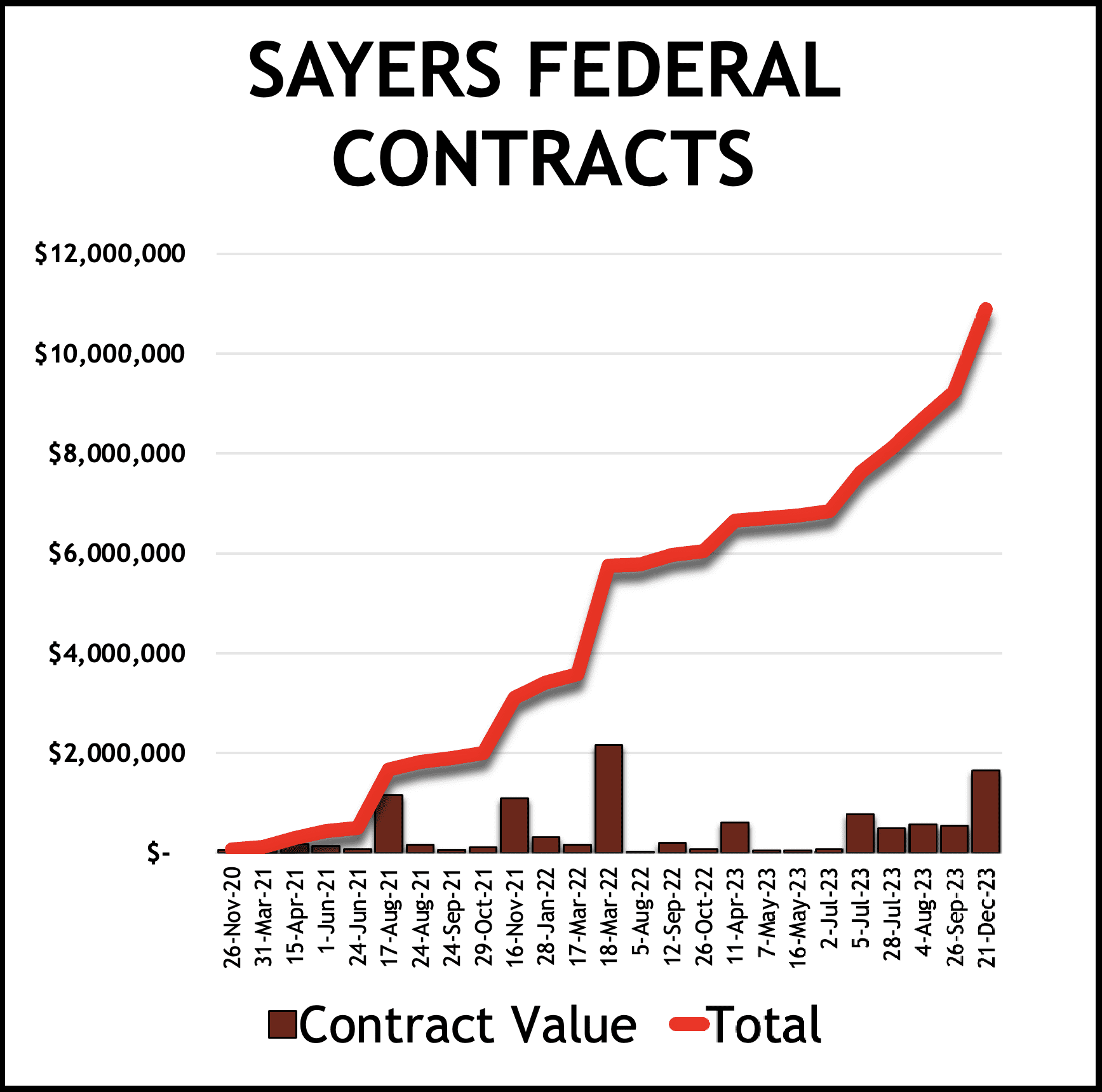

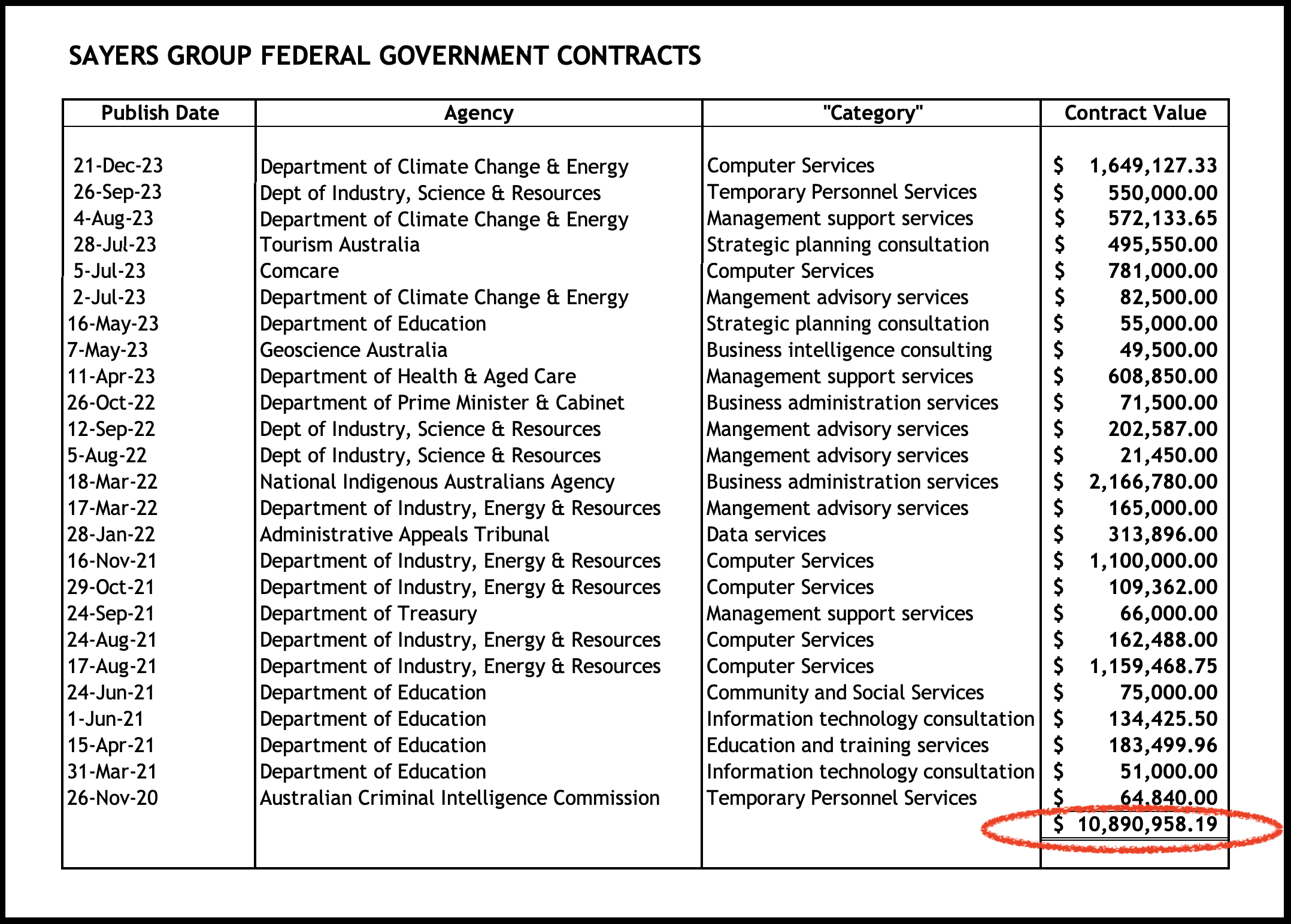

Investigations show the private company Luke Sayers founded in 2020 after departing as PwC Australia CEO has been given over $10 million in Australian Government contracts — around $9m of which while Cormann was a secret co-owner.

Between December 2020, and November last year, when Sayers said Cormann had “recently”, “rescinded” his equity, Sayers Group was awarded at least 23 Federal Government tenders worth $9.18m, investigations by The Klaxon reveal.

The true value is likely higher, as only contracts of a certain size and type are required to be published on government contracting register AusTender.

The profits of Sayers Group are shared among its owners.

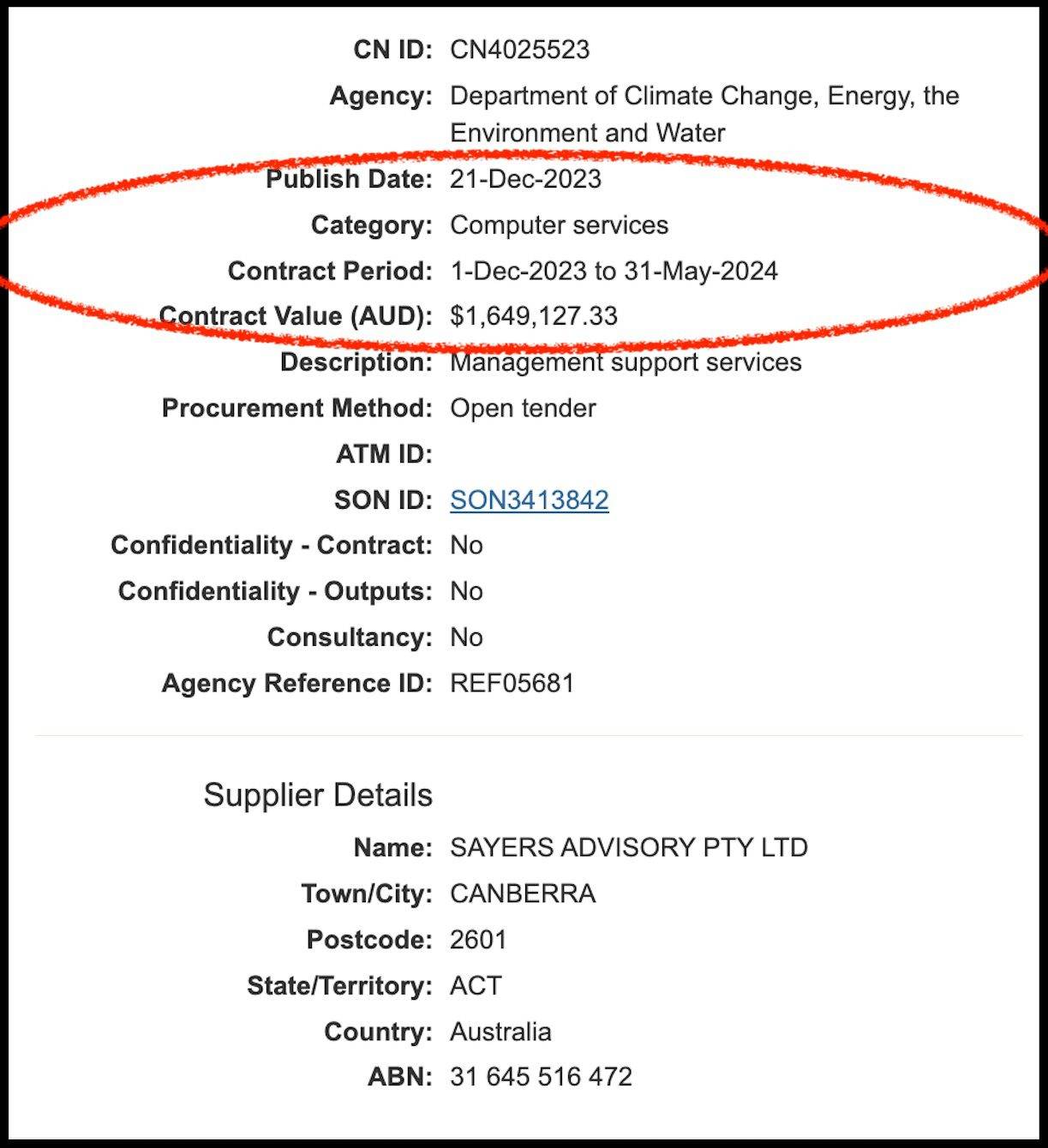

Despite Sayers having been PwC Australia CEO from 2012 to 2020 — and so for the entire PwC tax affair — Federal Government contacts to Sayers Group have continued to soar, with a new $1.65m deal posted days before Christmas.

Federal contracts to Sayers Group have exploded. Source: AusTender. Graphic: The Klaxon

Cormann left parliament on November 6, 2020.

Weeks later, in “December 2020”, he was issued the “equity” in Sayers Group in secret, with Sayers and Cormann structuring the deal through a “bare trust”, which meant it was hidden from Australian regulators and the public.

Sayers Group, like PwC, makes large amounts of money through government contracts by providing services previously provided by public servants, often at several times the cost.

Cormann was Australia’s longest serving Finance Minister, holding the position from 2013 until late 2020 in the former Coalition Federal Government, before becoming boss of the Organisation for Economic Co-operation and Development (OECD), announced in March 2021.

Please SUBSCRIBE HERE and support our quality journalism

Source: AusTender. Graphic: The Klaxon

Under Cormann — expenditure on contractors is overseen by the Department of Finance — the amount of taxpayer money given to the “Big Four” consultancies, including PwC, exploded almost five-fold: from $282m in 2012-23 to $1.4 billion in 2021-22.

PwC — and Luke Sayers — were among the biggest beneficiaries.

From 2013 to 2020 Federal Government payments to PwC Australia for “management advisory services”, the most common government category for Big Four expenditure, exploded more than 17 times — from $5.8m to $101.4m.

As PwC CEO from 2012 to 2020, Sayers was paid $30.217m, his pay ranging from $2.967m in 2012-13 to a high of $4.502m in the 2019 financial year.

Cormann was one of the most senior figures in Australia’s previous Federal Government, a coalition between the right-wing Liberal and National parties.

He not only oversaw the massive increase in money flowing to the Big Four consultancies as the minister responsible for the Department of Finance, but was its biggest defender, despite years of serious public concerns.

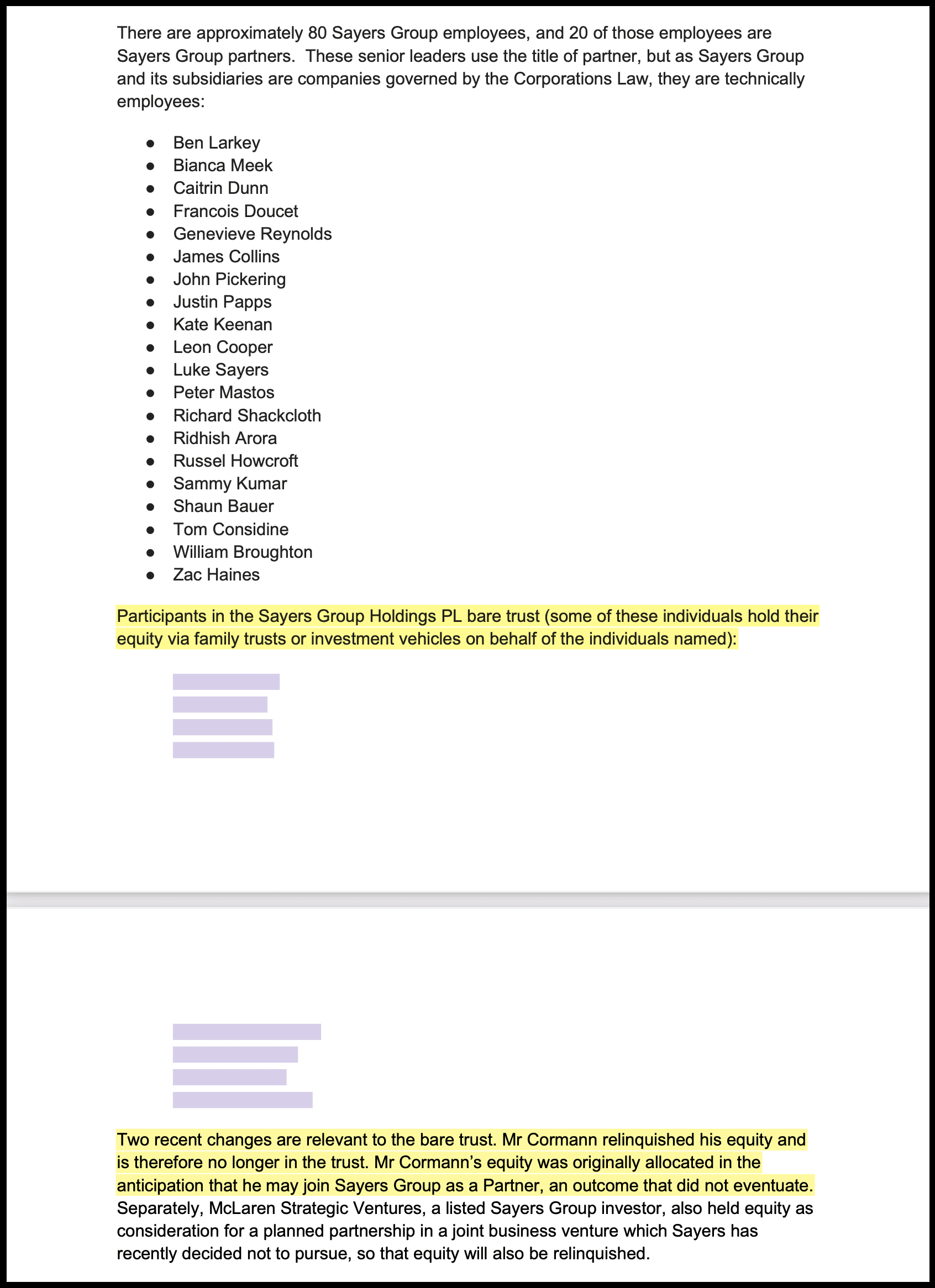

The “bare trust” hid Cormann’s ownership Sayers’ November response to the Senate inquiry. Source: Australian Parliament

After coming to power in May 2022, fulfilling an election promise after years of raising major concerns, the current Labor Party Government conducted an audit spend on contractors.

The audit, by the Department of Finance (previously answerable to Cormann), found $20.8 billion had been spent on outsourcing in just the 2021-22 financial year.

Under the Coalition, a giant, “shadow public service” had been created in large part due to an “arbitrary” 2015 cap that had “gutted” the public service.

Consultants formed 53,900 full-time-equivalent jobs, one-third the size of the actual public service.

With Cormann as Finance Minister, Federal contracts to PwC for “management advisory services” exploded more than 17 times. Source: Centre for Public Integrity

For the duration of his time in Federal Parliament (2010 to 2020) Cormann was a Federal Liberal Party senator for Western Australia.

As well as being Finance Minister (2013 to 2020), he was Australia’s Public Service Minster between 2018 and 2019.

In his first major speech as Public Service Minister, in October 2018, Cormann not only defended the ballooning consultancy expenditure, he called for a public sector overhaul so that public servants were rotated through the private sector.

“The public service does not have an exclusive monopoly on…delivering services on behalf of government,” Cormann said.

Cormann has repeatedly refused to respond to written questions from The Klaxon.

Sayers has also repeatedly refused to respond.

How the Big Four “infiltrated governments”. Source: ABC

OECD

The OECD is a powerful group of wealthy nations, with 38 member countries.

Its key roles include “international standard-setting”, “finding solutions to a range of social, economic and environmental challenges”, “best practice sharing” and “fighting international tax evasion”.

The mounting Cormann scandal presents the global body with some extremely serious questions.

Australia’s former Coalition Government, under former Prime Minister Scott Morrison, was extremely eager to have Mathias appointed the next OECD boss.

On November 7, 2020, the day after he left parliament, Cormann departed, aboard an $11,000-a-day taxpayer-funded Royal Australian Airforce Jet, on a 33-day international lobbying tour to become the next OECD Secretary-General — its top boss.

Cormann was also given a campaign team of 8.5 “full-time equivalent” employees from Australia’s Department of Foreign Affairs and Trade (DFAT), again at full taxpayer expense.

His appointment as the next OECD Secretary-General, for a five-year term was announced on March 5, 2021.

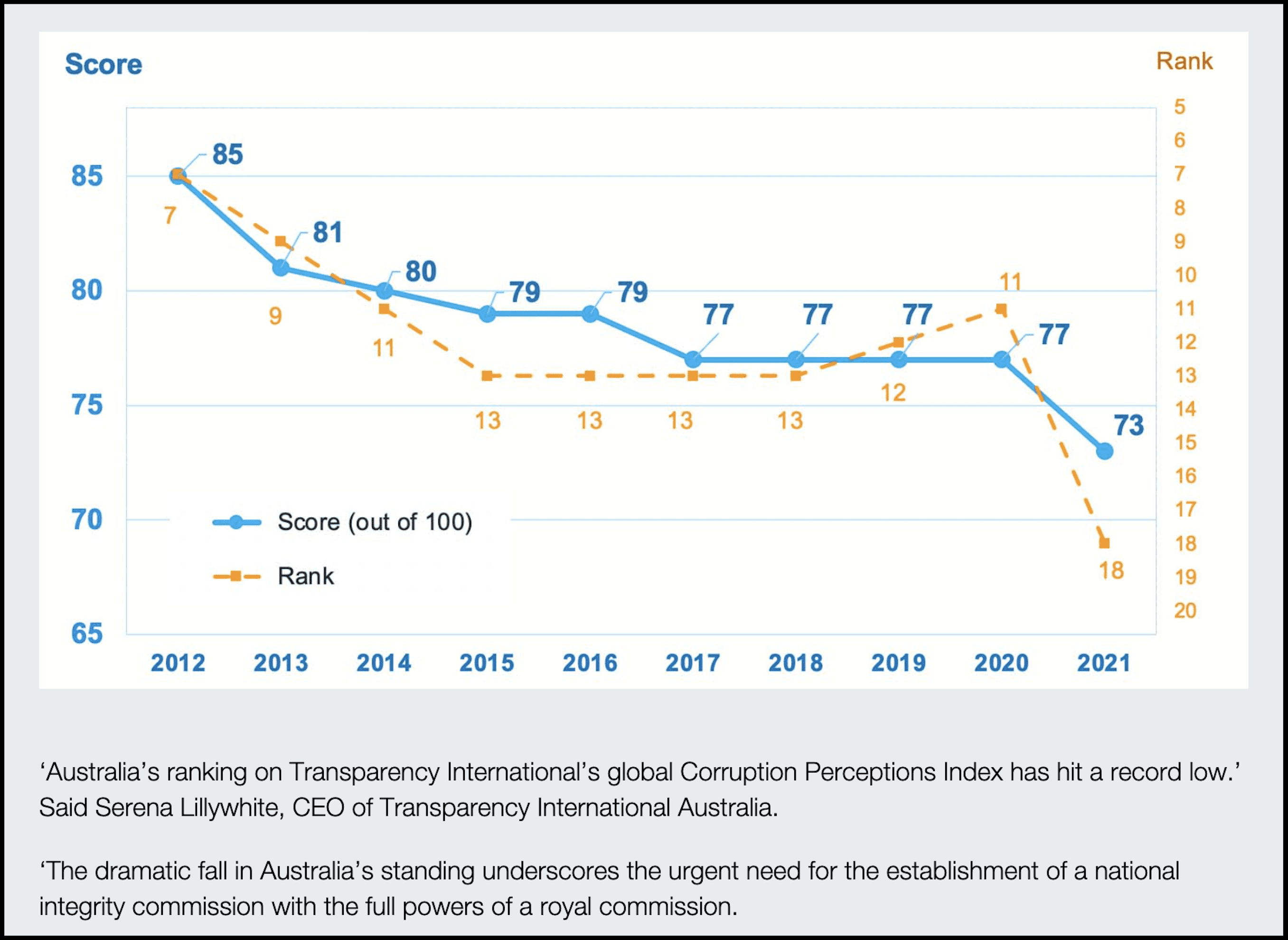

Australia’s former Coalition Government, which held power from 2013 to 2022, was one of, if not the most corrupt in the nation’s history, and was beset by rolling major scandals.

“Cormann was Finance Minister in one of the most corrupt governments in Australia’s history”

According to global anti-corruption group Transparency International, between 2012 and 2022 Australia fell faster toward corruption than any other OECD nation, except for Hungary, with which it tied.

(In 2022 the European Union declared Hungary had become a “hybrid regime of electoral autocracy” and was as no longer a democracy).

Please SUBSCRIBE HERE and support our quality journalism

Australia plummeted towards corruption under the Coalition Government. Source: Transparency International

Cormann’s lobbying for — and appointment to — the OECD’s top job was meet with deep concerns, both within Australia and internationally.

The Coalition Federal Government, of which Cormann was one of the most senior members and key decision makers, was pilloried on the international stage for its failures to act on climate change and attacked for being “captured” by fossil fuels interests.

As Finance Minister, Cormann was at the centre of multiple scandals.

“As Finance Minister, Cormann was at the centre of multiple scandals”

In 2019 it was revealed he had spent $37,000 of taxpayer money in one day using a Defence jet to fly between Perth and Canberra to promote a Coalition Government tax plan, which later failed.

Cormann’s Finance Department oversaw the Australian Government travel entitlements system.

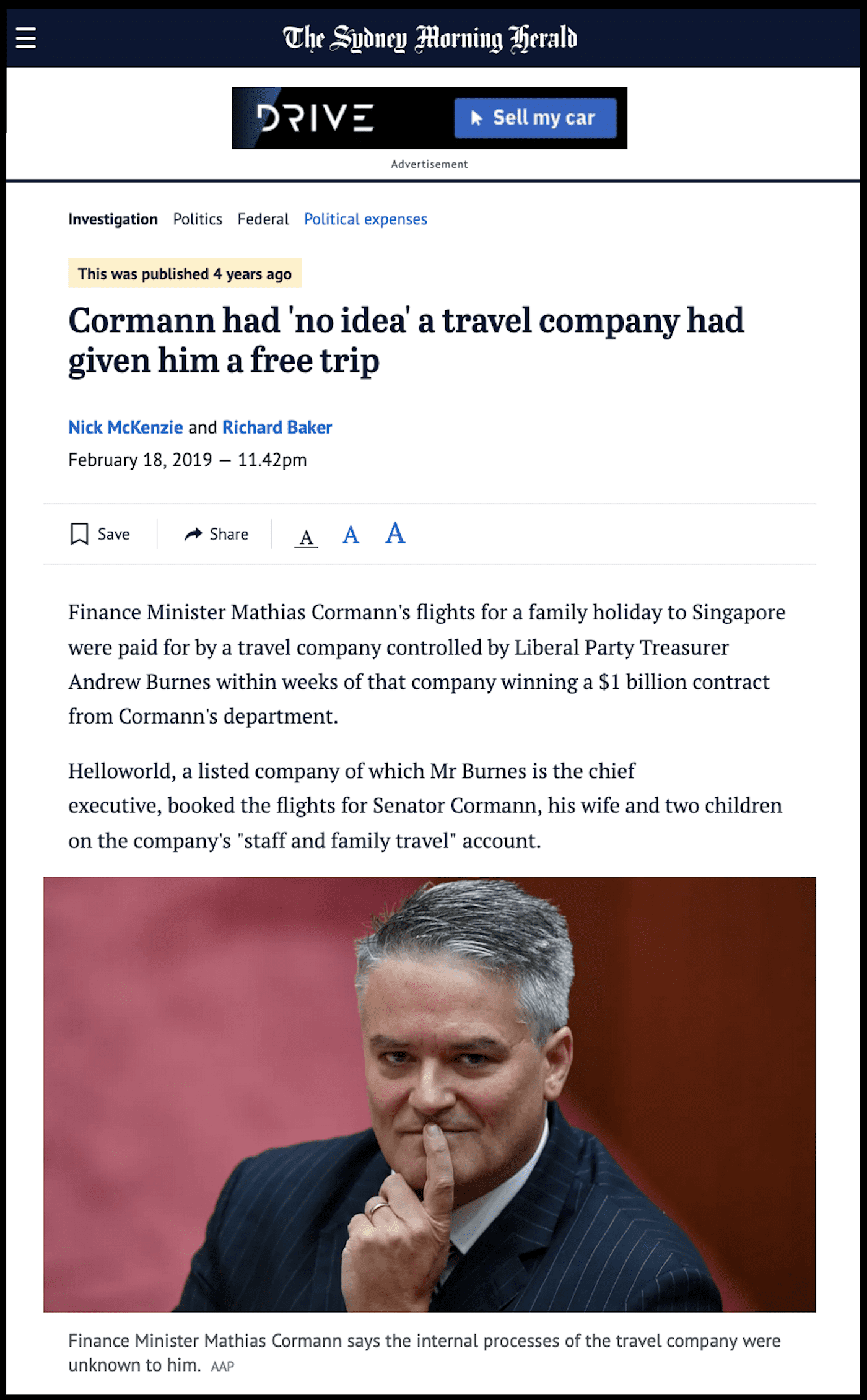

A month later that same year, it was revealed Cormann had, in 2017, been given $2780.82 in free flights for a family holiday in Singapore by a company that, within weeks, won a $1 billion contract from his Finance Department.

The CEO of the company, the ASX-listed Helloworld, was Liberal Party Treasurer Andrew Burnes.

Helloworld booked the flights, in July 2017, through its “staff and family travel” account.

The next month Helloworld announced its subsidiary had won a three-year-plus, $300m-a-year, Department of Finance contract.

Cormann, his wife and two children, took the trip in January 2018. It was never disclosed in his pecuniary interests register.

When the Sydney Morning Herald broke the story in February 2019, Cormann told the paper he had “no idea” his credit card had not been charged for the flights.

Cormann was given free international flights costing $2780.82. He later said he had “no idea” he hadn’t paid for them. Source: SMH

In 2016 it was revealed Cormann had charged Australian taxpayers at least $5189 so he and his wife could attend the 2013 AFL grand final in Melbourne, including $3594 so his wife could fly business class from Perth to Melbourne.

In August 2021, months after the announcement of his appointment as OECD Secretary-General, it was revealed Cormann had been a member of a WhatsApp messaging group — calling itself “the Clan” — that was used to secretly stack Liberal Party branches in Western Australia.

“Years of leaked WhatsApp messages between a group of WA Liberals referring to themselves as “The Clan” expose the true scale of influence wielded by powerbrokers Mathias Cormann, Peter Collier and Nick Goiran,” the West Australian reported.

“In the messages, they openly discuss stacking Liberal Party branches with ‘solid citizens’ who can be relied upon to vote how they want”.

PwC tax scandal

Cormann’s secret dealings with Sayers would almost certainly remain hidden if not for the PwC Australia tax affair, which is one of the biggest corporate scandals in Australian history.

In January last year it was revealed that from 2013 to 2018 — all under Sayers’ watch — PwC had taken stolen secret Australian Government tax policy information and shared it around the world for profit, including with multinationals seeking to avoid Australian tax.

Multiple PwC partners, including Australia’s former head of international tax Peter Collins, obtained that confidential information while providing government advice on stopping multinational tax avoidance.

Having refused to comment for most of the year, Sayers on October 12 appeared before the Senate inquiry into consultancies, which was formed in response to the PwC scandal and is comprised of members from each of Australia’s major political parties.

Sayers said he had known nothing of the tax leaks affair as PwC Australia CEO knew and could not “recall” key events, drawing deep scepticism from the inquiry.

The inquiry, which is ongoing, in June issued a highly-damning interim report titled PwC: A Calculated Breach of Trust which said PwC Australia had “engaged in a deliberate strategy” to cover-up the tax leaks affair “over many years”.

As well as being executive chairman and major owner of Sayers Group, Sayers is president of the AFL’s Carlton Football Club.

Former Australian Greens Senator Christine Milne raises a string of serious questions in response to The Klaxon’s December 28 expose. Source: Twitter/X

On November 2 Sayers provided the inquiry with a written response to questions he had taken “on notice” at the October 12 hearing.

In it, he lists 20 people as “partners” of Sayers Group, one being himself, as well around eight secret partners, whose ownership of the company is through a “bare trust” and so hidden from regulators and the public.

The names of the “bare trust” partners have been redacted by the Senate inquiry.

Sayers had been specifically asked about Cormann.

In his response, Sayers appears to seek to downplay the remarkable situation, stating: “Mr Cormann relinquished his equity and is therefore no longer in the trust”.

That was one of “two recent changes to the bare trust”, Sayers wrote.

“Mr Cormann’s equity was originally allocated in the anticipation that he may join Sayers Group as a Partner, an outcome that did not eventuate”.

As revealed by The Klaxon on December 28, Sayers appears to have since changed his story, in explosive revelations that only raise more extremely serious questions.

The Klaxon’s December 28 exclusive. Source: The Klaxon

Days before the Christmas break, Sayers Group responded to a series of follow-up questions the Senate inquiry.

Sayers now claims Cormann “did some work” for Sayers Group in the handful of months between Cormann leaving parliament and heading the OECD.

“In the period after retiring as Finance Minister and before taking on the job as OECD Secretary-General, Mr Cormann did some work for Sayers Group, then a start-up advisory and investment business in the process of establishment,” Sayers wrote.

Yet Sayers does not state what “work” Cormann conducted, or specifically when this occurred.

Timeline

July 5, 2020 – Cormann announces he will resign from parliament later in year

Oct 8, 2020 – Coalition Government announces it will nominate Cormann as OECD boss

Oct, 20 2020 – Cormann departs as cabinet minister

Nov 6, 2020 — Cormann departs as Senator

Nov 7, 2020 — Cormann starts international tour

Dec 10, 2020 — Cormann returns to Australia, enters quarantine

Dec, 2020 — Cormann “becomes shareholder” of Sayers Group in “December 2020”

Mar 5, 2021 — OECD announces appointment of Cormann as Secretary-General

June 1, 2021 – Cormann starts five-year term as OECD boss

In response to The Klaxon’s December 28 exclusive, Senator Barbara Pocock, a member of the Senate inquiry into consultancies, posted to social media regarding the further questions it raised.

“Mystery upon mystery in this other monied world beyond the world in which most Australians work, earn and live,” Pocock wrote.

Please SUBSCRIBE HERE and support our quality journalism

Senator Barbara Pocock responds to The Klaxon’s expose. Source: Twitter/X

The Klaxon’s exclusive was followed by the Australian Financial Review in a prominent article a week later, on January 3.

On January 2 the OECD, for the first time, responded to questions The Klaxon has been repeatedly putting to Cormann.

“With the OECD’s seasonal closure and your deadline now passed, are you still seeking answers to your questions?” wrote OECD head of media Reemt Seibel.

We replied that we did, and that we had been unsuccessfully seeking responses since November.

We received no response.

The Australian Financial Review covers the story on January 2 and 3. Source: AFR

Almost all disclosed Federal Government contracts to Sayers Group since its creation — 21 of the 23 — occurred between December 2020, when Cormann was secretly issued the equity, and November last year, when Sayers said Cormann had “recently”, “relinquished” the equity.

Sayers has provided no explanation as to why Cormann was given the equity before he actually joined as Sayers Group partner, in what — if that were the actual purpose of handing over the equity — would ordinarily be considered extremely poor governance.

He has also not explained why Cormann’s equity was issued through a “bare trust”, how much “equity” he was given, when it was “relinquished”.

Most importantly, Sayers — and Cormann — have refused to say what benefits Cormann has received, or is entitled to receive in future — including whether he received any dividends in the three-odd years he was secretly a co-owner of Sayers Group.

What he gained, or stands to gain from having “relinquished” his secret Sayers Group stake has also not been disclosed.

Cormann’s LinkedIn bio makes no mention of Sayers Group.

No mention of Sayers Group: Cormann’s LinkedIn bio. Source: LinkedIn

Weasel Words

The two Sayers written responses to the Senate are extremely carefully-worded — and fail to answer key questions.

In the most recent response, on December 18, Sayers Group states it has not been a party to any contracts involving the OECD and that it has not had any correspondence with the OECD.

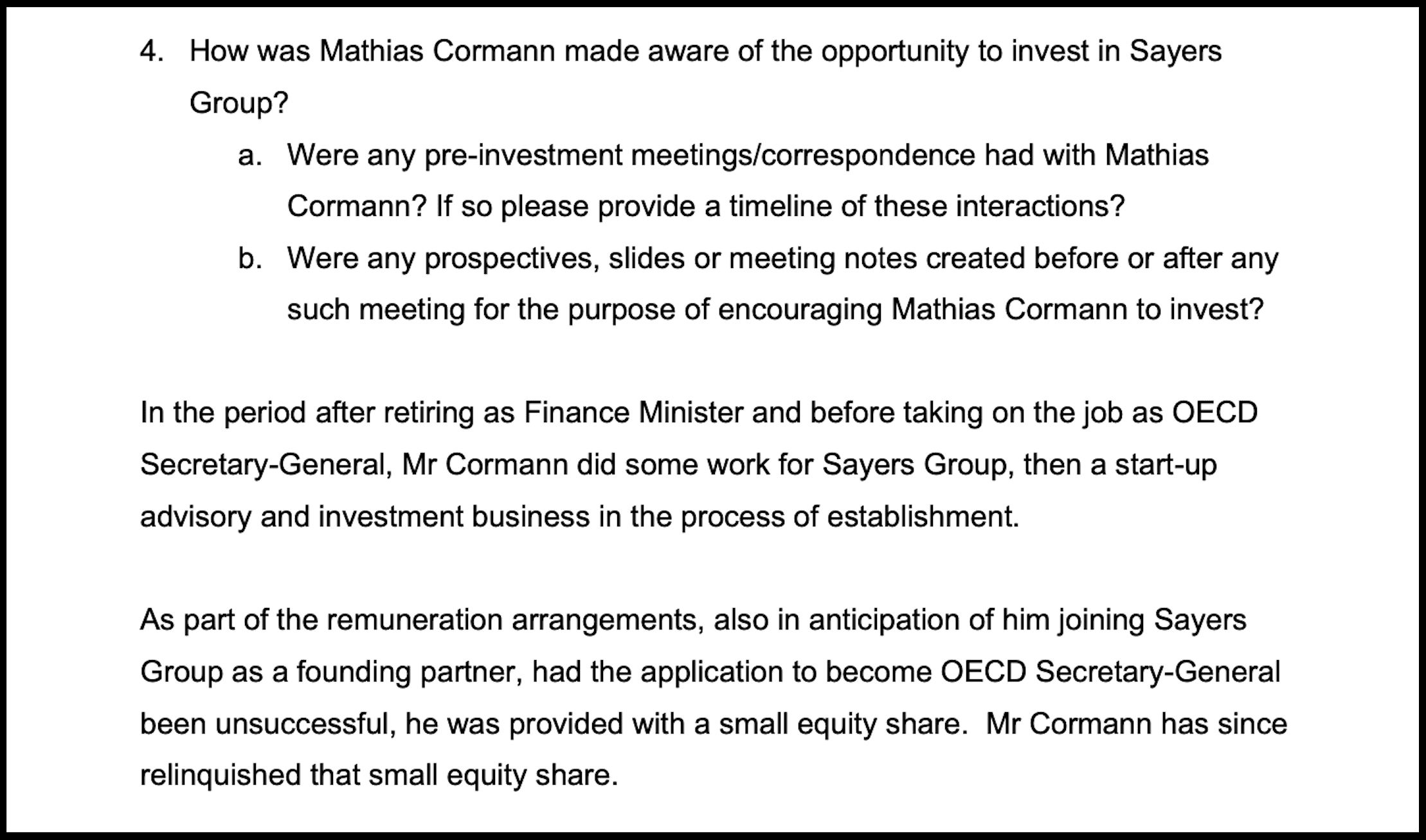

Sayers Group is asked whether “anyone from Sayers Group” had “any interactions with Mathias Cormann when he was a parliamentarian” and whether “the entity of Sayers group” was “discussed with Mathias Cormann when he was a parliamentarian”.

It states “no” to each.

Yet regarding how Cormann was “made aware of the opportunity to invest in Sayers Group” it dodges the question.

The Senate asks: How Cormann had been “made aware of the opportunity to invest in Sayers Group”; whether there had been any “pre-investment meetings/correspondence” with Cormann (and if so to provide a timeline of the interactions)” and whether “any prospective, slides or meeting notes” had been created “before or after any such meetings”.

Not one of the questions is answered.

Instead, Sayers Group responds:

“In the period after retiring as Finance Minister and before taking on the job as OECD Secretary-General, Mr Cormann did some work for Sayers Group, then a start-up advisory and investment business in the process of establishment”.

“As part of the remuneration arrangements, also in anticipation of him joining Sayers Group as a founding partner, had the application to become OECD Secretary-General been unsuccessful, he was provided with a small equity share.

“Mr Cormann has since relinquished that small equity share”.

Sayers’ December 18 response to the Senate inquiry. Source: Australian Senate

It is noteworthy that that December 18 response states the equity was given to Cormann “as part of the remuneration arrangements” in connection to the “work” he did for Sayers Group.

The November 2 response stated simply: “Mr Cormann’s equity was originally allocated in the anticipation that he may join Sayers Group as a Partner, an outcome that did not eventuate”.

Sayers Group does not define a “small equity share”.

Yet given it was issued to Sayers for being a senior partner in Sayers Group (even though he never became one) it was likely substantial.

Business as Usual

Tomorrow marks one year since the PwC tax scandal emerged, when the little-known Tax Practitioners Board posted to its website a statement regarding Collins having been given a two-year ban over making “unauthorised disclosures” of government tax policy to “partners and staff of PwC”.

In the ensuing storm, with public outrage that PwC could continue to be given taxpayer money, PwC Australia “sold for $1” its government consulting business to Private Equity firm Allegro Funds.

That contracts to Sayers Group — run by the CEO of PwC Australia for the entire tax leaks affair — are continuing to surge is likely to spark yet more public anger.

Sayers Group given a new $1.648m contract last month. Source: AusTender

On May 24 last year The Klaxon revealed Sayers Group had been given $6.26m in Federal Government contracts in the preceding 24 months; and on August 10 we revealed that surged by further $1.955m.

On December 21 the AusTender register was updated to show it had been given a new, six-month contract by the Department of Climate Change, Environment and Water for “computer services” — at a cost of $1,649,127.33.

That takes the disclosed Federal Government contracts to Sayers Group to $10.981m.

The Senate inquiry is due to report by March 28.

WAIT! BEFORE YOU GO! As you can see from the above, truly independent, quality journalism is vital to our democracy. We need your help to keep doing this work. Please SUBSCRIBE HERE or support us by making a ONE-OFF DONATION. Thank you!

Anthony Klan

Editor, The Klaxon

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.