Just weeks before we revealed Westpac was involved in systemic, industrial-scale gouging of its superannuation members, the head of super at the corporate cop was grandstanding. It was vital to be “supporting whistleblowers”, Jane Eccleston announced. We blew the whistle. Now Eccleston – herself a former Westpac lawyer – is nowhere to be seen. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Superannuation regulator the Australian Securities and Investments Commission has taken no action to stop Westpac-BT fleecing $4.5 million a day from super members, nine months since it was formally told of the scandal.

The loss to members since November last year, when The Klaxon formally warned ASIC of the gouging, is now $1.23 billion, which is the equivalent of over three times the regulator’s entire annual budget ($403 million in 2019-20).

Action to prevent or stem that Westpac gouging (such as under section 63 of the Superannuation Industry (Supervision) Act 1993 which gives regulators the power to freeze new contributions) would cost ASIC just a tiny fraction of the amount being gouged from the public every week.

In the past week alone, Westpac-BT has gouged another $31 million-odd from the 900,000-plus members of its “Retirement Wrap” umbrella super fund.

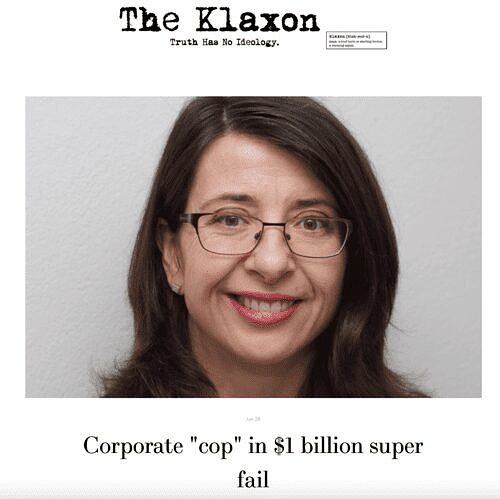

Jane Eccleston. Source: ASIC

Last week Federal Opposition leader Anthony Albanese put the spotlight on perceived failures in government agencies, warning that if Labor were elected he would not guarantee the jobs of public service chiefs.

ASIC is the regulator with primary responsibility for policing wrongdoing in the superannuation sector.

The ASIC boss responsible for super is Jane Eccleston, whose title is “Senior Executive Leader, Superannuation”.

On October 7 last year, Eccleston released a statement on behalf of ASIC: “Support and protections for whistleblowers”.

“The Australian Government’s reports to strengthen the whistleblower protection regime for superannuation funds have been in place for more than a year,” the statement said.

“Jane Eccleston, ASIC Superannuation Senior Executive Leader, reminds trustees of their obligations to support and protect whistleblowers and implement a whistleblower policy.”

“Jane Eccleston…reminds trustees of their obligations to support and protect whistleblowers and implement a whistleblower policy” — ASIC

According to Eccleston, whistleblowers “play an important role in calling out misconduct in the super sector” and “help uncover wrongdoing that may not otherwise be detected”.

Six weeks later, on November 20 last year, The Klaxon published a major expose.

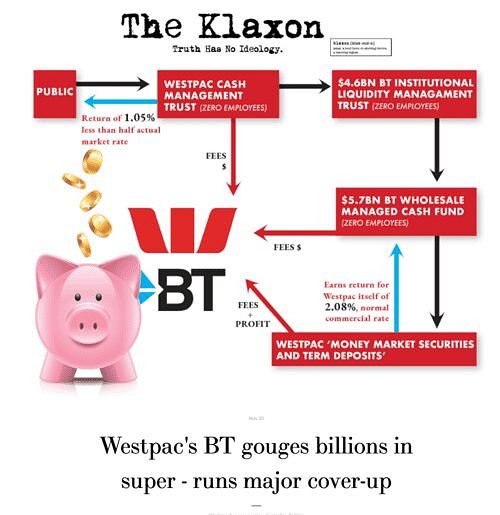

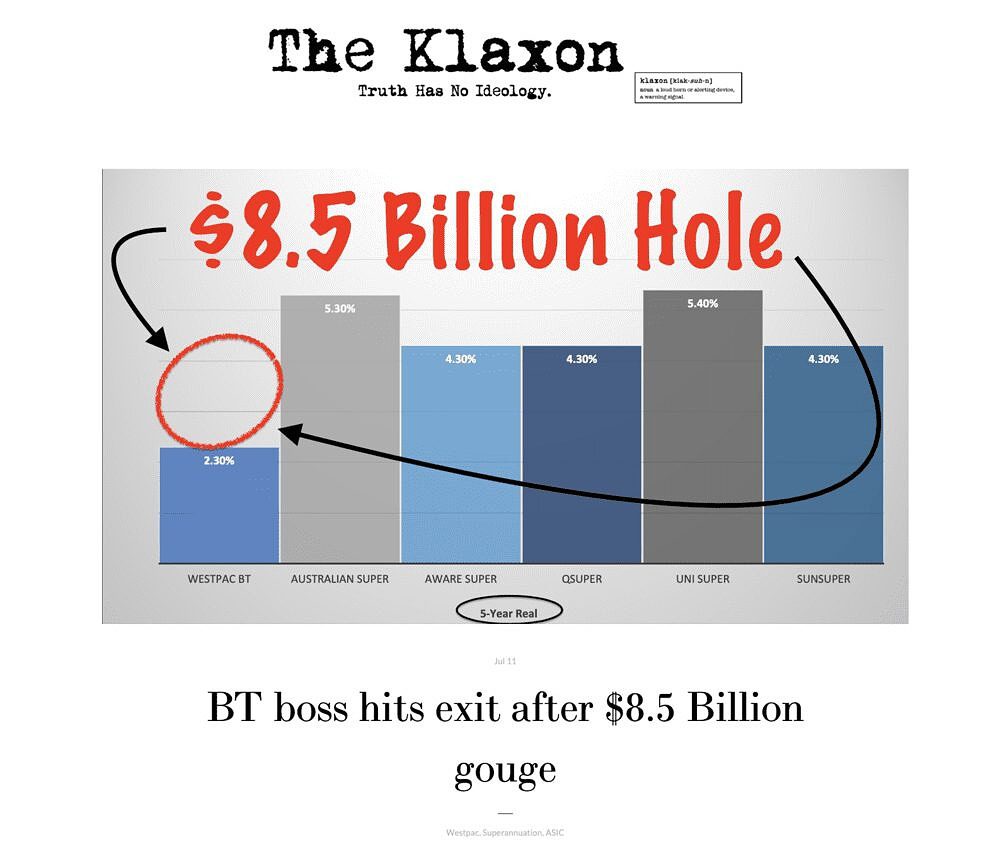

Westpac and its “wealth” arm BT had gouged over $8 billion from more than 900,000 super members over a decade.

The gouging – which remains ongoing – is via Westpac-BT’s “Retirement Wrap” umbrella superannuation fund.

The Klaxon’s November 20 expose.

The process includes Westpac-BT operating a complex web of obscure paper companies, many of which generate huge fees despite performing no real service and having no employees.

On November 23, three days later, The Klaxon formally wrote to ASIC about these major concerns.

We asked that ASIC deputy chair Karen Chester be alerted to the extremely serious information.

Chester joined ASIC in January 2019, immediately after overseeing a three-year review of Australia’s superannuation system, conduced by the Productivity Commission, where she was deputy chair.

ASIC did not respond.

The next day, November 24, we went back to ASIC, twice, with the same information.

The following day, November 25, ASIC Communication Manager Angela Friend responded:

“Consistent with our policy outlined in INFO 152 Public comment on ASIC’s regulatory activities, we do not propose to comment on whether we are or will investigate the issues you have raised.

“As background, I have already alerted relevant people to your article and the issues you have raised but at this time, have nothing further to say.”

We went back to ASIC the same day: “Could ASIC please confirm Ms Chester has been alerted?”

We received no response.

We went back to ASIC again on November 27:

“It’s been an entire week since the biggest scandal since Westpac’s child sex/money laundering case a year ago and ASIC still hasn’t made a comment despite being the regulator in charge, as expressly determined by the banking Royal Commission,” we wrote.

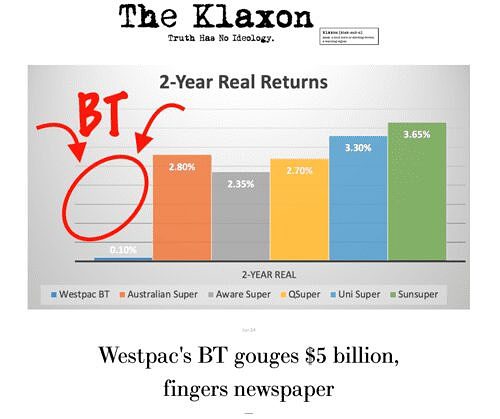

Westpac-BT returns almost non-existent (1/30th of market rates) between 2018-20. Story June 28. The Klaxon

“This issue involves $8 billion and the life savings of 950,000 hard working Australians.

“It has been missed by a three year Productivity Commission inquiry into super, a banking Royal Commission, scores of parliamentary and other inquiries into super, and by ASIC for 30 years.”

We asked: “Can we please get a meaningful response to this expose?”

We received no response.

On December 8 we went back to ASIC again.

We asked, could we please get a response from Chester regarding the Westpac-BT expose?

“Since then more than $20 million belonging to 950,000 Australians has been gouged from Westpac-BT super accounts,” we wrote.

“What steps has ASIC taken (if any) to rectify this?

We received no response.

Seven months

On June 25 this year we went back to ASIC again.

It was then seven months after the Westpac-BT super scandal broke.

Hundreds of millions of dollars more had been gouged in the interim, we wrote to ASIC on June 25.

What action had ASIC taken?

ASIC National Media Manager Gervase Green wrote back:

“Sorry, but we’ll have to decline to comment. (But thank you for the opportunity)”.

That was the same day, Friday June 25.

Repeat

Early the following week, on Tuesday June 29 – almost two months ago – we went back to ASIC again.

The day before we had reported that ASIC Senior Executive Leader, Superannuation, Jane Eccleston, had formerly worked as “in-house lawyer” at Westpac.

We wrote to ASIC: “Given the possibility of a conflict on interest in this regard, a high bar is set for what constitutes good governance, particularly given the large amount of illegal or otherwise improper activities Westpac has been allegedly involved in recently.”

We asked ASIC: Had Eccleston been removed from the position of determining whether ASIC would take action over the revelations that Westpac-BT had gouged over $8 billion from members (and if not why not)?

Further, what steps, if any, had ASIC taken to remove or mitigate this conflict of interest?

We also asked ASIC: Regarding our November 23 submission to ASIC detailing “widespread improper behaviour” regarding gouging by Westpac-BT, had ASIC taken this information “under whistleblowing provisions”, and if not why not?

We made our position clear:

Could ASIC please consider this information “as being provided to ASIC under whistleblowing provisions”.

“Ie. We are formally blowing the whistle on this activity,” we wrote.

ASIC did not respond.

The Klaxon’s report, July 11. Source: The Klaxon

The next day, June 30, we went back again, seeking a response to those same questions.

Later that day, ASIC’s Gervase Green responded:

“I replied to you and those questions last Friday. I attach that email to you as a reminder, to assist you. There is nothing to add”.

Green is referring to his response from Friday June 25.

That was the reply that said: “Sorry, but we’ll have to decline to comment. (But thank you for the opportunity)”.

Beyond the fact that response had provided no answers, it hadn’t even been in response to our latest questions.

It can’t have been – we’d only put those latest questions, including to the whistleblowing request, to ASIC on Tuesday, June 29.

Groundhog Day

On Friday July 2 we went back to ASIC again.

We noted that we had provided (over seven months earlier) information regarding “serious and demonstrably illegal” behaviour by Westpac.

Jane Eccleston. The Klaxon’s June 28 story. Source: The Klaxon

We noted we had also obtained evidence from multiple lawyers and superannuation experts who had all had agreed that this behaviour by Westpac-BT was illegal.

We asked ASIC again: “Has ASIC accepted this information under whistleblower provisions”?

Further: Had ASIC taken any action over these issues?

That same day, Friday July 2, ASIC Communication Manager Angela Friend came back with a one-sentence response:

“Your allegations – which I assume are outlined in your article – have been referred to our Misconduct and Breach Reporting Team for review”.

That was more than we had received in over seven months of requests.

It was also the first time we had been told information we had provided had been referred to the “Misconduct and Breach Reporting Team for review”.

But still, it answered very little.

When had this matter been referred for review? What specifically had been referred for review?

We went back to Friend at ASIC that same day:

Which of our allegations had been “referred to the Misconduct and Breach Reporting Team for review”?

Was it the November 23 information regarding the $8 billion gouged by Westpac-BT, or was it the June 29 correspondence regarding Eccleston’s past with Westpac?

Or was it both?

Further – did this mean the information we provided had been accepted under ASIC’s whistleblower provisions?

Angela Friend came back to us:

“Anthony, I’ve nothing to add”.

We went back again.

This was still Friday July 2.

These were “fair questions”, we wrote.

ASIC’s responses had cleared nothing up, and we needed to know whether our serious concerns had been accepted under ASIC’s whistleblower provisions.

“Has (ASIC) taken any action with regard to our detailed revelations that Westpac-BT had gouged over $8 billion from members?” we wrote.

ASIC and Friend did not respond.

(Eccleston has at all times refused to respond to our requests for comment.)

Whistle-stop

Over two weeks later, on July 20, we went to ASIC again.

Had any action been taken about the Westpac gouge we had exposed eight months earlier? What was the outcome of our information having been “referred to the Misconduct and Breach Reporting Team for review”? Had the information we provided been taken under ASIC’s whistleblower provisions?

ASIC came back that same day.

The information we provided to ASIC on November 23, about Westpac-BT’s super gouging, had not been dealt with under ASIC’s whistleblower provisions.

“In relation to super funds, a whistleblower needs to be a trustee, an investment manager, officer/employee of a body corp that is a trustee, custodian or investment manager of the super fund, or a supplier or employee of a supplier (see s1317AAA(f)),” Friend wrote.

“Unless you meet one of the above, you do not fall within the definition of a whistleblower.”

We were provided with a link to an ASIC report “Whistleblower rights and protections” and to ASIC report “How ASIC handles whistleblower reports”.

Friend wrote: “As previously advised, the media articles have been forwarded to our Misconduct and Breach Reporting Team. The process for assessing reports of misconduct is outlined in INFO 153”.

We were provided with a link to ASIC report “How ASIC deals with reports of misconduct”.

“We have no further comment to make,” Friend wrote.

Turnstiles

In the same July 20 request we had also asked ASIC about another, highly-serious, related matter.

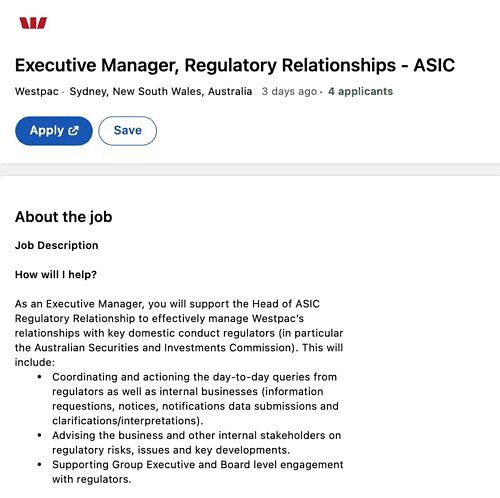

We had learned that Westpac had been aggressively seeking and employing former senior ASIC officials in key “regulatory” and “litigation” roles.

From ASIC to Westpac. Clock-wise from top left: Cameron Walter, Amber Rowland, Lidia Agioski, Felicity Minzlaff, Sean Polivnick, Kate Fowler, Anita Cuatolo and Irfan Malik. Source: LinkedIn

Westpac was currently advertising for a position titled: “Executive Manager, Regulatory Relationships – ASIC”.

Did ASIC have any concerns about Westpac targeting, or employing its former senior employees in this manner, we asked?

Did this in any way “weaken ASIC’s position and ability to properly enforce the law”?

Regarding these questions, ASIC did not respond.

The next day, July 21, The Klaxon ran the article.

Westpac had been aggressively recruiting prosecutors, lawyers and investigators from ASIC and now had at least ten former senior ASIC figures in its ranks.

They included ASIC’s long-time chief prosecutor, Cameron Walter, who joined Westpac in December; the former chief-of-staff to ASIC chairman Greg Medcraft; a former senior ASIC forensic financial investigator; and a string of other former key ASIC litigators and enforcers.

(The Westpac positions of “Group Head of Regulatory Relationships”, “Executive Manager, Regulatory Relations“, “Manager, Financial Markets Operational and Compliance Risk”, “Senior Manager, Consumer Incidents Compliance”, “Head of Strategy and Customer Experience” and “Senior Manager, Anti-Money Laundering Intelligence”, are now all held by former senior ASIC employees.)

On July 23, two days after the article ran, we went back to ASIC again.

At least 10 of ASIC’s former senior employees were now working at Westpac. Did ASIC consider this could influence any action taken against Westpac regarding the Westpac-BT super gouge?

A Westpac advertisement in July. Source: LinkedIn

Did ASIC have any strategy or processes in place to address/mitigate the potential impact of so many of its former senior staffers now working at Westpac?

According to her bio, Eccleston had worked as “Westpac Corporate Counsel” for three years, from 1993 to 1996.

This was a long time ago.

But the extremely close staffing links between ASIC and Westpac was new information that made the matter of any potential conflict of interest even more relevant.

We asked ASIC, again: What steps had been taken to mitigate this potential conflict?

The matter of Westpac-BT’s superannuation gouging had been “referred to ASIC’s Misconduct and Breach Reporting Team for review”, we had been told.

We asked ASIC again: What was the status of this referral? Would the issue be investigated further?

ASIC did not respond to any of the questions.

Tumbleweeds

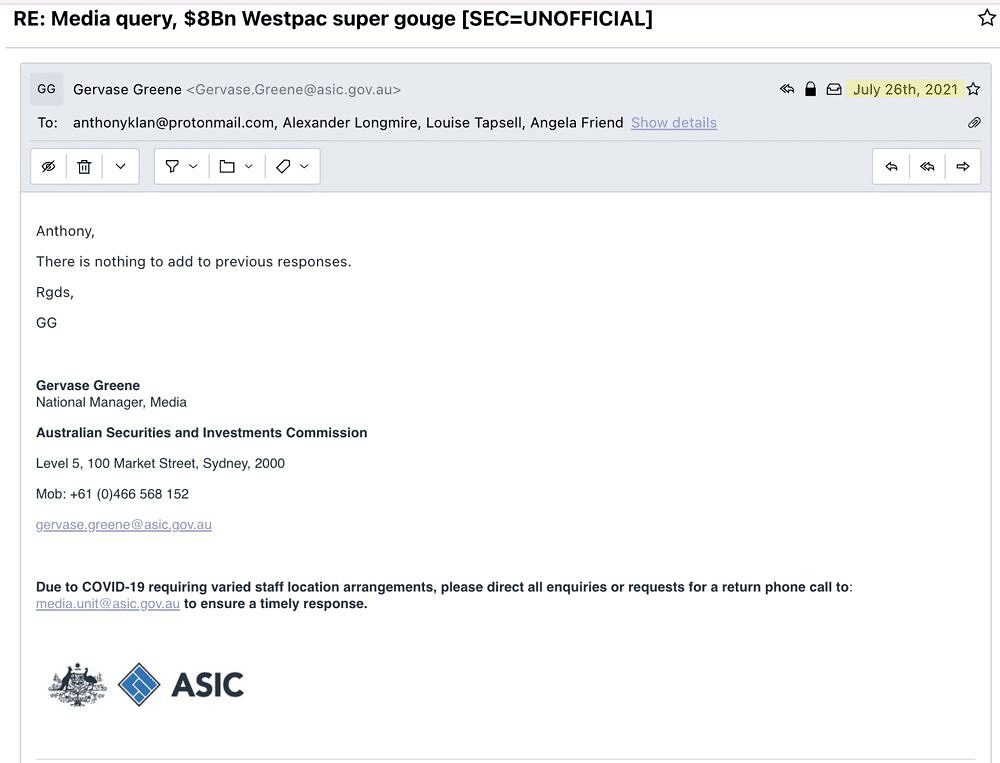

On Monday July 26, we went back to ASIC again – could we get responses to these same questions?

That same day ASIC National Media Manager Gervase Green replied:

“There is nothing to add to previous responses”.

On Monday August 2 we went back to ASIC again.

We wrote to ASIC’s entire media team, including Gervase Green, Angela Friend, ASIC spokesman Alexander Longmire and ASIC spokeswoman Louise Tapsell.

We received no response.

On August 18 – last Thursday – we wrote again to ASIC, including to Green, Friend, Longmore and Tapsell.

We received no response.

More to come…