TriCare received more in taxpayer cash last year than the entire GDP of Norfolk Island, the tax haven where it has been “based” for the past half a century. It’s one of only 93 companies registered in Norfolk Island. We have obtained the whole list. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Its revenue is at least double the entire GDP of Norfolk Island but the TriCare private aged care giant “based” in the Australian territory for the past 49 years has never operated a single bed there.

In fact, last year the company- currently at the centre of staff allegations of serious and systemic elder abuse – received more in cash from the Federal Government alone than the value of Norfolk Island’s entire economic output.

Queensland’s TriCare, run by super low-profile rich-listers – and major LNP donors – the O’Shea family, has been based on Norfolk Island since 1971.

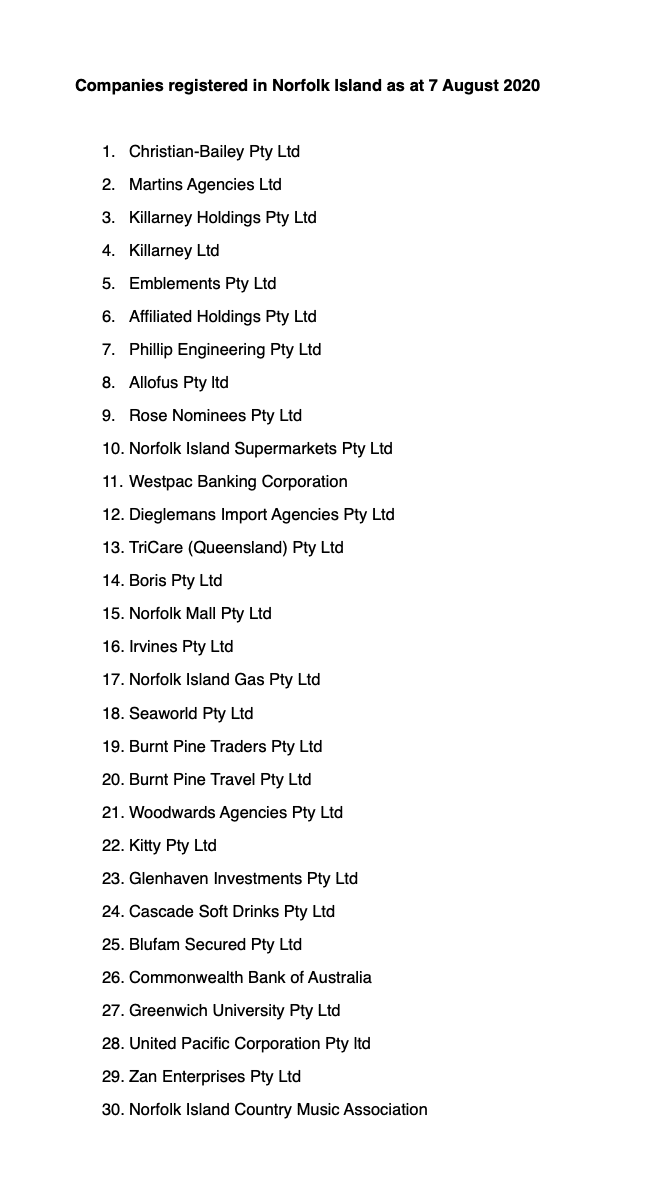

Companies registered in Norfolk Island. Source: Norfolk Island registry

If you’re the tax man, that is.

Otherwise it’s based at its actual headquarters, 250 Newnham Road, Mt Gravatt, Brisbane.

It’s been physically based in Brisbane since it was founded in 1968 by accountant Paul O’Shea, who had bought some nursing homes in the Sunshine State.

Three years later, O’Shea, a Queenslander, signed a few forms and registered the company – then called Nursing Centre of Australia – as being based (on paper) on Norfolk Island, which had five years earlier become the first tax haven in the Pacific Islands.

Remote Norfolk Island: Population 1,748. Source: NASA

TriCare has been “based” on Norfolk Island – and using its associated tax and accounting loopholes – ever since.

There are just 93 companies registered on Norfolk Island, documents obtained by The Klaxon show.

Others include Norfolk Island Real Estate, Norfolk Island Liquors and some company called “Phoenix Pty Ltd”.

No member of the O’Shea family need ever have set foot on the remote island, 1,400km east of Byron Bay, but they have been able to avoid filing financial accounts – and almost certainly paying vast sums of tax – thanks to its “offshore financial centre” status.

That also means the Australian public – the source of most of TriCare’s profits – have no way of knowing whether TriCare pays any tax at all.

Or any way of understanding of how much the aged care giant is profiting from its network of taxpayer-funded aged care homes across Queensland and NSW.

In just the year to June 30 2018, TriCare received $77.7m from the Federal Government, suggesting the O’Shea’s have funnelled hundreds of millions – most likely billions – of dollars through the tax haven over the past five decades.

The entire GDP of Norfolk Island was most recently estimated to be only about $68m a year. (The figures don’t include the revenues of companies using the island as a tax haven).

Tri-Care’s “headquarters” for tax purposes: on Norfolk Island. Source: Supplied

Experts say TriCare is structured in the same way as many other companies that have been found to be engaging in tax evasion.

TriCare and the O’Shea family have repeatedly declined to comment when approached by The Klaxon in recent weeks.

TriCare’s headquarters for tax purposes is a small accountancy on Taylor Street near the middle of Norfolk Island, a few doors up from petrol station Paw Paws Pump Shed.

The accountancy’s owner, Belinda Grube, is listed as a TriCare “company secretary” on Norfolk Island registry documents for legal purposes.

Grube did not respond to a request for comment.

TriCare operates more than a dozen Australian companies, but they are “ultimately” owned by TriCare Group Pty Ltd of Norfolk Island.

At June 30 2018 TriCare received Federal Government funding for 1,568 places across 15 aged care homes, all in Queensland.

TriCare’s actual headquarters: Upper Mount Gravatt, Brisbane. Source: Google Maps

That’s roughly equivalent to the total number of men, women and children living on Norfolk Island (1,748 at the 2016 census).

The Federal Government pays the company up to $90,000 – in some cases more – for every aged care resident, ever year.

Residents are also required to financially contribute.

TriCare also operates nine “retirement communities” in Queensland, NSW and Victoria.

Companies registered in Norfolk Island. Source: Norfolk Island registry

In 2016-17 TriCare owners Peter and John O’Shea were the biggest donors to Queensland’s LNP, according to a detailed report by the Tax Justice Network Australia and the Centre for International Corporate Tax Accountability & Research.

“A key objective (of TriCare) appears to be to shift profits, equity and debt to minimise tax payments,” the report says.

As we reported earlier this month, a group of nurses and carers at TriCare’s aged care facility in Toowoomba, west of Brisbane, have alleged the company is profiteering by operating with a “dire” lack of staff.

The group of TriCare staffers ay a “very poor quality of care” is being delivered, elderly residents are being out in physical danger and they are “extremely disgusted” with the situation.

The staffers wrote a detailed, nine-page letter to TriCare senior management, including director John O’Shea, outlining their concerns in June but received no response.

The Federal Government’s Aged Care Quality and Safety Commission has since said it is investigating the matter.

We also reported that the TriCare Toowoomba facility had been subject to many of the same allegations of systemic abuse – including residents being left for hours in soiled incontinence pads and some suffering serious injuries – back in 2012, but that no action appears to have been taken.

The staffers say government inspections are routinely gamed, with aged care operators regularly told well in advance when inspections are due to occur.

Companies registered in Norfolk Island: just 93 in total. Source: Norfolk Island registry

The TriCare Toowoomba facility has received scores of 100% on every one of its “reaccreditation” inspections over at least the past decade.

The Federal Government has come under fire over its mishandling of the aged care sector, with vast outbreaks of Coronavirus in many facilities drawing the spotlight on the long-broken industry.

Many devastating examples of ongoing abuse at aged care facilities continue to emerge, despite an ongoing Royal Commission into Aged Care, which began in 2018.

A study of 5,000 Australian aged care homes, instigated by the Royal Commission, found that most homes would receive a “one-star” rating if the same system used in the US and elsewhere was used here.

University of Wollongong researches have said staffing levels would need to increase by 20% across the board just to lift standards to an “acceptable” level.

To reach best practice, five stars, a staffing increase of almost 50% is needed, the researchers found.

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.