It’s been rocked to the core by a murky expenses scandal – but things are about to get a whole lot worse. With chairman – and former Goldman Sachs banker – James Shipton teetering on the ropes, we can exclusively reveal that behind-the-scenes the corporate regulator has been secretly rocked by the biggest internal fraud scandal in its 22-year history. This is what ASIC and the Coalition really don’t want you to see. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

The Australian Securities and Investments Commission has been the victim of the most serious case of alleged internal fraud in its existence, with the corporate regulator formally reporting the scandal to the Federal Coalition behind-the-scenes sometime last financial year.

The Klaxon can reveal the alleged fraud resulted “in a loss of $29,120.50” to ASIC; that ASIC reported the matter to Finance Minister Mathias Cormann as required by law; that the Commonwealth Department of Public Prosecutions has laid charges in the case; and that the CDPP is now “prosecuting the matter”.

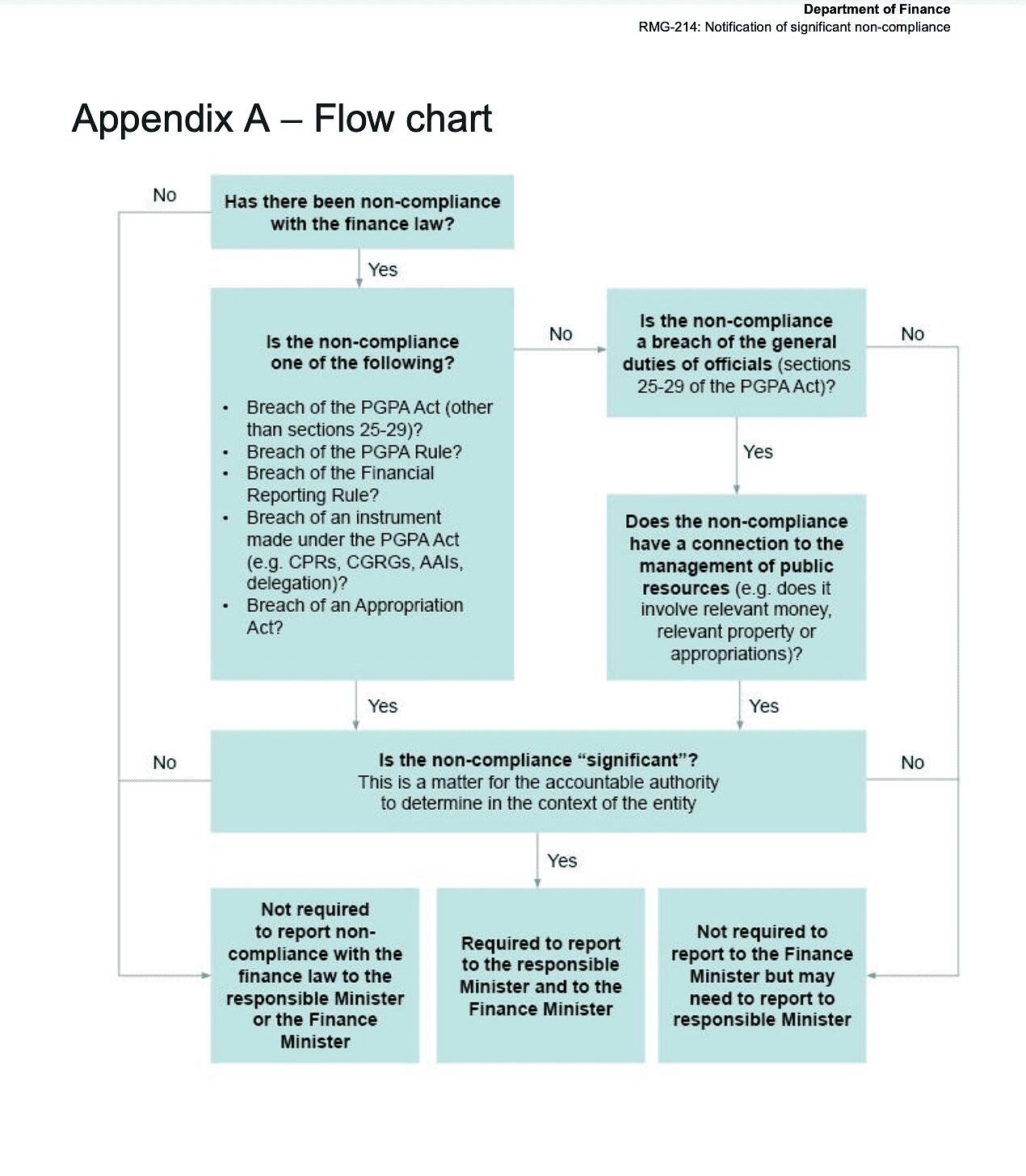

The internal ASIC fraud is particularly significant because it was reported under section 19 of the Public Governance, Performance and Accountability (PGPA) Act, which is reserved for only the most serious of cases of impropriety involving public officials and “the management of public money”.

To fall under section 19 of the PGPA Act, the matter must be “significant” and involve “significant non-compliance with the finance law”, where significant means “noteworthy; important; consequential”.

Government bodies that are subject to the PGPA Act, like ASIC, are legally bound to report section 19 matters, should they occur, to both the Federal Treasurer and to the Finance Minister.

ASIC has never before reported a crime under section 19 of the PGPA Act, searches of all its past annual reports reveal.

Despite the seriousness of the matter, details of the alleged $29,120 fraud are buried deep within ASIC’s 2019-20 annual report – and are comprised of just two sentences.

“This financial year, ASIC reported one instance of fraud, resulting in a loss of $29,120.50, to the Finance Minister under section 19 of the PGPA Act,” says the disclosure, halfway down page 226 of the 272-page report.

Tiny: ASIC’s “disclosure” of the fraud

“The CDPP has laid charges and is prosecuting the matter,” it says.

ASIC spokeswoman Angela Friend yesterday told The Klaxon that the $29,120.50 fraud was “not connected” to the alleged “relocation expenses” scandal that has engulfed the corporate crime regulator.

“I can confirm that the instance of fraud is not connected, I am checking whether any other details are public and will get back to you,” Friend told us in an email at 6.19pm yesterday.

We had received no more correspondence from ASIC or Friend by 5am this morning and we have been unable to obtain any information beyond the two sentence disclosure on page 226 of ASIC’s annual report, which was released last Friday.

It was unclear why ASIC, facing one of the biggest scandals in its existence – having lost both its chair and a deputy chair within three days – was unable to comment on, or to provide any information about, the most serious internal alleged fraud it has ever encountered – and one which is mentioned in its own annual report.

Under the PGPA Act, ASIC was legally forced to disclose the alleged $29,120 internal fraud in its 2019-20 annual report.

“Annual reports must include a statement of any non-compliance issues notified to the responsible Minister during the reporting period and an outline of the action taken to remedy the non-compliance,” according to the Department of Finance.

James Shipton, a former Goldman Sachs senior executive, stood aside as ASIC chairman last Friday.

On Monday ASIC Deputy Chairman James Crennan QC resigned from the regulator, effective immediately.

On Friday, hours after ASIC’s annual report was tabled in parliament (and so made public), Shipton told a parliamentary committee that he and Crennan had received “relocation payments” paid for by ASIC, and that those payments would now be subject to an independent review.

“I can confirm that the instance of fraud is not connected” — Angela Friend, ASIC

The two men allegedly improperly obtained over $180,000 in “relocation” payments from ASIC, despite the fact that neither of the men were eligible for the payments, Auditor General Grant Hehir alleges.

Shipton said he would stand aside as ASIC chairman “pending the outcome of the review” but that he believed he had “acted properly and appropriately in this matter”.

Crennan said on Friday that he would not be standing down. However on Monday he had an about-face.

“In the current circumstances, I have decided that it is in the best interests of ASIC for me to resign now,” Crennan said in a written statement.

On Thursday last week, October 22, Auditor-General Hehir wrote a three-page letter to Treasurer Josh Frydenberg.

Hehir said the “relocation” money paid to Shipton and Crennan was a matter “which I consider of such importance that it should be brought to the responsible Minister’s attention”.

The explosive revelations will raise serious questions for the Federal Government.

The spotlight will likely fall on who knew what and when.

It is not known who at ASIC was allegedly involved in the $29,120 alleged fraud; what the alleged fraud specifically entailed; when it was discovered by ASIC; when ASIC reported the alleged fraud to the Federal Government in 2018-19; whether ASIC had formally reported the fraud to Frydenberg as well as to Cormann, or only to Cormann; and why it is that ASIC appears to be downplaying, or even appearing to cover-up, the latest stunning revelations.

Cormann is due to retire from parliament on Friday after seven years as Finance Minster.

On July 5 Cormann announced he would retire from politics by the end of the year.

On October 8, Cormann announced his last day in parliament would be this Friday, October 30.

If ASIC’s claims are correct, then Cormann was aware of the serious, $29,120 internal ASIC fraud at the time he publicly announced his retirement, on July 5.

Section 19- Covers the most serious cases of wrongdoing. Source: Department of Finance

Prime Minster Scott Morrisson has said he will nominate Cormann for the position of secretary-general of the Organisation for Economic Cooperation and Development (OECD).

Applications for that position reportedly close on Saturday.

The PGPA Act states Commonwealth entities (such as ASIC) have a “duty to keep (the) responsible Minister and Finance Minister informed” of breaches.

The responsible minster is Frydenberg and the Finance Minster is Cormann.

The alleged $29,120 internal fraud is disclosed in ASIC’s report as having been “reported” by ASIC “this financial year”, meaning it was reported sometime between July 1 2019 and June 30 this year.

“The responsible Minister must be notified of significant non-compliance as soon as practicable after the accountable authority becomes aware of the issue,” the PGPA Act states.

Frydenberg has been the “responsible minister” for ASIC since he became Federal Treasurer in August 2018.

The “accountable authority” of ASIC is its chairman.

Between February 1 2018, when he was appointed ASIC Chairman, and last Friday, when he stood aside, ASIC’s “accountable authority” was Shipton.

Under section 19 of the PGPA Act, the “accountable authority” of a commonwealth entity must:

– “Keep the responsible Minister informed of the activities of the entity”

– “Give the responsible minister or the Finance Minister any reports, documents and information in relation to those activities as that Minister requires”

– “Notify the responsible Minister as soon as practicable after the accountable authority makes a significant decision in relation to the entity”

– “Give the responsible Minister reasonable notice if the accountable authority becomes aware of any significant issue that may affect the entity or any of its subsidiaries”

– “Notify the responsible Minister as soon as practicable after the accountable authority becomes aware of any significant issue that has affected the entity”.

Federal Parliament is sitting for the rest of this week, which is expected to place further pressure on both Shipton and the Federal Coalition, which has become embroiled in a string of governance scandals.

On Thursday of last week, Australia Post CEO Christina Holgate was forced to stand aside following revelations she approved the gifting of $12,000 worth of Cartier watches to four Australia Post senior employees as “bonuses”.

Australia Post, like ASIC, is subject to the PGPA Act.

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.