It’s over two weeks since The Klaxon revealed Westpac-BT was gouging over $1.65 billion a year from its superannuation members. Yet Westpac has failed to disclose the information to the market. The ASX is taking no action. Guess who runs both? Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Westpac Group has failed to disclose to the ASX revelations that its superannuation and “wealth” arm BT is engaging in wholesale gouging of its customers, despite that information likely to stymie its planned multi-billion dollar sale of the business.

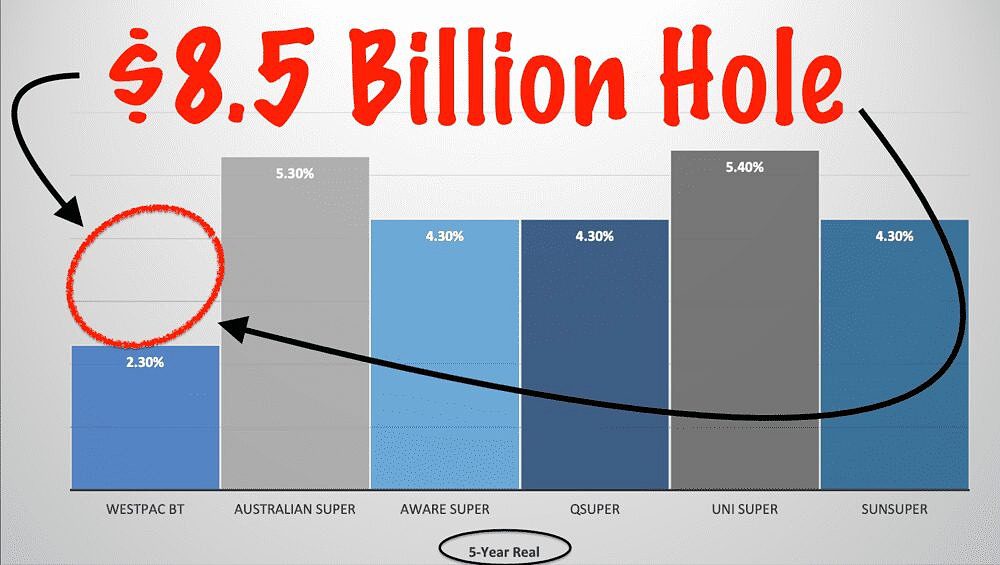

The Klaxon over two weeks ago revealed that Westpac’s BT had, over the past three years, gouged over $5 billion from its almost 1 million superannuation members, costing them over $1.65 billion a year.

That systemic gouging meant that from mid-2018 to mid-2020, over 900,000 Westpac-BT superannuation members were delivered average returns of just 1/30th of actual market rates.

The revelations are extremely important because Westpac is in the process of trying to sell BT, its “wealth management business”, which has been previously valued at “over $2.5 billion”.

The new information suggests it is highly unlikely that any properly informed potential buyer would pay anything like that amount, if a sale now occurs at all.

The $8.5 billion man. David Plumb – resigned abruptly on June 28 amid BT gouging scandal. Source: LinkedIn

As reported yesterday, it has also emerged that the head “trustee” responsible for protecting the interests of members across Westpac ’s entire superannuation businesses has resigned abruptly and without explanation.

David Plumb, who had been chairman and independent director of Westpac-BT super’s three “trustee” entities since 2015 resigned on June 28, four days after The Klaxon’s expose.

Westpac Group has not only failed to disclose the information contained in the June 24 expose to the market, (despite it being bound by “continuous disclosure” laws) but it has refused to make any comment on the revelations whatsoever.

Further, the ASX, which is responsible for policing the law (although it is not a government entity of any kind), has refused to force Westpac to disclose the information.

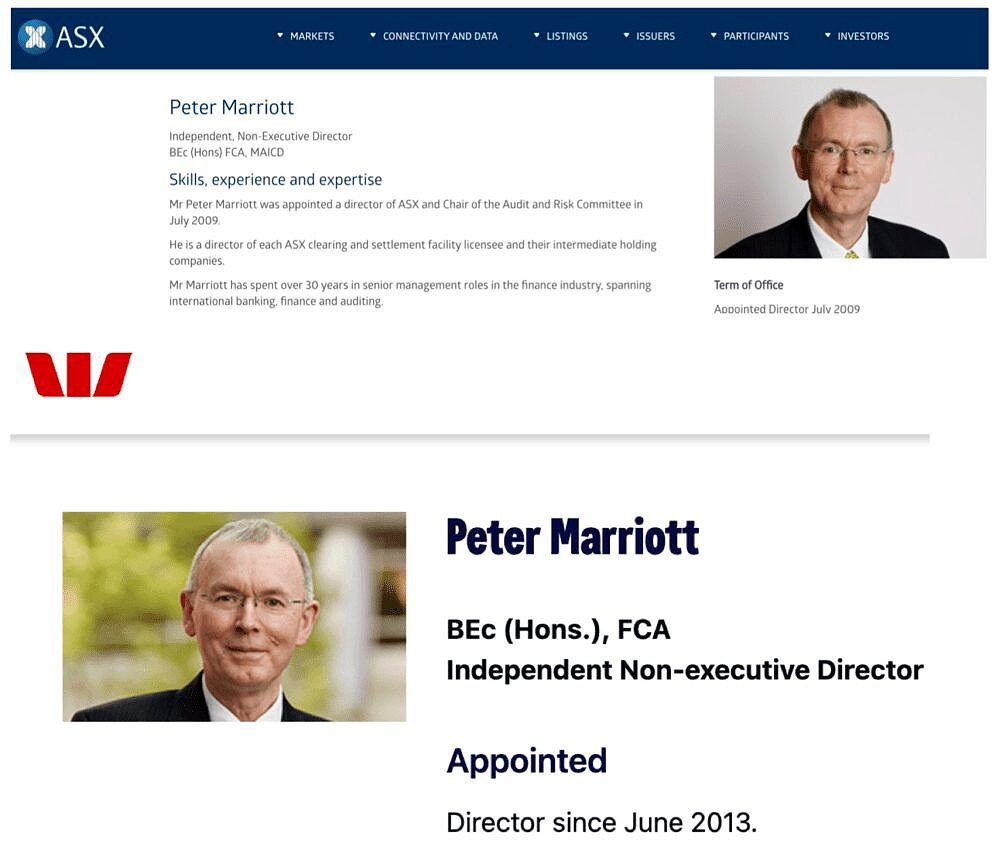

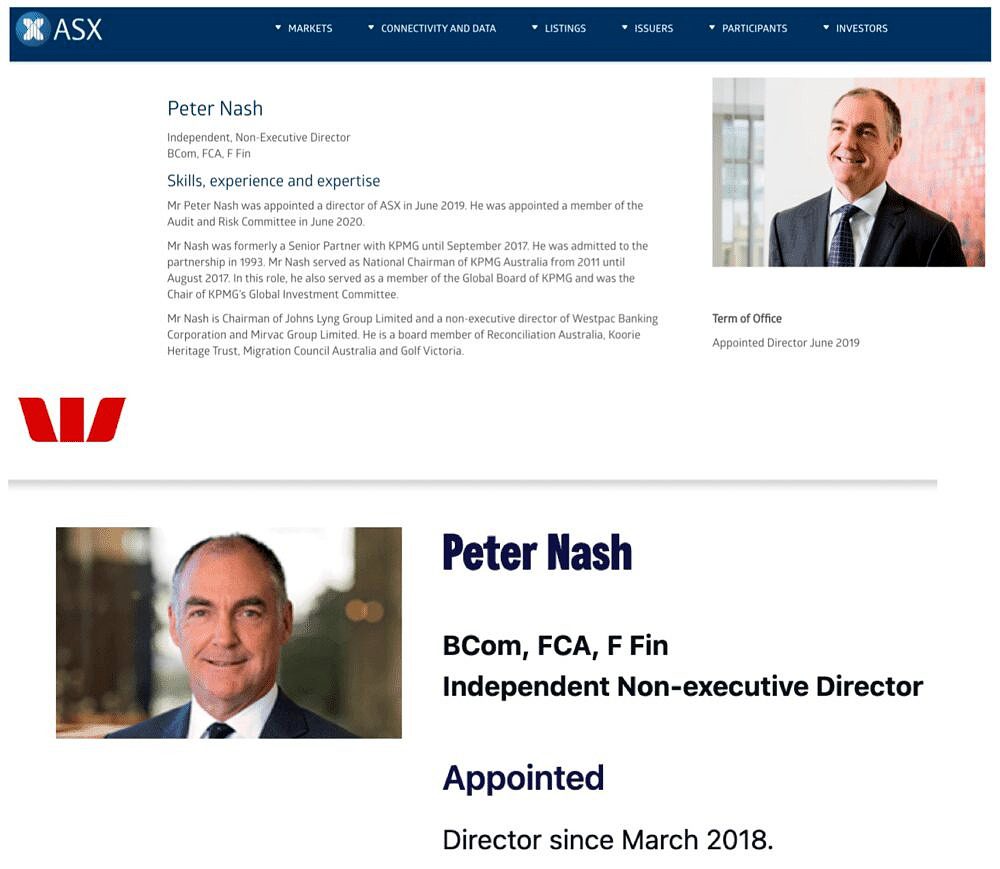

The failure presents a potentially massive conflict of interest: two of ASX current directors are also currently directors of Westpac.

ASX directors Peter Marriott and Peter Nash are also directors of Westpac Banking Corporation.

Marriot, the current chair of the ASX “audit and risk committee”, began as ASX director in 2009.

He joined the Westpac board in 2013.

Nash, a member of the ASX “audit and risk committee”, began as ASX director in June 2019.

He joined the Westpac board in March 2018.

ASX Limited (the official name of ASX) has eight directors, not including its managing director and CEO Dominic Stevens.

That means one-quarter of the people running the ASX are also in charge at Westpac.

Marriott, Nash and Westpac did not respond to repeated requests for comment from The Klaxon over the past two weeks.

The Board of ASX Limited (the official name of ASX) is ultimately accountable to shareholders for the performance of ASX. It is responsible for overseeing the conduct of the affairs of the Group,

That 25% of the directors of the ASX are also running, and being paid by, Westpac is particularly remarkable given Westpac itself is not only listed on the ASX, but that it is the fourth biggest stock on the entire exchange.

BT is a “wholly-owned subsidiary” of Westpac.

As revealed on June 20, much of Westpac-BT’s alleged $2.5 billion “value” is derived from the gouging of Westpac-BT customers.

Yet the gouging of funds held in Australia’s compulsory superannuation system – established to fund the nation’s workers in retirement – is against the law.

Super trustees are legally required to act in the “best interests” of members, or face penalties including up to two years jail.

Westpac, and its fully-owned subsidiary BT, had in the past denied gouging super members.

Westpac-BT returns almost non-existent (1/30th of market rates) between 2018-20. Story June 28. Source: The Klaxon

ASX Limited

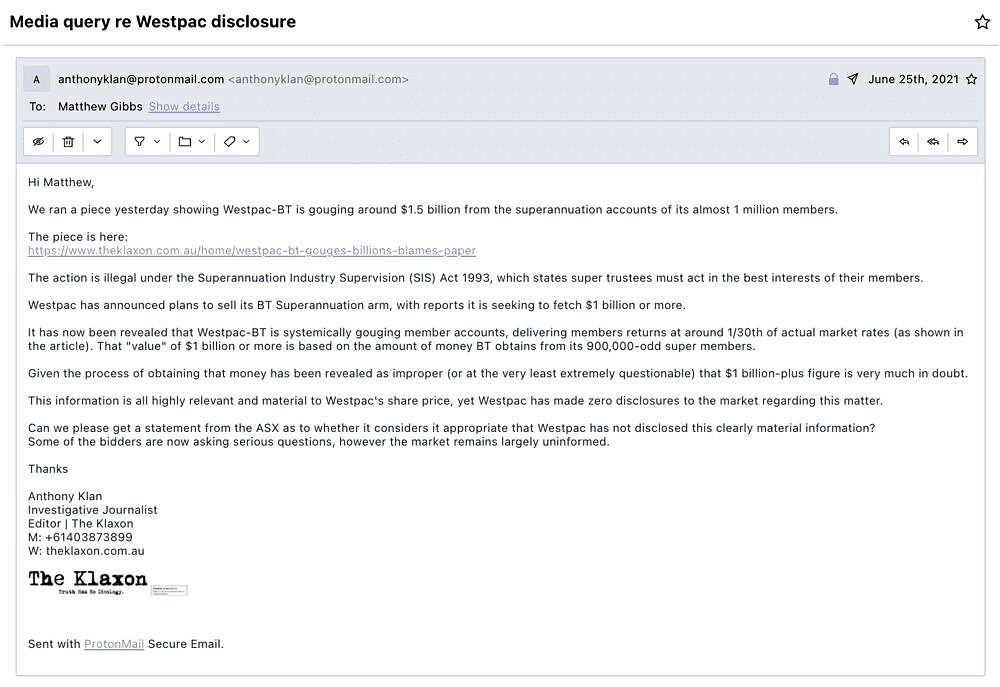

Two weeks ago, on Friday June 25, we alerted the ASX to our story the day before.

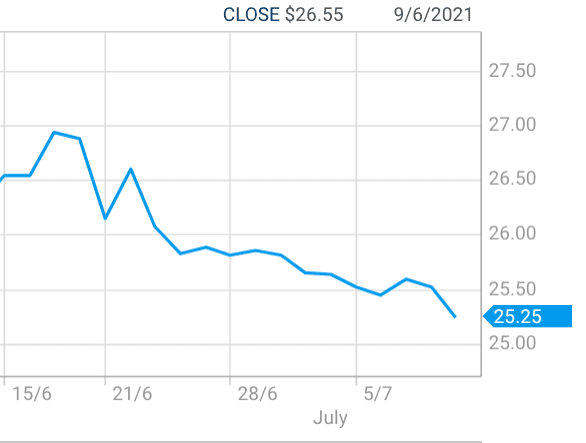

We highlighted the Westpac-BT gouging, that it was almost certainly illegal, that Westpac was trying to sell BT for a very large sum, that we believed this information was “highly relevant and material” to Westpac’s share price – and that Westpac had disclosed none of it.

ASX Limited simply threw it back to Westpac Banking Corporation.

David Park, ASX senior media adviser, wrote:

“The obligation to keep the market informed rests with the listed company. It is best placed to assess materiality.

“Clearly, Westpac is aware of these allegations and its disclosure obligations, including the consequences of not keeping the market informed.

“In the meantime, ASX will continue to monitor any new information in the market and/or unexplained share price movement to assess whether the market is being appropriately informed”.

We responded: Did this mean that ASX wouldn’t take action against a company unless the company either dobs itself in, or the company’s share price moves for no obvious reason?

The response from Park was brief:

“ASX will take action when it forms the view – based on evidence – that material information has not been disclosed”

We went back again:

“Does the ASX consider that Westpac-BT is not gouging around $1.5 billion annually from 900,000-odd superannuation accounts, or that Westpac-BT is doing this, but that Westpac-BT has appropriately disclosed this information to the market?

Park responded:

“ASX does not comment on any specific supervisory matters.

“Any action we do take will become public via an announcement on the market announcement platform.

Westpac’s share price, June 15 to Friday’s close. Source: ASX Limited

That was all on Friday June 25.

A week later, on Friday July 2, we went back again.

There had still been no announcement of any type from Westpac, and Westpac was still refusing to respond to our queries.

We asked whether ASX Limited had taken any action regarding Westpac’s failure to inform the market of the information, and if so what?

We also said we had become aware that two of ASX Limited’s directors were also directors of Westpac, which “appears to present a clear and substantial conflict of interest”.

“What steps, if any, has ASX Limited taken to ensure appropriate governance is adhered to and the roles of Nash and Marriott are not improperly influencing (or being seen to be improperly influencing) ASX Limited’s stance regarding Westpac and the BT non-disclosure matter?”

Park responded:

“ASX does not comment on specific supervisory matters. If any action is to be made public it will be released across the market announcements platform,” he said.

“ASX board directors play no role in supervising listed companies or compliance matters. These are managed by a Chief Compliance Officer and a separate Compliance division.”

“Strict governance and conflict handling arrangements are in place, and ASX is subject to the regular oversight of ASIC”.

ASIC is the corporate regulator, the Australian Securities and Investments Commission.

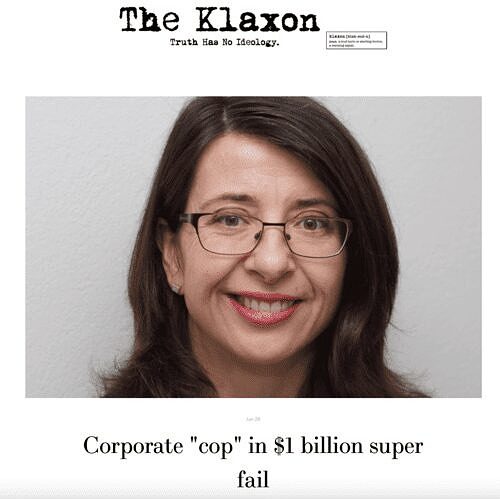

Jane Eccleston. The Klaxon’s June 28 story. Source: The Klaxon

As revealed by The Klaxon on June 28, ASIC has taken zero action to stop Westpac’s wholesale gouging of super accounts, since it was formally alerted the scandal over six months ago.

Further, it had emerged that the person at ASIC responsible for taking action to stop the gouging by Westpac-BT was formerly “in-house” lawyer at Westpac.

Since the story ran on June 24, Westpac has posted 26 announcements to the ASX.

None of them have disclosed the revelations of Westpac-BT’s gouging, or anything remotely related to it.

Also since The Klaxon’s story ran on June 24, Westpac has posted 10 “media releases” to its website.

One media release is headed “Going, going, gone! Westpac research reveals more home owners are planning to sell a property”.

Its latest, which includes comments from Westpac CEO Peter King, is headed: “Westpac offers five days paid leave for employees who experience early pregnancy loss”.

None of the media releases have disclosed the revelations of gouging, or anything related to it.

According to ASX Limited’s website, its board is “ultimately accountable to shareholders”.

“It (the board) is responsible for overseeing the conduct of the affairs of the Group, consistent with the Group’s licence obligations and public policy objectives directed at financial market and payments system integrity,” it states.

Over $8.5 billion missing in just five years, all under Plumb’s watch. Source: APRA, RBA. Graphic: The Klaxon

Westpac

The failure by Westpac to disclose the revelations about its gouging is particularly concerning given the great lengths the bank has gone to to cover-up the information.

The gouging was first revealed by The Klaxon on November 20 last year.

We revealed Westpac-BT had gouged $8 billion from the life savings of its almost one million superannuation fund members over the decade to 2018, including by operating a complex web of obscure paper companies, many of which generate huge fees despite many performing no real service and having no employees.

The expose had been slated to run in mid-2018 in The Australian newspaper where this reporter worked at that time.

The article was killed following an aggressive, behind-the-scenes campaign by Westpac-BT.

Westpac-BT was providing The Australian with large amounts of money at the time.

Westpac, nor anyone else, has identified a single error in the article – either before or after its ultimate publication in The Klaxon on November 20.

Almost immediately after the article was published, The Klaxon was told Westpac operatives had been telling media behind-the-scenes that the article was incorrect.

Parrett – refusing to comment when asked about alleged ongoing cover-up. Source: LinkedIn

One reporter told us they had been contacted by Westpac-BT senior media manager Lisa Parrett who allegedly said the article was “completely false” before allegedly signalling that Westpac would pull its advertising from the publication if it ran with the story.

The reporter said their editors subsequently refused to run the story.

Westpac-BT and Parrett have failed to indicate a single error in the article, despite repeated approached by The Klaxon over the past seven months.

Parrett did not respond last week (Thursday) when asked about her alleged attempts to silence other media outlets by withdrawing advertising.

When asked whether he considered such behaviour was appropriate, Westpac CEO King also declined to comment.

Following The Klaxon’s November 20 expose, the House of Representatives standing committee on economics, led by Labor MP Andrew Leigh, has been pursuing the matter.

On Thursday The Australian Financial Review reported that Westpac, in response to questions taken “on notice”, had told the committee that in the 2020 financial year it had received $25 million in “dividends” from its subsidiary BT Funds.

That figure was $221 million since 2016, it emerged.

Westpac’s plans to sell BT have been public knowledge since at least March 2019.

The bank reaffirmed that plan at its half-year results announcement on May 3.

The “value” of BT super reflects how much money can be gouged from BT super member accounts.

What Westpac is essentially seeking to sell to another party is the ability for that other party to gouge Westpac-BT’s super customers.

While $221 million is an enormous amount to be taken by Westpac from Westpac-BT’s super members over the past five years, the true figure is vastly higher.