Appreciate our quality journalism? Please donate here

EXCLUSIVE

The corporate regulator has taken zero action to stop Westpac’s wholesale gouging of superannuation accounts since it was formally alerted to the scandal over six months ago – costing over 900,000 Australians almost $1 billion in that time.

The ongoing gouging by Westpac-BT is now costing its 915,000 members about $1.65 billion a year, or $4.49 million a day, seven days a week, analysis shows.

It has further emerged that the person responsible for taking action to stop the gouging by Westpac-BT was formerly “in-house” lawyer at Westpac.

Jane Eccleston, ASIC Senior Executive Leader, Superannuation. Source: Supplied.

Jane Eccleston, the senior executive at the Australian Securities and Investments Commission (ASIC) responsible for superannuation, previously worked at Westpac as “in-house counsel for Westpac Banking Corporation”, ASIC’s website states.

The ongoing refusal by ASIC – which recently lost its chair and deputy chair in a corruption scandal – to take action is particularly remarkable, given ASIC’s deputy chair, Karen Chester, is intimately aware of the problem.

Immediately before joining ASIC, Chester was deputy chair of the Productivity Commission where she headed the commission’s multi-million dollar, three-year study into the “efficiency and competitiveness” of Australia’s superannuation system.

That review found widespread problems in the super system, mainly due to so-called “retail” funds – such as Westpac-BT – gouging vast sums of money from members.

Chester’s three-year review said those problems were caused by inadequate “governance and regulation”.

Regulators “focus too much on the interests of funds and not members”, Chester’s review says.

Karen Chester, ran review into “competitiveness and efficiency” superannuation system, now ASIC deputy chair. Refusing to comment. Source: Supplied.

The revelations of ASIC’s latest failure come just over a week after the Your Future Your Super legislation – allegedly aimed at reducing gouging in the sector – passed the Senate.

Those changes include super funds being “stapled” to each member, so a new fund isn’t opened each time a person switches jobs (although funds can still be proactively changed at any time).

Existing laws already prohibit the gouging of super funds – under the Superannuation Industry (Supervision) Act (1993), super trustees must act in the ‘best interests’ of their members or face serious penalties, including up to two years jail.

However, in order for those penalties to actually be imposed by a judge – that is, for the laws to actually work – ASIC must first instigate action.

It consistently refuses to do so.

ASIC was formally alerted to the scandal by this publication in writing on November 23 last year.

That was over seven months ago.

Three days earlier, on November 20 The Klaxon had revealed that Westpac-BT had gouged over $8 billion from the life savings of almost one million Australians in the decade to 2018.

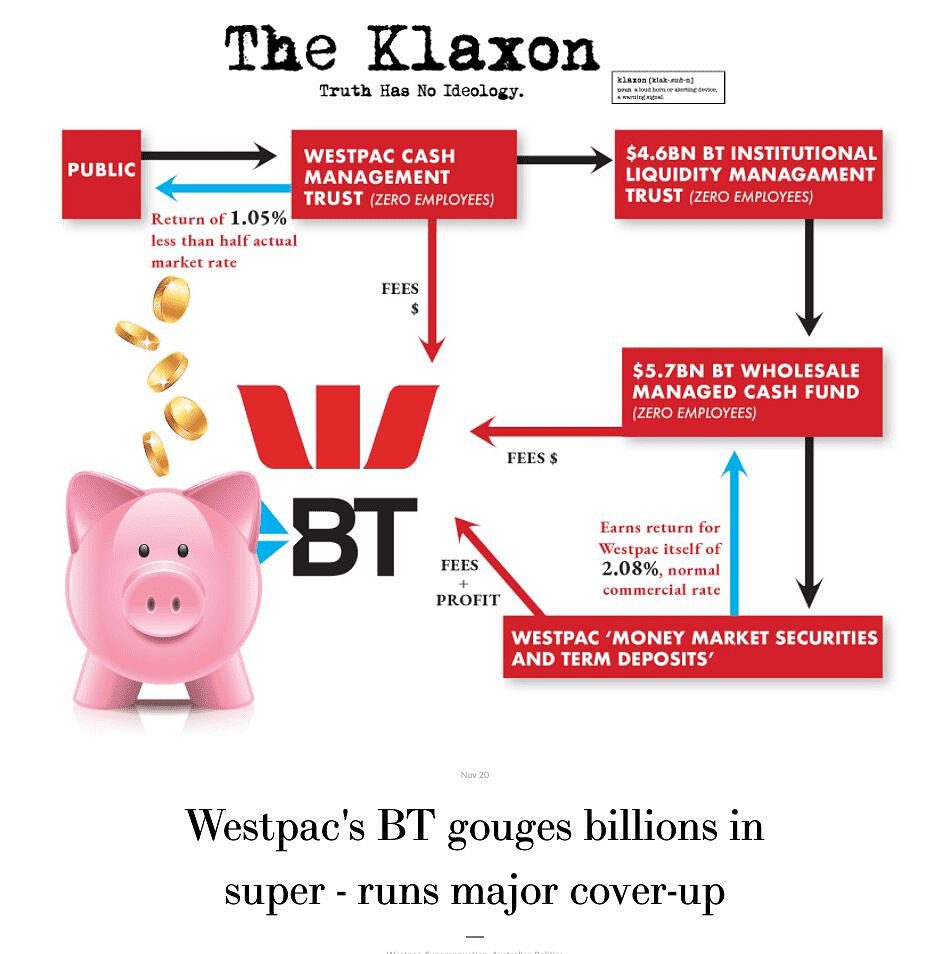

The gouging occurs via a complex web of obscure paper companies, many of which generate huge fees despite many performing no real service and having zero employees, the investigation revealed.

The story, deeply relevant to more than 900,000 Australian workers and retirees, ultimately ran in The Klaxon in November last year.

The deeply improper practices meant the 900,000-plus members in the Westpac-BT “Retirement Wrap” superannuation fund made almost nothing on their investments in the entire decade from 2008-2018, despite very strong growth in investment markets.

(Retirement Wrap is an “umbrella” fund – if you have super with Westpac/BT, regardless of the name of your particular “product”, you’re most likely within the Retirement Wrap fund.)

The revelations had been slated to run as a major expose in The Australian newspaper in mid-2018, however then editor (now managing editor) John Lehmann inexplicably killed the story and prevented it from running.

“The gouging is now costing $4.5 million a day, seven days a week”

Westpac, BT, nor anyone else has ever identified a single error in the article.

At the time the story was spiked – midway through the Royal Commission into banking – Westpac was providing large amounts of money to the newspaper.

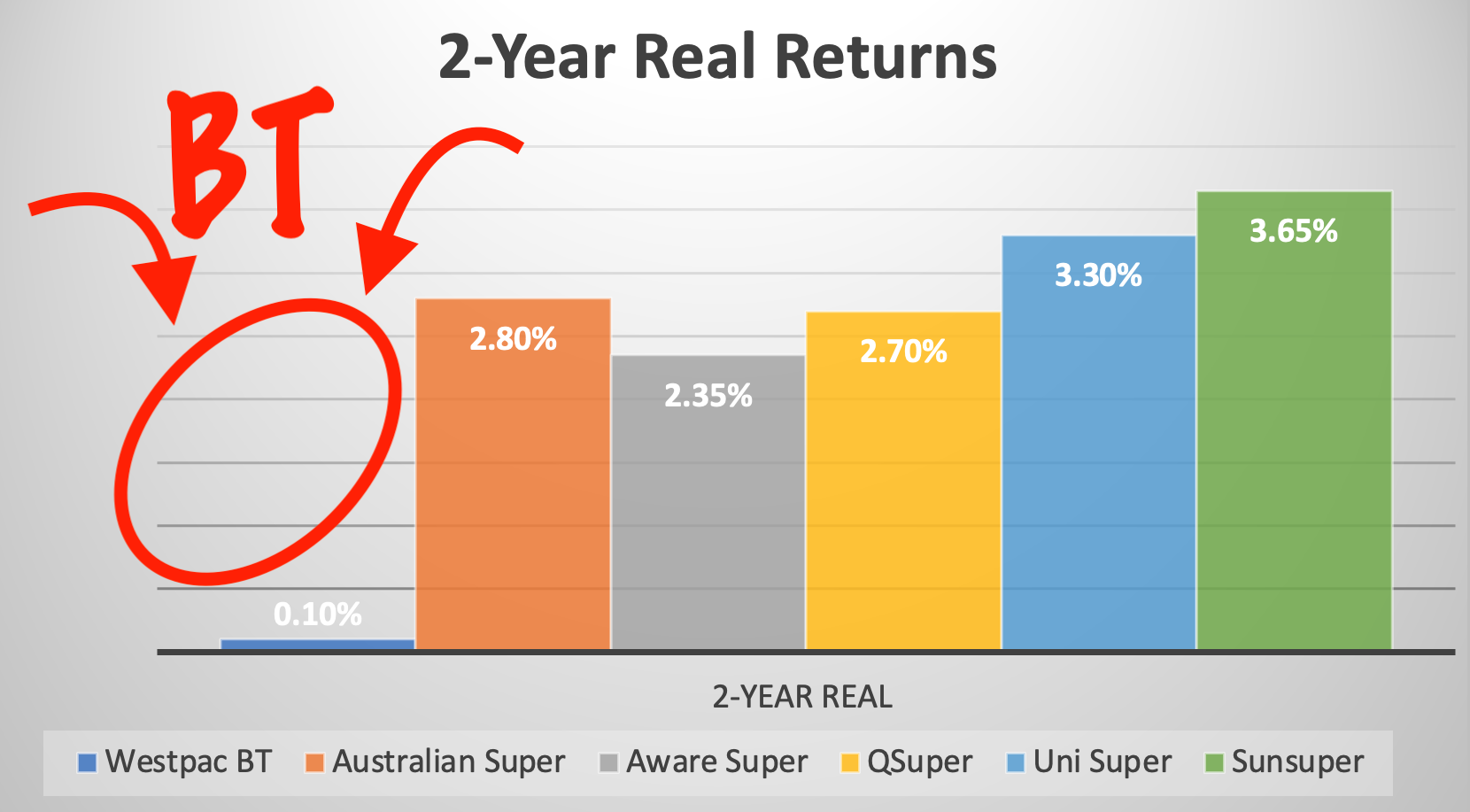

On Thursday The Klaxon revealed that in just two years – from mid-2018, when Lehmann spiked the story, and mid-2020 – Westpac-BT gouged an additional $3.29 billion.

Average returns for Westpac-BT’s 900,000-odd Retirement Wrap members were 1/30th of actual market rates.

Missing: $3.29 billon gone in just two years as Westpac-BT super returns almost non-existent. Source: APRA, RBA. Graphic: The Klaxon

By the end of this financial year – this Wednesday – those losses will total $5 billion.

For the 2018-19 and 2019-20 financial years, when loses were $1.53 billion and $1.75 billion respectively, totalling $3.29 billion.

That equates to loses due to gouging of about $1.65 billion a year, or $4.49 million a day, every day, 365 days a year.

Just since November last year when expose was ultimately published in The Klaxon – and when ASIC was formally alerted to the situation – around $960 million more has been gouged from 915,000 Westpac-BT super accounts.

The expose was the biggest scandal to face Westpac since its CEO Brian Hartzer and chair Lindsay Maxsted were ousted when it emerged in 2019 that Westpac had been facilitating child rape.

Yet ASIC has still failed to take any action whatsoever.

Superannuation fund “trustees” are the people responsible for looking after members and ensuring their funds aren’t stolen, gouged, or otherwise misappropriated.

In the case of Westpac-BT, it is the trustees that are permitting and facilitating the ongoing wholesale gouging of members’ funds.

That the person responsible for policing superannuation trustees in Australia, Eccleston, is herself a former in-house lawyer for Westpac, makes ASIC’s complete failure to act regarding Westpac’s super gouging even more serious.

Eccleston’s bio states she has a history in corporate law.

“Before joining ASIC, Jane was a senior associate with Mallesons Stephen Jaques (now King & Wood Mallesons), working within the Corporate/Mergers & Acquisitions team. She has also worked as in-house counsel for the Westpac Banking Corporation,” the bio states.

“Jane holds honours degrees in Law and Psychology from the University of Sydney.”

Westpac is currently trying to “sell” its BT super arm, which has been reported to have a “value” of $1 billion or more.

That “value” is derived solely from the money BT takes from the accounts and returns of its members.

“Regulators focus too much on the interests of funds and not members” — Chester Productivity Commission review

What Westpac is selling is the ability for some other party to continue gouging those 900,000-plus Westpac-BT super members.

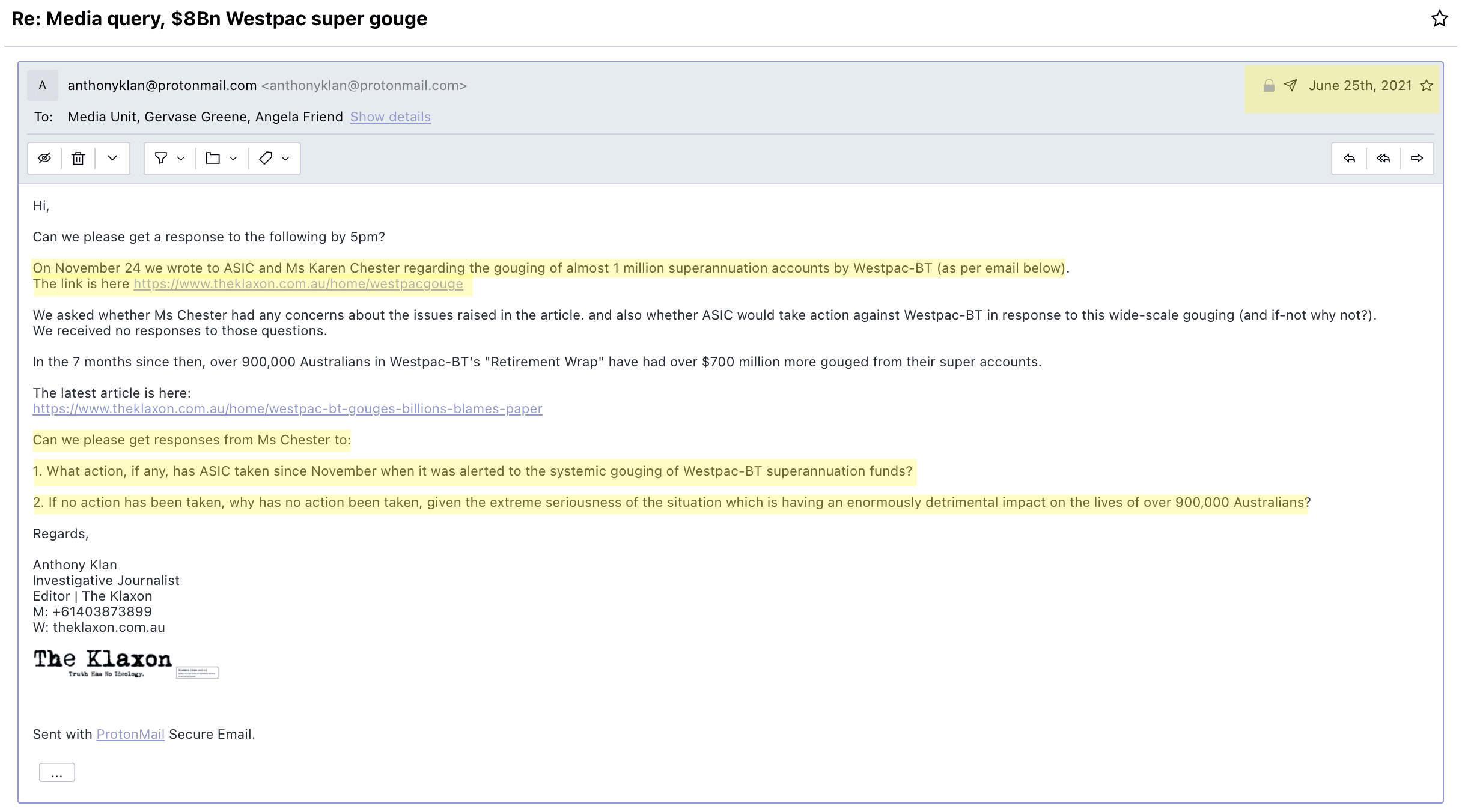

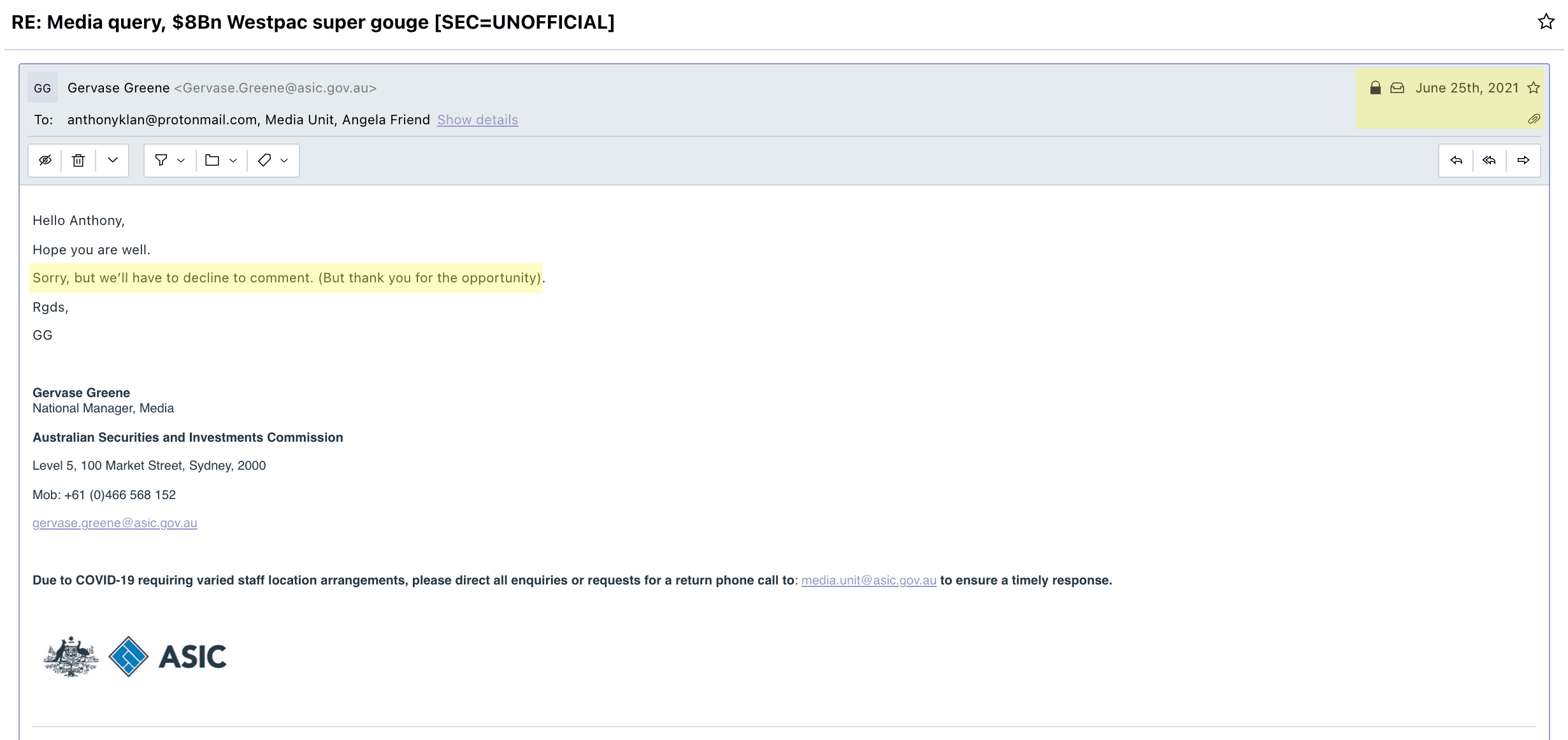

On Friday, following The Klaxon’s latest revelations, ASIC and Chester doubled-down on their inaction, refusing to provide any response.

“Sorry, but we’ll have to decline to comment. (But thank you for the opportunity),” ASIC national media manager Gervase Green wrote to us in response.

No other information was provided.

The Klaxon’s questions to ASIC and Chester:

ASIC and Chester’s response:

It was the same story in November last year.

The Klaxon wrote to ASIC, formally blowing the whistle on the Westpac-BT systemic gouging.

We asked whether ASIC was taking action, and if not why not?

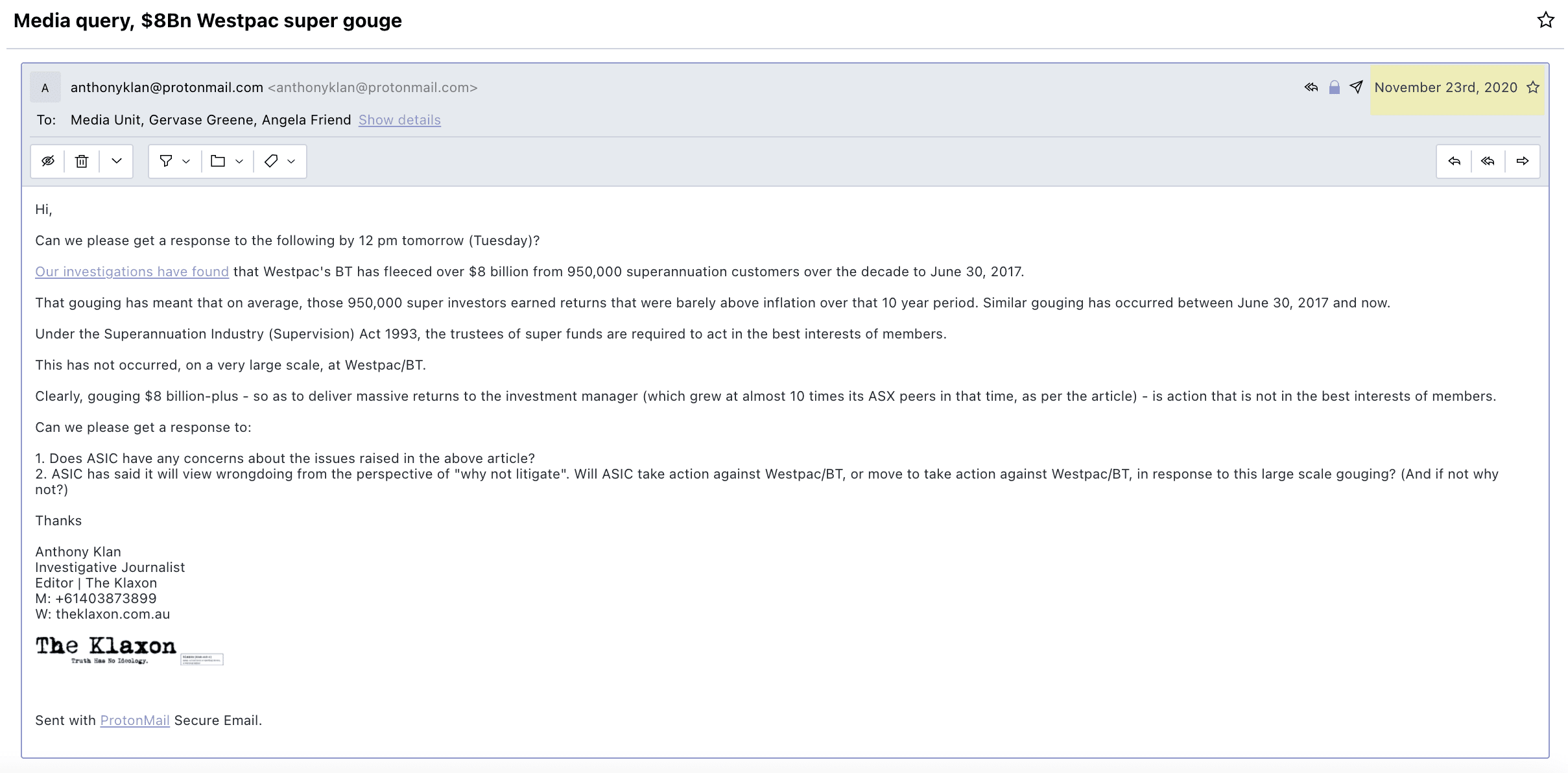

The Klaxon’s November 23 email to ASIC:

Blowing the whistle – The Klaxon’s November 23 email to ASIC

We received no response, and so the following day, on November 24, we pushed again for a response.

Later that same day, we again wrote to ASIC, specifically requesting that our questions be put to deputy chair Chester.

On November 25, ASIC media spokeswoman Angela Friend responded: “we do not propose to comment on whether we are or will investigate the issues you have raised”.

“I have already alerted relevant people to your article and the issues you have raised but at this time, have nothing further to say,” Friend wrote.

We wrote back the same day: “Can you please confirm Ms Chester has been alerted”?

We received no response.

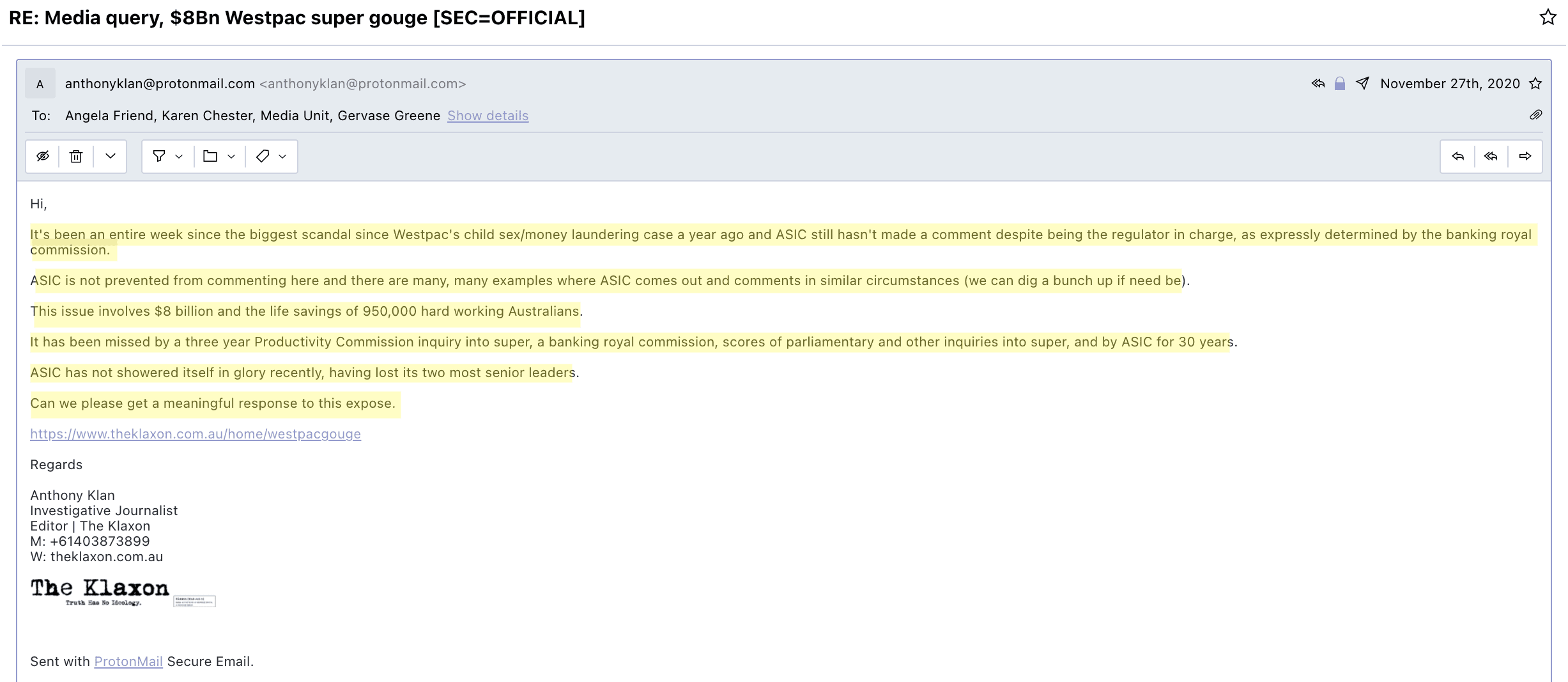

On November 27, one week after the expose was published, we approached ASIC again, pressing the seriousness of the matter.

The Klaxon’s November 27 email:

Again, we received no response.

The $960 million more gouged by BT-Westpac since November equates to an average just over $1,000 a member, in just seven months.

The impacts are compounded because the average Westpac-BT Retirement Retirement Wrap balance is just $77,000, which is largely due to the systemic gouging.

Chester, who receives a $620,730 taxpayer-funded annual salary, started at ASIC deputy chair on January 29, 2019, just weeks after her Productivity Commission super report was released on January 10.

Chester’s final report, released less than three weeks before Chester started as deputy chair of ASIC, states “inadequate” action by regulators

(ASIC is the main regulator for superannuation).

“The system offers products that meet most members’ needs, but members lack simple and salient information and impartial advice to help them find the best products,” Chester’s review says.

“Inadequate competition, governance and regulation have led to these outcomes.

“Regulations (and regulators) focus too much on the interests of funds and not members,” the review says.

More to come.

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.